The United States Supreme Court has held that tax exemption for churches is constitutional under the Establishment Clause. Moreover, the Court has found that churches and religious organizations may be subject to a general sales and use tax; however, the Court has not addressed whether government may enact a specific "church tax."

The constitution of a number of countries such as the United States could be and have been interpreted as both supporting and prohibiting the levying of taxes unto churches; prohibiting church tax could separate church and state fiscally, but it could also be favorable treatment by the government.

When you consider that many churches have made unsavory headlines for engaging in political activity anyway, it's no wonder why the separation of church and state—and whether or not churches should be stripped of their tax-exempt status—remains such a hot topic.

To that end, the idea that churches are threatened by government overreach is also a hot topic, particularly on the more conservative side of the aisle. For example, in October 2021, Tennessee Republican Senator Marsha Blackburn made the odd claim that President Joe Biden aimed to "close the churches" as soon as Democrats could pass a much-scrutinized infrastructure bill.

Blackburn's assertion that churches would be closed down as soon as the bill is approved appears to have materialized out of thin air. In fact, where the infrastructure bill does mention churches is quite positive. The bill, which the Senate ultimately passed, provides $50 million in grants to nonprofits, including religious congregations, so they can upgrade their buildings with new energy-efficient heating and cooling systems.

We did tell you this is a hot-button issue. People were all too eager to share their thoughts with us after one Redditor asked the online community,

"Would you support taxing churches? Why or why not?"

"The Church of Jesus Christ of Latter Day Saints..."

"The Church of Jesus Christ of Latter Day Saints (Mormons) had over $130 billion in the stock market many years back. Yet they are tax exempt."

CAT_SNIFFER

And did you know that news outlets reported in 2019 that the Mormon Church amassed a fund worth more than $100 billion so its members could prepare for the "Second Coming of Christ"?

Yeah, that was a thing.

"If churches were nothing more..."

"If churches were nothing more than local parishes who served the community, collected donations to keep the lights on, and the priests were working class folks who took the job as a "calling" rather than a business opportunity?"

"I'd be more than happy to let them slide. It would be like taxing a soup kitchen, and who wants to do that?"

"But if the local 'pastor' has a Gulfstream? Tax the sh** out of him. And if they even bring up politics from the pulpit? Tax the ever-loving sh** out of them."

[deleted]

Religious doctrine will always have political implications. Makes sense, right?

"I'm a Christian..."

"I'm a Christian and have served in church leadership, I'm in favor of taxing churches. Churches exist in society and should contribute to it. I do have some caveats."

"One: I think governments should use taxes for the betterment of communities. That includes physical infrastructure, but also caring for the poor, sick, elderly, etc. All of that is a part of the church's overall mission. I see no reason why the church shouldn't be in favor of the government doing those things, and paying taxes in support of that."

"Two: I think churches should be able to write off any charitable giving. That would obviously have to be well defined; however, I think it would incentivize churches actually helping people, rather than misusing funds (which tons of churches do. There are good churches out there that care a lot for their communities, but there are many that don't)."

superclay

The ability to write off charitable giving is the devil in the details. No matter how you word it. It will be worked around. There are tons of lawyers whose only job is to know the tax code and give rich people/corporations tax breaks.

Still, this is surely an improvement over a default charitable status that is only reviewed under an occasional audit.

"Churches that provide..."

"Churches that provide community social services should be tax exempt. Churches that have large holdings, or church leaders with lavish homes or engage in political activities should not."

[deleted]

It would be soooo easy for a rich pastor to claim he's compliant with the tax free requirements.

If a church is doing enough social service to actually qualify as a non-profit, then they can file as one. There is no reason to give them any special rules or exceptions.

"I do believe..."

"I do believe in separation of church and state. I feel if a church is donating more to the people than the church then no taxes. I'd rather have the money go to the people than the government."

BetterAd-5309

As I recall, this is the original idea. Churches are not supposed to have influence on the political process and thus would be exempt from taxes because of that. But the church has not been keeping their end of the bargain.

"My aunt runs a church."

"My aunt runs a church. Over 90% of donations actually go towards charity work, such as healthcare and food for the homeless, clothes and school supplies for children. In many impoverished communities, churches are the only institutions truly keeping people housed and fed."

"Churches should be audited, as should any nonprofit. Saying they’re all bad is ignorant. Taxing them all would be robbing the poor."

[deleted]

If only things were this simple. Alas.

"Send your videos..."

"Well you can certainly get them in trouble by recording their sermon telling you who to vote for. It’s against the law for these religious institutions to influence anyone to vote for or against any political candidate."

"Send your videos and complaints to the IRS."

Dyspaereunia

This was a big deal in Kansas over the last few weeks, particularly ahead of a crucial campaign that secured a win for reproductive rights activists after citizens voted to enshrine reproductive rights in the state constitution, the result of an effort to ensure the state—typically Republican and conservative—remains a safe haven for abortion in the Midwest.

"Yes, primarily..."

"Yes, primarily because I think if churches or religions in general want to be playing a larger role in the politics of the world, as the various Christian denominations seem to desire in the U.S., then they should have to provide revenue and contribute to the nation or they should shut up."

theinsanegamer23

Straight and to the point, I see!

"Churches should have to go by..."

"Churches should have to go by the same rules as any other non-religious tax-exempt charity. File taxes proving where your money came from and where it went to prove you're using it for charitable purposes."

"Preaching is not, in and of itself, a charitable activity IMHO, so church buildings/expenditures used solely for church services don't deserve tax exempt status. Want to have something not taxed? It had better be actually helping someone."

Dragonness

Now if only we could fund the IRS appropriately...

"I think any business..."

"I think any business that makes a profit should be taxed. If you truly are being charitable then you shouldn't be making profit, all that excess income should be going back into growing the business and helping more people with whatever service you provide. Religious affiliation should be irrelevant."

MorbidAversion

Reforms would be pretty simple, provided there is bipartisan support in Congress. Enforcing them, however? Another matter entirely, and that's why it's important to stay on top of this issue.

This is a complex issue that is not likely to be resolved soon, and the impact of religious lobbying in Congress is certainly felt more than ever.

Would stripping churches of their tax-exempt status solve quite a few problems—namely the polarization and shoddy campaign finance laws—that have metastisized in American politics?

Answering that is not so easy.

Have some opinions of your own? Tell us more in the comments below!

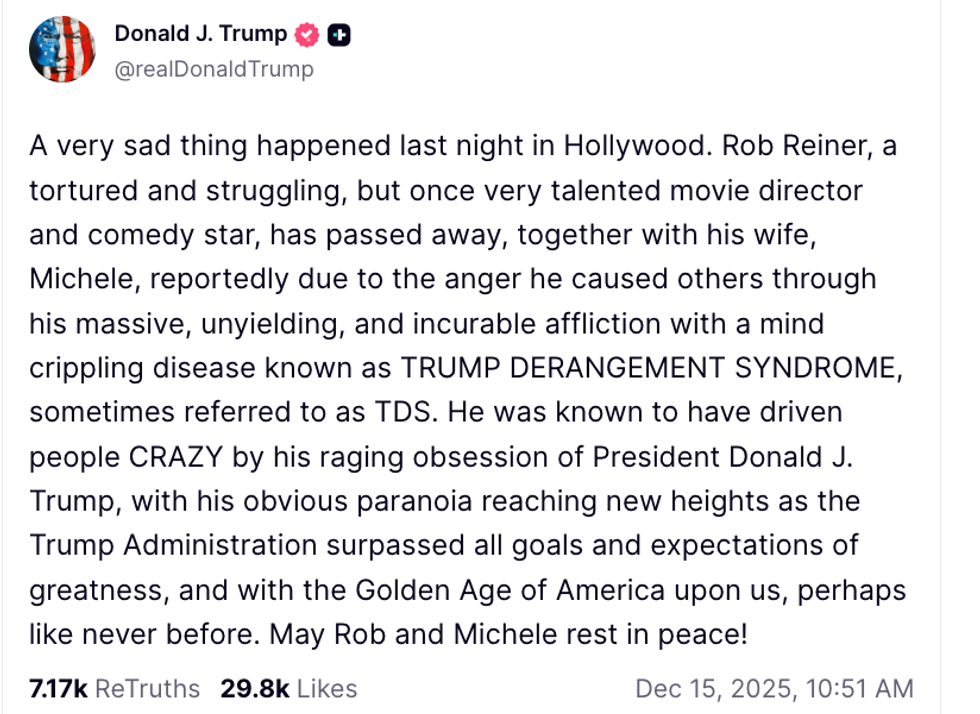

@realDonaldTrump/Truth Social

@realDonaldTrump/Truth Social