Companies are typically in business for profit, and very few have the goal of keeping the customer's interests in mind.

But some corporations go even further to get more out of their customer in exchange for their "quality services" and as a result, the line between general business and scam becomes blurred.

Redditor jwwin asked:

"What is a predatory business that shouldn't be legal, but is?"

Students paying an exorbitant amount in tuition in order to seek higher learning should be warned there are additional expenses to cover for.

A Textbook Example

"College textbooks, they will release an 'updated' edition every semester but the information doesn't change. And then after you spent a fortune on the books the places that buy textbooks will give you like 5% of what you paid for the book."

– teethalarm

A "Double Whammy"

"Former Prof here. I talked with a book rep about this once and learned a lot. It is a bit complicated but worth understanding. Book publishers rely on large quantity sales to make any money on a book because the cost of production is so high up front (author, editors, printing, etc.). So, for a book to be profitable, it has to sell a lot of copies to spread the cost of production across all the books. A paperback in the fiction section might sell 100,000 or more. A textbook might sell as few as 1,000. So, the publisher needs everyone to buy the book to break even."

"Now add colleges into the mix. Somewhere in the 1980s (give or take), colleges saw publishers selling books and making larger profits on them than the college bookstore was making per book. So they got the bright idea to start buying used texts and reselling them. Before that, a text would come out and 97% (making the number up but it was close to that) of the students would buy the book in year one, 85% in year two, 75% in year three, 60% in year four and 50% in year five. A $50 dollar book would cost $25 to make (again, making the numbers up), sell to the bookstore for $40 ($15 publisher profit), and be sold to the student for $50 ($10 bookstore profit). Across the five years, the producer would make a profit."

"Then, college bookstores began offering students $25 for a used book and selling it for $40 ($15 profit - $5 higher than that of a new book). Students would then prefer the $40 used book over the $50 new book. But that cut the publisher's sales from 97% to 50% in the first year. Because they could not sell as many books they had to do two things: (1) raise the initial price of the text to cover the production cost in 1-2 years rather than 4-5 years, and (2) cut the cycle down from 4-5 years to 1-2 years to ensure that they got sales of the book. That is a double whammy. Texts that used to cost $50 now cost $300 or more. And they have a new version out every 18 months or so. Students refuse to pay that price and that cuts the sales numbers even further forcing the price up again. And, with new editions out so frequently, it is harder to sell them back to the bookstore."

"That's why you see so many 'course packs' now - where a professor will pick a few pages from a book to give to the students. I went from having nearly every student purchasing a text in my early career to having zero students with a text late in my career. Your professor probably dislikes the state of affairs as much as you do. I cut down what books I would select because I could not justify students paying that much for what they were getting. I would also recommend students look for older editions on Amazon and the like which got me in trouble with my administration because I was not supporting the bookstore. But, it was difficult to teach from a text that no one had or had access to. The University's desire to generate revenue from texts truly was killing the chicken because it was not producing enough eggs."

"So look for an older edition on Chegg, Amazon, or the like and match it up with what your professor is teaching from the new edition. You are right, it probably has not changed. Be careful for the problems at the end of the chapter - that is often where the changes are."

– BewnieBound

These businesses parade as services but they are notorious for taking more than what you're willing to pay for.

For A Future Owner

"Rent to Own (furniture, appliances, TVs, video game systems, etc.) The mark up on the interest over time ends up costing 4 times the purchase - or more."

– PartyAlarmed3796

"Well the trick is to not pay (seems to be what a lot of people do)."

– Expensive_Ad2695

"Which is why those places are so expensive and why they're actually kinda necessary for some people."

"They're taking a pretty big risk on people with no credit, and if a person with shi*ty credit needs a refrigerator or other necessary appliance, there's usually nobody else willing to work with them. Also, most of them report to credit agencies so you can build your credit through them."

"I'm not a fan by any means and I hate that people are buying video game systems and couches through them, but I still think they're filling a need."

– Pitiful-Pension-6535

Money Sucker

"Payday loan companies – they're like financial vampires, sucking the life out of people with high-interest rates."

– neonliolia

"And yet most of them are owned by major banks... hmmmm."

"Bank of America, Wells Fargo, US Bank, JP Morgan/Chase collectively all own the largest payday lender companies."

– Bramtyre

"In Canada, there is an effort to turn Canada Post into a kind of bank that offers basic banking services to the most vulnerable. Not sure what happened to that, but it was an alternative to check cashing and payday loan rackets."

– hobbitlover

Greedy Event Vendor

"Ticket Master."

– LTVOLT

"Agreed. We went to a preseason hockey game the other week. Tickets were $5 each but there was around $8 of Ticketmaster fees for each one and you had to use their app to get in the door because the barcodes change like every 30 seconds or something. It's ridiculous."

– darfus1895

Where can citizens turn to receive genuine care without drying up their financial resources?

Big Pharma

"Health Insurance and over priced perscription drugs."

"Wife is type 1 diabetic. Her pump is over $1000 a month WITH 50% coverage. $177 for just the sensor pack. We have the best coverage we can afford."

– Dukeboys_

"US pays the middle man for health care coverage. The middle man and the health care provider come up with "health packages" you can buy into, just in case you get sick. It's just sick how they funnel money from the middle class into this."

– dcoolidge

"Healthcare insurance industry. They can straight up reject claims you should be covered for and make you jump through near endless hoops to get them to pay for the service that is part of your plan."

– ColdHardPocketChange

All Out To Get Ya

"Homeopathic 'medicine' sellers."

"Psychics"

"Domain search engine registration scams (fake emails or physical mail that shows up saying 'your domain search registration is about to expire' and look exactly like warnings that your domain name is about to expire)"

"Fake homeowner warranty/car warranty scams loaded with so many limitations and exclusions they’ll basically never pay out."

"Multilevel marketing systems like Amway."

– 4wqrewtety

Losing Sight Of Kids' Well-Being

"From my experience working in group homes for youth are awful. The owners only want money and the more kids in care the more money."

– OddReputation3765

Going Nowhere Fast

"Car insurance."

"You get penalized for using it. Even just once in some cases."

– Effective_Sundae_839

"1000% agree. I was rear ended by a hit and run driver while i was stopped at a stop sign. Literally came to a stop for 3 seconds max and got destroyed. Car insurance wanted to give me 4k and shut me up. It’s called the nuisance fee. I eventually lawyered up and got 25k out of it. But like wtf. B*tch that’s what we PAY FOR, following renewal of my policy it increased hundreds of dollars a month and that was even after i switched to a different company. 'A claim is a claim regardless who is at fault.'”

– HitBackZach

Businesses taking advantage of their customers should be a crime, yet here we are.

What companies can you think of that legally continue to look after their own profitable interests above providing a decent service?

Roberto Schmidt/AFP via Getty Images

Roberto Schmidt/AFP via Getty Images

u/pizzaratsfriend/Reddit

u/pizzaratsfriend/Reddit u/Flat_Valuable650/Reddit

u/Flat_Valuable650/Reddit u/ReadyCauliflower8/Reddit

u/ReadyCauliflower8/Reddit u/RealBettyWhite69/Reddit

u/RealBettyWhite69/Reddit u/invisibleshadowalker/Reddit

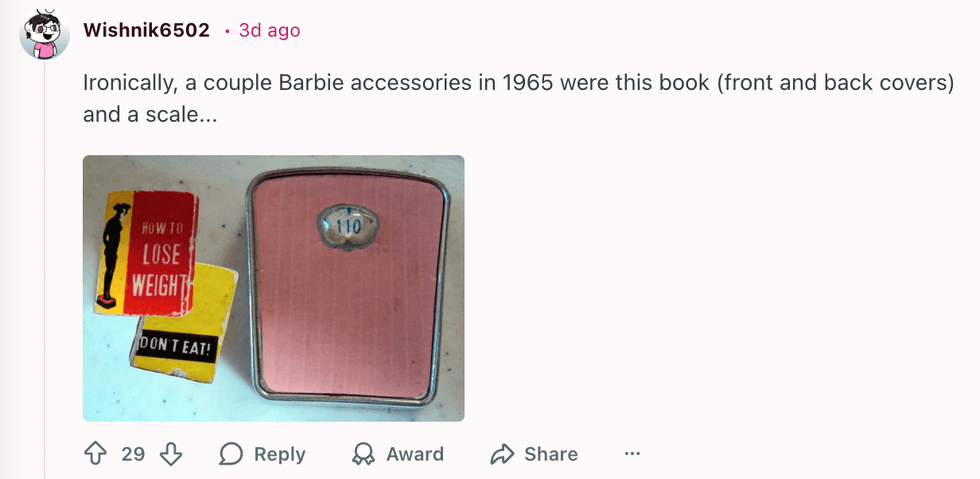

u/invisibleshadowalker/Reddit u/Wishnik6502/Reddit

u/Wishnik6502/Reddit u/kateastrophic/Reddit

u/kateastrophic/Reddit u/blking/Reddit

u/blking/Reddit u/SlagQueen/Reddit

u/SlagQueen/Reddit u/geezeslice333/Reddit

u/geezeslice333/Reddit u/meertaoxo/Reddit

u/meertaoxo/Reddit u/crystal_clear24/Reddit

u/crystal_clear24/Reddit u/stinkpot_jamjar/Reddit

u/stinkpot_jamjar/Reddit

u/Bulgingpants/Reddit

u/Bulgingpants/Reddit

@hackedliving/TikTok

@hackedliving/TikTok @hackedliving/TikTok

@hackedliving/TikTok @hackedliving/TikTok

@hackedliving/TikTok @hackedliving/TikTok

@hackedliving/TikTok @hackedliving/TikTok

@hackedliving/TikTok @hackedliving/TikTok

@hackedliving/TikTok @hackedliving/TikTok

@hackedliving/TikTok @hackedliving/TikTok

@hackedliving/TikTok @hackedliving/TikTok

@hackedliving/TikTok @hackedliving/TikTok

@hackedliving/TikTok

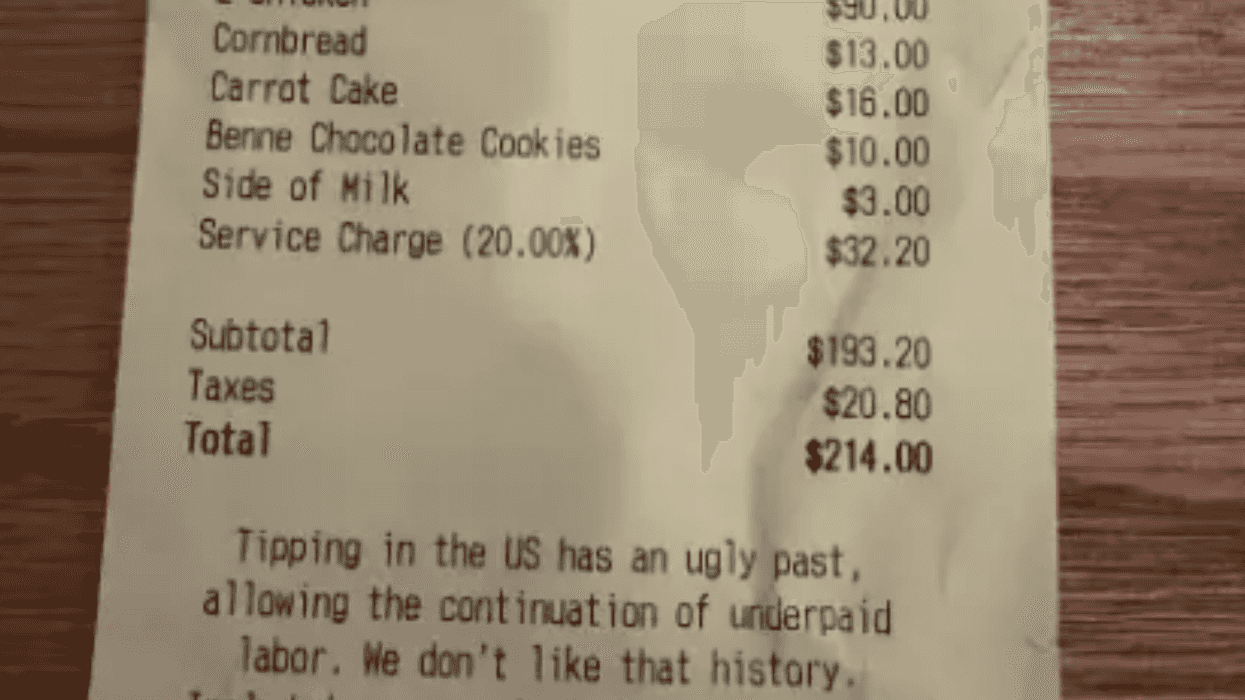

@vanderjames/Instagram

@vanderjames/Instagram @vanderjames/Instagram

@vanderjames/Instagram @vanderjames/Instagram

@vanderjames/Instagram @vanderjames/Instagram

@vanderjames/Instagram @vanderjames/Instagram

@vanderjames/Instagram @vanderjames/Instagram

@vanderjames/Instagram @vanderjames/Instagram

@vanderjames/Instagram @vanderjames/Instagram

@vanderjames/Instagram @vanderjames/Instagram

@vanderjames/Instagram @vanderjames/Instagram

@vanderjames/Instagram