Tax day is Tuesday, April 17, which means many Americans will be lamenting the fact that they have no idea how taxes work or where their money goes on an annual basis. Fortunately, John Oliver, host of Last Week Tonight on HBO, decided this occasion was the perfect opportunity to explain a major problem in United States economics: corporate taxes.

If you've been paying attention to the news, you may have heard that Republicans in Congress passed a new tax plan in 2017. President Trump signed their bill and drastically changed the amount of taxes corporations have to pay the federal government. While the top corporate bracket used to be taxed at 35%, their rate will now be reduced to 21%. The supposed reasons for this and how it will likely affect our nation were explained by Oliver in his most recent episode!

Oliver says the largest problem with the U.S. corporate tax code isn't the rates, it's the loopholes that make avoiding payment possible.

For instance, though the tax rate on many corporations has been 35% until very recently, between 2008 and 2015, many of the nation's largest companies (including General Electric) paid no federal taxes due to various loopholes. You read that right—General Electric paid $0 in federal taxes despite being a massive, multi-billion dollar organization.

Another way companies avoid taxes is to relocate their earnings to off-shore accounts.

Simply by storing their money in countries with a lower tax rate, companies are able to defer paying American taxes, or even avoid paying completely. In fact, moving assets to Panama is so common it even has a name among businesses: "The Panama Scoot." Moving assets like capital, patents, and computer code to another country is sometimes as easy as clicking a button, but could mean the difference between paying U.S. taxes or paying none.

So if big corporations are barely paying any taxes, why is the GOP lowering their tax rates?

The tax plan is actually making an attempt to try and lure corporation's offshore funds back to the U.S. with promises of low taxes and even tax-free periods if a company is willing to "re-invest" in America. While the plan seems worth a shot on the surface, the same thing was actually attempted in 2004 by the American Jobs Creation Act. The legislators who passed the bill claimed that the tax breaks given to companies would result in higher pay for workers and the creation of more jobs. When the Act's outcome was measured by the Senate several years later, however, they found the money had almost no impact on job creation in the U.S. and that the majority of increased profits had been distributed to shareholders in the form of "stock buybacks and dividends."

So as you settle in to do your taxes this April 17, take a moment to imagine the big companies who will be paying less than you because legislators couldn't be bothered to fix loopholes in the tax code.

In the words of Mr. Oliver:

We just had a huge chance to reform our tax code and we absolutely blew it.

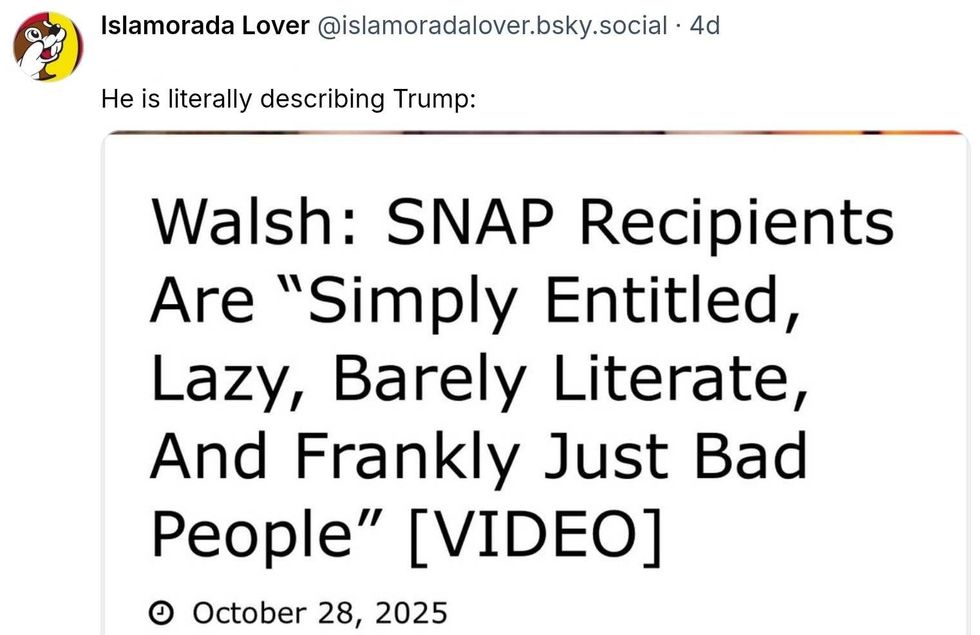

@islamoradalover/Bluesky

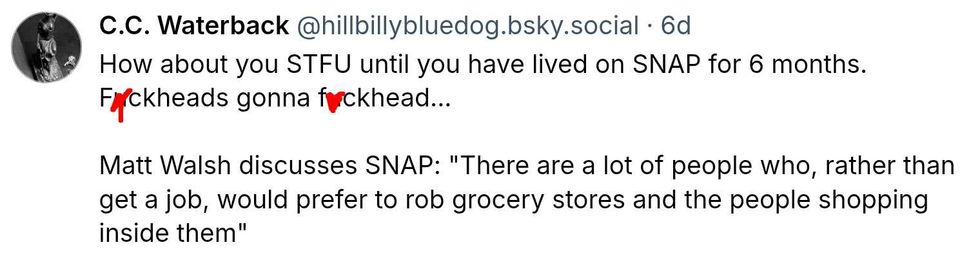

@islamoradalover/Bluesky @hillbillybluedog/Bluesky

@hillbillybluedog/Bluesky