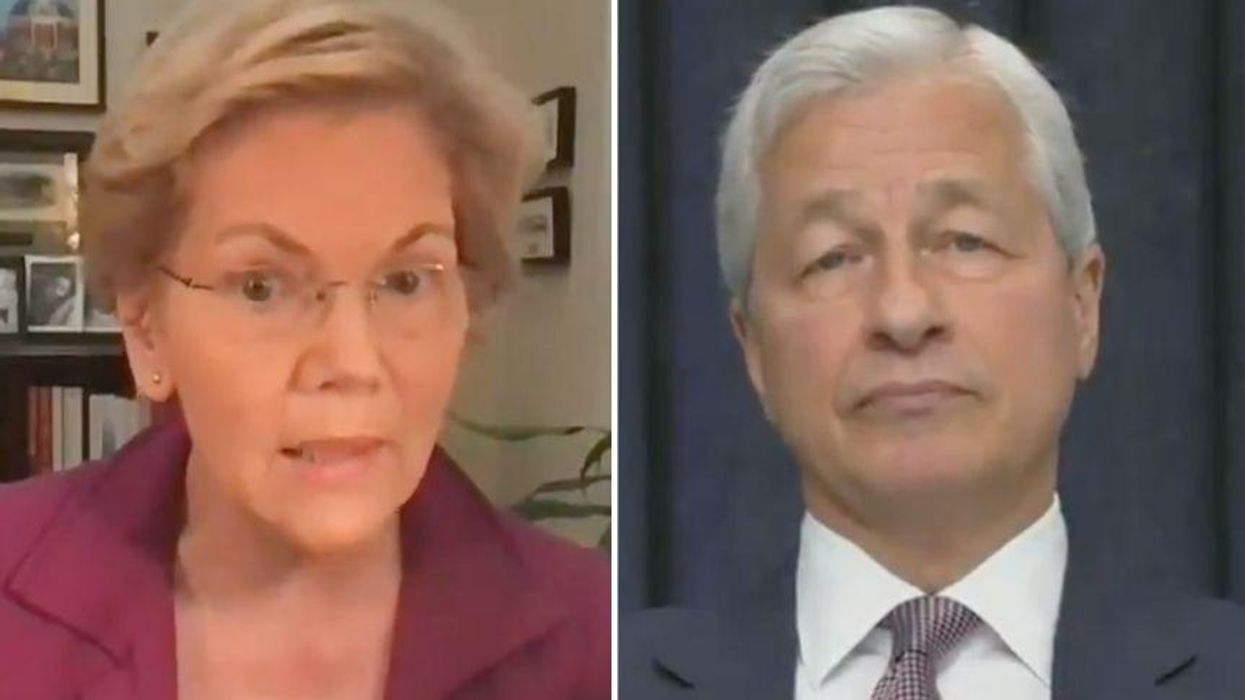

Democratic Senator Elizabeth Warren of Massachusetts has earned a reputation for holding corporations and the executives who profit from them accountable.

Such was the case during a Senate Banking, Housing, and Urban Affairs Committee hearing on the Federal Reserve and the U.S. Economy this past Wednesday, which featured testimony from CEOs of major banks.

Among those CEOs was JPMorgan Chase executive Jamie Dimon—with whom Warren has come to barbs before.

This time, Warren pressed Dimon over the bank's $1.5 billion in revenue driven by overdraft fee charges during the pandemic. JPMorgan enforced these overdraft fees despite regulators urging banks to automatically waive overdraft fees during the pandemic and despite the Federal Reserve waiving overdraft fees for banks in their own Fed accounts.

What followed was a tense exchange.

The big bank CEOs came to the Senate today to talk about how they stepped up and took care of customers during the pandemic \u2013 and I told them that\u2019s a bunch of baloney. They nickel and dimed their struggling customers with overdraft fees to line their own pockets.pic.twitter.com/yKYwScMUs9— Elizabeth Warren (@Elizabeth Warren) 1622043529

Labeling Dimon the "star of the overdraft show," Warren said:

"Your bank, JPMorgan, collects more than seven times as much money in overdraft fees per account than your competitors. So, Mr. Dimon, how much did JPMorgan collect in overdraft fees from their consumers in 2020?"

Dimon claimed Warren's numbers were "totally inaccurate."

As Dimon talked over her, Warren said:

"Sir, these are public numbers. Can you just answer my question? How much did JPMorgan collect?"

Dimon said that he didn't have the number in front of him, but that JPMorgan waived some overdraft fees upon request.

Warren responded:

"I actually have the number in front of me. It's $1.463 billion. That's nearly one and a half billion dollars that you collected from your customers. Now, do you know how much JPMorgan's profit would've been in 2020 if you had followed the recommendation of the regulators and waived overdraft fees to help struggling consumers? In other words, without that overdraft money, would your bank have been in financial struggle?"

Dimon once again deflected before Warren gave him the answer: $27.6 billion.

The Senator concluded:

"You and your colleagues come in today to talk about how you stepped up and took care of customers during the pandemic, and it's a bunch of baloney."

People were thrilled at the takedown.

@ewarren is what an American hero looks like.https://twitter.com/SenWarren/status/1397577973000192007\u00a0\u2026— David Rothkopf (@David Rothkopf) 1622053495

Go Elizabeth!https://twitter.com/senwarren/status/1397577973000192007\u00a0\u2026— Marianne Williamson (@Marianne Williamson) 1622045866

My girl EW ain\u2019t playing!!https://twitter.com/senwarren/status/1397577973000192007\u00a0\u2026— TRL (@TRL) 1622054471

Facts @ewarren https://twitter.com/senwarren/status/1397577973000192007\u00a0\u2026— Scott Tillman (@Scott Tillman) 1622052964

I would watch Elizabeth Warren pummel Jamie Dimon all day.pic.twitter.com/S1XPzMriZf— Sawyer Hackett (@Sawyer Hackett) 1622043145

If it\u2019s 1 thing Elizabeth Warren is going to do... it\u2019s piss off rich white men! I stanhttps://twitter.com/senwarren/status/1397577973000192007\u00a0\u2026— Stone Cold Steve Pfizer (@Stone Cold Steve Pfizer) 1622050736

But while countless people enjoyed seeing Dimon's feet held to the fire, they still want to see action and expanded regulation imposed on big banks.

Good show and all but anyone gonna do something about it?https://twitter.com/senwarren/status/1397577973000192007\u00a0\u2026— mantis toboggan (@mantis toboggan) 1622052354

These hearings seem like a show, all show in fact and no go. Without action to regulate the banks greed people continue to suffer from low wages, high costs of living and predatory lending banking practices all while incredibly profitable big banks get special taxpayer favors!https://twitter.com/SenWarren/status/1397577973000192007\u00a0\u2026— Joe Segal- Be Kind To Yourself & Others (@Joe Segal- Be Kind To Yourself & Others) 1622053060

As much as I love seeing CEOs like Jamie Dimon being roasted on an open fire, mandating overdraft & other fee wavers in the pandemic is one of those things Congress could've & should've been done.\n\nAt this point it's little more than a performance.https://twitter.com/SenWarren/status/1397577973000192007\u00a0\u2026— 2021: The 2020 Sequel Nobody Asked For (@2021: The 2020 Sequel Nobody Asked For) 1622049538

That's unlikely to happen as long as the filibuster remains unchanged.

breast cancer GIF by Baptist Health South Florida

breast cancer GIF by Baptist Health South Florida  Teddy Bear Doctor GIF

Teddy Bear Doctor GIF  feeling neck skin GIF

feeling neck skin GIF  praying GIF

praying GIF

Snail Ugh GIF by Sticker Book iOS GIFs

Snail Ugh GIF by Sticker Book iOS GIFs  Serious

Serious  Home Alone Reaction GIF by 20th Century Fox Home Entertainment

Home Alone Reaction GIF by 20th Century Fox Home Entertainment  Cat Working GIF

Cat Working GIF