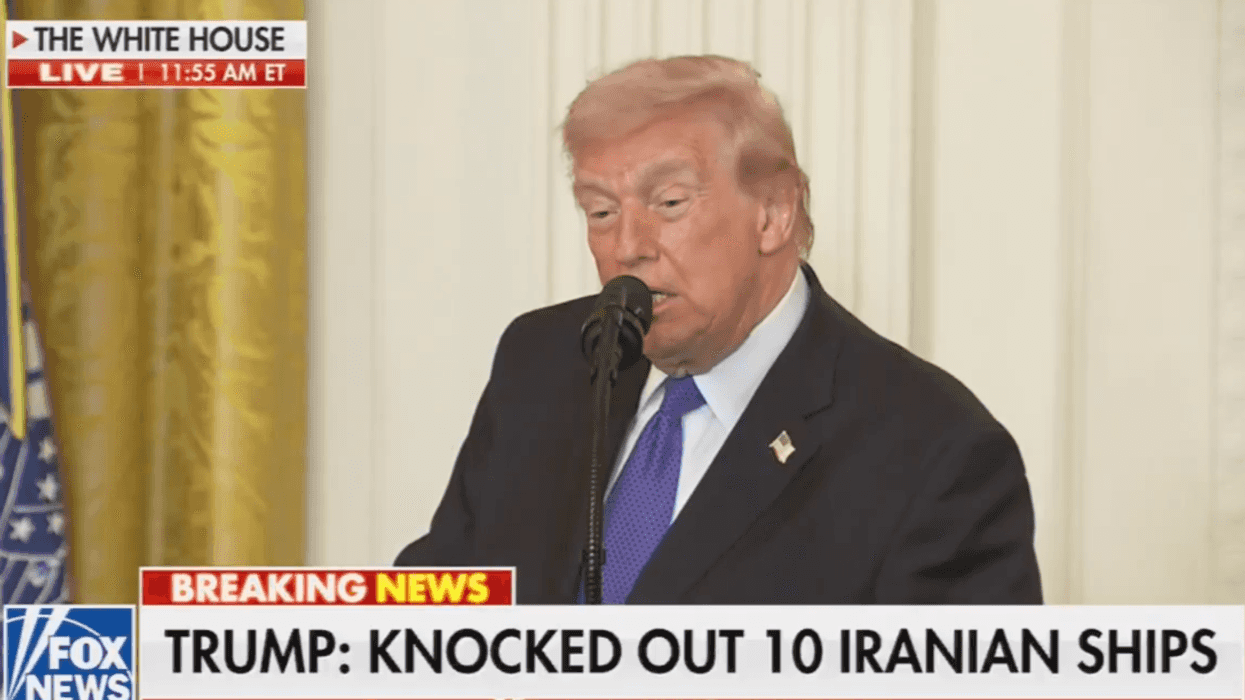

Yesterday it was announced that President Donald Trump would be canceling planned pay increases for millions of federal employees.

The reason he stated:

"To put our nation on a fiscally sustainable course."

But now it appears that even as he was signing this order, he was touting a policy change he's considering that would primarily benefit the wealthiest one percent in the United States.

In an interview with Bloomberg, the president confirmed that he's weighing the possibility of indexing capital gains taxes according to inflation. The move would result in an additional 100 billion dollars to the rich.

BLOOMBERG: Do you favor the idea of indexing capital gains?TRUMP: I’m thinking about it. I’m thinking about it...I’m thinking about it very strongly.

I’m also thinking about going, as you know, to a -- to a half-time instead of a quarter-time for reporting and guidance.

BLOOMBERG: Yeah, any closer on that, on making a decision?

TRUMP: I’ve asked Jay Clayton to look at it very strongly. He’s looking at it. I like the concept, but I’ll -- I’ll be relying -- the only one that will be fighting us on that will be the accountants.

Assets typically gain value over time, therefore many make the case that taxing investment gains without adjusting for inflation cheats investors out of a growth in value that isn't profit or value based, but simply inevitable growth due to inflation.

The policy would exacerbate the already rampant wealth inequality in the United States.

Many Americans are saying that the move only benefits the rich and does nothing to boost the economy.

Trump says that he's considering making the move through executive order, however, it doesn't seem like he actually has the ability to do that.

In 1992, George H.W. Bush's treasury department and department of justice found that the president cannot unilaterally instruct the Department of the Treasury to index capital gains according to inflation.

Law professors Daniel Hemel and David Kamin reached the same conclusion in the Yale Journal on Regulation:

"the legal authority for presidential indexation simply does not exist. The Justice Department under the first President Bush reached the conclusion in 1992 that the Executive Branch cannot implement inflation indexing unilaterally, and doctrinal developments in the last quarter century have—if anything—strengthened that conclusion."

Hemel and Kamin also note that indexation would not bolster the economy in the way that many of its supporters claim.

"whatever the merits of comprehensive legislation that adjusts the taxation of capital gains and various other elements of the Internal Revenue Code for inflation, rifle-shot regulatory action that targets only the capital gains tax would be costly and regressive, and would open a number of large loopholes that allow for rampant tax arbitrage."

Americans are pointing out that indexing according to inflation does nothing to help the average worker and does plenty to hurt them.

The move doesn't necessarily come as a surprise, given the slashing of corporate tax rates in this administrations tax deal that mainly benefit the rich. Many aren't surprised that, once again, Trump seems to be looking out for number one.

@sko2535/Threads

@sko2535/Threads @hayderz/Threads

@hayderz/Threads @zetaplant2/Threads

@zetaplant2/Threads @dark_elle_akalisa/Threads

@dark_elle_akalisa/Threads @freeasfox/Threads

@freeasfox/Threads @mygirlfriday007/Threads

@mygirlfriday007/Threads drbenwayoperates/Threads

drbenwayoperates/Threads