President Donald Trump's post-G20 boastful rhetoric over improved trade relations with China may be "completely fabricated," according to JP Morgan's note to traders.

After a Saturday meeting with Chinese President Xi Jinping in Argentina, Trump declared a de facto cease-fire on the US-China trade war.

Trump on Sunday tweeted that Xi had "agreed to reduce and remove tariffs on cars coming into China from the U.S.," which the president said are currently at 40 percent.

There is no evidence this actually happened.

In a note to traders on Tuesday, JP Morgan expressed its doubts over whether China capitulated to Trump.

"It doesn’t seem like anything was actually agreed to at the dinner," the bank said in a note to traders, "and White House officials are contorting themselves into pretzels to reconcile Trump’s tweets (which seem if not completely fabricated then grossly exaggerated) with reality."

Adam Crisafulli, executive director at J.P. Morgan Chase, said "this ceasefire looks very similar to what China had offered Washington months ago," therefore, it is not "exactly clear what was gained by dragging the dispute out until the end of the year," referring to Trump's 90-day deadline.

Sure does look like Trump caused a problem so he could take credit for fixing it.

Other major financial institutions have their reservations as well.

Alec Phillips, chief political economic for Goldman Sachs, suspects the US and China are at a "pause" phase whose outcome is uncertain.

"This outcome is closest to the "pause" scenario we outlined in recent comments (here and here) although the length of the pause is fairly short," Phillips said.

Helen Qiao, China and Asia economist for Bank of America Merrill Lynch, noted the complexities of what each side is after. "The next step is to find out how big is the gap between what China is willing to offer and what the U.S. is willing to accept to make it a deal," she said.

Sacha Tihanyi, deputy head of emerging markets strategy at TD Securities, said the "aforementioned 'structural' issues are not ones that we believe can be easily tackled in a 90-day period."

Ellen Zentner, the chief US economist at Morgan Stanley, worries that "the U.S. agreed to pause tariffs without any meaningful concessions on the toughest negotiating points." She added: "There's still plenty of scope for further escalation before final resolution. If the U.S. continues to insist on its toughest demands, it's learned it can lean on more tariffs, as its pressure tactics have worked to some extent."

Trump on Tuesday reaffirmed his administration's efforts to achieve trading parity with China, which Trump slapped with hefty tariffs earlier this year.

But, in a seemingly contradictory move, Trump threatened to impose additional tariffs if China does not play ball his way.

President "Tariff Man" is missing a key point here. Tariffs are paid by American taxpayers, not foreign governments. Higher tariffs mean more money out of consumers' wallets.

Senator Ben Sasse (R-NE) reminded him of this in a tweet.

Trump does not have as much to brag about as he would like to believe.

JP Morgan's concerns were coupled with the more than 700-point plunge the Dow took on Tuesday, which has stoked fears that another recession could be on its way.

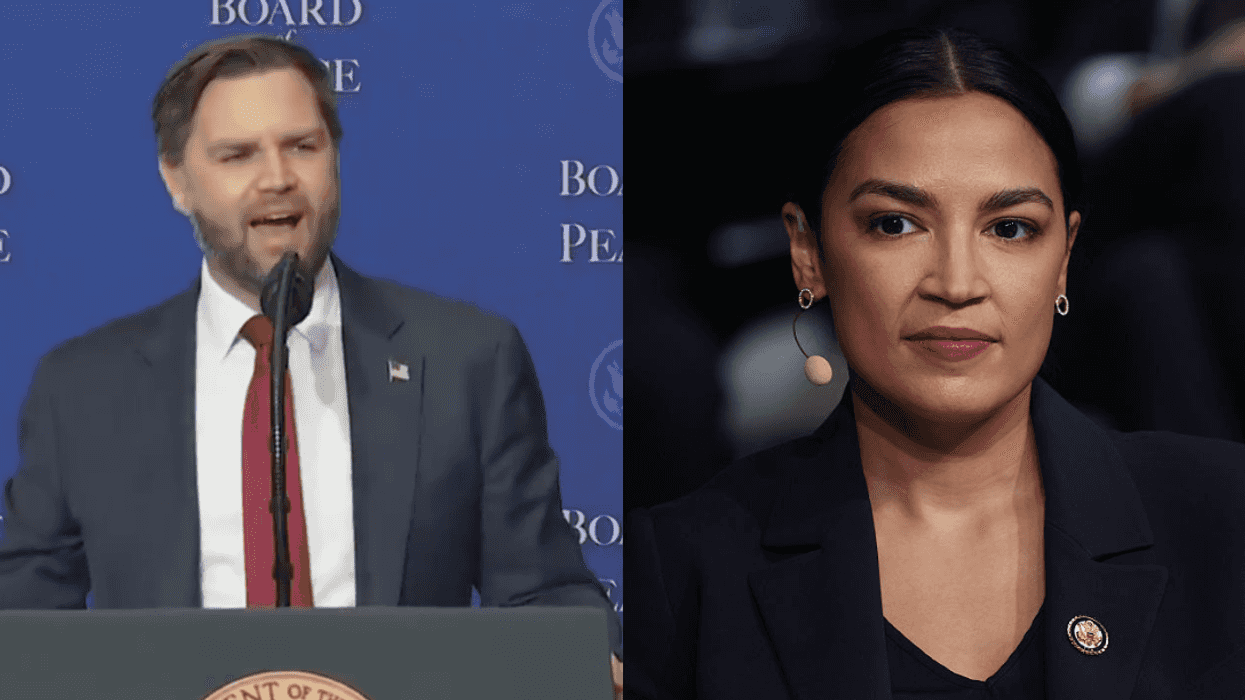

The Benny Show

The Benny Show

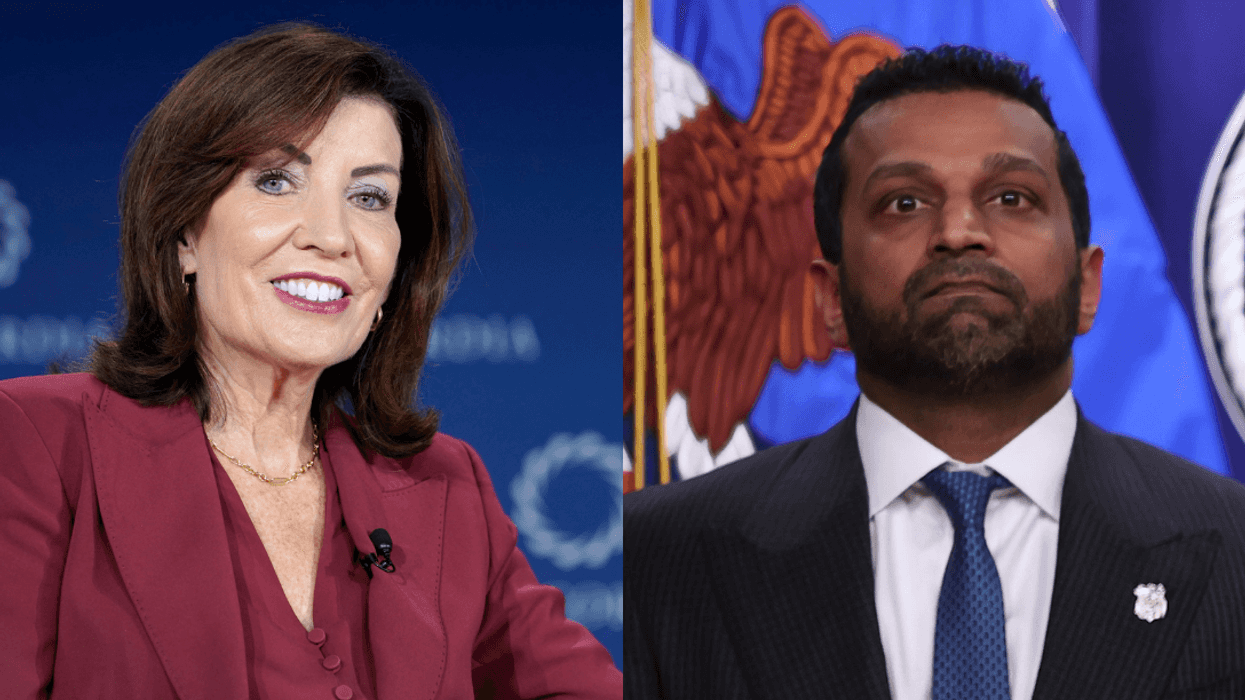

@neilforreal/Bluesky

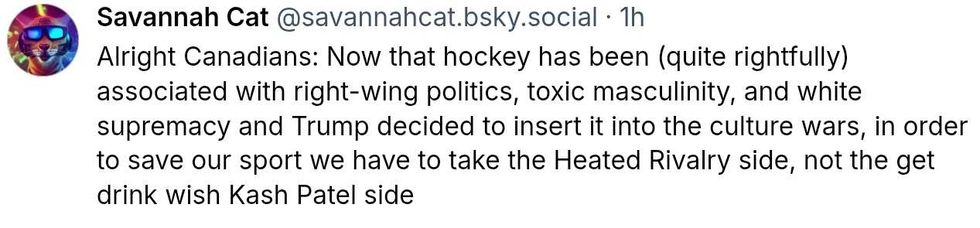

@neilforreal/Bluesky @savannahcat/Bluesky

@savannahcat/Bluesky @qadishtujessica.inanna.app

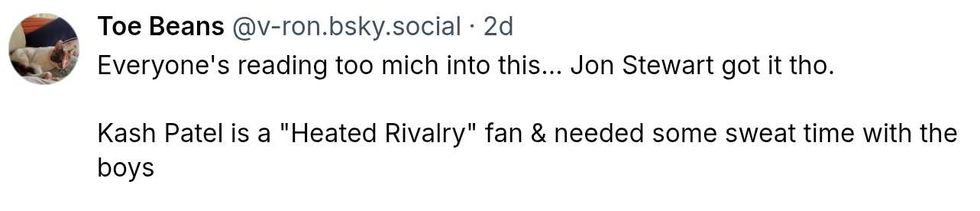

@qadishtujessica.inanna.app @v-ron/Bluesky

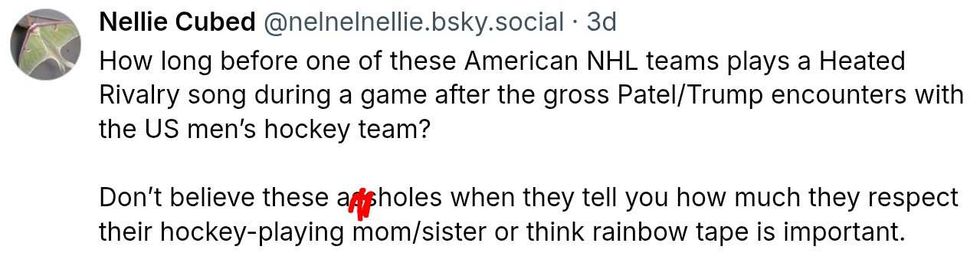

@v-ron/Bluesky @nelnelnellie/Bluesky

@nelnelnellie/Bluesky @beatlenumber9/Bluesky

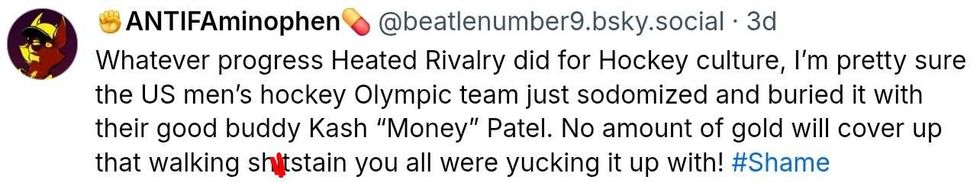

@beatlenumber9/Bluesky @pinkzombierose/Bluesky

@pinkzombierose/Bluesky

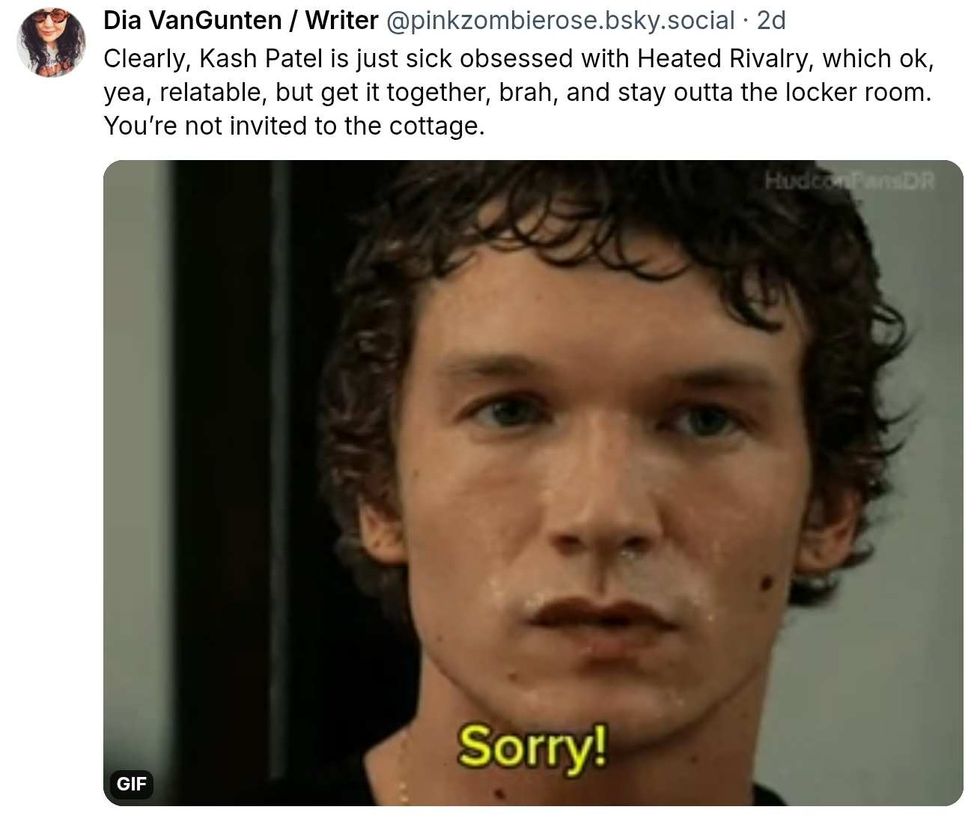

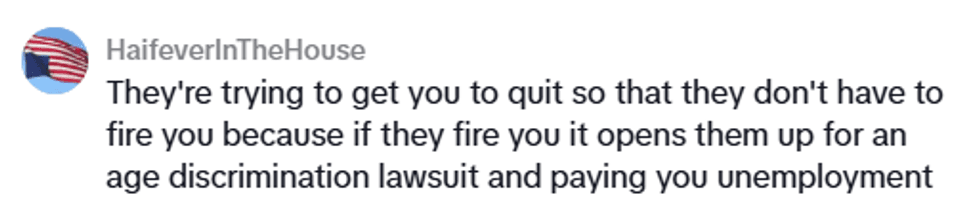

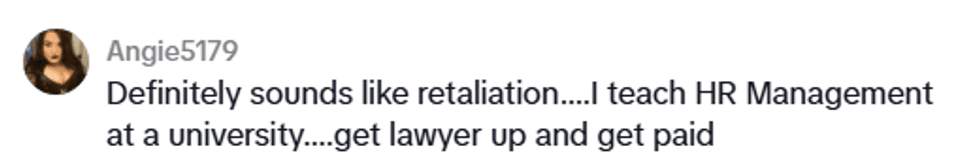

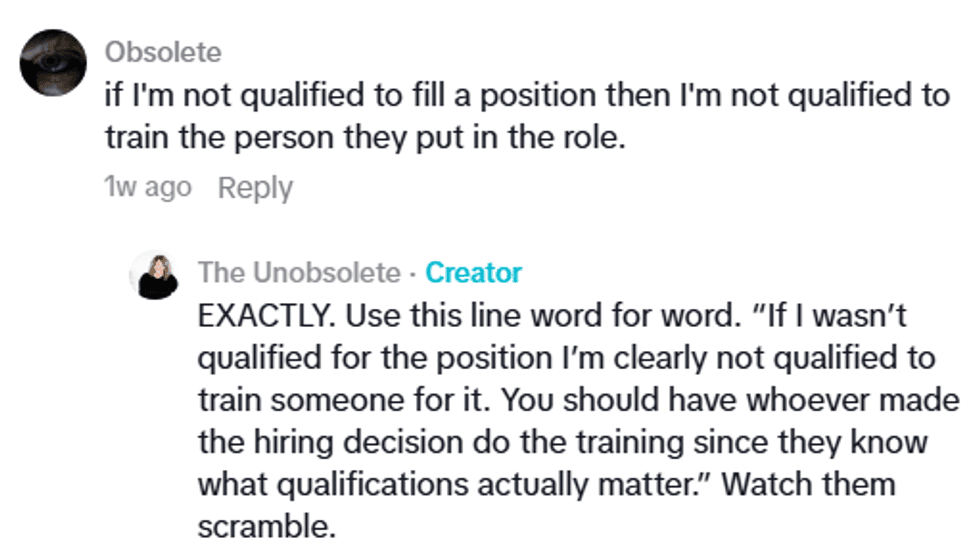

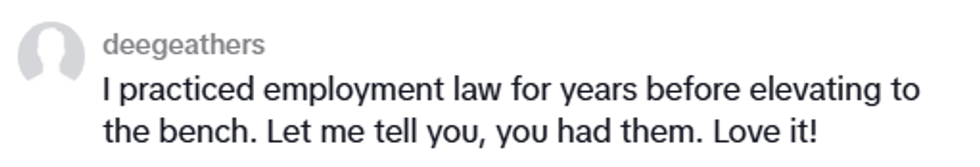

@theunobsolete/TikTok

@theunobsolete/TikTok @theunobsolete/TikTok

@theunobsolete/TikTok @theunobsolete/TikTok

@theunobsolete/TikTok @theunobsolete/TikTok

@theunobsolete/TikTok @theunobsolete/TikTok

@theunobsolete/TikTok @theunobsolete/TikTok

@theunobsolete/TikTok @theunobsolete/TikTok

@theunobsolete/TikTok @theunobsolete/TikTok

@theunobsolete/TikTok @theunobsolete/TikTok

@theunobsolete/TikTok @theunobsolete/TikTok

@theunobsolete/TikTok @theunobsolete/TikTok

@theunobsolete/TikTok @theunobsolete/TikTok

@theunobsolete/TikTok @theunobsolete/TikTok

@theunobsolete/TikTok @theunobsolete/TikTok

@theunobsolete/TikTok @theunobsolete/TikTok

@theunobsolete/TikTok @theunobsolete/TikTok

@theunobsolete/TikTok @theunobsolete/TikTok

@theunobsolete/TikTok

@laysuperstar/TikTok

@laysuperstar/TikTok @laysuperstar/TikTok

@laysuperstar/TikTok @laysuperstar/TikTok

@laysuperstar/TikTok @laysuperstar/TikTok

@laysuperstar/TikTok @laysuperstar/TikTok

@laysuperstar/TikTok @laysuperstar/TikTok

@laysuperstar/TikTok @laysuperstar/TikTok

@laysuperstar/TikTok @laysuperstar/TikTok

@laysuperstar/TikTok @laysuperstar/TikTok

@laysuperstar/TikTok @laysuperstar/TikTok

@laysuperstar/TikTok @laysuperstar/TikTok

@laysuperstar/TikTok @laysuperstar/TikTok

@laysuperstar/TikTok @laysuperstar/TikTok

@laysuperstar/TikTok @laysuperstar/TikTok

@laysuperstar/TikTok @laysuperstar/TikTok

@laysuperstar/TikTok