A self-described "Conservative mom in her don't give af 40s. Crunchy & carnivorish!" TikToker who went by @appalachianqueen5 got royally roasted after making a false claim about MAGA Republican President Donald Trump's tax plan for those who aren't among the ultra wealthy.

She said that Trump passed a law saying anyone making under $120,000 didn't have to file a tax return because they wouldn't be paying any taxes.

You can watch her post here:

The woman declared:

"So my President, my President, Trump, my President, I love him, just signed into law that families making less than $120,000 a year—which is the majority—the majority of families in the United States, will now not have to file taxes."

A large number of people already never had to file a tax return.

If a taxpayer knows they're due a refund or that they don't owe any additional taxes and don't have certain types of income, they don't have to file a tax return. However they won't receive a refund on any overpayment, any tax credits that require filing—like Earned Income Credit or Child Tax Credit—and will pay penalties if an audit finds they did owe taxes over and above what they paid.

This isn’t a new situation created by Trump.

But then the Appalachian Queen added:

"They will not have to pay federal taxes. They will not have to get a tax refund at the end of the year because they loaned the government their money."

This is false—not needing to file a tax return doesn't mean a person is not paying federal taxes.

She continued:

"My President signed that in and I just cannot wait, I cannot wait for you crazy a** blue people to be pissed about it. I can't wait for you to be pissed about the fact that our President, my President, our President, isn't gonna take your money anymore."

Again, not remotely true. Federal taxes for families making under $120,000 per year didn't magically disappear.

Still not done, she said:

"I'm sure you're gonna be up in arms about how much more money you're making because you're not lending it to the federal government. I can't wait for the psychotic breakdowns that are gonna happen when people realize that he's actually helping them and they have to admit it."

"I love this country. And I love my President."

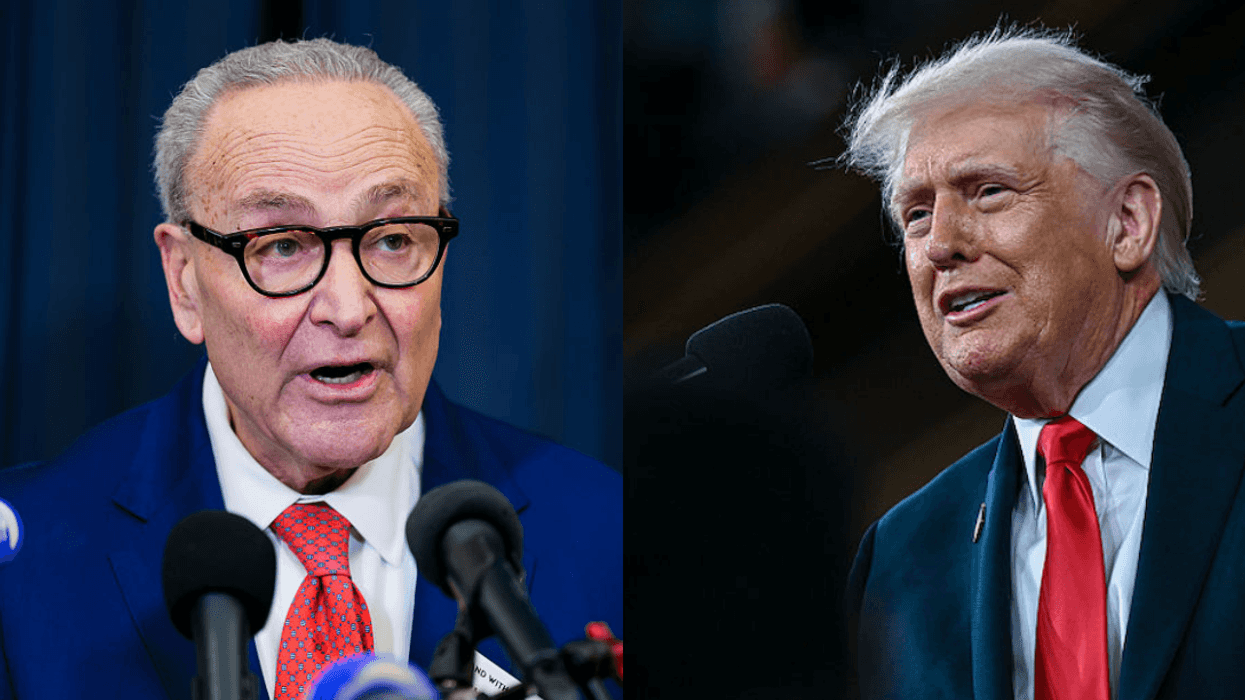

During the 2024 campaign, Trump and his cronies employed vague language and outright lies to garner support, making promises like no taxes and releasing the Epstein files. Campaign rhetoric emphasized a reduction in federal income tax, which is only part of an individual's total taxes.

While trying to gain votes for his ridiculously named "One Big Beautiful Bill," the GOP and Trump administration again used simplified language and lies to convince people the bill was doing things it wasn't.

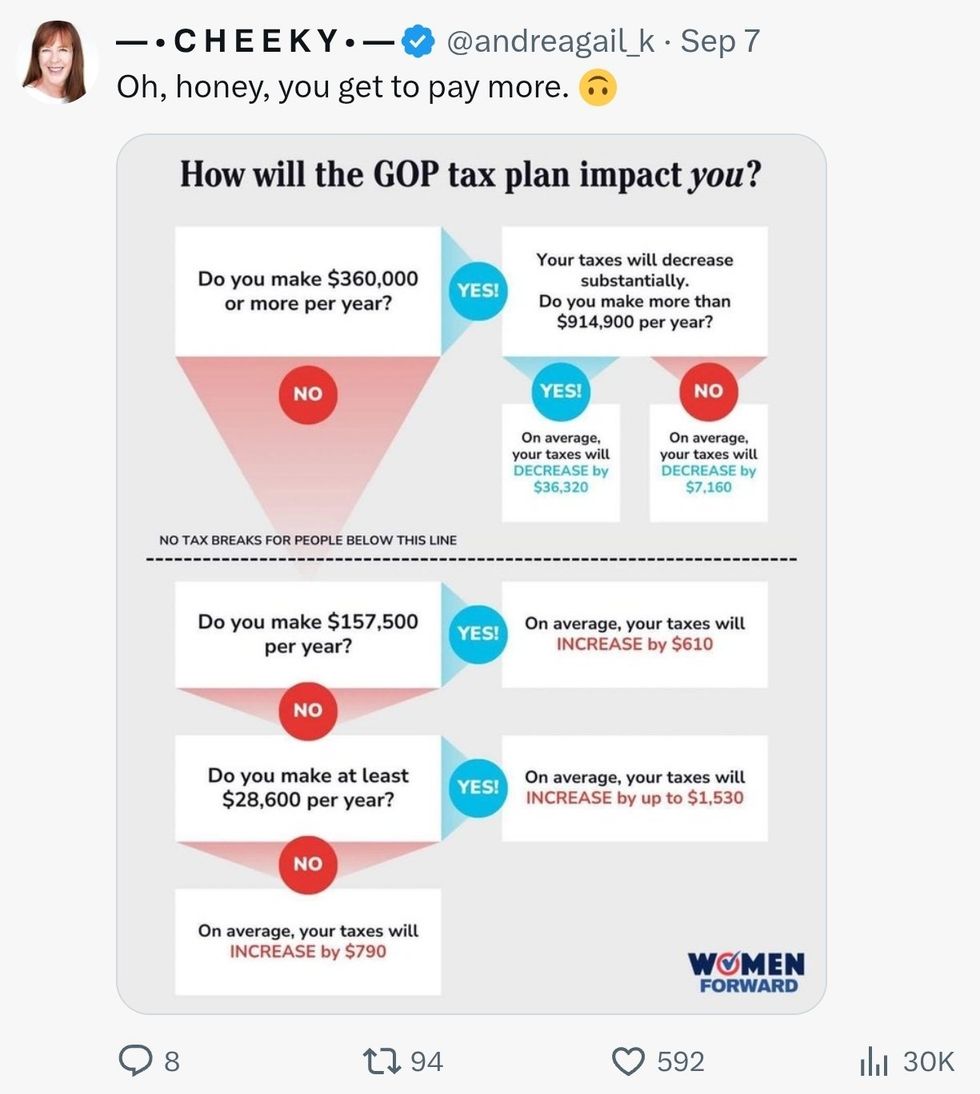

Many—from across the political spectrum—who understood the language actually in the bill pointed out it clearly, grossly benefits higher-income earners, with middle-income families facing higher costs without offsetting benefits.

As one person who reposted her video noted:

"This is the blissful ignorance of the Trump supporter, MAGA, in full bloom."

The post got roasted so hard for its ignorance that @appalachianqueen5 either deleted their TikTok account or made it private.

Some MAGA minions tried to praise their Dear Leader, but even they knew her "no taxes" claim was completely false.

Even when smacked in the face with reality, some just kept digging by making false claims about the merits of tax breaks for billionaires.

But no one was buying their brand of BS either.

Trump's "One Big Beautiful Bill Act" includes an enhanced standard deduction and other provisions that MAGA minions like the Appalachian Queen incorrectly interpreted as a blanket elimination of taxes for those earning below $120,000.

The plan doesn't eliminate all federal taxes for earners in this range, especially not their payroll taxes. Many of the credits will still require filing a tax return to receive them.

And, as with Trump's 2017 tax cuts, several tax breaks aimed at garnering support from middle class and lower income voters—including the senior deduction and exemptions for tips and overtime—are temporary and set to expire by the end of 2028—After the 2026 midterms and 2028 presidential elections.

Once again, only the tax reductions and credits for the wealthy are permanent.

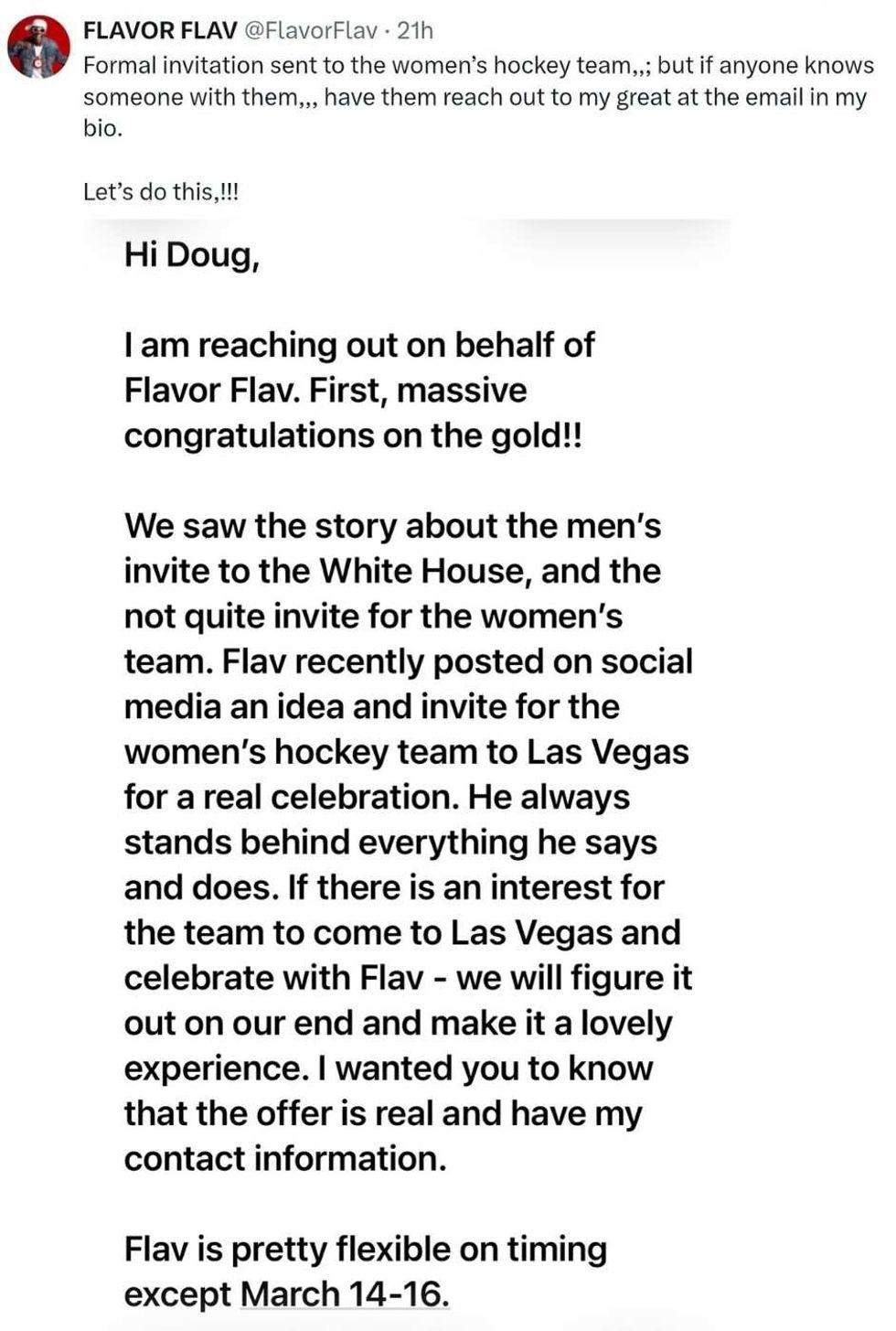

@FlavorFlav/X

@FlavorFlav/X @flavorflavofficial/Instagram

@flavorflavofficial/Instagram @flavorflavofficial/Instagram

@flavorflavofficial/Instagram