Global trading markets were thrown into a tizzy on Monday after President Donald Trump threatened to levy additional tariffs on Chinese imports amid rising tensions in trade talks between China and the United States.

Investors around the world had been, for weeks, optimistic about the global economic outlook.

Two Trump tweets were all it took to shatter that confidence.

"For 10 months, China has been paying Tariffs to the USA of 25% on 50 Billion Dollars of High Tech, and 10% on 200 Billion Dollars of other goods. These payments are partially responsible for our great economic results. The 10% will go up to 25% on Friday. 325 Billions Dollars...."

"....of additional goods sent to us by China remain untaxed, but will be shortly, at a rate of 25%. The Tariffs paid to the USA have had little impact on product cost, mostly borne by China. The Trade Deal with China continues, but too slowly, as they attempt to renegotiate. No!:"

And the effects were more than negligible.

"The VIX Index jumped 43 percent, the most since October -- the start of a horrible quarter for U.S. equities," Bloomberg reported on Monday "S&P 500 Index futures slid 1.7 percent and the Shanghai Composite fell 5.6 percent, the most since February 2016. European shares also dropped."

The Chinese Foreign Ministry has reportedly been on the fence about sending a delegation to the US this week to continue the talks, which has driven disruptions in assets and commodities.

The yuan, China's national currency, plunged to a three-year low. Oil plummeted to $60 a barrel, soybean shares tumbled, and gold ticked upward.

Whether Trump is simply posturing as a negotiating tactic or actually plans on imposing additional taxes in Chinese products - which ultimately costs American consumers more money - remains to be seen.

This is the last thing that Americans with strained budgets need.

Trump just does not seem to grasp how tariffs work.

This is the same "stable genius" who bankrupted multiple casinos in Atlantic City.

In March, two studies were published that calculated the price Americans are paying for Trump's trade wars - and the bill is steep.

Economists Mary Amiti, Stephen Redding, and David Weinstein at the Federal Reserve Bank of New York, Princeton University, and Columbia University found that American consumers are footing the bill for most of Trump’s $250 billion tax penalty on Chinese imports, specifically products that use steel and aluminum.

And the price tag is steep. The economists’ paper calculated that Trump’s tariffs have resulted in $3 billion in additional taxes per month on consumers and $1.8 billion in additional losses to American businesses. A further $165 billion has been siphoned off from American trade, mainly due to a collapse in supply chains, the trio’s study determined.

“This is kind of the worst-case scenario in terms of consumers,” Weinstein said in an interview. “It’s pretty unclear that this trade war is a net win for the economy at this point.” Weinstein added that additional research is being conducted to determine how much of a hit investment has taken because of uncertainty spurred by the president’s trade war.

Pinelopi Goldberg, the World Bank’s chief economist, Pablo Fajgelbaum of UCLA, Patrick Kennedy of the University of California Berkeley, and Amit Khandelwal of Columbia University took their research one step further. They factored in what effects retaliatory tariffs – imposed by countries such as China, Germany, and Canada – have had on the American economy.

The increased costs of imports have robbed the economy of $68.8 billion, their study revealed. But, because of the revenue raised by tariffs and rising prices of domestically-produced goods, the overall loss was adjusted to $6.4 billion.

Farmers and manufacturing workers among Trump’s political base are among the hardest hit, the study showed.

“Workers in very Republican counties bore the brunt of the costs of the trade war, in part because retaliations disproportionately targeted agricultural sectors, and in part, because US tariffs raised the costs of inputs used by these counties,’’ the authors wrote.

Additionally, the Institute of International Finance determined last week that retaliatory tariffs have shaved $40 billion off American exports.

Meanwhile, American taxpayers are now being forced to provide billions in bailouts to farmers who are no longer able to compete in the global market. Soy farmers have been among the hardest hit. One report released in November found soy exports to China have fallen 94 percent since the inception of Trump’s trade war.

Farm forecasts issued late last year are, understandably, not terribly optimistic. Another study, published in February, warned that tariffs on foreign cars, which Trump has threatened to impose, would be disastrous.

@CNN/Instagram

@CNN/Instagram @CNN/Instagram

@CNN/Instagram @CNN/Instagram

@CNN/Instagram @CNN/Instagram

@CNN/Instagram @CNN/Instagram

@CNN/Instagram @CNN/Instagram

@CNN/Instagram @CNN/Instagram

@CNN/Instagram @CNN/Instagram

@CNN/Instagram @CNN/Instagram

@CNN/Instagram @CNN/Instagram

@CNN/Instagram @CNN/Instagram

@CNN/Instagram @CNN/Instagram

@CNN/Instagram @CNN/Instagram

@CNN/Instagram @CNN/Instagram

@CNN/Instagram @CNN/Instagram

@CNN/Instagram @CNN/Instagram

@CNN/Instagram @CNN/Instagram

@CNN/Instagram @CNN/Instagram

@CNN/Instagram @CNN/Instagram

@CNN/Instagram @CNN/Instagram

@CNN/Instagram

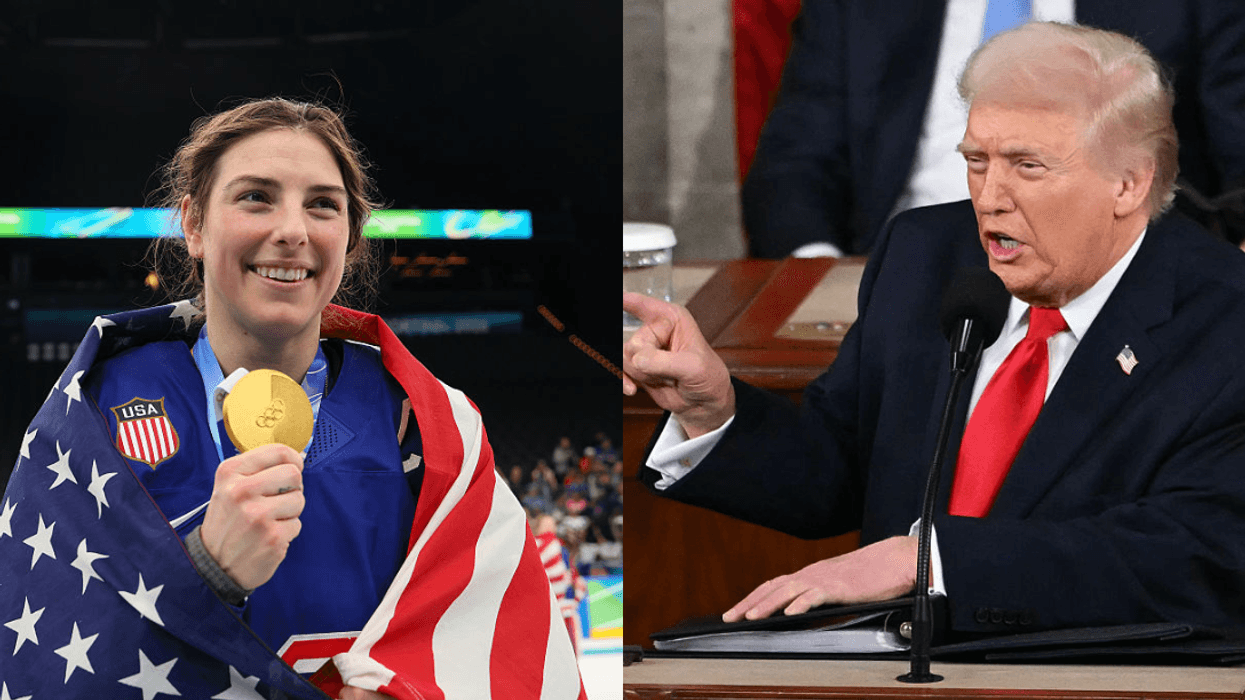

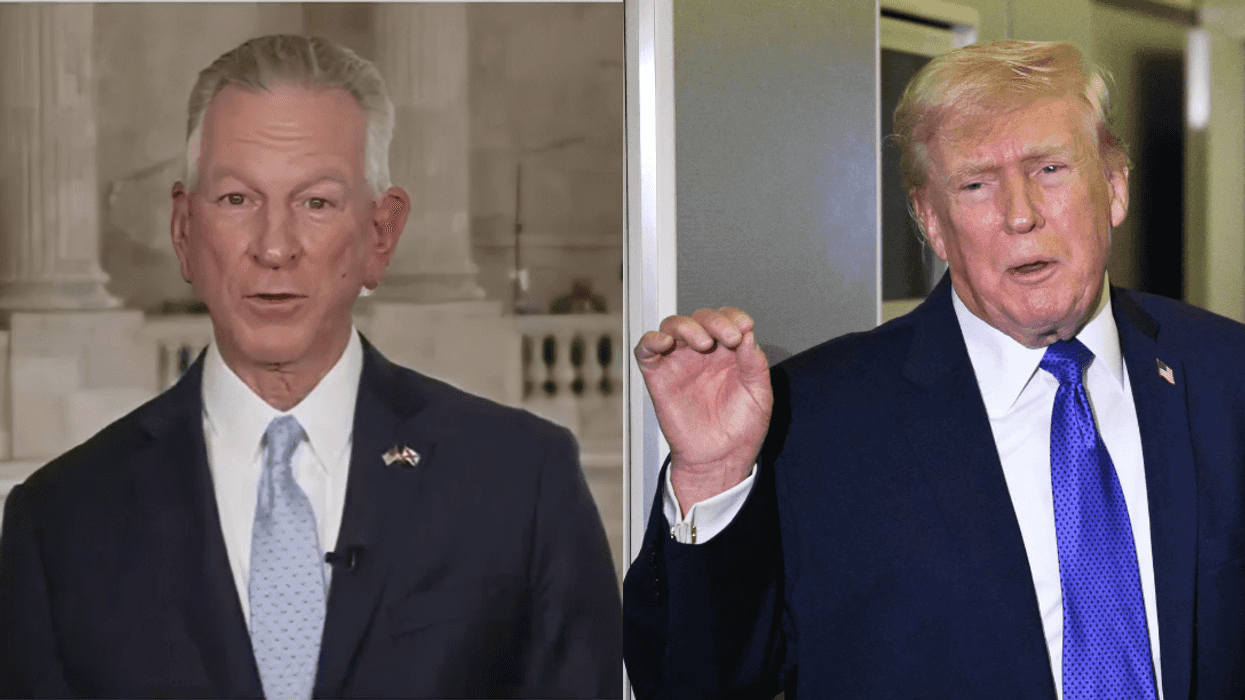

Saul Loeb/AFP via Getty Images

Saul Loeb/AFP via Getty Images

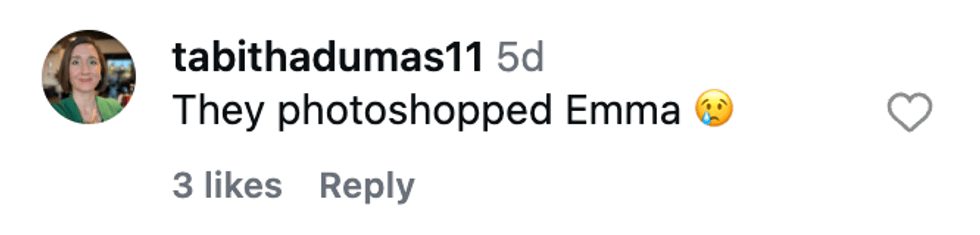

@tabithadumas11/Instagram

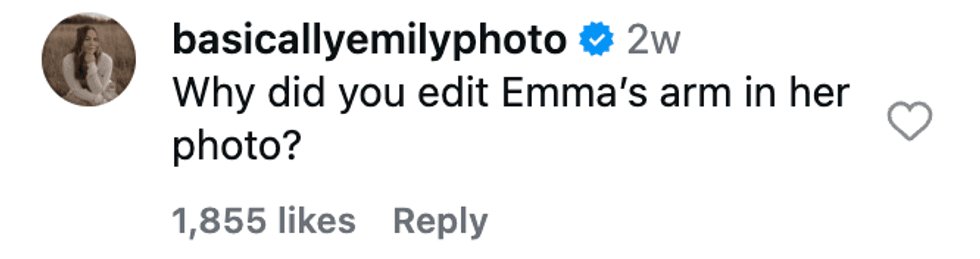

@tabithadumas11/Instagram @basicallyemilyphoto/Instagram

@basicallyemilyphoto/Instagram @ibexiga/Instagram

@ibexiga/Instagram @operasaurus/Instagram

@operasaurus/Instagram @gabbyyhorne/Instagram

@gabbyyhorne/Instagram @rosieposie_josie/Instagram

@rosieposie_josie/Instagram u/Happylittlepinetree/Reddit

u/Happylittlepinetree/Reddit u/idkeverynameistaken9/Reddit

u/idkeverynameistaken9/Reddit u/absentmindedlurking/Reddit

u/absentmindedlurking/Reddit u/Clinically-Inane/Reddit

u/Clinically-Inane/Reddit u/Make_Buff_Again/Reddit

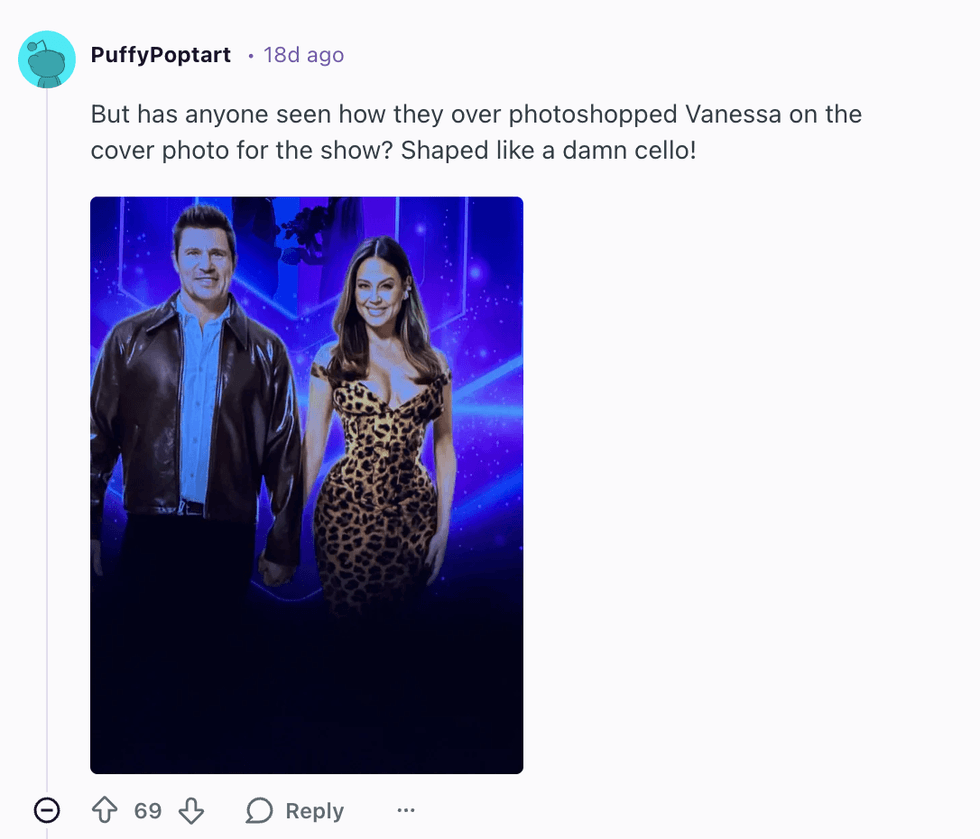

u/Make_Buff_Again/Reddit u/PuffyPoptart/Reddit

u/PuffyPoptart/Reddit