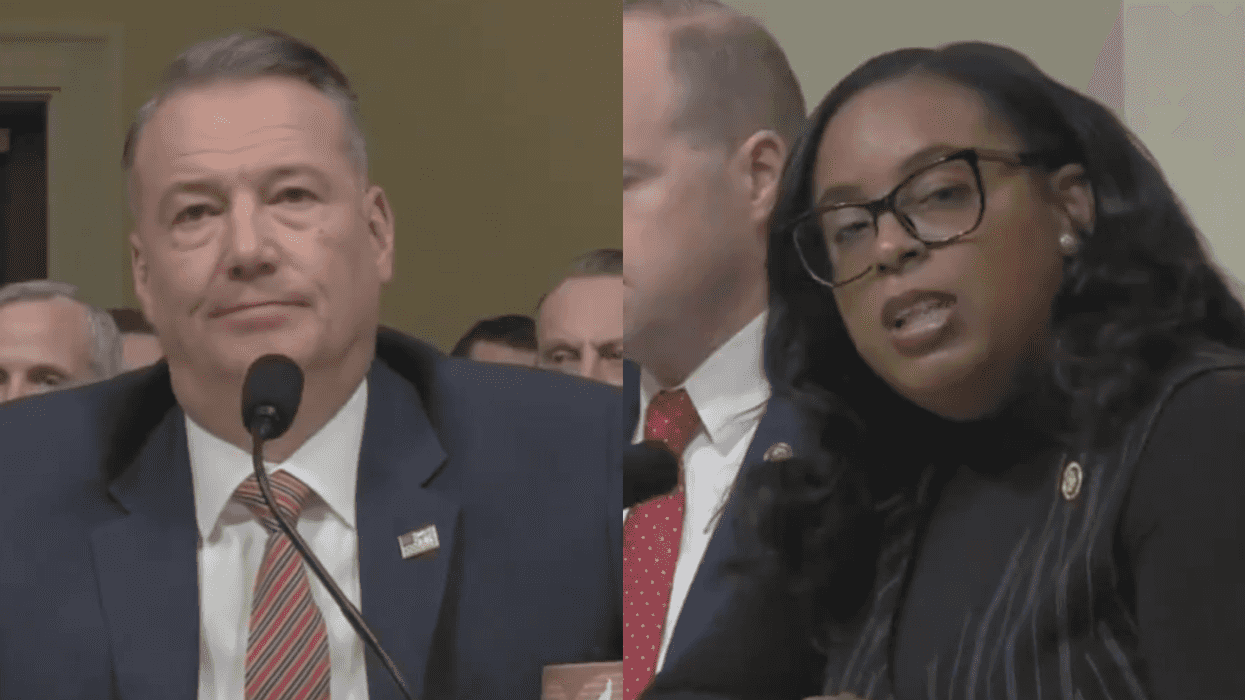

In a segment called "Breakfast with 'Friends'," Fox News weekday correspondent and weekend host of Fox & Friends, Pete Hegseth spoke to voters in Ohio about the latest Democratic presidential debate.

Speaking to a table of Republicans and a table of Democrats, Hegseth got a lesson on wealth inequality from a retiree named Bill.

Sitting down with two men at the Democrats table, Hegseth asked Bill what he thought about raising taxes on the wealthiest in the United States, citing Senator Elizabeth Warren.

Bill replied:

"I think she makes a lot of sense. You know, when she brought up that billionaires and taxing them after about $50 million, two cents of every dollar that they've made after, it's nothing to them, and it would help so many people here."

"I mean, we could build our infrastructure, the schools, colleges—we could do so [much] with that."

"These 3 percent of the people that we have that own almost half of what we are worth in the United States is just deplorable."

But Hegseth pressed back with the standard Republican criticism of such plans.

According to Hegseth and the GOP since the age of President Ronald Reagan, rich people who pay less in taxes than the poor and middle class are "job creators."

Their excess wealth will trickle down.

Having lived through Reaganomics, Bill wasn't buying what Hegseth was peddling, though.

Bill responded:

"It seems to me like—if I remember correctly—back in the 1960s and 1970s, that if you were a millionaire, your taxes were awfully high."

"I think it was in that range 50, 60, 70 per cent—nobody bitched about it then, still made lots of billionaires."

Bill added:

"I think once you get past a couple of million dollars, you got all the money you need. How about giving some of that to the people who worked for a living that can't make it?"

His criticism comes at a time when the wealthiest—thanks to GOP tax cuts—pay a lower percentage of taxes on their income than any other group.

Watch the exchange here.

Bill's facts were correct.

The 1980s and Ronald Reagan began the era of shrinking tax rates for the wealthiest in the United States. Previous tax rates were as high as 94% after WWII and never dipped below 50% until the age of Reaganomics and his "trickle down" theory.

Some feared for Bill's safety after the bit of education provided to Hegseth—who looked quite uncomfortable.

Others remarked on Hegseth's body language.

Others remarked on accurate information on Fox & Friends.

Others had clear memories as well.

Some were thinking Bill had the chops for national office.

As of Wednesday, October 16, the 2020 presidential election is 383 days away.

******

Have you listened to the first season of George Takei's podcast, ' Oh Myyy Pod!'?

In season one we explored the racially charged videos that have taken the internet by storm.

We're hard at work on season two so be sure to subscribe here so you don't miss it when it goes live.

Here's one of our favorite episodes from season one. Enjoy!

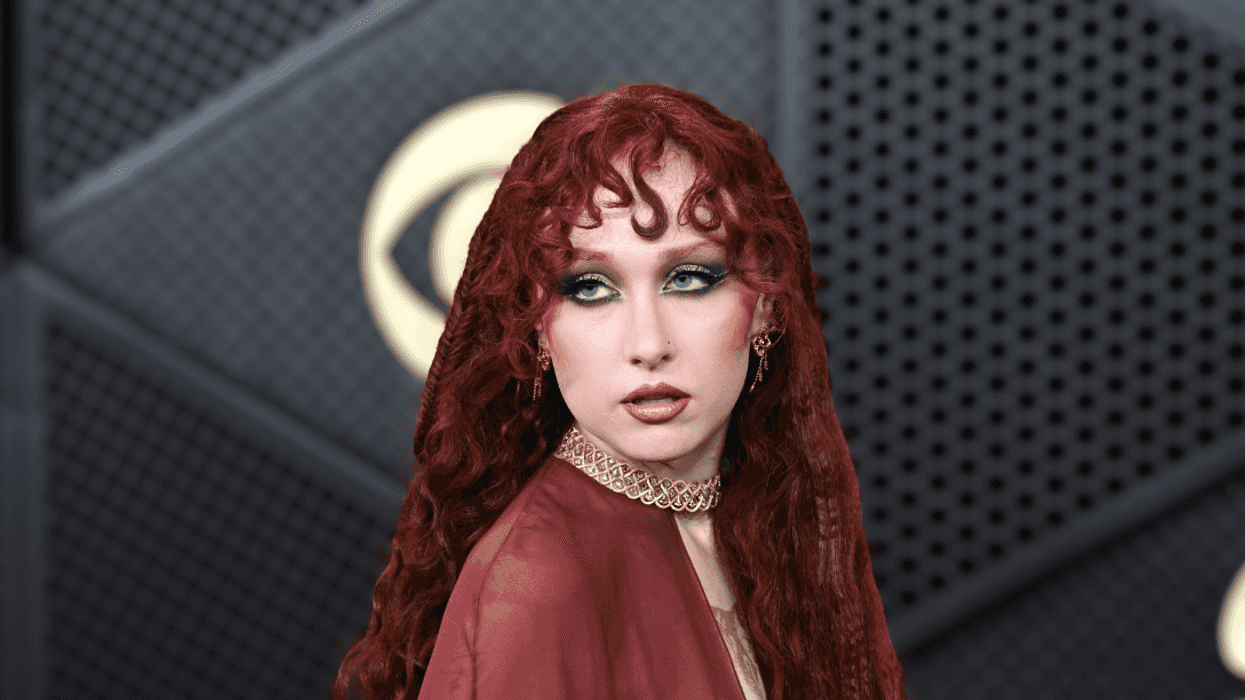

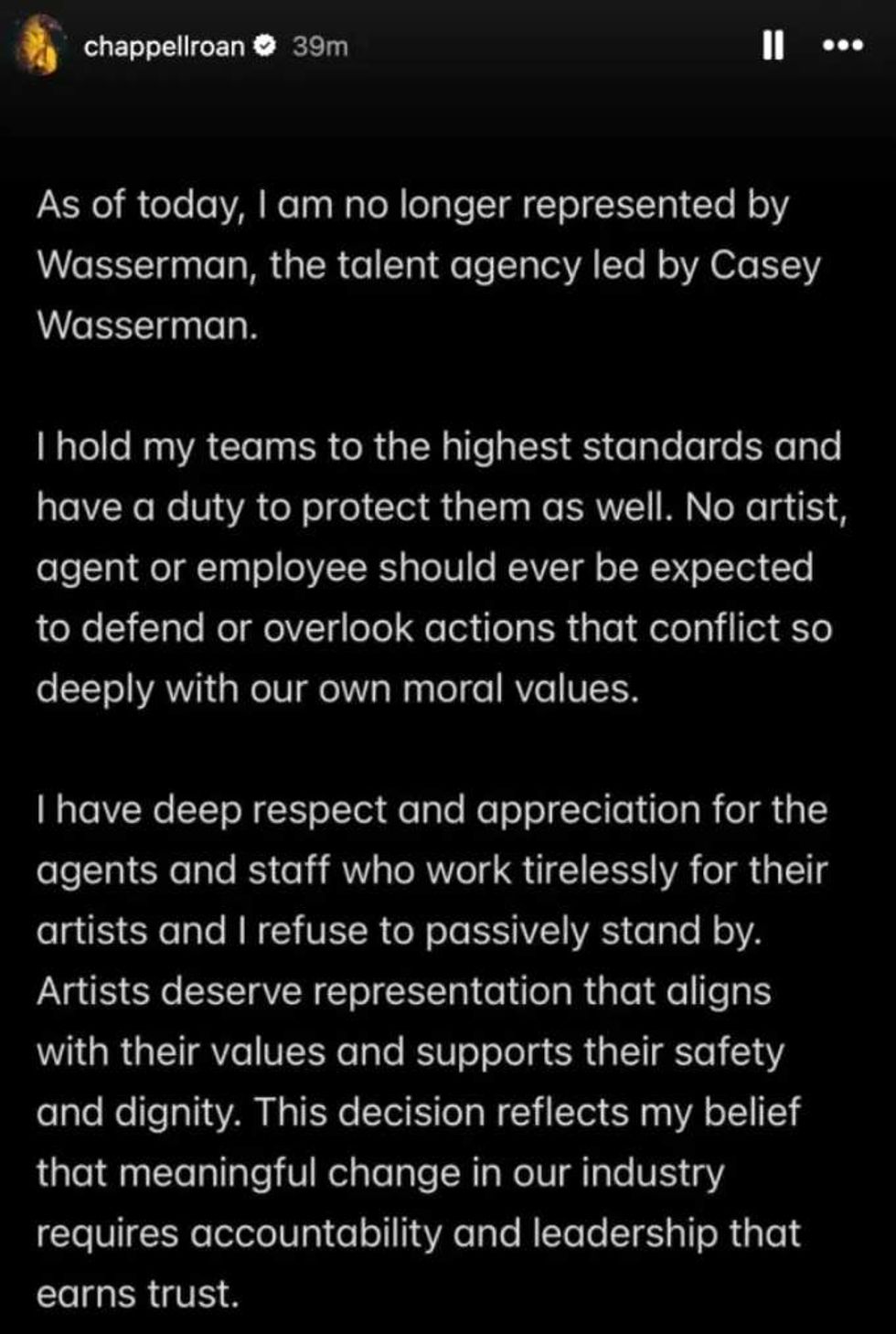

@chappellroan/Instagram

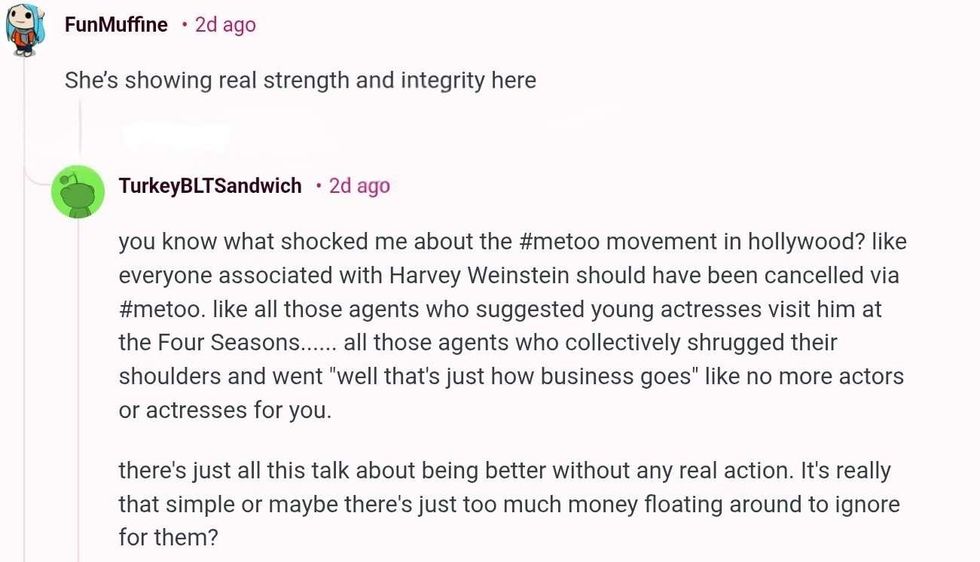

@chappellroan/Instagram r/Fauxmoi/Reddit

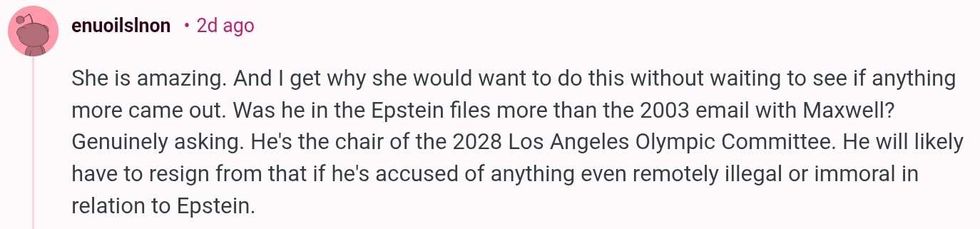

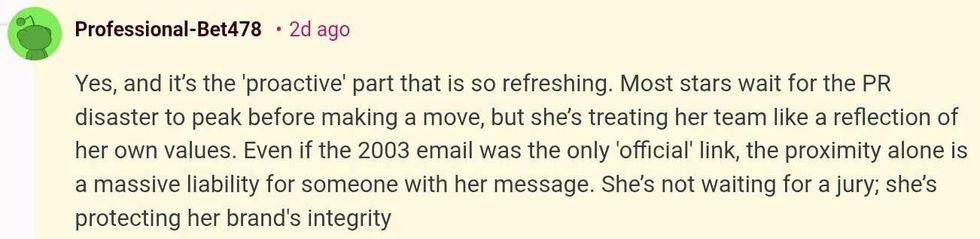

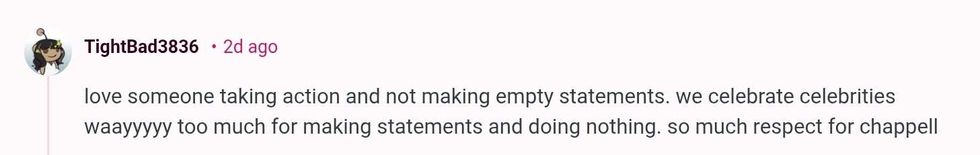

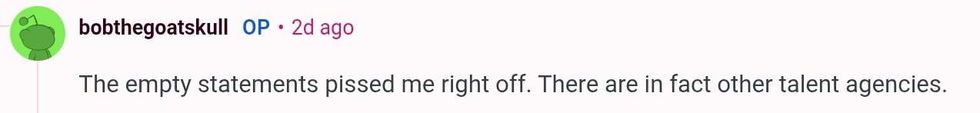

r/Fauxmoi/Reddit r/Fauxmoi/Reddit

r/Fauxmoi/Reddit r/Fauxmoi/Reddit

r/Fauxmoi/Reddit r/Fauxmoi/Reddit

r/Fauxmoi/Reddit r/Fauxmoi/Reddit

r/Fauxmoi/Reddit r/Fauxmoi/Reddit

r/Fauxmoi/Reddit r/Fauxmoi/Reddit

r/Fauxmoi/Reddit r/Fauxmoi/Reddit

r/Fauxmoi/Reddit r/Fauxmoi/Reddit

r/Fauxmoi/Reddit r/Fauxmoi/Reddit

r/Fauxmoi/Reddit r/Fauxmoi/Reddit

r/Fauxmoi/Reddit r/Fauxmoi/Reddit

r/Fauxmoi/Reddit r/Fauxmoi/Reddit

r/Fauxmoi/Reddit r/Fauxmoi/Reddit

r/Fauxmoi/Reddit @ANASKHA96399553/X

@ANASKHA96399553/X r/Fauxmoi/Reddit

r/Fauxmoi/Reddit r/Fauxmoi/Reddit

r/Fauxmoi/Reddit r/Fauxmoi/Reddit

r/Fauxmoi/Reddit

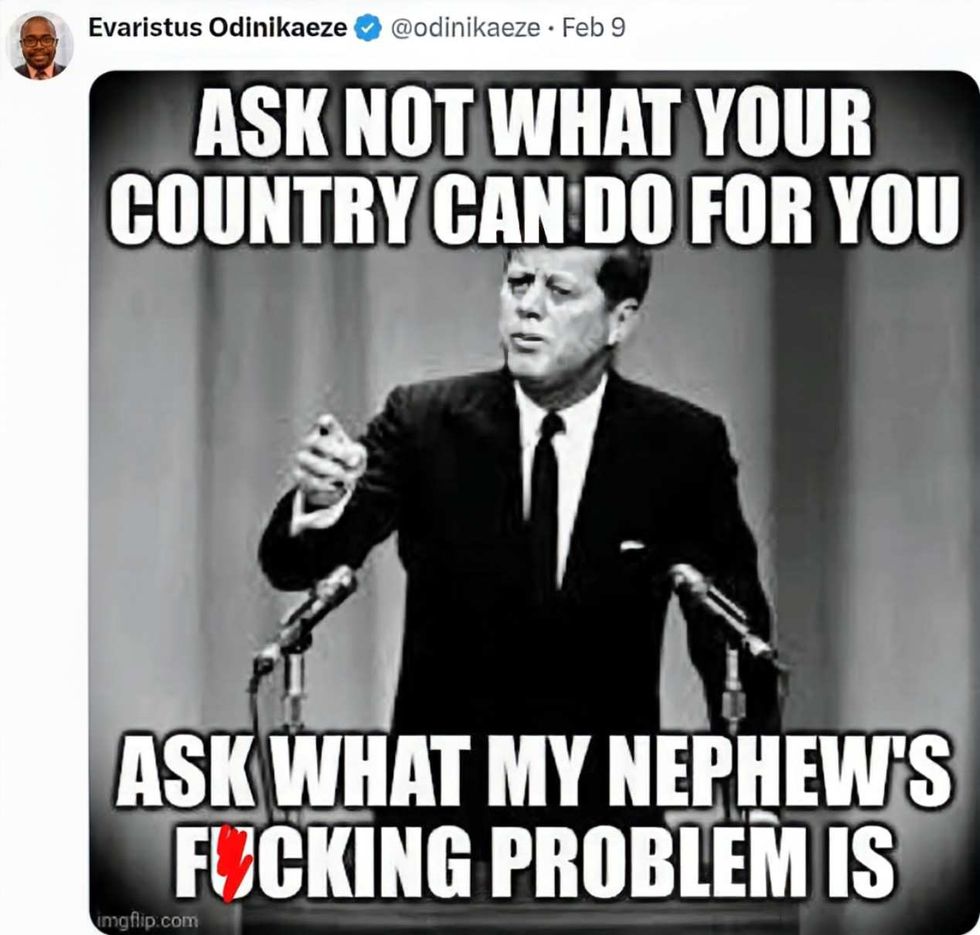

@odinikaeze/X

@odinikaeze/X @OneSixtyToOne/X

@OneSixtyToOne/X @Dazz222/X

@Dazz222/X

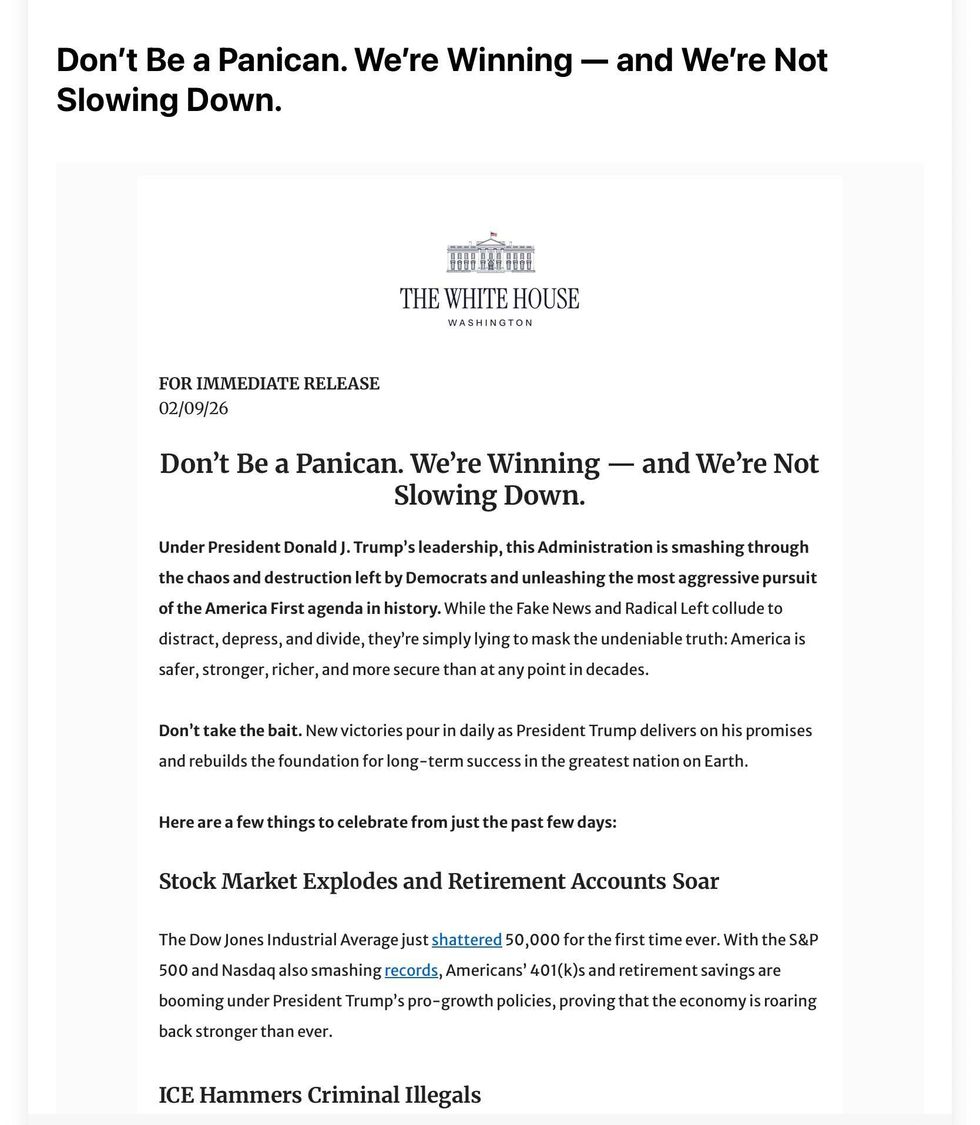

The White House

The White House @JBPritzker/X

@JBPritzker/X