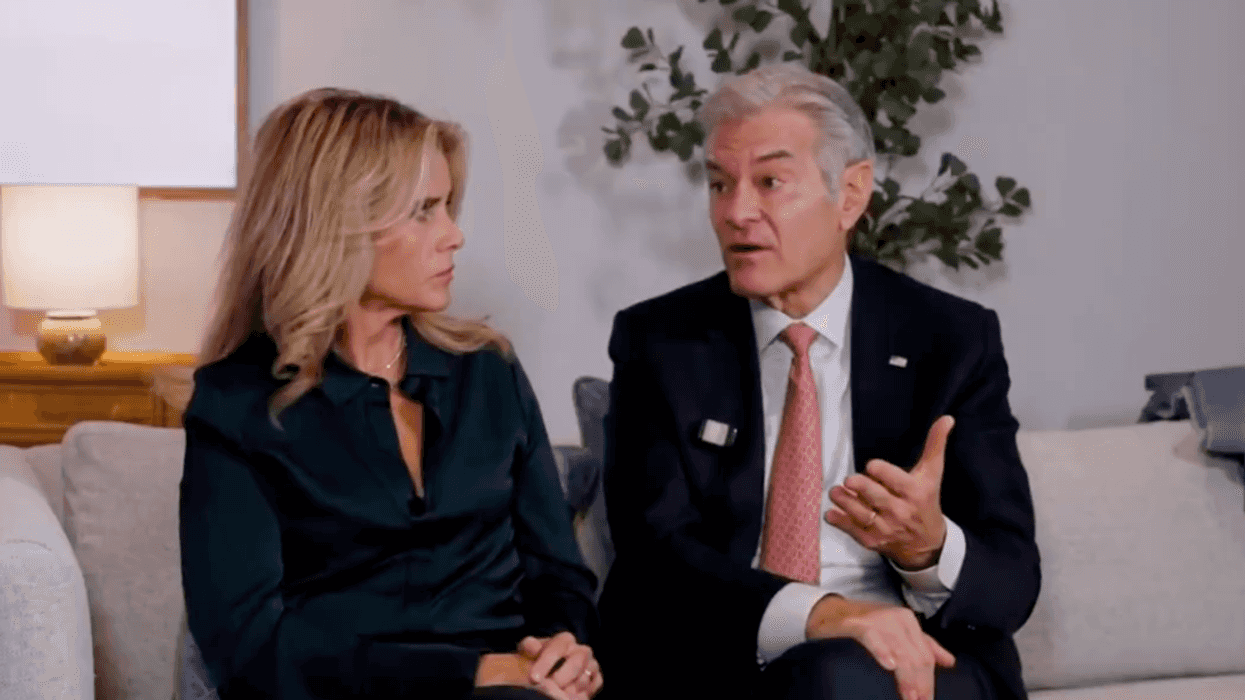

Mick Mulvaney, Interim Director of the Office of Management and Budget and Head of the Consumer Financial Protection Bureau, admitted that he only spoke to lobbyists who gave money during his time in Congress.

Speaking at the American Bankers Association in Washington D.C., Mulvaney told attendees that money means access. The ABA strongly advocates for loosening regulations and weakening protections for consumers.

We had a hierarchy in my office in Congress. If you're a lobbyist who never gave us money, I didn't talk to you. If you're a lobbyist who gave us money, I might talk to you.

Mulvaney added that his constituents always came first, however, even if they didn't write a check.

If you came from back home and sat in my lobby, I talked to you without exception, regardless of the financial contributions.

At the end of his speech, Mulvaney said that lobbying members of Congress with money is a "fundamental underpinnings of our representative democracy. And you have to continue to do it.

A spokesman for Mulvaney said that the bureau chief's comments emphasized the importance of listening to constituents.

He was making the point that hearing from people back home is vital to our democratic process and the most important thing our representatives can do. It's more important than lobbyists and it's more important than money.

President Donald Trump appointed Mulvaney, a former three-term Republican Congressman from South Carolina, to head the CFPB last November. Mulvaney was and continues to be an outspoken critic of the agency, which was established in 2010 under the Dodd-Frank banking law to protect consumers from predatory practices by financial institutions.

Throughout his time at the bureau, Mulvaney has stalled investigations into financial abuse and restricted access to bank records and has refused to pursue complaints of abuse by payday lenders, auto lenders, and others. During his time in Congress, Mulvaney received $63,000 in contributions from payday lenders, who are well-known for usury (charging unreasonable interest rates) and preying on the poor and destitute.

Mulvaney's tenure at the CFPB has also included limiting public access to the bureau's records, which were put in place to inform consumers about the business practices of banks or other financial services to whom they may give their business. "I don't see anything in here that says I have to run a Yelp for financial services sponsored by the federal government," Mulvaney said.

In his crusade to weaken the CFPB and undermine its public image, Mulvaney refers to the agency under its statutory name, the Bureau of Consumer Financial Protection. "I'm trying to get in the habit of now saying the 'B.C.F.P.' It's really, really hard to do that when you've said the C.F.P.B. for so long," he added. Removing the word 'consumer' from the beginning is an attempt to weaken the bureau's image, officials have said.

The national debate over money in politics has raged since 2010 when the United States Supreme Court ruled in the Citizens United case that money counts as free speech.

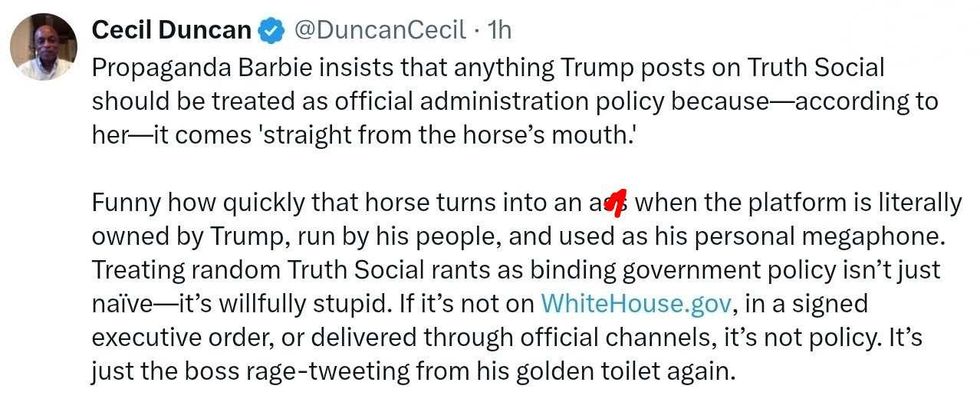

@DuncanCecil/X

@DuncanCecil/X @@realDonaldTrump/Truth Social

@@realDonaldTrump/Truth Social @89toothdoc/X

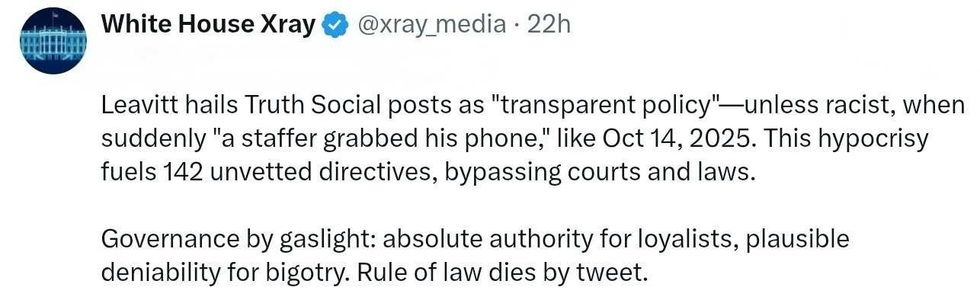

@89toothdoc/X @xray_media/X

@xray_media/X @CHRISTI12512382/X

@CHRISTI12512382/X

@sza/Instagram

@sza/Instagram @laylanelli/Instagram

@laylanelli/Instagram @itssharisma/Instagram

@itssharisma/Instagram @k8ydid99/Instagram

@k8ydid99/Instagram @8thhousepath/Instagram

@8thhousepath/Instagram @solflwers/Instagram

@solflwers/Instagram @msrosemarienyc/Instagram

@msrosemarienyc/Instagram @afropuff1/Instagram

@afropuff1/Instagram @jamelahjaye/Instagram

@jamelahjaye/Instagram @razmatazmazzz/Instagram

@razmatazmazzz/Instagram @sinead_catherine_/Instagram

@sinead_catherine_/Instagram @popscxii/Instagram

@popscxii/Instagram