I have to admit. I was not fond of being poor. I was ten when I realized my family had some financial issues. My mother sat me down to explain that she needed to go to the food drive to get somethings. It had been a hard year and she wanted me to be prepared in case someone we knew saw us. It was heartbreaking.

My mother has always been a hard worker and she hates asking for help. So that's why it infuriates me when people try to say that being poor is just a mentality and the poor should just try not to be poor. My mother did make it out of several financial holes but it was always an uphill battle, because the truth is... being poor only makes you more poor. The system is designed that way.

Redditor u/26point2PipeDream wanted everyone to start realizing that the game is rigged, often by the system keeping the poor, poor. They asked everyone to explain by inquiring... In what way is it expensive to be poor?

There are so many small details from the everyday, mundane that people with out an endless well of money have to do to survive. And it all may seem like nothing, but the nothings add up. They add up to spending and debt that can be necessary to survive. Look at real estate. Paying outrageous amounts of rent is fruitless. And mortgage is cheaper. But who can afford down payment for a mortgage? Maybe if you could get a free year of rent you could save for it. Hmmm....

Clothing Transport

cats laundry GIFGiphy

cats laundry GIFGiphyI saw a lady coming out of a laundromat, loading her baskets of clothes into a taxi (there is zero other public transport where I saw this happen and only a few taxis).

Not being able to put enough money together at one time to buy a car or a washing machine (she probably rented so this maybe wasn't even an option) was costing her a fortune. Just being nickeled and dimed to death.

Don't Accept

If you're ever desperate enough to take out a title/payday loan you'll discover you just stepped in financial quicksand.

About a year and a half ago I forgot to leave enough money in my bank account for a payment that needed to be done. It wasn't much, around $500 maybe, but didn't want the late payment and fees that come with it, so I decided to look into the payday loans. I needed $500 to last until Friday (when I would be paid)... I checked on it on Monday.

When I was to click "Accept", I read the entire thing... it said I had to pay back $950 IF I paid on Friday...or about $2,500 if I went with their payment plan.

I NOPED out of that bull as fast as I could, called my bank and I luckily had overdraft protection or whatever, payment went through and all I had to pay was like $15 or something for the overdraft.

Fees, fees and fees...

There are late fees for everything. Overdraft fees at the bank. Sh!tty jobs usually don't have good healthcare plans. If you're poor, you need credit cards just to survive, but interest rates are higher for those with low credit scores (see late fees above). Crappy cars are always breaking down, and that's expensive.

Death is Easier

Healthcare. That's the big one. If you don't have a healthcare plan, or have a crappy one you don't go to the doctor unless it's life or death. That means small problems that could have been caught in the beginning become hugely expensive problems later on.

Just Walk

Like parking tickets. I couldn't afford the £2 to pay to park my car so I get a £30 fine, after 2 weeks it goes up to £60 and so on. If I didn't have £2 to park in the first place I don't know how they think I can pay more.

Have you ever watched "killed by my debt"? That was about how a parking fine spiralled into severe debt and worse.

When you're poor you have to crafty. You also have to be thrifty and smart ,but crafty is often overlooked. See poor people are constantly in a fight to survive so learning how to maneuver is a key going forward. You just have to maneuver very carefully. Don't fall for the financial traps. They're always ready to get you. Case in point...

Renting is like Credit

Credit Card Money GIF by HustlersGiphy

Credit Card Money GIF by HustlersGiphyRenting to own anything is really bad. You pay 4X the value of whatever it is you're renting to own. And if you miss a payment they repossess it and someone else might start at the beginning of attempting to pay for it again. Not only that you very well might be paying 4X the new value for a used item.

And only low quality items are sold rent to own. Ashley furniture, crappy used cars, the cheapest big screen TVs available at wholesale. Houses might be better, but rent a center, and JD Byrider are worse than loan sharks.

Skyrocketing rates

Being stuck with higher interest rates because you don't have enough credit to get low rates.

The fact that rent payments aren't added into the credit score equation is bull. Or even just into mortgage lending.

How a lender can ignore me paying upwards of $1500 a month in rent while contemplating a mortgage loan that is equivalent to $850 a month. You'd think that would be a pretty safe bet right there.

The Pre-Pay Options

You can seldom buy in bulk, so you end up paying more for thing. For example, our local butchery sells ground beef cheap if you buy 2 kg or more at a time. If you're paid weekly and can afford only 500 g per week, you end up paying more.

Buying in bulk is a huge money saver.

And it's so damn expensive.

You don't just need the money in advance to buy the groceries. You also need a freezer or cooler large enough to store it. And of course a vehicle to get it home. So many things to pre-pay before you can start saving.

Luxuries

I'll add that when you have less money the power relationship is flipped in nearly every financial interaction you have.

When you have money, banks and companies compete to get access to your reliable spending, be it with low interest rates on borrowing or better deals for early payment. They have to compete because you have the option to go to someone else who will gladly take your payment history and stable income.

You're a safe bet, so you have the luxury of choice.

When you don't have money institutions know you have nowhere else to go. So they happily gouge you knowing agreeing to horrendous loan terms is your only option.

I teach econ and always remind my kids that commercials boasting about "no credit, low credit, no problem!" know exactly who they're getting in the door. People who have nowhere else to go.

Time for Restructure

story justice GIF by PrimerGiphy

story justice GIF by PrimerGiphyThe justice system. If you can't pay a fine, the state will make things more expensive by adding fees on top of fees on top of fees, then they will incarcerate you for not paying the inflated fees. Then you have to pay the parole officer who is keeping an eye on you while you care unable to get a job that pays enough to pay him.

Keeping Clean

Not having in-home laundry is a great example.

Say it costs you $4 to do your laundry each week (which I think is very cheap). In 5 years you will have spent over $1000 on laundry.

For $1000 you can get a good washing machine that would last you through those 5 years, then another 5 years, and maybe a lot more. And that doesn't count the time saved doing laundry at home, and any transportation costs.

Transport Worries

My car has a leaky seal on the transmission. It'd be about $250 to replace the seal and flush the transmission. I don't have $250, so I keep topping up the fluid and keep driving it because I'll never get $250 if I don't get to work. But, in time, that's going to destroy the transmission, which will be about $1200 to replace.

Edit: I never thought I'd say this in my entire life, but please stop offering me money. (I know. I'm insane, right?)

I'm getting by and my world will not end if my cars dies. It will be irritating and problematic, but I have other options I can make work, if the worst happens. In the mean time, plans are in place to resolve the issue and I have every reason to think that my car will survive until I can repair it.

I cannot tell you how much these offers mean to me. It has really made my night to have so many people want to help. Please, I ask you to turn your generous offers to others who are in a much more dire situation than I am.

There are several who commented on other threads on this post (as well as at least one who commented on this thread). I would not feel comfortable taking money under these circumstances when I have other options available to me. In short, other people here need it more.

Know that your kindness has made me smile on a day when really needed some brightness. I cannot put into words my gratitude. Thank you all.

For Walking

happy reno 911 GIF by Comedy CentralGiphy

happy reno 911 GIF by Comedy CentralGiphyIf you're well off, you buy 1 pair of boots for $150 and they last a lifetime.

If you're poor, you buy boots for $30 and they last a winter.

You end up spending more, because you can't afford to spend more. Terry Pratchett uses it to explain poverty via Sam Vines in one of his City Watch books.

Shady Funds

If you can't maintain a minimum balance or don't have a bank in your neighborhood or were raised to be suspicious of banks and don't have a bank account, you've got to pay fees to cash your paychecks. Then there are fees to buy money orders to pay your bills-- or the cost of getting TO the utility office or car dealership or wherever to pay in cash.

Mouth Matters

So is one dental cleaning every 6 months (the reason its 6 months is because that is the time when cavities can form). Root Canals are now thousands of dollars and those dentists demand up front payment for those expensive services. Most people don't have an extra 2 grand in their bank account for a root canal.

Big Plans

scared homer simpson GIFGiphy

scared homer simpson GIFGiphyMental health. Or more specifically stress. You will always have stress about future, always making decisions based on your poverty so that it won't affect your situation in bad way.

What Really Hurts

Everything is expensive when you're poor. Jokes aside, this is true. I've been poor for most of my life and I'm still not in a great financial situation. And the biggest problem is that you not only don't have a lot of money, but all the prices stay the same, so literally ANYTHING that you buy feels like a fortune.

I walked to the grocery store do buy some stuff to make a special dinner on my daughter's birthday and I spent about R$100,00 (about 20 dollars I think, Idk), and I swear I'd win an Oscar for how I kept my poker face. The second I walked out of the store I bursted out crying. Everyone on the street could see me crying as I walked back home. Seeing my daughter's smile later that day during dinner made me feel a lot better, but those R$100 ($20) REALLY hurt.

The Assist

If you're poor you already have no or very little money to invest in yourself, so you have to take on debt to do so. If you want to get technical certifications or degrees. Sometimes there's financial assistance but a lot of the time taking on loans is necessary.

Miles and Miles and Miles...

Tires! Used tires cost 1/3 price and get about 20% of the life of a new tire. Also you are paying mount and balance every time, plus worry about blow outs. Even a new tire at $80 with a 30K mileage expectancy or a $100 tire at 65k mileage warranty. Over twice the life, little more than 20% in extra charge.

A Hole

donald duck disney GIFGiphy

donald duck disney GIFGiphyDebt. Basically if you're poor you need to borrow some money to either get a house or buy food and after a while the debt keeps getting bigger and bigger.

In this moment the country is in the throws of cultural and financial battles. As I type, we await the Senate rulings on a financial plan for Covid. And the squabbling is endless. One of the main sticking points is raising the minimum wage to $15 and hour. Some Senators act like people are asking for a million dollars. Because God forbid we give the poor a leg up and shave a few measly dollars off the top from the super wealthy. You know, the ones rigging the whole game. Mhmmm.... Stay vigilant people and save those pennies.

Want to "know" more? Never miss another big, odd, funny, or heartbreaking moment again. Sign up for the Knowable newsletter here.

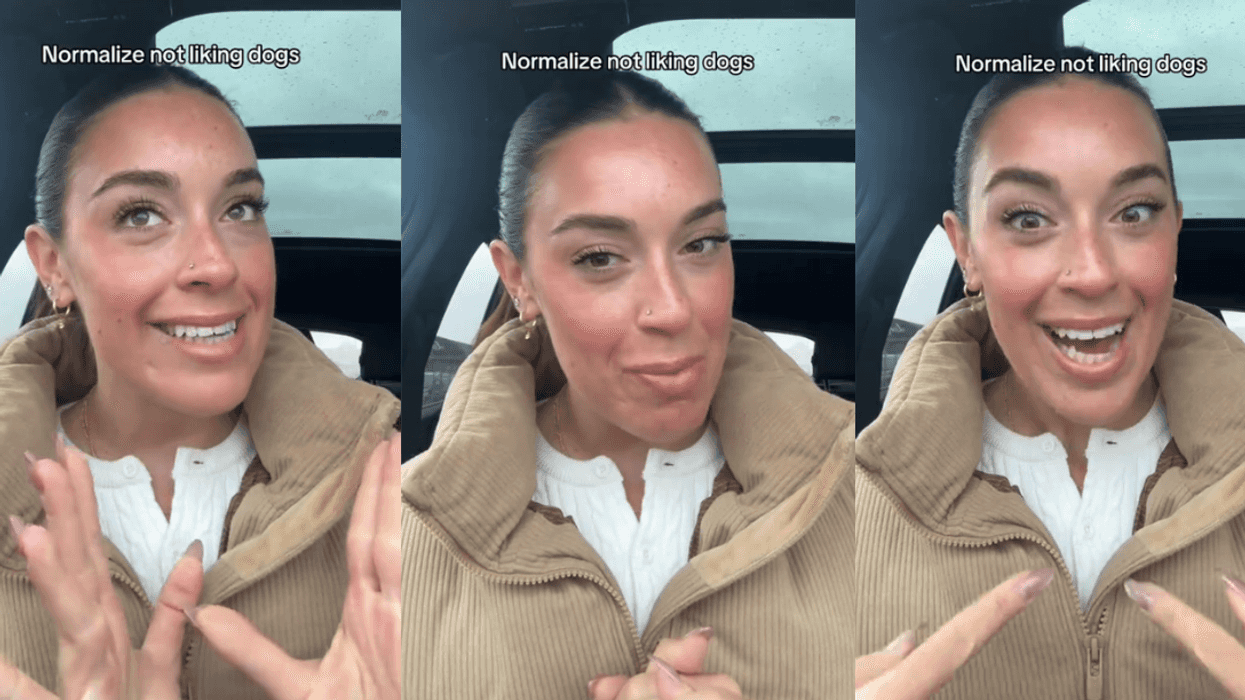

@madswellness/TikTok

@madswellness/TikTok @madswellness/TikTok

@madswellness/TikTok @madswellness/TikTok

@madswellness/TikTok @madswellness/TikTok

@madswellness/TikTok @madswellness/TikTok

@madswellness/TikTok @madswellness/TikTok

@madswellness/TikTok @madswellness/TikTok

@madswellness/TikTok @madswellness/TikTok

@madswellness/TikTok @madswellness/TikTok

@madswellness/TikTok @madswellness/TikTok

@madswellness/TikTok @madswellness/TikTok

@madswellness/TikTok

@vanellimelli030/TikTok

@vanellimelli030/TikTok @vanellimelli030/TikTok

@vanellimelli030/TikTok @vanellimelli030/TikTok

@vanellimelli030/TikTok @vanellimelli030/TikTok

@vanellimelli030/TikTok @vanellimelli030/TikTok

@vanellimelli030/TikTok @vanellimelli030/TikTok

@vanellimelli030/TikTok @vanellimelli030/TikTok

@vanellimelli030/TikTok @vanellimelli030/TikTok

@vanellimelli030/TikTok @vanellimelli030/TikTok

@vanellimelli030/TikTok @vanellimelli030/TikTok

@vanellimelli030/TikTok @vanellimelli030/TikTok

@vanellimelli030/TikTok

@anissahm15/TikTok

@anissahm15/TikTok @anissahm15/TikTok

@anissahm15/TikTok @anissahm15/TikTok

@anissahm15/TikTok @anissahm15/TikTok

@anissahm15/TikTok @anissahm15/TikTok

@anissahm15/TikTok @anissahm15/TikTok

@anissahm15/TikTok @anissahm15/TikTok

@anissahm15/TikTok @anissahm15/TikTok

@anissahm15/TikTok @anissahm15/TikTok

@anissahm15/TikTok @anissahm15/TikTok

@anissahm15/TikTok @anissahm15/TikTok

@anissahm15/TikTok @anissahm15/TikTok

@anissahm15/TikTok @anissahm15/TikTok

@anissahm15/TikTok @anissahm15/TikTok

@anissahm15/TikTok @anissahm15/TikTok

@anissahm15/TikTok

@hustleb***h/TikTok

@hustleb***h/TikTok @hustleb***h/TikTok

@hustleb***h/TikTok @hustleb***h/TikTok

@hustleb***h/TikTok @hustleb***h/TikTok

@hustleb***h/TikTok @hustleb***h/TikTok

@hustleb***h/TikTok @hustleb***h/TikTok

@hustleb***h/TikTok @hustleb***h/TikTok

@hustleb***h/TikTok