Actor and former California Governor Arnold Schwarzenegger had a snarky response to reports that President Donald Trump will consider ordering grid operators to buy electricity from struggling coal and nuclear plants in a bid to extend their life, marking an unprecedented federal intervention into energy markets.

The so-called "Governator"––a nickname he received thanks to the leading role he played in the Terminator film franchise––slammed the proposal, saying he will "eagerly await the administration’s regulations protecting pagers, fax machines, and Blockbuster."

The Trump administration's plan to prop up coal has drawn significant criticism from researchers and policymakers alike whose findings conclude that the coal industry is largely obsolete. The president has long promised his supporters that he would bring back "beautiful" coal despite its well-documented decline.

Schwarzenegger's criticisms came as a diverse group of energy industry associations also criticized the proposal.

Todd Snitchler, the Market Development Group Director for the American Petroleum Institute called the Trump administration's draft plan "unprecedented and misguided."

"The natural gas and oil industry is committed to strengthening national security and is playing a leading role in reducing our decades long dependence on foreign energy," Snitchler said in a statement.

He continued:

As the world’s largest producer and refiner of oil and natural gas, which today is the number one source of U.S. electricity, our nation is on track to achieve the President’s vision for energy dominance. However, unprecedented government intervention in the energy markets to support high cost generation will put achieving that vision in jeopardy and hurt customers by taking more money out of their pockets rather than letting people keep more of what they earn – a key priority of this administration. Cleaner and abundant US natural gas and the infrastructure that supports it is powering one in three homes and businesses today and serving as a critical partner in renewable generation. As an industry we stand ready to do our part to protect our nation’s energy and national security.

Malcolm Woolf, the Senior Vice President for Advanced Energy Economy, also weighed in, saying the Trump administration's "plan to federalize the electric power system is an exercise in crony capitalism taken solely for the benefit of a bankrupt power plant owner and its coal supplier."

It would be a command-and-control mechanism that fundamentally disrupts and undermines the competitive electricity markets that have improved our electricity system’s reliability, resilience, and affordability, while fostering innovation. As has been well established – by FERC, by grid operators, by industry experts – there is no emergency that would justify propping up uneconomic power plants that are superfluous in an over-supplied region. The Administration’s plan to alter competitive electricity market outcomes through the use of narrow emergency authorities crafted by Congress to protect the nation from true imminent threats to electric reliability is wholly unprecedented and legally indefensible. We will fight this needless energy tax on businesses and families with every tool at our disposal.

Likewise, Todd Foley, the Senior Vice President on Policy and Government Affairs for American Council of Renewable Energy said the plan would "actually undermine competitive markets, raising electricity costs to consumers and businesses across the country."

"Arbitrary market interventions deprive businesses of the certainty they need to invest in power plants of all types, harming not helping electric reliability," Foley continued, ending his statement with a call for the Trump administration to reject this ill-conceived draft plan and adopt a policy approach that promotes market forces and competition in our nation’s power system, which is the central approach to assure a reliable and affordable grid system in the future."

There is an economic incentive for power plants to rely on coal because the fossil fuel is cheaper than oil or natural gas, but, as the U.S. Energy Information Administration (EIA) notes in one report, “renewables are the world’s fastest-growing energy source, with consumption increasing by an average 2.3%/year between 2015 and 2040. The world’s second fastest-growing source of energy is nuclear power, with consumption increasing by 1.5%/year over that period.”

The agency's findings are rather damning for the coal industry, which has been replaced by renewables for reasons far beyond the effect coal usage poses to the environment:

Coal is increasingly replaced by natural gas, renewables, and nuclear power (in the case of China) for electric power generation, and demand for coal also weakens for industrial processes. China is the world’s largest consumer of coal, but coal use is projected to decline in China by 0.6%/year from 2015 to 2040, and in the combined OECD countries coal also declines by 0.6%/year over that same period. With coal consumption in India and other nations in non-OECD Asia growing over the projection period, worldwide coal consumption is not as low as it would otherwise be in 2040. The coal share of total world energy consumption declines significantly over the projection period, from 27% in 2015 to 22% in 2040.

The president has in the past come under fire for stacking his administration with coal energy veterans and other members of the fossil fuel lobby. Just why so many of these individuals hold such prominent positions in Trump's Washington is obvious: The leading coal mining states of Kentucky, Ohio, West Virginia and Wyoming all voted reliably for Trump and the president's latest action is simply another maneuver to shore up his base.

All of these criticisms come as the U.S. coal lobby threatens to ax The Black Lung Disability Trust Fund as black lung rates hit highs not seen in decades. A report the U.S. Government Accountability Office plans to publish soon found that the fund, as reported by Reuters, "is at risk of insolvency due to soaring debt and a slashing of coal-company contributions through a tax cut scheduled for the end of the year."

This shortfall, the news outlet notes, "could force the fund to restrict benefits or shift some of the financial burden to taxpayers."

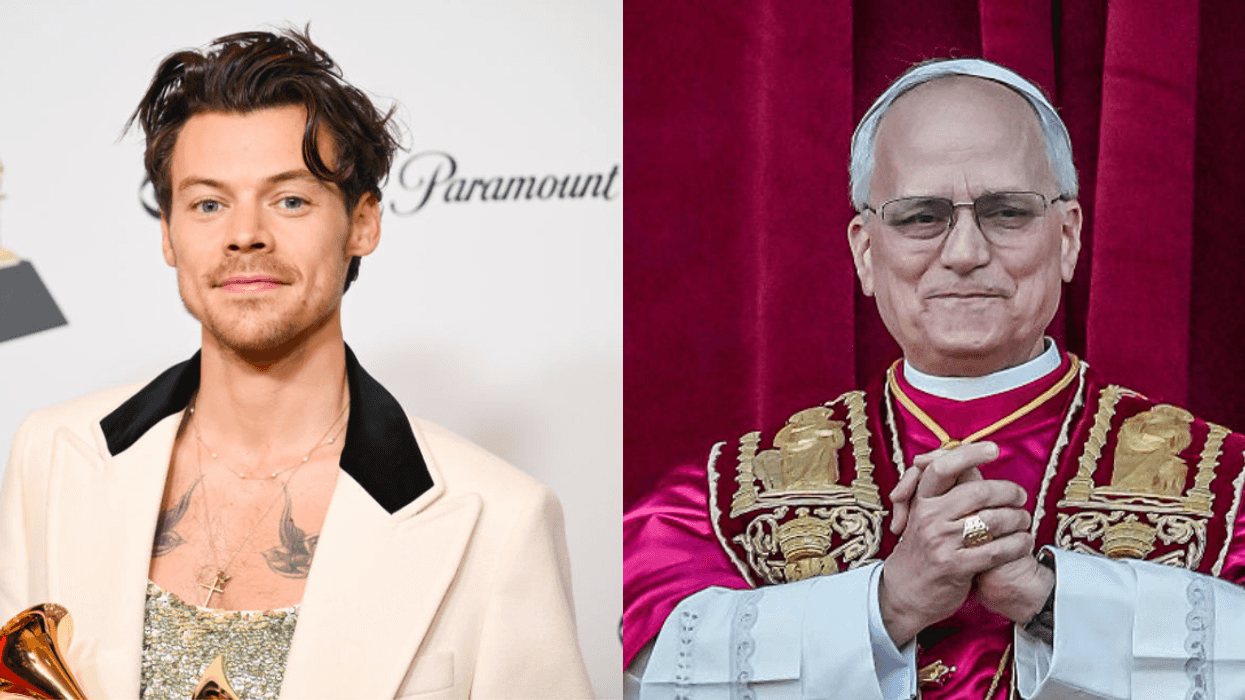

@complexpop/Instagram

@complexpop/Instagram  @complexpop/Instagram

@complexpop/Instagram @complexpop/Instagram

@complexpop/Instagram @complexpop/Instagram

@complexpop/Instagram @complexpop/Instagram

@complexpop/Instagram @complexpop/Instagram

@complexpop/Instagram @complexpop/Instagram

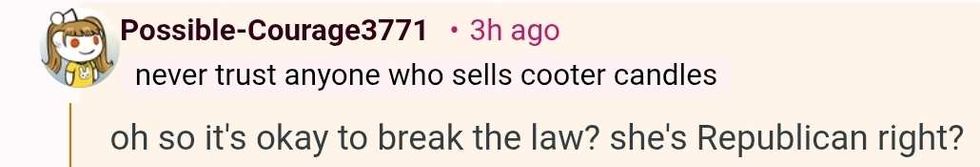

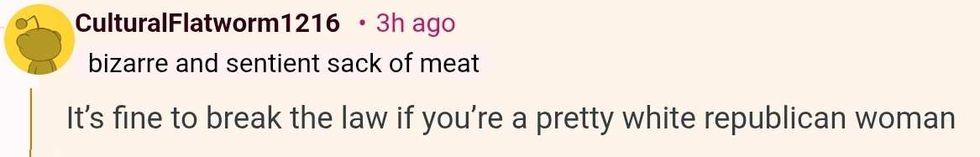

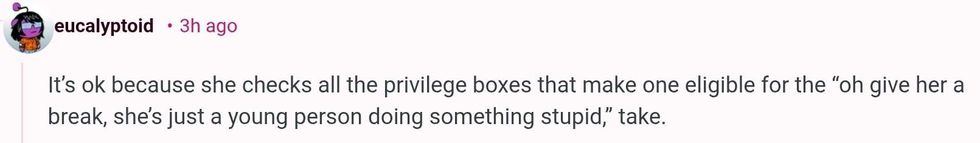

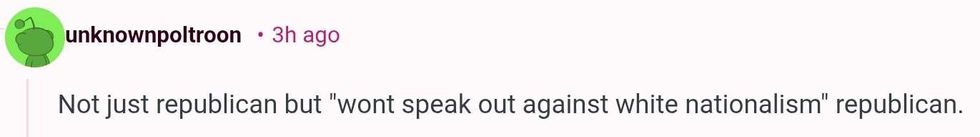

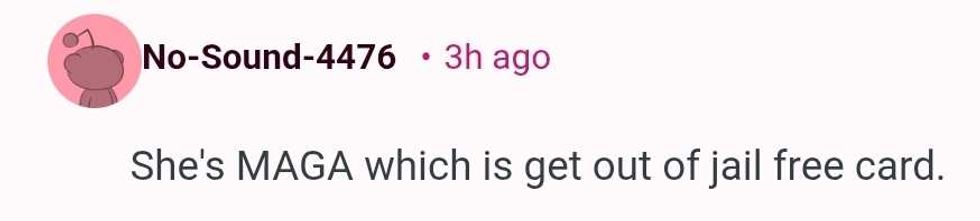

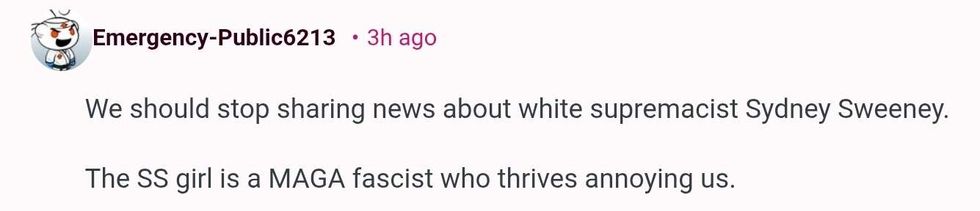

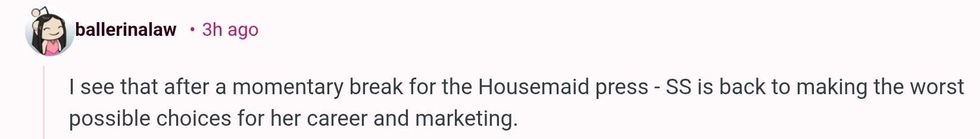

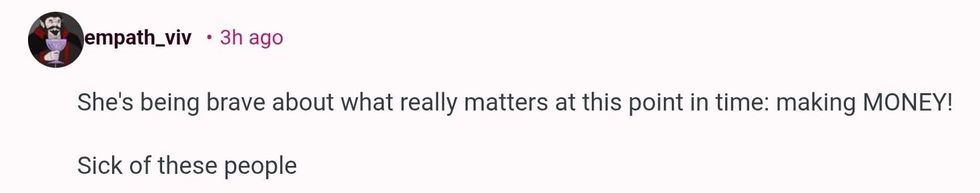

@complexpop/Instagram r/Fauxmoi/Reddit

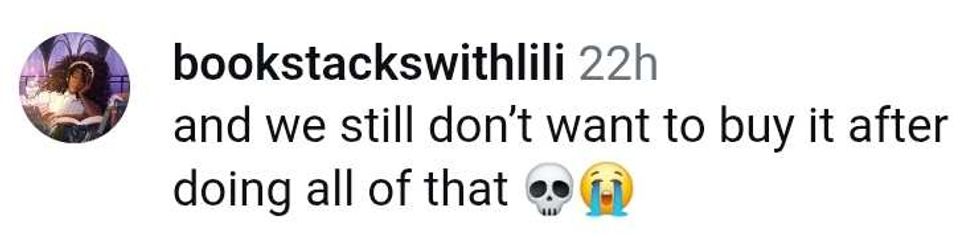

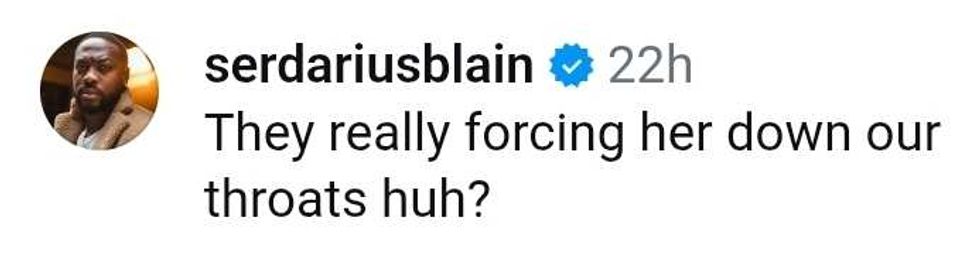

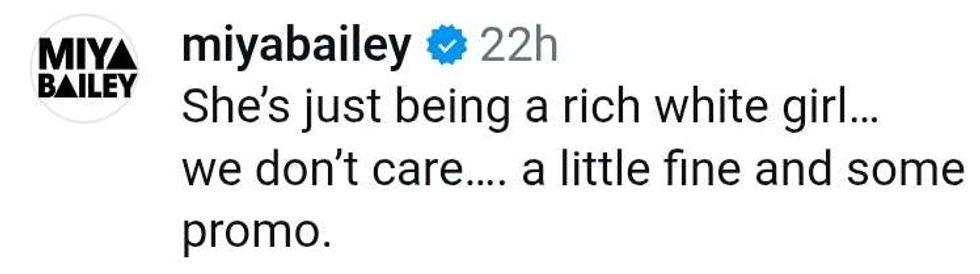

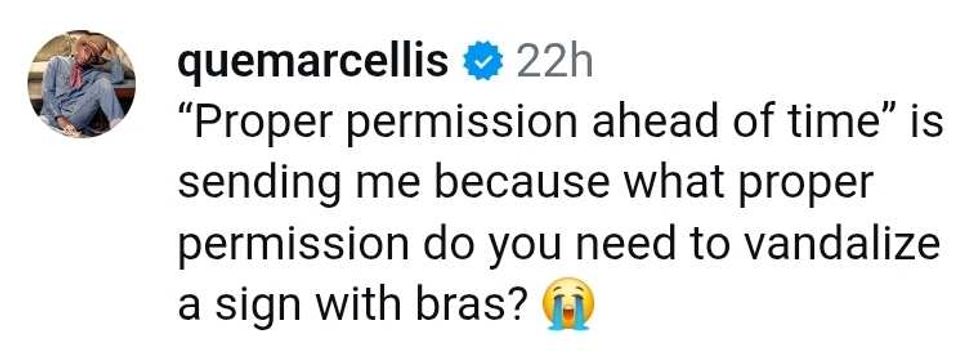

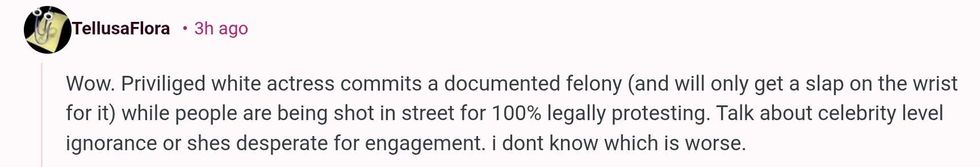

r/Fauxmoi/Reddit r/Fauxmoi/Reddit

r/Fauxmoi/Reddit r/Fauxmoi/Reddit

r/Fauxmoi/Reddit r/Fauxmoi/Reddit

r/Fauxmoi/Reddit r/Fauxmoi/Reddit

r/Fauxmoi/Reddit r/Fauxmoi/Reddit

r/Fauxmoi/Reddit r/Fauxmoi/Reddit

r/Fauxmoi/Reddit r/Fauxmoi/Reddit

r/Fauxmoi/Reddit r/Fauxmoi/Reddit

r/Fauxmoi/Reddit r/Fauxmoi/Reddit

r/Fauxmoi/Reddit r/Fauxmoi/Reddit

r/Fauxmoi/Reddit r/Fauxmoi/Reddit

r/Fauxmoi/Reddit r/Fauxmoi/Reddit

r/Fauxmoi/Reddit r/Fauxmoi/Reddit

r/Fauxmoi/Reddit r/Fauxmoi/Reddit

r/Fauxmoi/Reddit r/Fauxmoi/Reddit

r/Fauxmoi/Reddit r/Fauxmoi/Reddit

r/Fauxmoi/Reddit r/Fauxmoi/Reddit

r/Fauxmoi/Reddit r/Fauxmoi/Reddit

r/Fauxmoi/Reddit r/Fauxmoi/Reddit

r/Fauxmoi/Reddit r/Fauxmoi/Reddit

r/Fauxmoi/Reddit r/Fauxmoi/Reddit

r/Fauxmoi/Reddit r/Fauxmoi/Reddit

r/Fauxmoi/Reddit r/Fauxmoi/Reddit

r/Fauxmoi/Reddit r/Fauxmoi/Reddit

r/Fauxmoi/Reddit