Unless you specifically work in legal or financial spaces, wills, inheritance accounts and other similar topics can feel really overwhelming, if not literally inaccessible.

Attorney Brittany Cohen has been working hard on her TikTok channel to demystify these tough subjects and to help her viewers make better decisions for themselves and their families.

One subject she's been seeing a lot of people approach inefficiently is the creation of their will. While many people think that this is the be-all-end-all solution for families and their assets, Cohen argues that wills often leave much to be desired.

In a viral TikTok video, Cohen explains that important assets like money, houses, and important possessions should be placed into a trust with beneficiaries appointed.

If a person wants everything to go to their children when they pass away, they're better off appointing their children as beneficiaries, rather than putting their names directly on a will.

You can watch the video here:

@brittanycohen_attorney Trusts are for the middle class too #fy #fyp #foryou #foryourpage #foryoupage #estateplanning #attorney #assetprotection #livingtrust #wills #probate #probatecourt #beneficiary #ssi #investor #family #wealth #generations #momsoftiktok #dadsoftiktok #middleclass

The attorney's comments blew up with questions and, quite frankly, skepticism.

Some TikTokers quipped that they would never need to worry about these tips, since they had no money to pass to their children.

But Cohen argued that "trusts are for the middle-class, too," and explained that these principles could be applied to anything a family member might want to pass down to someone that they wanted to guarantee would go to them and not someone else.

Even if a person doesn't have a large sum of money or a house to pass down, they might have belongings of great importance that they want to guarantee will go to someone special. A trust is more likely to protect that desire than a will, and any financial costs associated with that item will be protected from inflation.

Others questioned Cohen's reasoning around putting a home in a trust, but her response made sense.

Using a property like a home as an example, Cohen explains that transferring the ownership of the home from the parents to the children will require a reevaluation of the property taxes of that home. Because of inflation and more, the home likely will have much higher property taxes now than when the parents first purchased it, placing a much greater financial burden on their kids.

A trust would effectively work as a time capsule, locking the value and property taxes required into essentially a static position, only requiring the children to pick up the expenses where their parents left off, rather than having to pay substantially more than their predecessors.

With Cohen's additional advice, fellow TikTokers started to come around to the idea.

Though everyone has to do their own research and decide what is best for their family, as well as where they want to open up a trust and who all will be appointed to that account, this seems like an option more families should be looking into.

It's important to note that this option is not "just for rich people," and folks with lower incomes who believe they are potentially selling themselves, their families and their possessions short.

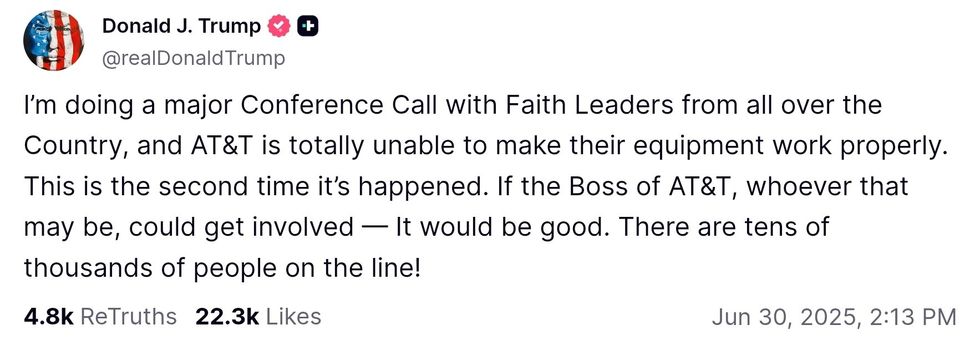

@realDonaldTrump/Truth Social

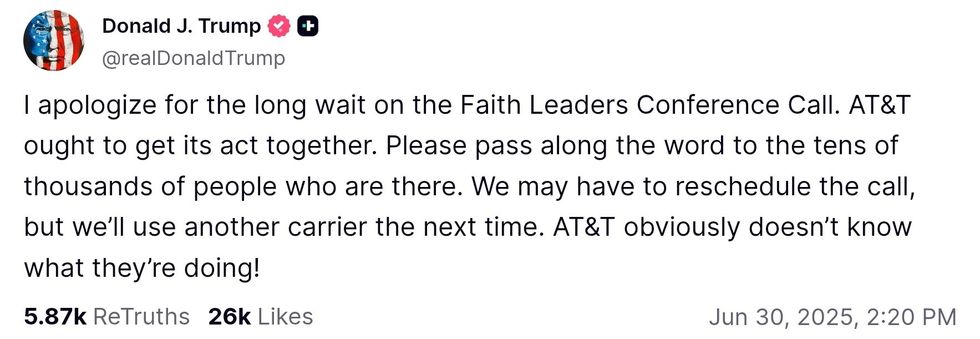

@realDonaldTrump/Truth Social @realDonaldTrump/Truth Social

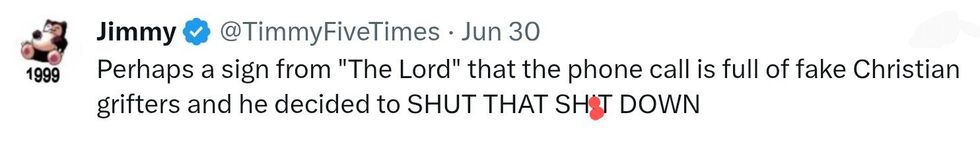

@realDonaldTrump/Truth Social @TimmyFiveTimes/X

@TimmyFiveTimes/X