Critics criticized President Donald Trump for not seeing the very clear problems with his administration's proposal to offer 50-year mortgages after he tried to downplay the effects of such a move during an interview with Fox News personality Laura Ingraham.

Trump has floated the idea of introducing a 50-year mortgage plan to make it easier for young Americans to buy homes. By extending repayment over a longer period, such loans would reduce monthly payments and lower the amount of principal needed upfront. Federal Housing Finance Agency Director Bill Pulte hailed the proposal as “a complete game changer.”

However, the Qualified Mortgage rule under the Dodd-Frank Wall Street Reform and Consumer Protection Act, enacted after the 2008 financial crisis, bars the federal government from creating mortgages longer than 30 years. That means Trump would need to find a novel workaround to make his plan viable.

The 30-year mortgage, which originated during the Great Depression, has long dominated the U.S. housing market because it offers relatively low monthly payments compared to shorter loan terms. A 50-year loan could lower payments even further—but at a steep cost. Borrowers would ultimately pay far more in interest over the life of the loan.

Here's just one example.

Richard Green, professor of finance and business economics at the University of Southern California’s Marshall School of Business, said the Trump administration's proposal is "not a good idea," noting that "it depends on what the interest rate is, but it could be like 30 or 40 years before you’ve even paid half your mortgage principal under those circumstances.”

When Ingraham pointed out that even Trump's own MAGA supporters have called his proposal "a giveaway to the banks and simply prolonging the time it takes for Americans to own a home outright," Trump was dismissive, blaming President Joe Biden and the Federal Reserve.

He claimed the long-term implications for borrowers would be minimal:

"It's not even a big deal. You pay a bit less. Some people have a 30, some people have a 40, now you have a 50. All it means is you pay less monthly over a longer period of time."

"It's not, like, a big factor. It might help a little bit but the problem was Biden did this. He increased the interest rates and I have a lousy Fed person who's going to be gone in a few months."

You can watch their exchange in the video below.

The math ain't mathin'—and people were quick to call Trump out.

The White House did not provide a concrete answer when journalists asked whether there are legislative plans to move the proposal forward, only saying that Trump "is always exploring new ways to improve housing affordability for everyday Americans."

Trump has repeatedly criticized the Federal Reserve this year for what he sees as a sluggish pace in lowering interest rates. The Fed cut its benchmark rate by a quarter-point in both September and October, but Chair Jerome Powell cautioned at a press conference last month that another rate reduction in December is not a “foregone conclusion.”

Meanwhile, Raphael Bostic, president of the Federal Reserve Bank of Atlanta, is set to retire when his term ends in February, creating a vacancy on the Fed’s key interest rate-setting committee just as Trump is looking to expand his influence over the central bank.

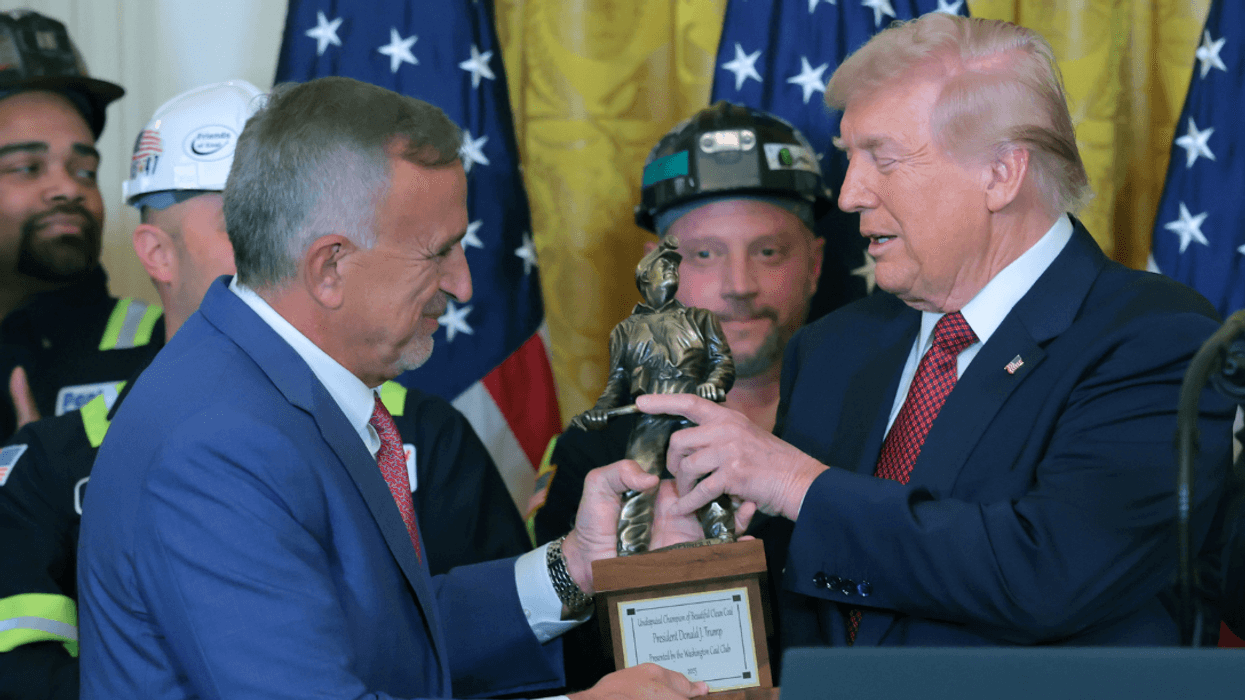

Roberto Schmidt/AFP via Getty Images

Roberto Schmidt/AFP via Getty Images

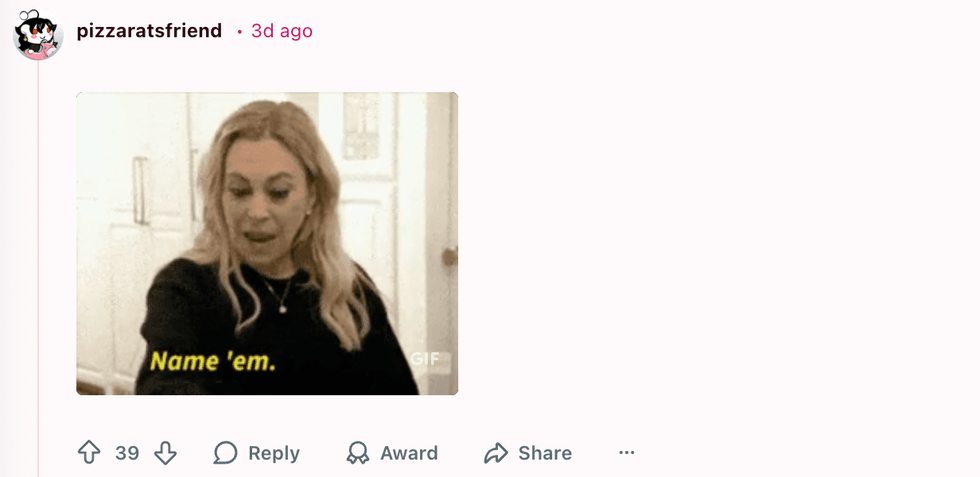

u/pizzaratsfriend/Reddit

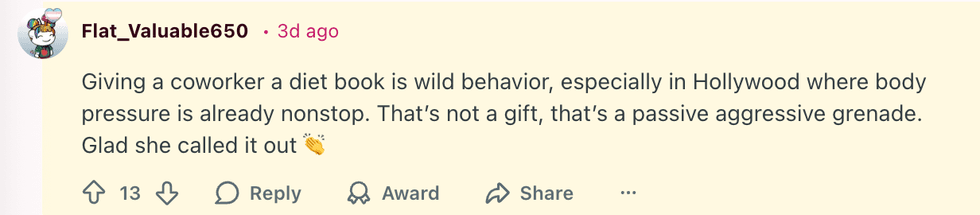

u/pizzaratsfriend/Reddit u/Flat_Valuable650/Reddit

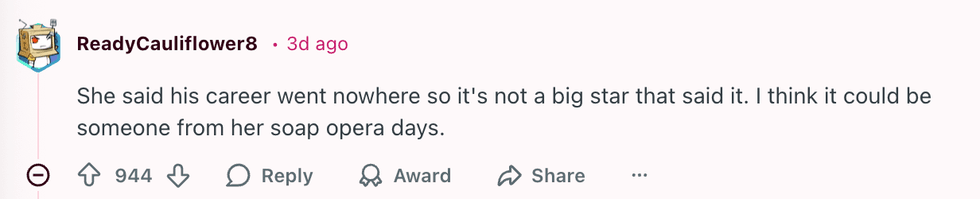

u/Flat_Valuable650/Reddit u/ReadyCauliflower8/Reddit

u/ReadyCauliflower8/Reddit u/RealBettyWhite69/Reddit

u/RealBettyWhite69/Reddit u/invisibleshadowalker/Reddit

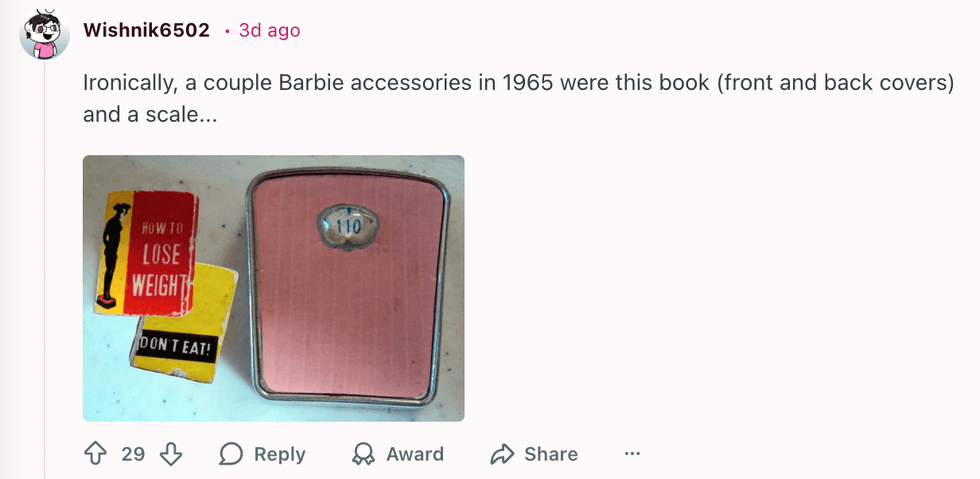

u/invisibleshadowalker/Reddit u/Wishnik6502/Reddit

u/Wishnik6502/Reddit u/kateastrophic/Reddit

u/kateastrophic/Reddit u/blking/Reddit

u/blking/Reddit u/SlagQueen/Reddit

u/SlagQueen/Reddit u/geezeslice333/Reddit

u/geezeslice333/Reddit u/meertaoxo/Reddit

u/meertaoxo/Reddit u/crystal_clear24/Reddit

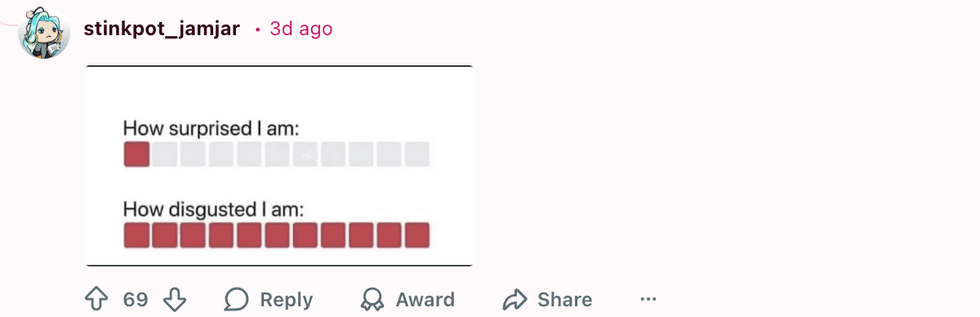

u/crystal_clear24/Reddit u/stinkpot_jamjar/Reddit

u/stinkpot_jamjar/Reddit

u/Bulgingpants/Reddit

u/Bulgingpants/Reddit

@hackedliving/TikTok

@hackedliving/TikTok @hackedliving/TikTok

@hackedliving/TikTok @hackedliving/TikTok

@hackedliving/TikTok @hackedliving/TikTok

@hackedliving/TikTok @hackedliving/TikTok

@hackedliving/TikTok @hackedliving/TikTok

@hackedliving/TikTok @hackedliving/TikTok

@hackedliving/TikTok @hackedliving/TikTok

@hackedliving/TikTok @hackedliving/TikTok

@hackedliving/TikTok @hackedliving/TikTok

@hackedliving/TikTok

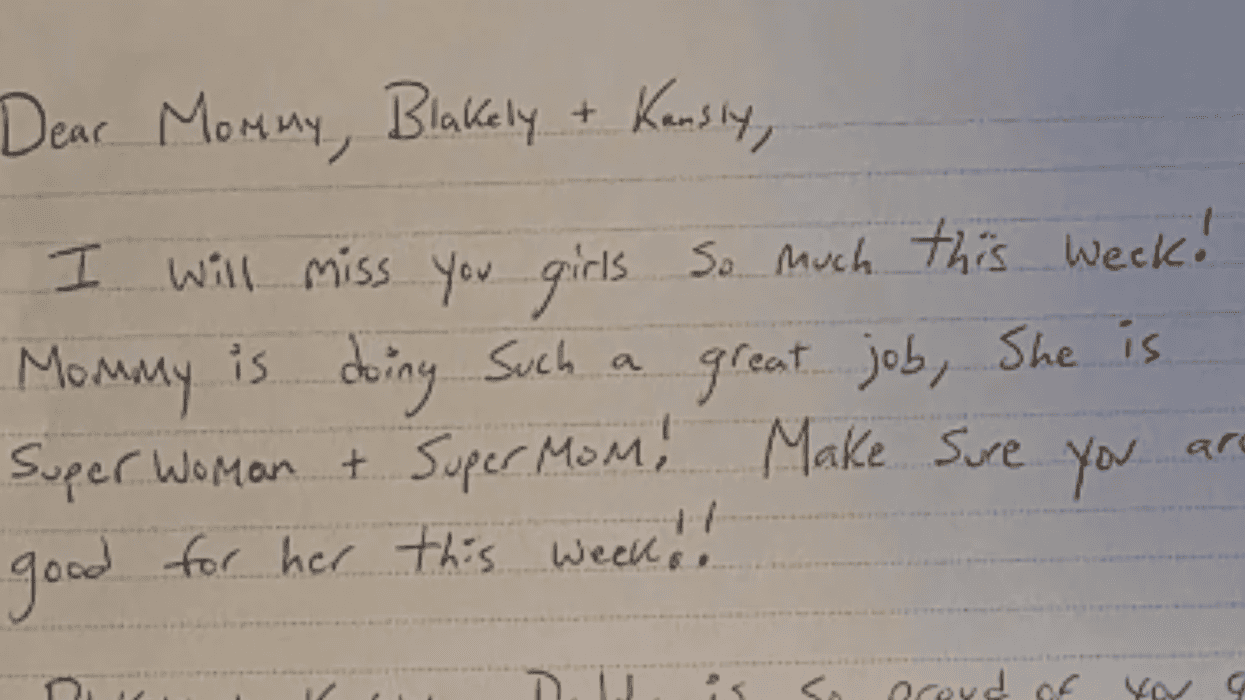

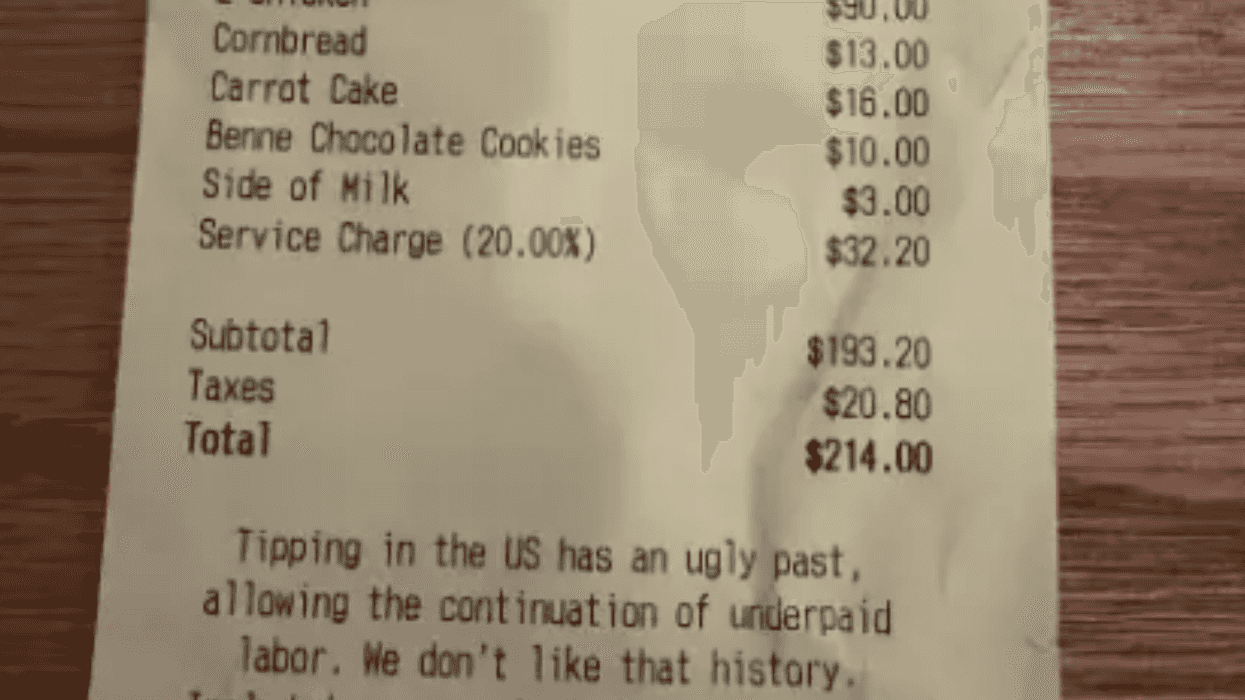

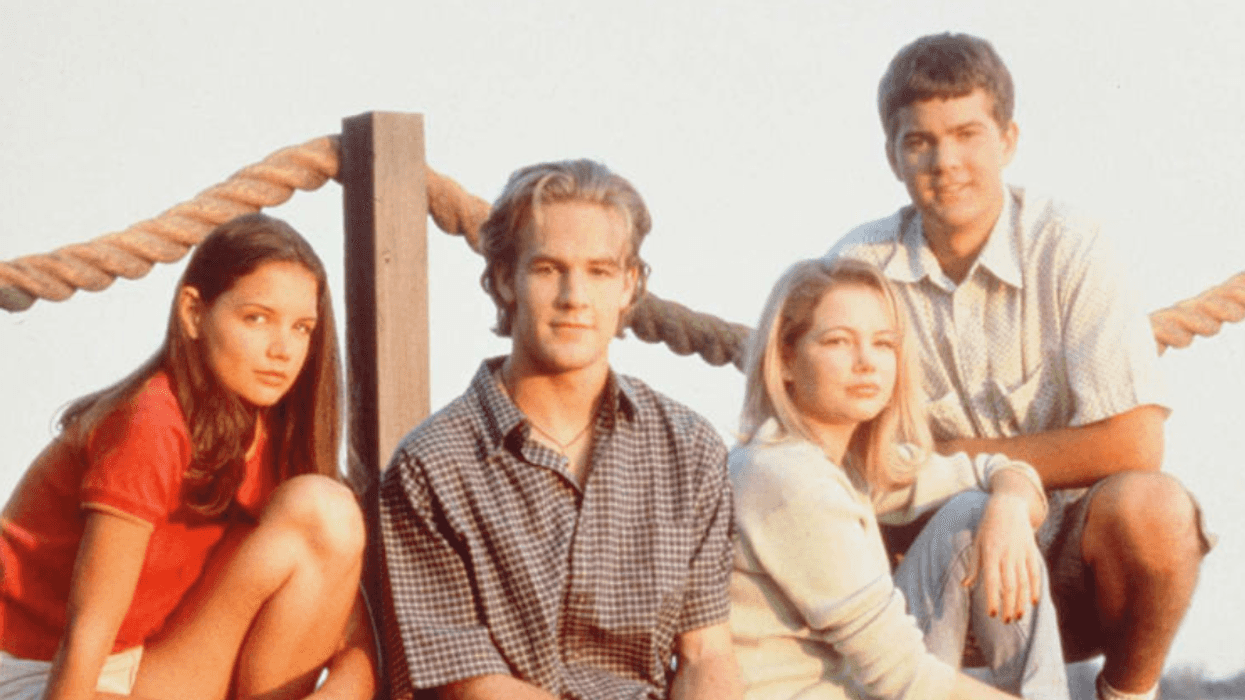

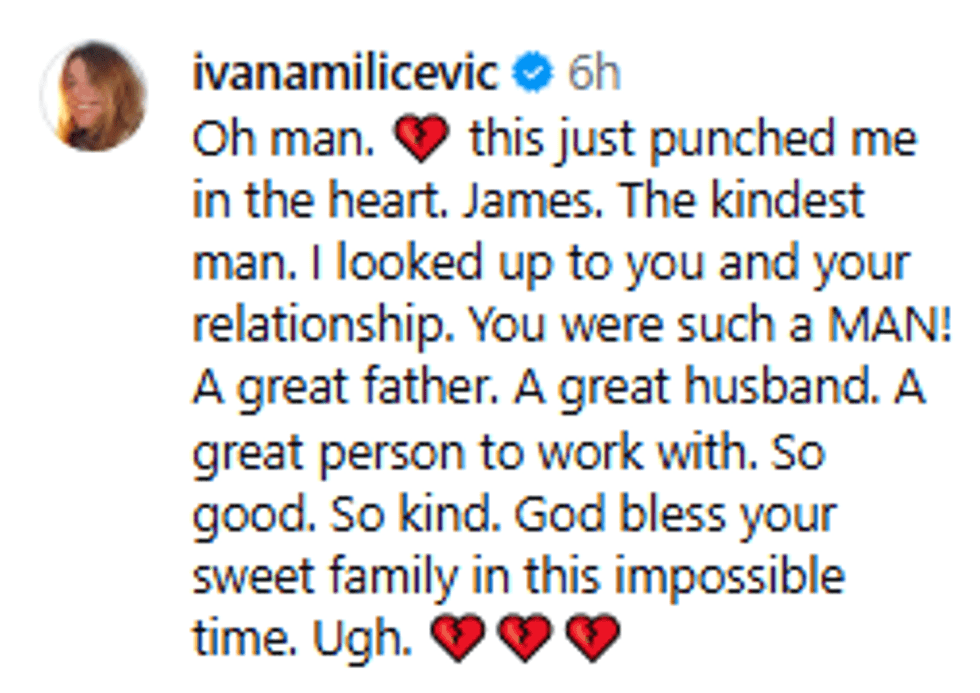

@vanderjames/Instagram

@vanderjames/Instagram @vanderjames/Instagram

@vanderjames/Instagram @vanderjames/Instagram

@vanderjames/Instagram @vanderjames/Instagram

@vanderjames/Instagram @vanderjames/Instagram

@vanderjames/Instagram @vanderjames/Instagram

@vanderjames/Instagram @vanderjames/Instagram

@vanderjames/Instagram @vanderjames/Instagram

@vanderjames/Instagram @vanderjames/Instagram

@vanderjames/Instagram @vanderjames/Instagram

@vanderjames/Instagram