EAT THE RICH.

You might want to once you hear just how rich they are.

According to a working paper by University of California at Berkeley, economist Gabriel Zucman, the 400 richest Americans (that's just .00025 percent of the population, by the way) own more than the 150 million adults in the bottom 60 percent.

Here's what Zucman's abstract on "Global Wealth Inequality" had to say:

Both surveys and tax data show that wealth inequality has increased dramatically since the 1980s, with a top 1% wealth share around 40% in 2016 vs. 25–30% in the 1980s. Second, I discuss the fast growing literature on wealth inequality across the world. Evidence points towards a rise in global wealth concentration: for China, Europe, and the United States combined, the top 1% wealth share has increased from 28% in 1980 to 33% today, while the bottom 75% share hovered around 10%. Recent studies, however, may under-estimate the level and rise of inequality, as financial globalization makes it increasingly hard to measure wealth at the top. I discuss how new data sources (leaks from financial institutions, tax amnesties, and macroeconomic statistics of tax havens) can be leveraged to better capture the wealth of the rich.

Even more sobering news: The share of the nation's wealth by the bottom 60 percent dropped from 5.7 percent in 1987 to 2.1 percent in 2014, according to information from the World Inequality Database that Zucman and other economists maintain.

"U.S. wealth concentration has followed a marked U-shaped evolution of the last century," Zucman writes, noting:

It was high in the 1910s and 1920s, with a particularly fast increase in the second half of the 1920s. The top 0.1% wealth share peaked at close to 25% in 1929. It then fell abruptly in the early 1930s (in the context of the Great Depression) and continued to fall gradually from the late 1930s to the late 1940s (in the context of the New Deal and the war economy). After a period of remarkable stability in the 1950s and 1960s, the top 0.1% wealth share reached its low-water mark in the 1970s, and since the early 1980s it has been gradually rising to close to 20% in recent years. U.S. wealth concentration seems to have returned to levels last seen during the Roaring Twenties.

Zucman's paper comes as support for a proposal from Senator Elizabeth Warren (D-MA) to raise taxes on the super wealthy continues to gain traction.

According to a recent poll from Morning Consult, the vast majority of Americans support a wealth tax by a 60-21 margin, a number that includes majority support from Republican voters. Americans also support raising the marginal tax rate back up to 70 percent, as Representative Alexandria Ocasio-Cortez (D-NY) has suggested.

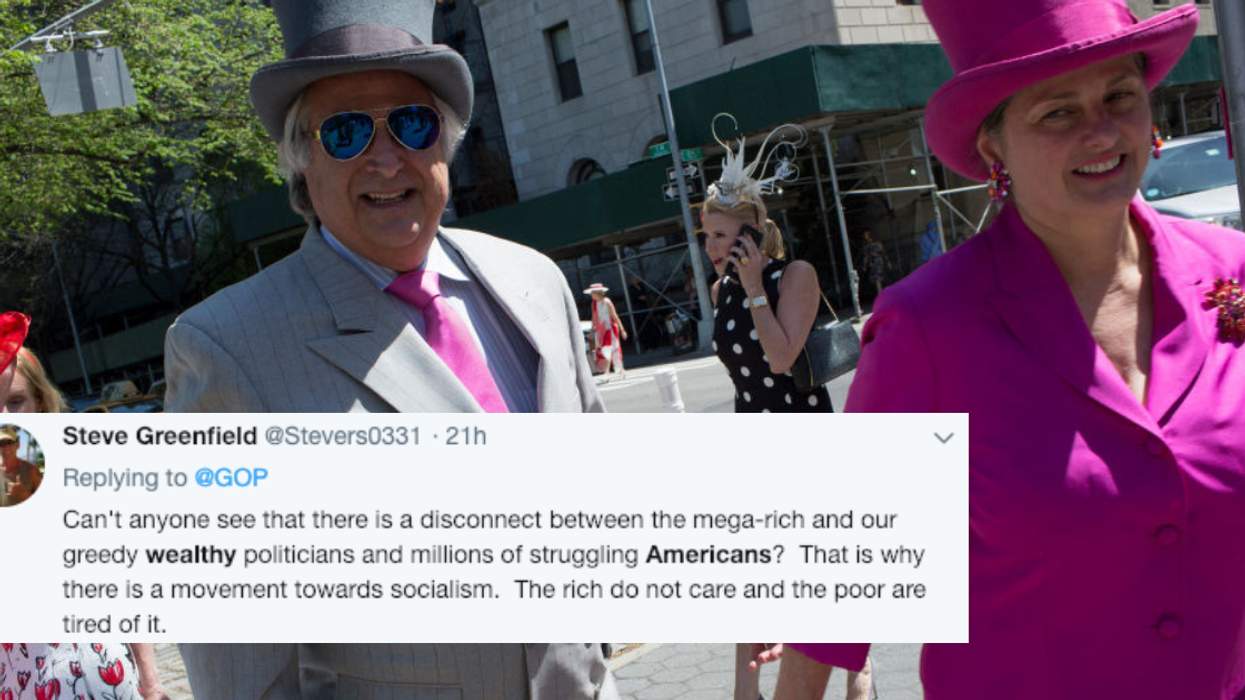

Such news has only galvanized people who'd like to see wealth inequality actually be addressed.

Warren herself posted the results of the Morning Consult poll after former Starbucks CEO and billionaire Howard Schultz dismissed her wealth tax proposal as "ridiculous."

"Dear Howard Schultz: if you're looking for bold ideas with broad bipartisan appeal for your 'centrist' presidential campaign, may I suggest my #UltramillionaireTax?" she tweeted, noting how the tax would provide avenues for such initiatives as student debt relief and health care.

Americans "don't want to replace a self-absorbed billionaire President with another one," she said. "Americans want real change. We should listen."

Ocasio-Cortez, meanwhile, has suggested going back to a marginal tax rate of 70 percent on income over $10 million, which she says her critics have mischaracterized as a tax on all income.

"You look at our tax rates back in the sixties and when you have a progressive tax rate system, your tax rate, let's say from zero to $75,000, maybe 10 percent or 15 percent, etc," she said during an interview last month. "But once you get to the tippy-tops — on your 10 millionth dollar — sometimes you see tax rates as high as 60 or 70 percent. That doesn't mean all $10 million are taxed at an extremely high rate, but it means that as you climb up this ladder, you should be contributing more."

@elxavipapi/Instagram

@elxavipapi/Instagram r/TikTokCringe/Reddit

r/TikTokCringe/Reddit @deniscepalacios/TikTok

@deniscepalacios/TikTok r/TikTokCringe/Reddit

r/TikTokCringe/Reddit @deniscepalacios/TikTok

@deniscepalacios/TikTok r/TikTokCringe/Reddit

r/TikTokCringe/Reddit @deniscepalacios/TikTok

@deniscepalacios/TikTok r/TikTokCringe/Reddit

r/TikTokCringe/Reddit

@WhiteHouse/X

@WhiteHouse/X

@carol_haynes_/Instagram

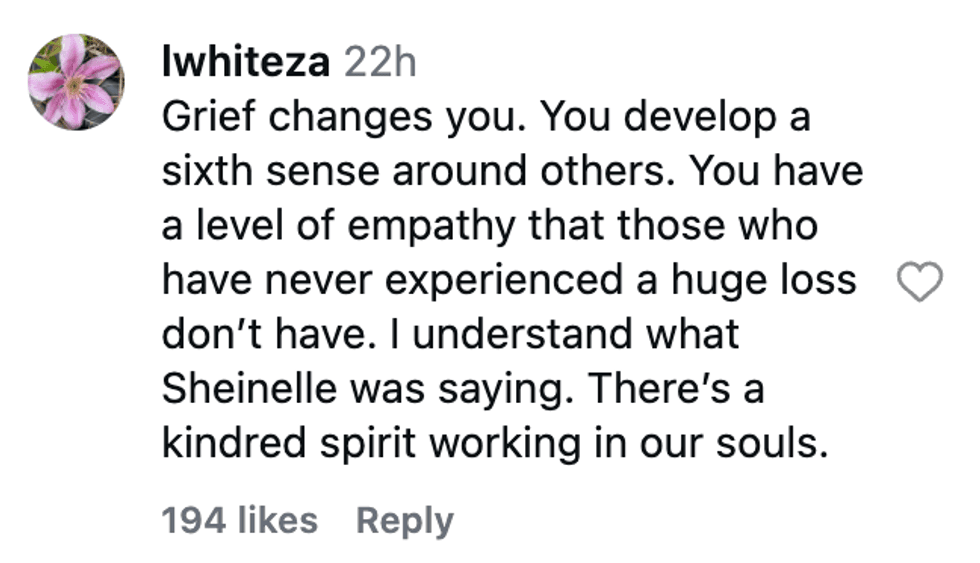

@carol_haynes_/Instagram @lwhiteza/Instagram

@lwhiteza/Instagram @iamdrkandace/Instagram

@iamdrkandace/Instagram @solveigerway/Instagram

@solveigerway/Instagram @sziulkow/Instagram

@sziulkow/Instagram @claudiatorres2019/Instagram

@claudiatorres2019/Instagram @carolken/Instagram

@carolken/Instagram @karenpayton34/Instagram

@karenpayton34/Instagram @mamaburnside/Instagram

@mamaburnside/Instagram @alr_thrives/Instagram

@alr_thrives/Instagram @dr.rxq/Instagram

@dr.rxq/Instagram @bogie1954/Instagram

@bogie1954/Instagram