This grandma insists she is “thrifty at 60," as she shares her savvy tips for saving hundreds of pounds a month.

Saving $500 just by switching her utility bills during the lockdown, Maggie Deakin refuses to let a drop of wasted water go down the sink.

She began saving money by returning items and buy them again at a reduced price and even saved herself $200 on a new TV by buying it cheaper online while she was inside the shop.

Deakin estimates she saves $5,200 a year by using cash-back websites, coupons, club-cards, and completing paid surveys.

“The worst thing for me is wasting money. If there's a way of saving it, I will find it. If I don't have to spend money I won't," she said.

“Once I was buying a television with my husband and I took my iPad into the store with me and showed the staff that I could get 10 per cent off using a cash-back website."

“They said they couldn't match the difference, so I bought it from the website while in store and saved myself about £160."

“I'm not shy about asking for a refund or asking them to knock the money off," she continued.

Always a bargain hunter, Deakin spends hours searching the sale racks and looking for "buy one get one free" offers with her daughters.

But one of her top tips is to shop online using websites like "TopCashback" to recoup a percentage of money back on the things she buys.

Cash-back sites work by partnering with retailers, who pay commission when shoppers are directed to their stores and make purchases.

“If I'm buying anything online I will go through there. It's saved me more than £400 since I joined," she said.

“You can even save money on there if you sell items like clothes on the Preloved website. I advertise on there for free and they give me 16p for every advert I post."

“I also do a lot of market research surveys. They can be time consuming and take up several hours each week, but for some you collect points and convert them into vouchers for places like Amazon and others pay cash. When you reach 5,000 points you get sent a cheque for £50," she said.

“I also downloaded this app that will look at what you browse on the internet to collect data, then send you a £10 voucher each month.

“I can spend hours on eBay, scrolling through pages and pages to get the cheapest thing. I buy batteries on there, or tools that my husband needs for his work."

Deakin is always looking for coupons and vouchers online.

“I always look for discount voucher codes as well if I'm shopping online. There are lots of different ones out there and hopefully there's always one that works," she said.

“I get a real buzz out of it. My husband says I'm tight, but I say I''m thrifty! My daughters think I'm great at grabbing a bargain."

Deakin used the vouchers she got through her Tesco club-card to buy entries into the Sea Life Centre and Legoland for her daughter, Tina and granddaughter Olivia and herself.

And her weekly groceries comes to around $65 for two people.

“I shop at Costco every few weeks for toilet roll, potatoes and milk, which works out a lot cheaper if you buy in bulk," she said.

“We treat ourselves to some sirloin steak from Costco now and again, as it's far cheaper than in the supermarket and generally, we buy our chicken breast from Bookers at £19.99 for 5kg as opposed to a 500g pack of chicken which would cost about £6 in the supermarket, so it's a big saving."

“Occasionally, when they come up on offer, I purchase pre-paid cards for restaurants like Nandos," she said.

“Costco sell these for £34.99, and you have to buy a minimum of two, but the value is £80, saving £10."

Another of her top tips is to use comparison websites to find the best deals for insurance policies and utilities, then to keep switching to get the most competitive rate.

“I'm on a water meter, so barely any of it goes down the sink unused. I used to think that would cost more, but actually I save a lot of money compared to if I paid water rates as I'm so careful about what I use," she continued.

“I never let the tap run without using it. If I want hot water I will always fill the kettle with the cold first before it starts to heat up, so not a drop is wasted and use left over drinking water for plants."

“It's better for the environment as well as being cheaper."

“I switch almost everything off when it isn't in use – the television, DVD player, they are never left on standby. Most thing with a digital clock are turned off," she said.

Daekin also says she has managed to save an estimated $500 by switching her utilities during lockdown and shopping around using moneysavingexpert.com.

“My supplier had changed and I saw that my direct debits were going to go up by £24, so I used Money Saving Expert to find a cheaper deal," she said.

"I'm now paying just over £600 for gas and electric whereas before it was just over a thousand a year and I will happily switch again if I see a cheaper deal."

“I'm registered with the website Petrol Prices, so I get daily alerts of the cheapest fuel whenever I need to fill up, too."

She argues there is no shame in taking something back to be refunded if that saving ends up back in her pocket.

“In one shop, I'd bought a picnic blanket for £22 and when I went back to get one for my daughter I spotted them at a reduced price for £17.99, nearly £5 cheaper so I bought two, with the intention of getting it refunded for the full price I'd paid for it," she recalled.

“I had the receipt for the original one, so the shop assistant refunded that at the full price so I could buy it at the sale price. They said that little bit of cash is better off in my pocket anyway," she said.

“I will always take something back and buy it back cheaper if I can. The shop assistants are normally willing to do it. They can't really say no as you could have returned the item anyway."

“Before, I've bought some items for full price, then seen them reduced, so returned them to the store, got them refunded and re bought them at the sale price."

“When I bought a bed earlier this year, I found the pre-drilled holes were in the wrong place, and when it was assembled it was not in line. I complained and got a £50 refund. I am happy to take a partial refund for keeping the slightly faulty items," she said.

Daekin also advises travelers to book last minute, which has saved her $1,300 in the past.

“I managed to get a week long Mediterranean cruise with food and drinks for £530 each, including transfers, which was a bargain when you consider you would normally spend that just on meals," she said.

“I also had a cruise cancelled recently, so agreed to let the deposit sit in the account of the travel company as credit, which will give me an extra 25 per cent back to spend on the next cruise," she continued.

Collecting coupons for supermarkets like Farmfoods, Daekin rarely buys branded goods and gets her household items from high street shops such as Home Bargains and B&M.

“I rely on dogged determination. 'Perseverance is the key,' is my motto," she said. “My bargain hunting might cost me time, but it doesn't cost me money."

“Without being so savvy about it, I think I'd spend an extra £10 a day, which when you add it up is thousands of pounds a year," she said.

“Being thrifty at 60 really makes sense!"

Visit TopCashback.co.uk to shop with over 5000 retailers and charities, and receive a portion of your purchase back.

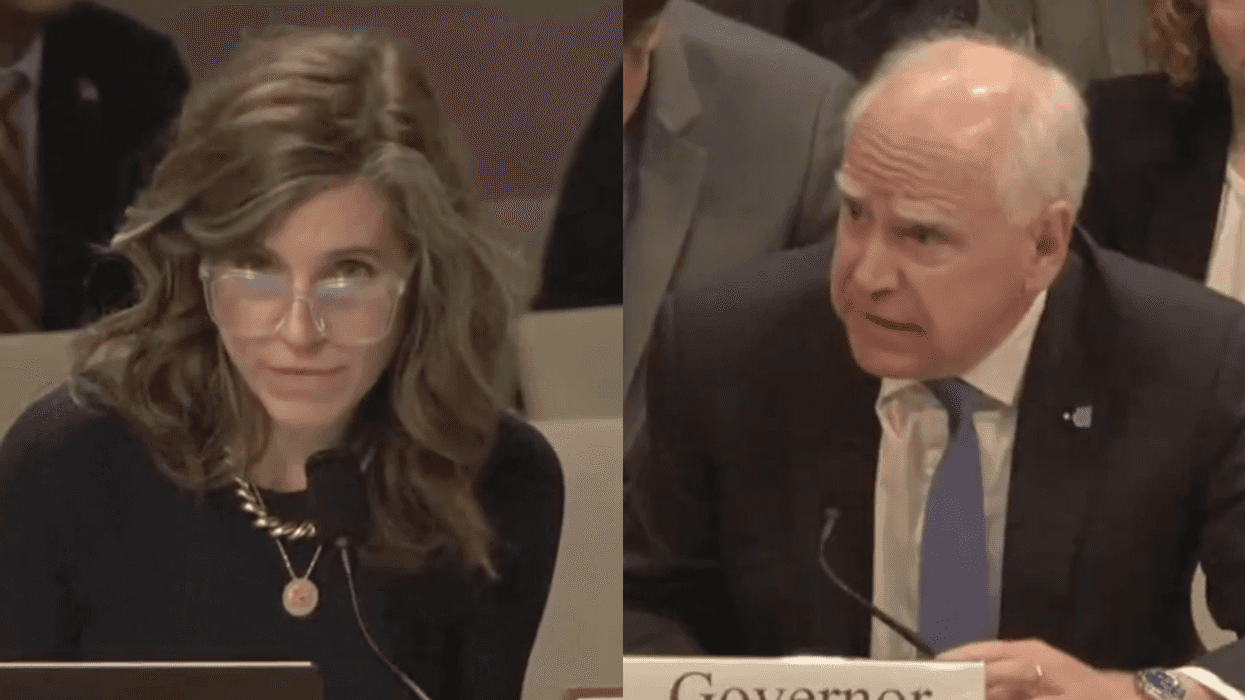

@maddiemcrojas/Instagram

@maddiemcrojas/Instagram @eeemgeeebeee/Instagram

@eeemgeeebeee/Instagram @chefmelissaking/Instagram

@chefmelissaking/Instagram @catsonacouch/Instagram

@catsonacouch/Instagram @alwayskimhill/Instagram

@alwayskimhill/Instagram @_completelybooked/Instagram

@_completelybooked/Instagram @whereisrobinusa/Instagram

@whereisrobinusa/Instagram @veeeekaaay/Instagram

@veeeekaaay/Instagram @getlei_d/Instagram

@getlei_d/Instagram @andrebsteele/Instagram

@andrebsteele/Instagram @xxthisiskkxx/Instagram

@xxthisiskkxx/Instagram @ddrobjr/Instagram

@ddrobjr/Instagram