After bank employees in Detroit refused to deposit a check with the money she won from a casino jackpot, a retired schoolteacher filed a federal discrimination lawsuit.

Lizzie Pugh, 71, went to Soaring Eagle Casino & Resort in Mt. Pleasant, Michigan on April 9 with her church group. While there, she struck it rich on a slot machine.

Pugh—who taught in Detroit for 35 years—made the decision to pay the taxes on the casino jackpot then took the majority of the winnings as a check with a small amount in cash.

Pugh attempted to deposit the check at a Fifth Third Bank in Livonia, Michigan a few days later.

According to Pugh's lawsuit, Fifth Third Bank employees told her the check was fraudulent, refused to give it back to her and were blatantly racist.

Pugh told The Detroit Free Press:

"I couldn’t really believe they did that to me. I was devastated."

"I kept asking, ‘How do you know the check is not real?’ … And they just insisted that it was fraudulent. … I was just terrified."

She added:

"To think that maybe they would have police coming and running at me — it was humiliating and stressful."

“For someone to just accuse you of stealing?"

"I’m 71 years old. Why would I steal a check and try to cash it? I just didn’t think anybody would do that."

Pugh was brought by a bank employee into an office where she provided the employee the check and explained she wished to set up an account. The check was embossed with Soaring Eagle’s logo and Pugh’s address which matched her state issued driver’s license.

The employee left the room, returned and told Pugh the check was fake. Two more bank employees eventually entered the discussion—claiming the check was fake—then stated they weren’t giving the check back.

Pugh refused to leave the bank without her jackpot winnings. There was even a threat to call Detroit police before the bank’s employees agreed to give the check back.

All three bank employees were White.

When Pugh deposited the same check at a Chase bank branch, the check was accepted and cleared without a hitch.

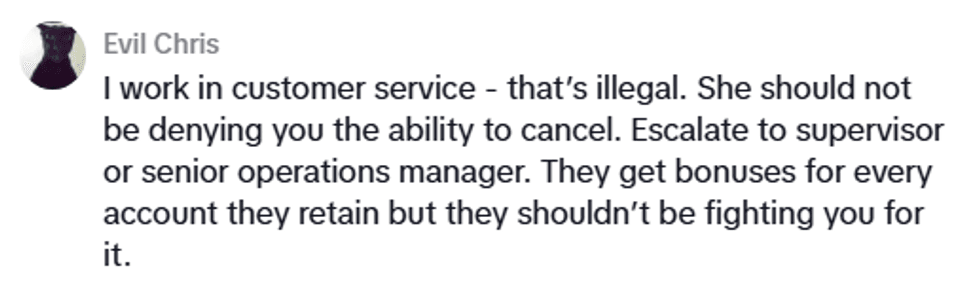

Reactions to what many are calling racial bias varied online.

First, there was general outrage at the bank employee's behavior.

Then there was the hope Pugh wins her lawsuit.

A large section of comments centered around how this experience is very common for BIPOC.

In January 2020 in Vancouver, Canada, Heiltsuk First Nation citizen Maxwell Johnson and his 12-year-old granddaughter were handcuffed and placed in separate police cars after bank employees called police when he tried to open a bank account for the girl. Johnson—who had been a customer with the bank since 2014—was accused by bank employees of fraud.

Johnson felt he was racially profiled by bank employees who didn't believe an Indigenous man could have money.

Also in January 2020, Sauntore Thomas—who is Black—had police called by his Detroit, Michigan bank—where he had been a customer for two years—when he tried to deposit a check. His bank also accused him of fraud because of the value of the check.

In a stroke of ultimate irony, Thomas' check was a settlement payment from his former employer for racial discrimination.

Part and parcel of "Banking While Black" as one Tweet put it.

Others placed this event in the troubled history of banks' well documented racist lending—or not lending, as the case may be—practices.

It speaks to the deep institutional problems in America.

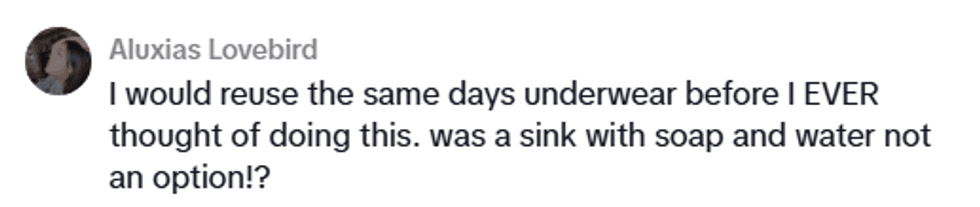

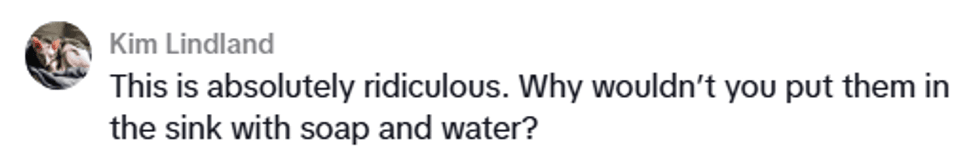

Some added what the bank could and should have done instead of accusing Pugh of fraud.

One White commenter added her story of a similar banking transaction, contrasting her positive experience with Pugh's negative one.

Here's hoping Pugh wins her lawsuit against the bank for their employee's biased choices.

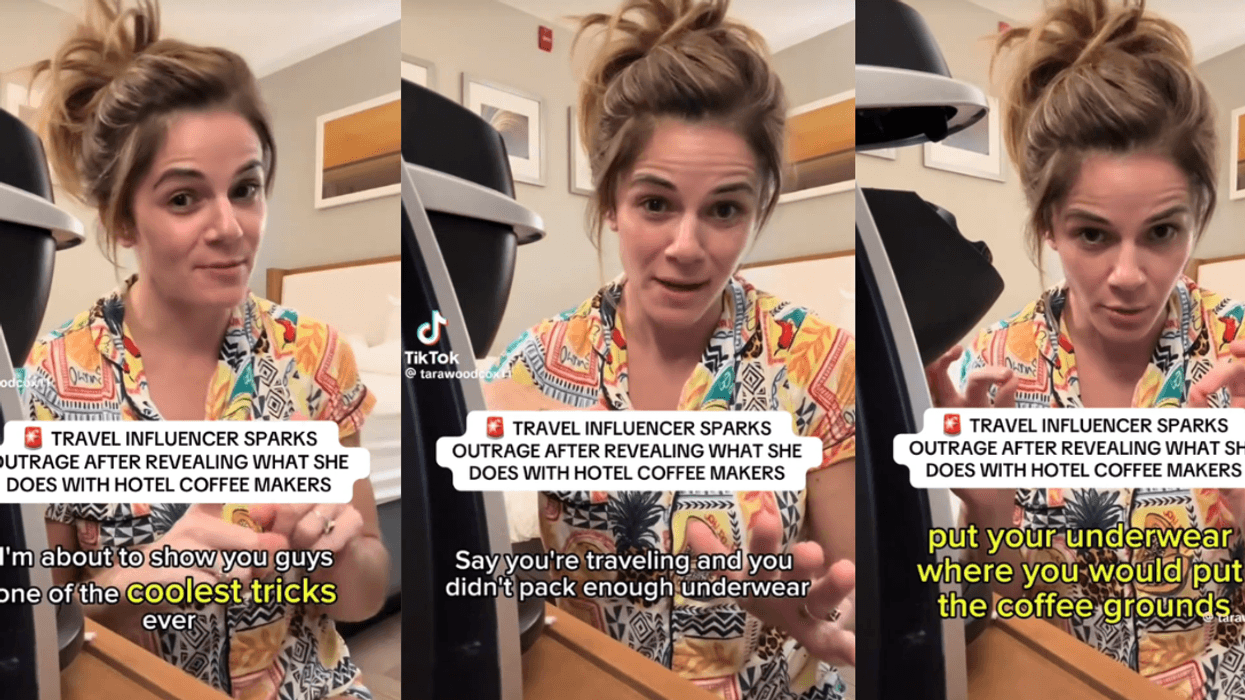

@madswellness/TikTok

@madswellness/TikTok @madswellness/TikTok

@madswellness/TikTok @madswellness/TikTok

@madswellness/TikTok @madswellness/TikTok

@madswellness/TikTok @madswellness/TikTok

@madswellness/TikTok @madswellness/TikTok

@madswellness/TikTok @madswellness/TikTok

@madswellness/TikTok @madswellness/TikTok

@madswellness/TikTok @madswellness/TikTok

@madswellness/TikTok @madswellness/TikTok

@madswellness/TikTok @madswellness/TikTok

@madswellness/TikTok

@vanellimelli030/TikTok

@vanellimelli030/TikTok @vanellimelli030/TikTok

@vanellimelli030/TikTok @vanellimelli030/TikTok

@vanellimelli030/TikTok @vanellimelli030/TikTok

@vanellimelli030/TikTok @vanellimelli030/TikTok

@vanellimelli030/TikTok @vanellimelli030/TikTok

@vanellimelli030/TikTok @vanellimelli030/TikTok

@vanellimelli030/TikTok @vanellimelli030/TikTok

@vanellimelli030/TikTok @vanellimelli030/TikTok

@vanellimelli030/TikTok @vanellimelli030/TikTok

@vanellimelli030/TikTok @vanellimelli030/TikTok

@vanellimelli030/TikTok

@anissahm15/TikTok

@anissahm15/TikTok @anissahm15/TikTok

@anissahm15/TikTok @anissahm15/TikTok

@anissahm15/TikTok @anissahm15/TikTok

@anissahm15/TikTok @anissahm15/TikTok

@anissahm15/TikTok @anissahm15/TikTok

@anissahm15/TikTok @anissahm15/TikTok

@anissahm15/TikTok @anissahm15/TikTok

@anissahm15/TikTok @anissahm15/TikTok

@anissahm15/TikTok @anissahm15/TikTok

@anissahm15/TikTok @anissahm15/TikTok

@anissahm15/TikTok @anissahm15/TikTok

@anissahm15/TikTok @anissahm15/TikTok

@anissahm15/TikTok @anissahm15/TikTok

@anissahm15/TikTok @anissahm15/TikTok

@anissahm15/TikTok

@hustleb***h/TikTok

@hustleb***h/TikTok @hustleb***h/TikTok

@hustleb***h/TikTok @hustleb***h/TikTok

@hustleb***h/TikTok @hustleb***h/TikTok

@hustleb***h/TikTok @hustleb***h/TikTok

@hustleb***h/TikTok @hustleb***h/TikTok

@hustleb***h/TikTok @hustleb***h/TikTok

@hustleb***h/TikTok