In 2016, Donald Trump became the first presidential candidate notorious for withholding his tax returns.

His adamant refusal to comply with congressional demands of releasing his tax information raised many red flags and confirmed our suspicions that the then-real estate mogul was always a fraudster and a terrible businessman.

The New York Times obtained the self-professed billionaire's previously unreleased tax information and reported that "year after year, Mr. Trump appears to have lost more money than nearly any other individual American taxpayer" between the years 1985 to 1994.

The Times received the tax information from someone who had legal access to Trump's returns and matched the data to figures in the public database of IRS information on top earners.

Additionally, Trump's core losses totaled more than $250 million each year in 1990 and 1991, according to IRS tax transcripts.

The same reporters from the newspaper wrote in October that Trump “participated in dubious tax schemes during the 1990s, including instances of outright fraud, that greatly increased the fortune he received from his parents."

Because he lost so much money, Trump avoided paying income taxes for eight of the ten years, as mentioned by the Times.

Twitter is hardly surprised.

But the revelation doesn't make it any better.

The Times also got their hands on Trump's 1995 tax information revealing his loss of $916 million during the 2016 presidential election.

They added that his massive deductions "could have allowed him to legally avoid paying any federal income taxes for up to 18 years."

On Wednesday, Trump defended his actions on Twitter, explaining:

"You always wanted to show losses for tax purposes....almost all real estate developers did - and often re-negotiate with banks, it was sport."

Then he added his signature dig at the newspaper for their reporting on outdated and "highly inaccurate Fake News."

On Saturday, Trump's lawyer Charles J. Harder called the tax information as reported by the Times "demonstrably false" and added that the statement "about the President's tax returns and business from 30 years ago are highly inaccurate."

On Tuesday, Harder told the Times:

"IRS transcripts, particularly before the days of electronic filing, are notoriously inaccurate" and "would not be able to provide a reasonable picture of any taxpayer's return."

As we head towards 2020, now we need incentive? Catch up, folks.

Happy Jennifer Aniston GIF

Happy Jennifer Aniston GIF  look ceiling GIF

look ceiling GIF  Creepy GIF

Creepy GIF  Hidden Room Loop GIF by sheepfilms

Hidden Room Loop GIF by sheepfilms

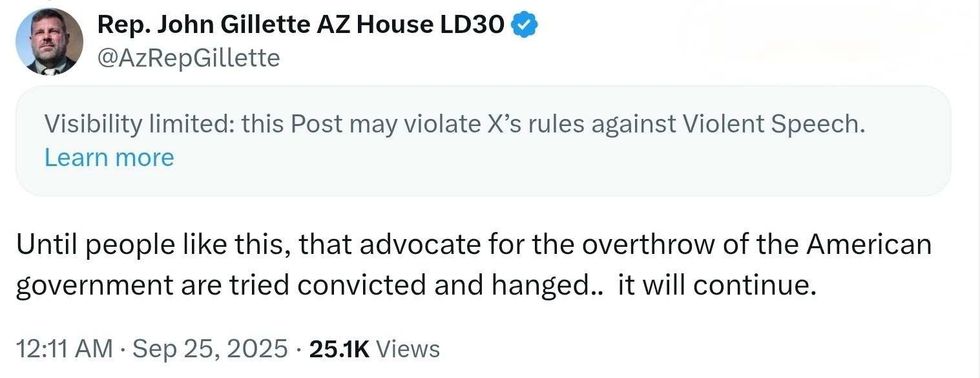

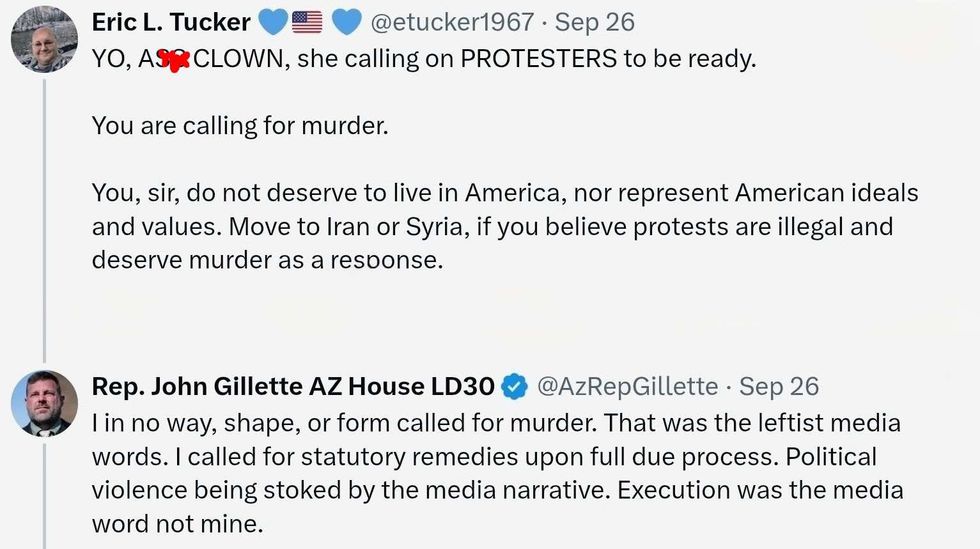

@AzRepGillette/X

@AzRepGillette/X @AzRepGillette/X

@AzRepGillette/X @AzRepGillette/X

@AzRepGillette/X

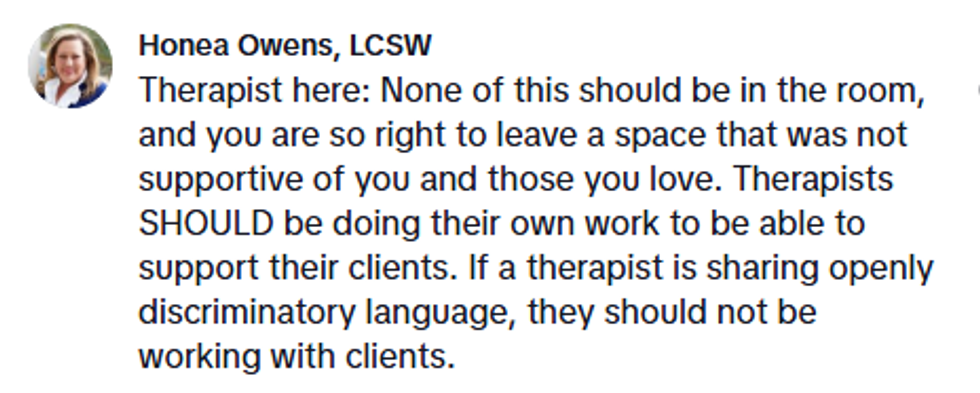

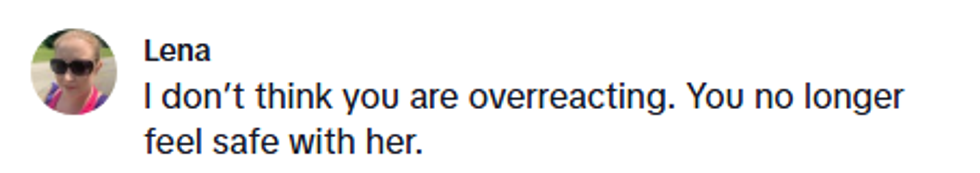

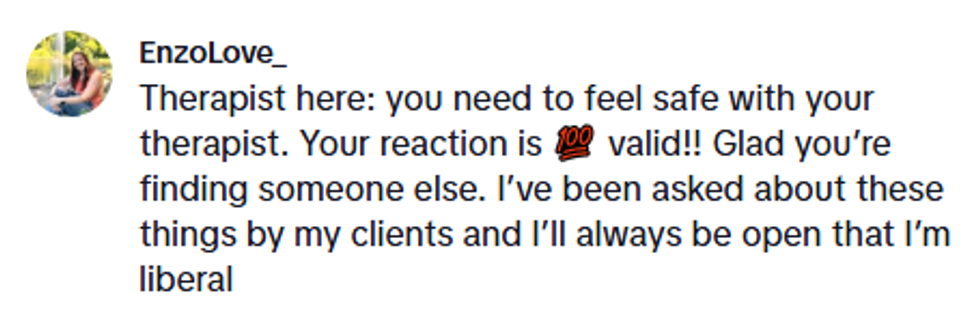

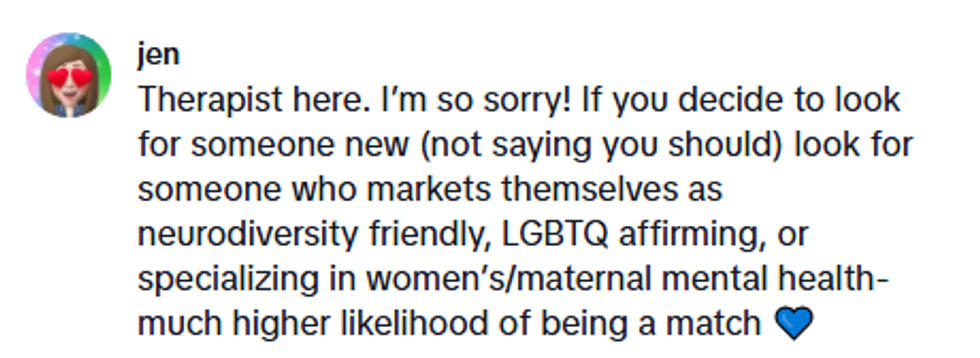

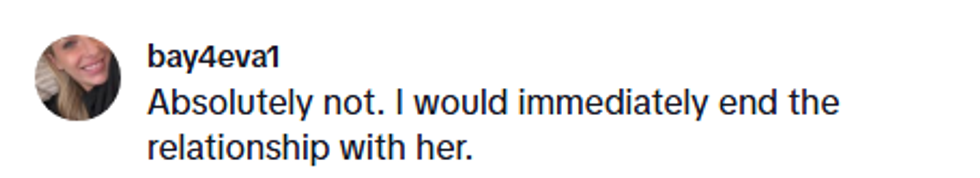

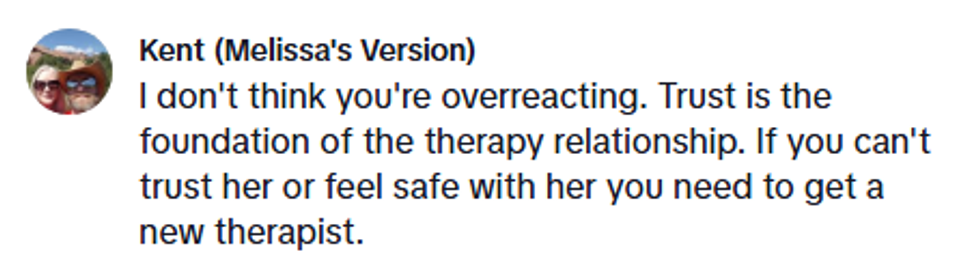

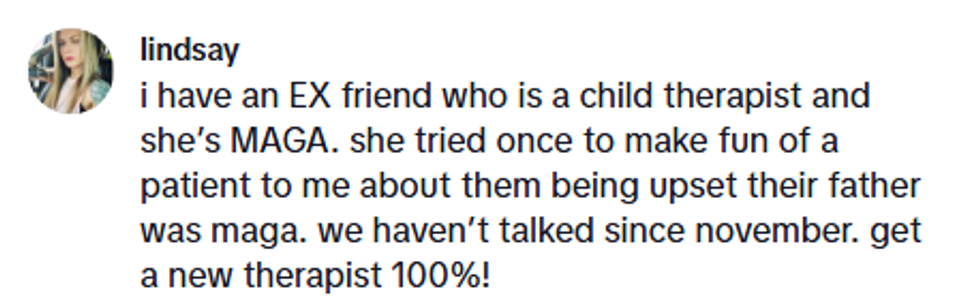

@nicolekatelynn1/TikTok

@nicolekatelynn1/TikTok @nicolekatelynn1/TikTok

@nicolekatelynn1/TikTok @nicolekatelynn1/TikTok

@nicolekatelynn1/TikTok @nicolekatelynn1/TikTok

@nicolekatelynn1/TikTok @nicolekatelynn1/TikTok

@nicolekatelynn1/TikTok @nicolekatelynn1/TikTok

@nicolekatelynn1/TikTok @nicolekatelynn1/TikTok

@nicolekatelynn1/TikTok @nicolekatelynn1/TikTok

@nicolekatelynn1/TikTok @nicolekatelynn1/TikTok

@nicolekatelynn1/TikTok @nicolekatelynn1/TikTok

@nicolekatelynn1/TikTok @nicolekatelynn1/TikTok

@nicolekatelynn1/TikTok @nicolekatelynn1/TikTok

@nicolekatelynn1/TikTok

@valerieelizabet/TikTok

@valerieelizabet/TikTok @valerieelizabet/TikTok

@valerieelizabet/TikTok @valerieelizabet/TikTok

@valerieelizabet/TikTok @valerieelizabet/TikTok

@valerieelizabet/TikTok @valerieelizabet/TikTok

@valerieelizabet/TikTok @valerieelizabet/TikTok

@valerieelizabet/TikTok @valerieelizabet/TikTok

@valerieelizabet/TikTok @valerieelizabet/TikTok

@valerieelizabet/TikTok @valerieelizabet/TikTok

@valerieelizabet/TikTok @valerieelizabet/TikTok

@valerieelizabet/TikTok @valerieelizabet/TikTok

@valerieelizabet/TikTok