An Indigenous grandfather says he and his 12-year-old granddaughter were racially profiled by a bank employee.

The events on December 20 also exacerbated his panic disorder.

Maxwell Johnson, a Heiltsuk First Nation member, planned on opening an account for his granddaughter so he could send money electronically to her while she was on the road for basketball games.

Johnson has been a loyal customer with the bank since 2014. But the way he was treated would indicate otherwise.

He recounted the humiliating encounter with an employee at the Bank of Montreal on Burrard Street in downtown Vancouver, Canada.

He knew something was off when he presented their government-issued Indian Status cards which are legal forms of ID in Canada, his birth certificate and her medical card to establish their identities to open the account in both their names.

Johnson told CBC the bank employee looked at them with suspicion while examining the identification cards and took them with her upstairs.

"She said the numbers didn't match up what she had on her computer."

The employee then returned and asked Johnson and his granddaughter to come upstairs with her to retrieve their cards.

As they made their way there, the police arrived.

Johnson and his granddaughter suddenly found themselves being treated like criminals for no reason.

"They came over and grabbed me and my granddaughter, took us to a police vehicle and handcuffed both of us, told us we were being detained and read us our rights."

It was devastating.

"You can see how scared she was … It was really hard to see that."

The frustration rippled across Twitter.

The Vancouver Police Department corroborated Johnson's account of what happened.

Sgt. Aaron Roed, a spokesperson for the Vancouver Police Department, said that officers detained the "two suspects" after claims from BMO "he and his granddaughter were committing a 'possible fraud' that was in progress and [BMO] identified the two as suspects.

However VPD found nothing to support BMO's claims.

"It was determined that there was no criminal activity and no fraudulent transactions."

After Johnson and his granddaughter were released, BMO issued a statement regretting their actions to CBC News on Tuesday.

"Although there were some mitigating circumstances, they do not excuse the way in which we handled the situation."

A BMO representative clarified that the "mitigating circumstances" could include a customer without proper identification.

However no proof was provided that any of Johnson's or his granddaughter's identification was improper or that the bank's records did not match as the employee claimed before calling the police and having them arrested.

Johnson suspects another reason for the employee flagging him for potential fraud.

He believes the employee was suspicious because he is Indigenous and had $30,000 in his bank account. That is the amount he and every other member of the Heiltsuk Fist Nation received in December from the federal government as part of an Aboriginal rights settlement package for violations of federal laws and treaty provisions committed by the Canadian government against the Heiltsuk.

The incident left Johnson—who suffers from panic disorders—with heightened fear of police and distrust in banks.

But his anxiety will not prevent him from fighting the good fight if he must.

"If I have to go to court to make this right, not only for myself but for every First Nations person that's been discriminated against by a bank or a big store or something like that, I will."

Fo Niemi, an executive director of the Centre for Research-Action on Race Relations in Montreal, said the incident exemplifies a rise in "commercial racial profiling."

"The pattern tends to be that when you see a person of color, the person is treated rather with a lack of respect, a lack of professional courtesy … and automatic assumption of guilt and criminal activity."

Carly Teillet, a lawyer with the B.C. Civil Liberties Association, criticized how the bank and the police handled the incident.

"I just can't imagine a situation where a 12-year-old girl trying to open a bank account needs to be handcuffed and is escorted out of a building."

"It doesn't foster trust between Indigenous people and Canadian institutions. I really hope that the folks that are involved use this incident as a learning opportunity."

BMO continued with their damage control on Thursday by issuing an apology to the public and Indigenous communities.

"We value our long and special relationship with Indigenous communities. Recently, an incident occurred that does not reflect us at our best."

"We deeply regret this and unequivocally apologize to all. We are reviewing what took place, how it was handled and will use this as a learning opportunity."

"We understand the importance and seriousness of this situation at the highest levels of the bank."

But are official apologies enough?

Twitter didn't think so.

The National Chief of the Assembly of First Nations denounced BMO.

The AFN's Perry Bellegarde tweeted:

"The AFN has reached out to BMO to express our deep disappointment and the need to set better standards for their employees. I urge BMO to publicly state what they plan to do to address this to ensure it doesn't happen again."

The B.C. AFN Regional Chief, Terry Teegee, said BMO "should be ashamed of themselves" and is pushing for all bank employees to go through stricter cultural sensitivity training in addition to educating them about racism and Indigenous people.

@RepOgles/X

@RepOgles/X @RepOgles/X

@RepOgles/X

@chrisbrownofficial/Instagram

@chrisbrownofficial/Instagram u/oatlatt/Reddit

u/oatlatt/Reddit u/LoveTheAhole/Reddit

u/LoveTheAhole/Reddit u/SoFetch89/Reddit

u/SoFetch89/Reddit u/00trysomethingnu/Reddit

u/00trysomethingnu/Reddit u/kittybuscemi/Reddit

u/kittybuscemi/Reddit u/___nic/Reddit

u/___nic/Reddit u/WaterMagician/Reddit

u/WaterMagician/Reddit u/west-brompton/Reddit

u/west-brompton/Reddit u/GhostlySpinster/Reddit

u/GhostlySpinster/Reddit u/Asleep_Tap6199/Reddit

u/Asleep_Tap6199/Reddit u/afreudtolove/Reddit

u/afreudtolove/Reddit u/myfriendtoldmetojoin/Reddit

u/myfriendtoldmetojoin/Reddit

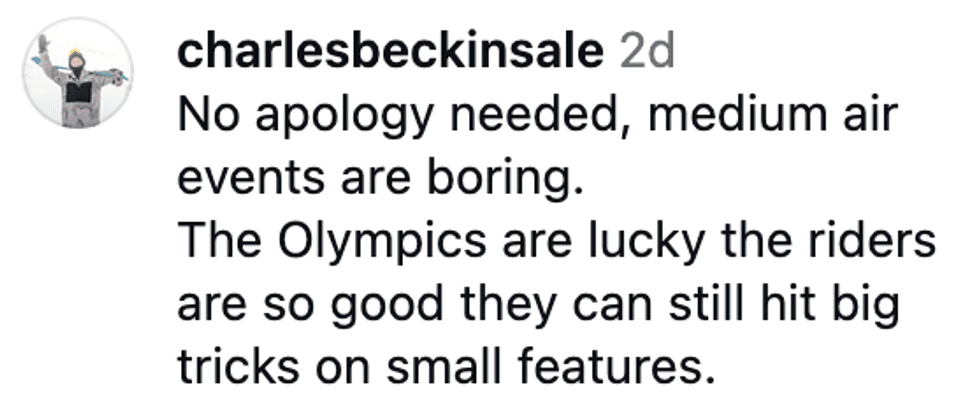

@charlesbeckinsale/Instagram

@charlesbeckinsale/Instagram @liamgriffin/Instagram

@liamgriffin/Instagram @valentinoguseli/Instagram

@valentinoguseli/Instagram @17is/Instagram

@17is/Instagram @torahbright/Instagram

@torahbright/Instagram @mcfetridge/Instagram

@mcfetridge/Instagram @colleenquigley/Instagram

@colleenquigley/Instagram @jonathanwaynefreeman/Instagram

@jonathanwaynefreeman/Instagram

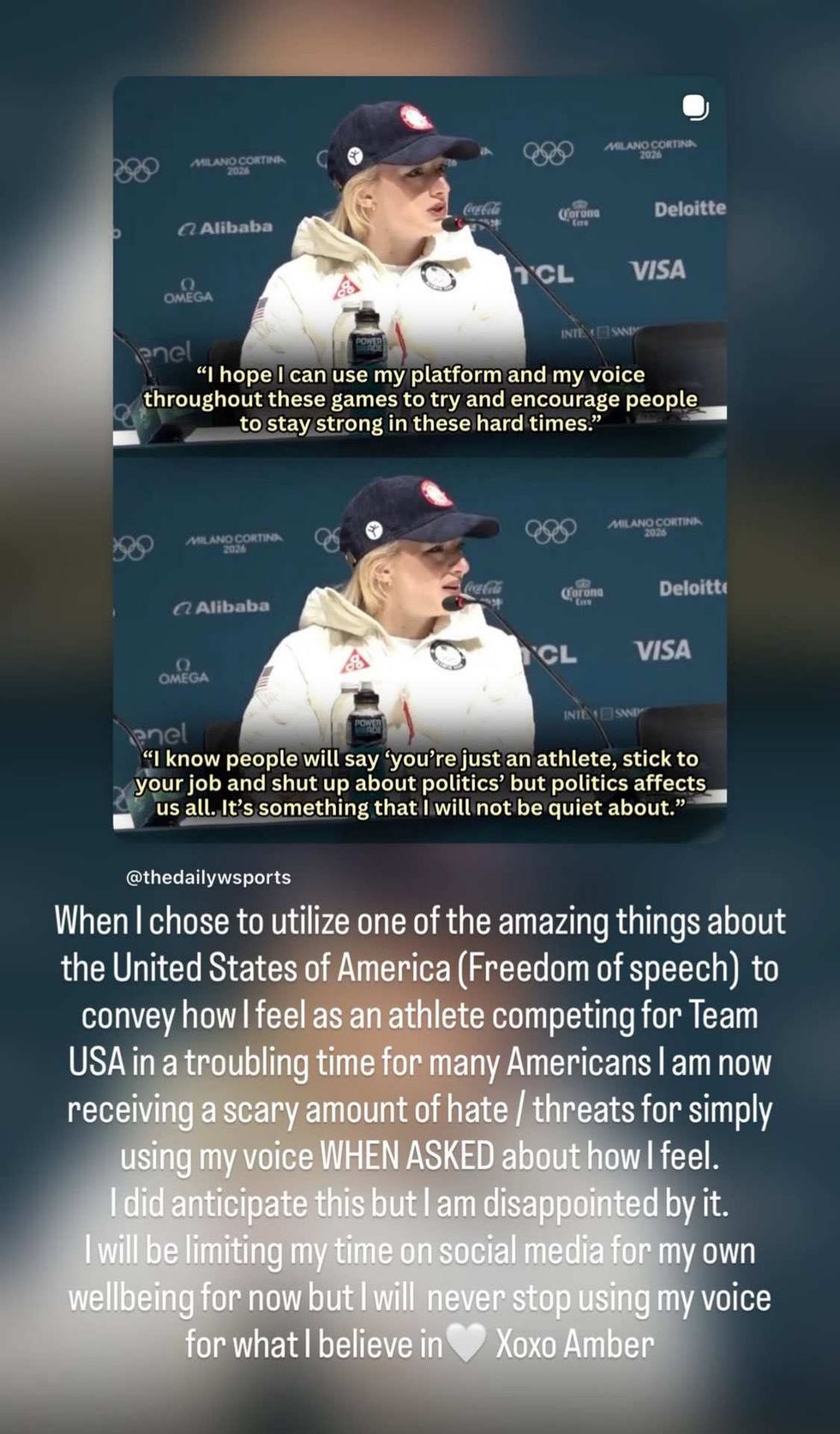

@amberglenniceskater/Instagram

@amberglenniceskater/Instagram