People aren't doing too well after AriZona CEO Don Vultaggio said he is now considering raising the price of the company's 22-ounce tallboy iced teas—which for decades have been priced at exactly $0.99 per can—because of President Donald Trump's tariffs.

The company is looking at changing course for the first time following Trump's announcement in June that he’s doubling tariffs on aluminum and steel imports from 25% to 50%.

The company, which sells about 2 billion cans of iced tea, juice cocktails, and energy drinks annually, has kept prices steady through three recessions since 1997 by keeping costs low and controlling nearly every step of production and distribution. AriZona owns its own rail lines to ship sugar directly to its factory, carries no outside debt, and has no shareholders to appease.

But the brand uses over 100 million pounds of aluminum each year, with roughly 20% imported from Canada—now subject to the steep new tariffs.

Remarking on the possibility of raising prices, Vultaggio said:

“I hate even the thought of it. It would be a hell of a shame after 30-plus years.”

In a statement to PEOPLE, he said:

"We’re holding the line for now despite rising aluminum costs. It’s particularly unfair—80% of our can sheet metal comes from recycled U.S. beverage cans, yet 100% of our aluminum is subject to tariffs."

"If pressures keep rising, we may have no choice but to adjust pricing, though we’ll work hard to avoid it. Wherever we see savings—like lower crude oil costs for PET—we’re passing them to customers with deeper promotions or outright price cuts, including plastic tall boys at $1."

You can see a news report about the potential decision below.

- YouTube www.youtube.com

People were not happy about the latest casualty of Trump's tariff frenzy.

The U.S. is the world’s second-largest steel importer after the European Union, sourcing most of its supply from Canada, Brazil, Mexico, and South Korea, according to government data.

In his first term, Trump imposed tariffs of 25% on steel and 10% on aluminum under a national security law meant to protect vital industries. But many imports dodged those duties after the U.S. struck trade deals with allies and granted company-specific exemptions.

Critics warned the policy could hurt foreign steel producers, provoke retaliation from trade partners, and drive up costs for U.S. manufacturers. In March, Trump scrapped those carve-outs, saying they'd been weakened.

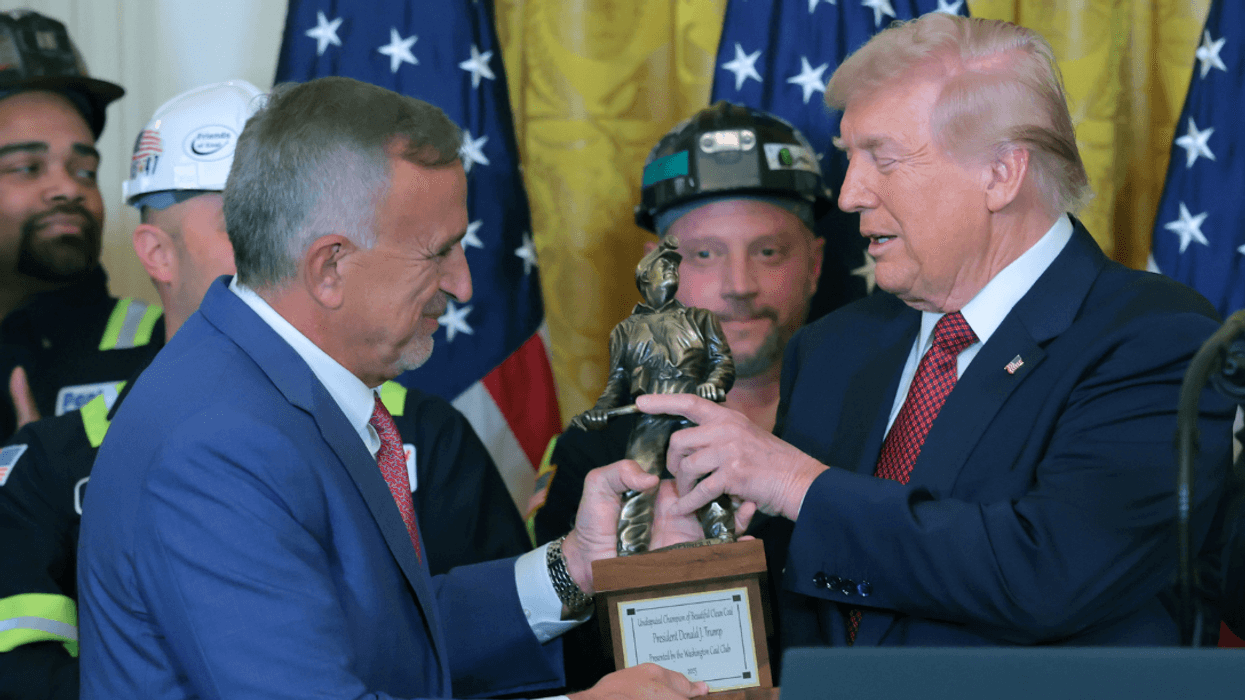

Roberto Schmidt/AFP via Getty Images

Roberto Schmidt/AFP via Getty Images

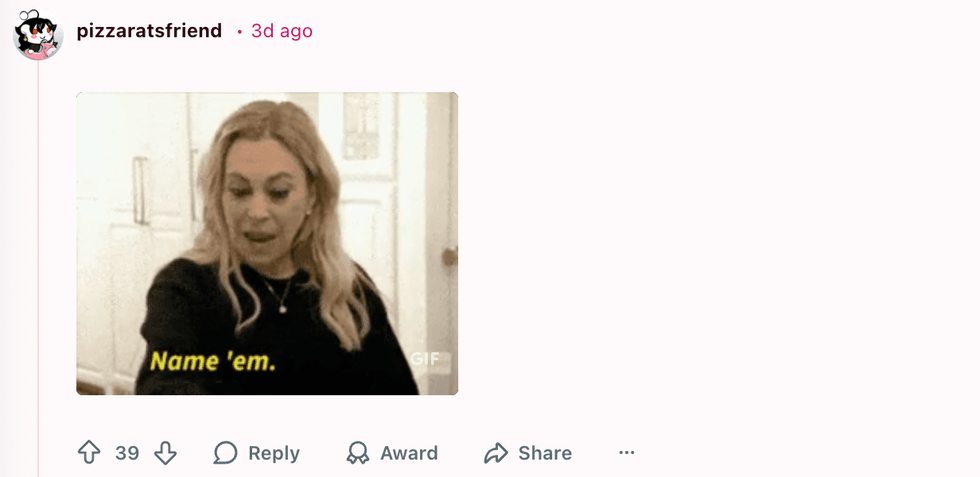

u/pizzaratsfriend/Reddit

u/pizzaratsfriend/Reddit u/Flat_Valuable650/Reddit

u/Flat_Valuable650/Reddit u/ReadyCauliflower8/Reddit

u/ReadyCauliflower8/Reddit u/RealBettyWhite69/Reddit

u/RealBettyWhite69/Reddit u/invisibleshadowalker/Reddit

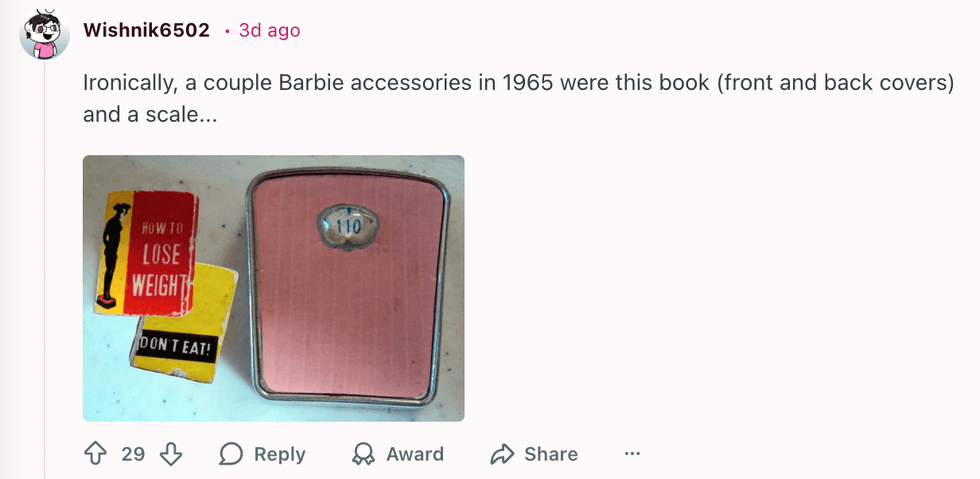

u/invisibleshadowalker/Reddit u/Wishnik6502/Reddit

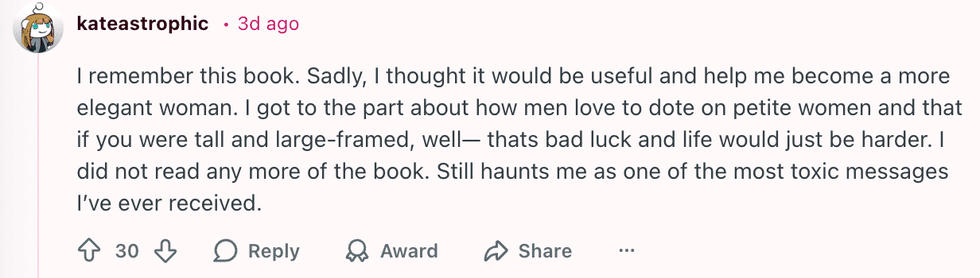

u/Wishnik6502/Reddit u/kateastrophic/Reddit

u/kateastrophic/Reddit u/blking/Reddit

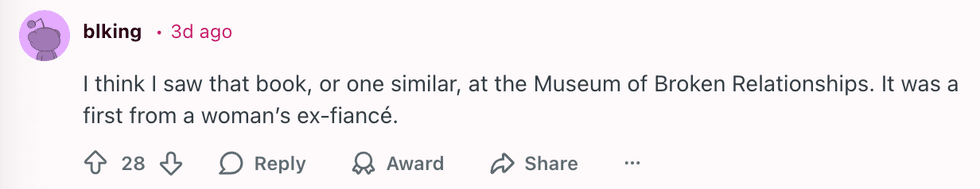

u/blking/Reddit u/SlagQueen/Reddit

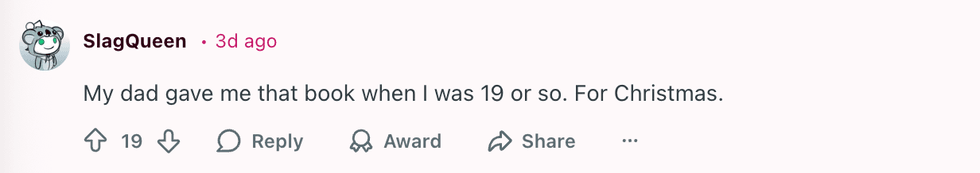

u/SlagQueen/Reddit u/geezeslice333/Reddit

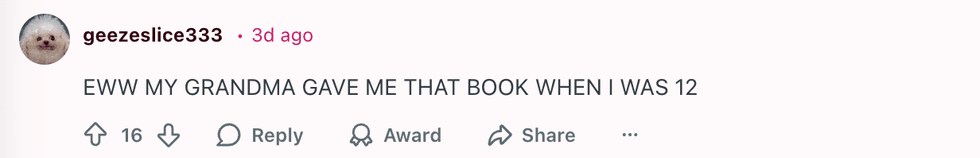

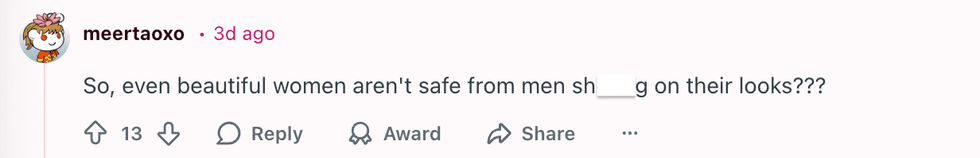

u/geezeslice333/Reddit u/meertaoxo/Reddit

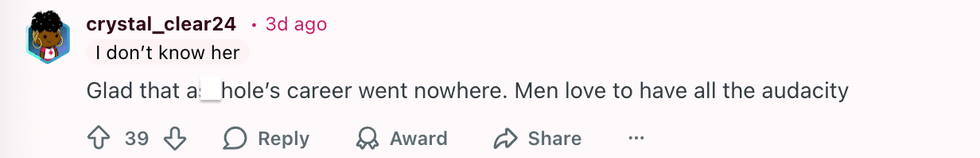

u/meertaoxo/Reddit u/crystal_clear24/Reddit

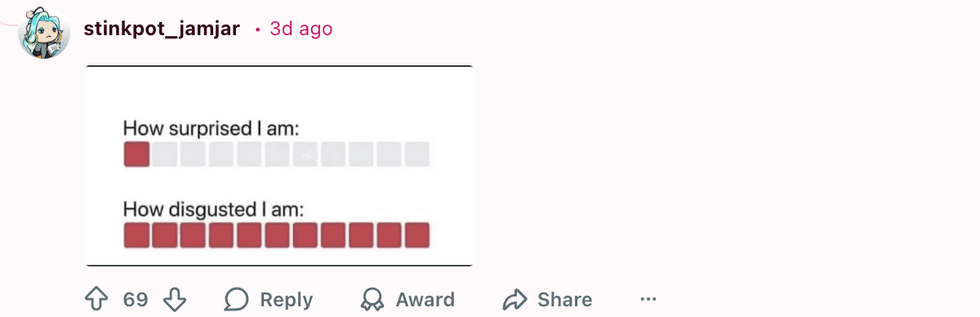

u/crystal_clear24/Reddit u/stinkpot_jamjar/Reddit

u/stinkpot_jamjar/Reddit

u/Bulgingpants/Reddit

u/Bulgingpants/Reddit

@hackedliving/TikTok

@hackedliving/TikTok @hackedliving/TikTok

@hackedliving/TikTok @hackedliving/TikTok

@hackedliving/TikTok @hackedliving/TikTok

@hackedliving/TikTok @hackedliving/TikTok

@hackedliving/TikTok @hackedliving/TikTok

@hackedliving/TikTok @hackedliving/TikTok

@hackedliving/TikTok @hackedliving/TikTok

@hackedliving/TikTok @hackedliving/TikTok

@hackedliving/TikTok @hackedliving/TikTok

@hackedliving/TikTok

@vanderjames/Instagram

@vanderjames/Instagram @vanderjames/Instagram

@vanderjames/Instagram @vanderjames/Instagram

@vanderjames/Instagram @vanderjames/Instagram

@vanderjames/Instagram @vanderjames/Instagram

@vanderjames/Instagram @vanderjames/Instagram

@vanderjames/Instagram @vanderjames/Instagram

@vanderjames/Instagram @vanderjames/Instagram

@vanderjames/Instagram @vanderjames/Instagram

@vanderjames/Instagram @vanderjames/Instagram

@vanderjames/Instagram