CNN anchor Jake Tapper clashed with Louisiana Republican Representative Mike Johnson over Republicans’ misleading claims Democrats want to fund the Internal Revenue Service (IRS) to hire 87,000 "agents" who would go after average Americans.

Shortly after officially taking control of the House of Representatives following a protracted battle over who among the GOP would be elected House Speaker, Republicans passed legislation to rescind the majority of about $80 billion in IRS funding over a decade approved last year by Democrats.

Republicans repeatedly falsely claimed the 87,000 new IRS employees—to be added over a decade—are "agents" though only a small portion of current IRS employees are agents. The agency said the figure accounts for other workers such as customer service representatives and includes replacements for the estimated 52,000 employees expected to retire over the next six years.

Tapper noted Johnson lied when he claimed in a tweet House Republicans would bar the Biden administration from "unleashing 87,000 new IRS agents to go after families and small businesses."

You can watch their interaction in the video below.

Tapper called out Johnson for disputing a nonpartisan Congressional Budget Office (CBO) analysis that found the Republican legislation would eliminate about $71 billion of the total $80 billion allocated for the IRS while reducing tax revenue by about $186 billion, an action that would create a $114 billion deficit over the next decade.

An unmoved Johnson said the CBO lacks "credibility":

"The CBO doesn't have a lot of credibility here right now."

"Their analysis is wildly inaccurate in a lot of ways and they don't always do appropriate analysis..."

"I mean, when they come out with an estimate on Capitol Hill right now, there's lots of eye rolling typically, and that's a problem."

Johnson also pushed back when Tapper said he is not being "honest" about "what the bill would actually do" regarding the 87,000 figure, saying that is "exactly what it is."

He deflected when Tapper said just because there would be 87,000 new IRS "employees" doesn't mean all of those employees would be "agents," ultimately contradicting his earlier claim:

"I’m not saying every one of them [would be agents] but I’m saying a large percentage of those will be employees who are deemed as agents to go after and do audits."

"That’s a large—very important function of the IRS. That’s not hyperbole. That’s what’s on paper.”

When asked if he sees a "problem... with wealthy individuals and companies not paying their fair share in taxes," Johnson conceded the problem indeed exists but insisted that Republicans "are not preventing that."

He proceeded to defend Republicans as the "law and order" team that wants to tackle the issue of wealthy tax cheats but still insisted the provision in the Democrats' bill allotting IRS funding would have ultimately made life "harder for middle class working families and small businesses."

Johnsoncould not provide a direct answer when Tapper questioned why Republicans don't just make an adjustment to the legislation that would make it easier for the IRS to go after individuals who make a hypothetical "$5 million a year" instead of rescinding funding altogether, only saying Republicans "are open to a proper analysis and proper instruction from Congress on the use of those funds."

Many criticized Johnson's blatant lies since his interview with Tapper aired.

Johnson was a staunch supporter of the Tax Cuts and Jobs Act of 2017, which is based on tax reform advocated by congressional Republicans and the Trump administration, calling it "the first comprehensive tax reform in 31 years" that "will dramatically strengthen the U.S. economy and restore economic mobility and opportunity for hardworking individuals and families all across this country."

However, a CBO analysis at the time found the plan "gives substantial tax cuts and benefits to Americans earning more than $100,000 a year"—hitting the nation's poorest citizens particularly hard—and the legislation would "add an increase in the deficit of $1,414 billion over the next 10 years."

In 2019, the nonpartisan Congressional Research Service (CRS) released a report indicating the GOP tax bill was not beneficial to the economy, noting growth effects were "relatively small," the tax bill did not have positive effects on workers' bonuses, and it did not usher in a surge in wages.

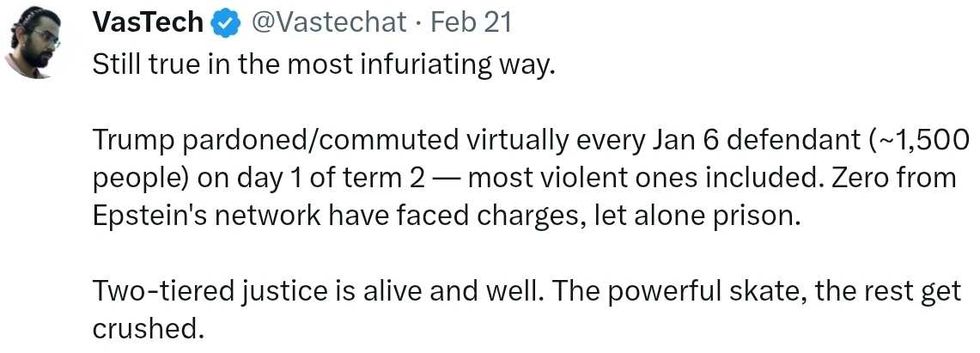

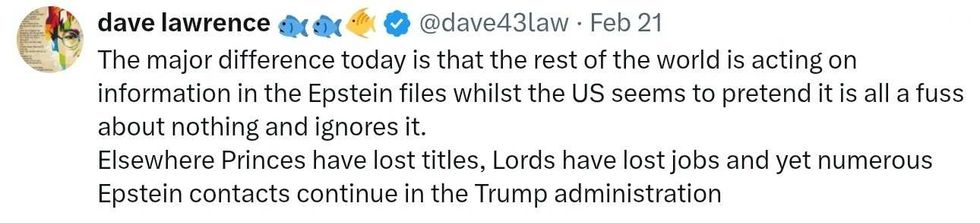

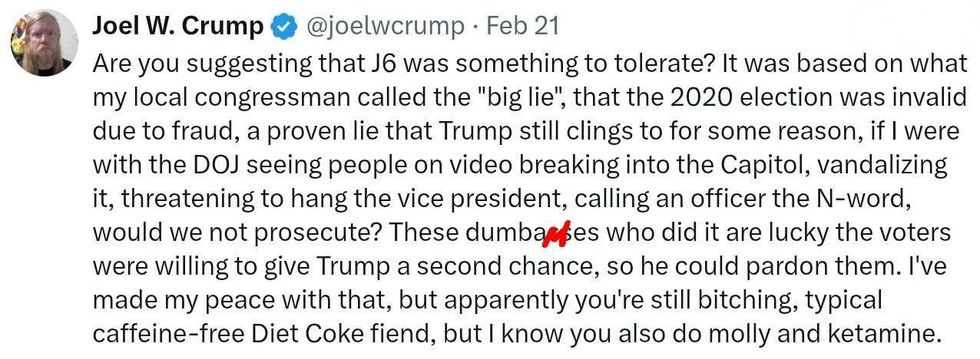

reply to @elonmusk/X

reply to @elonmusk/X reply to @elonmusk/X

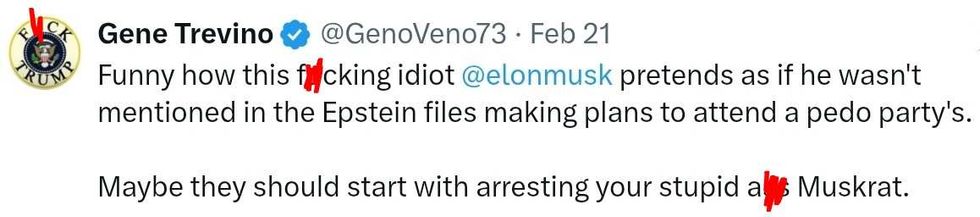

reply to @elonmusk/X reply to @elonmusk/X

reply to @elonmusk/X reply to @elonmusk/X

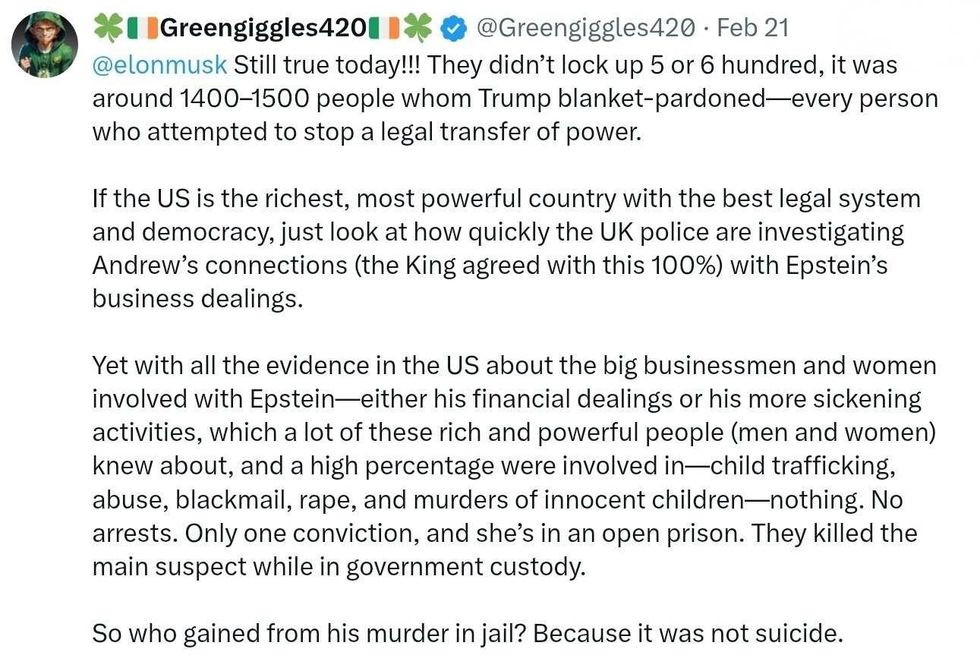

reply to @elonmusk/X reply to @elonmusk/X

reply to @elonmusk/X reply to @elonmusk/X

reply to @elonmusk/X reply to @elonmusk/X

reply to @elonmusk/X