There's an article we need to talk about. You might have seen it around social media lately. It's that article that shames people for spending money on "non-essentials."

The article has gone through many iterations since USA Today shared it to its social media pages with the following graphic, which shows the "average adult in the USA spends $1,497 a month on nonessential items."

Don't spend money on restaurant meals or drinks, everyone. USA Today has spoken.

And don't get it started on cable, rideshares, subscription boxes, or even personal grooming.

It's funny to see and hear regular coverage about how Americans need to spend money and stimulate the economy on a regular basis... and then see pieces like this, which adopt a survivalist mindset.

It's no secret that wages are stagnant and that most Americans barely have retirement savings––if any.

Is the average American not supposed to have anything they enjoy?

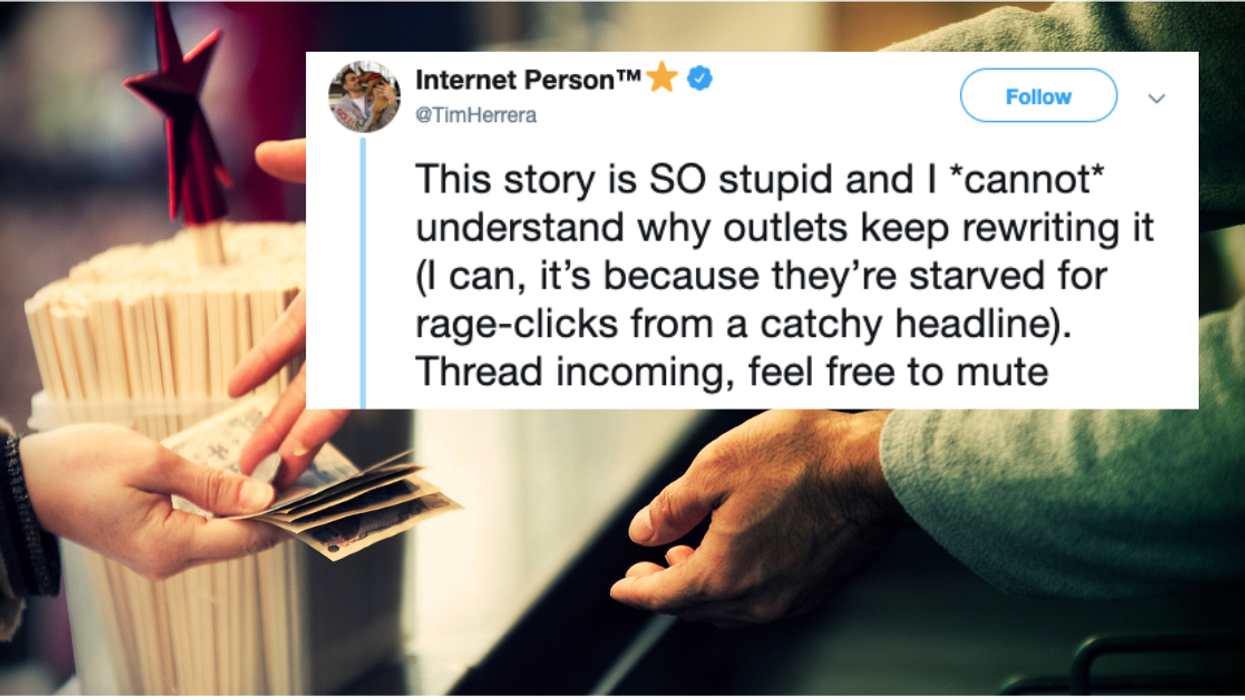

One person who's had enough with pieces like this one is New York Times editor Tim Herrera.

He goes ALL IN, too.

He points out that while the items highlighted in USA Today's article aren't "essential," they are "items that help us live":

On top of that, he says, USA Today's math is a little wonky:

Oh, before we continue with what Herrera said, we should note that USA Today recommends that you forego these items and purchase life insurance instead.

In fact, there are three separate instances in the article that mention purchasing a life insurance policy over eating out, personal grooming, and the like.

Here:

"The tendency to splurge consistently on nonessentials is causing Americans to skimp on other important items. Case in point: A good 38% of Americans claim they can't afford to fund a retirement plan because they don't have enough money. Meanwhile, 35% say they can't afford a life insurance policy, 28% can't afford to pay off credit card debt, and 26% can't afford car repairs."

Here:

"First, set up a budget, which will show you what your various living costs really entail. Next, assess your savings, and see what it'll take to build a true emergency fund – meaning at least three months' worth of savings in the bank. Next, identify the financial holes in your life (no life insurance, no retirement savings) and figure out how much money you'll need each month to fill them."

And here:

"Once you have that information, you'll need to play around with different scenarios in which you trim your spending on nonessentials and see where that leaves you... From there, you might slash two of those expenses to pay for a life insurance plan, and cancel a streaming service or two and your gym membership to eke out money for a retirement account."

Herrera notes that the article cites a study commissioned by Ladder, a company that helps you––GUESS WHAT?––pick out life insurance policies:

The article, he concludes, is an example of "irresponsible publishing":

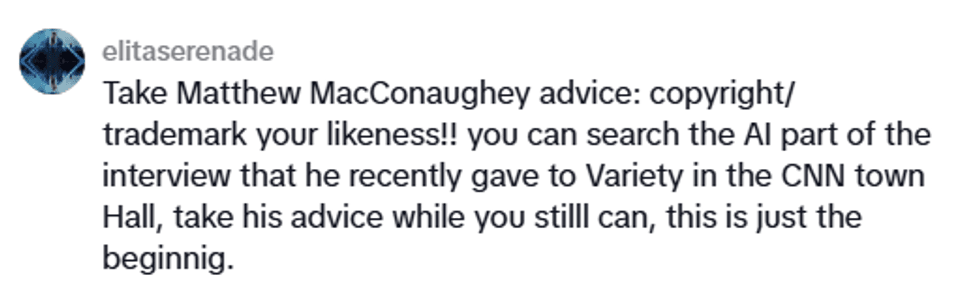

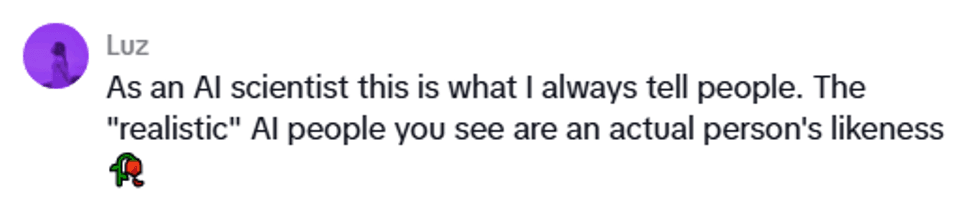

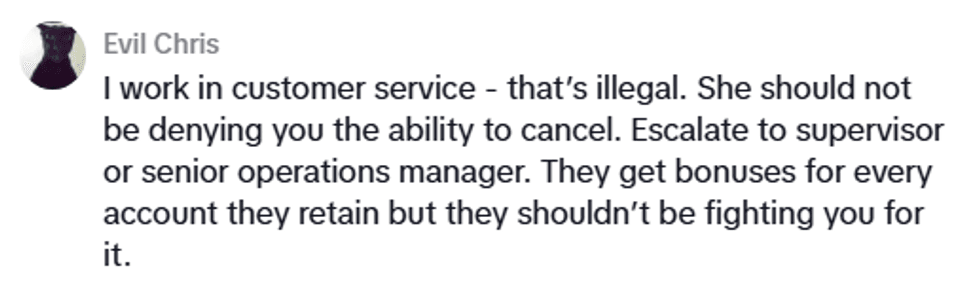

People had their own criticisms about that article to share, too.

Tell you what: Let's do something about those stagnant wages. Then come back to us about retirement savings and life insurance policies.

We see you, USA Today.

@madswellness/TikTok

@madswellness/TikTok @madswellness/TikTok

@madswellness/TikTok @madswellness/TikTok

@madswellness/TikTok @madswellness/TikTok

@madswellness/TikTok @madswellness/TikTok

@madswellness/TikTok @madswellness/TikTok

@madswellness/TikTok @madswellness/TikTok

@madswellness/TikTok @madswellness/TikTok

@madswellness/TikTok @madswellness/TikTok

@madswellness/TikTok @madswellness/TikTok

@madswellness/TikTok @madswellness/TikTok

@madswellness/TikTok

@vanellimelli030/TikTok

@vanellimelli030/TikTok @vanellimelli030/TikTok

@vanellimelli030/TikTok @vanellimelli030/TikTok

@vanellimelli030/TikTok @vanellimelli030/TikTok

@vanellimelli030/TikTok @vanellimelli030/TikTok

@vanellimelli030/TikTok @vanellimelli030/TikTok

@vanellimelli030/TikTok @vanellimelli030/TikTok

@vanellimelli030/TikTok @vanellimelli030/TikTok

@vanellimelli030/TikTok @vanellimelli030/TikTok

@vanellimelli030/TikTok @vanellimelli030/TikTok

@vanellimelli030/TikTok @vanellimelli030/TikTok

@vanellimelli030/TikTok

@anissahm15/TikTok

@anissahm15/TikTok @anissahm15/TikTok

@anissahm15/TikTok @anissahm15/TikTok

@anissahm15/TikTok @anissahm15/TikTok

@anissahm15/TikTok @anissahm15/TikTok

@anissahm15/TikTok @anissahm15/TikTok

@anissahm15/TikTok @anissahm15/TikTok

@anissahm15/TikTok @anissahm15/TikTok

@anissahm15/TikTok @anissahm15/TikTok

@anissahm15/TikTok @anissahm15/TikTok

@anissahm15/TikTok @anissahm15/TikTok

@anissahm15/TikTok @anissahm15/TikTok

@anissahm15/TikTok @anissahm15/TikTok

@anissahm15/TikTok @anissahm15/TikTok

@anissahm15/TikTok @anissahm15/TikTok

@anissahm15/TikTok

@hustleb***h/TikTok

@hustleb***h/TikTok @hustleb***h/TikTok

@hustleb***h/TikTok @hustleb***h/TikTok

@hustleb***h/TikTok @hustleb***h/TikTok

@hustleb***h/TikTok @hustleb***h/TikTok

@hustleb***h/TikTok @hustleb***h/TikTok

@hustleb***h/TikTok @hustleb***h/TikTok

@hustleb***h/TikTok