Money management is not a skill everyone has, and when you are actually broke, it can feel like you're constantly playing “bill roulette". Not a good feeling.

The other side however is people who are broke all the time not because they are underpaid, but because they can't seem to get a handle on budgeting. That friend who is constantly upgrading and getting the brand new gadget but needs to borrow money to put gas in the car—this is for you.

A Redditor by the screen name of Disrupter52 wanted to hear what the common signs were that someone couldn't handle their finances. They asked:

“What's a red flag that someone is very bad with their money?"

Well here's your sign because we've got a bundle flags about to go up.

…

“They are involved in multi-level marketing schemes, and when asked by friends why you need to pay into such schemes, they say ‘well, you need to spend money to make money.’” Giediprimal

Awkward Season 2 GIF by The OfficeGiphy

Awkward Season 2 GIF by The OfficeGiphyChronic borrowers…

“Constantly borrows money from friends/family but never pays it back. Bonus points if they never give a reason or vague reason for the money - uses manipulation or having their friends' pressure/guilt you into giving them money."

“Also constantly buying expensive stuff or always eating out but is always behind their bills (plus doing the borrowing money thing). Pretty much prioritizing their WANTS over their or others' NEEDS when managing money or paying for things." TheoryAddict

Do you really need a BMW?

“Leasing an expensive car. Bruv, you're just about making enough to cover rent and bills, so why are you driving around in a BMW?” manawasteman

They could have saved themselves so much…

“I had a friend who I used to play Xbox with online. He would frequently not be on for weeks at a time because he'd sold his xbox to pay bills. As soon as he had money again, he'd pay $400 for a new console, then he'd run out of money and pawn it for $50-100. This happened probably 5 or 6 times a year.” irreverant_usernam3

Good food for thought.

“Asking what to buy. If you don't have anything you'd want to buy already in mind, just save the money for later instead of buying things you didn't think you needed, because you most likely don't need them” SnakeR515

“Any time you find yourself asking somebody this question, you already have your answer -- pay down some of your debt. The best way to increase your means is to live below them. Good luck!” FaceDownInTheCake

Did it all for the likes…

“They flex their sh*t on instagram/ tiktok. Why be fiscally responsible when you can spend 10k on Yeezys?" Elitus-Meatus

“I had a friend who was always complaining he was broke. His car was broken said he couldn't afford to fix the 600 dollar repair bill and was going to lose his job because he couldn't get to work. 3 days later posted on Facebook how he just got the brand new xbox (it had just come out that week). I asked if he got his car fixed and he blocked me." streetmitch

Season 2 Tom GIF by Parks and RecreationGiphy

Season 2 Tom GIF by Parks and RecreationGiphyA loan for PizzaHut?

“The combination of needing to borrow money but choosing to buy expensive things is a dead giveaway. I had a housemate at uni who once asked me if she could borrow £20 because she had no money for food until she got paid in a week.”

“At that time/area £20 would easily feed onr person for a week, and you wouldn't even have to be stingy... an hour later the delivery guy knocks on the door. She's ordered a £20 Pizza Hut meal deal. Eventually she paid me back but I never lent her money again.” MerylSquirrel

Strangest Things Seen In A Contract's Terms And Conditions | George Takei’s Oh Myyy

Couldn’t keep the lights on…

“I used to work for a utility company. We would shut people's electric off and then they'd come into the office to pay with cash to get turned back on.”

“Half of them I could tell weren't good with money because they'd have their nails done, hair dyed, coach purse and wallet, crying because ‘I only have $30 to my name. I can't pay $300 to get my electricity back on. What can you do for me?’” Mermaids_tatertots

A laundry list…

“I'll give you a subtle one: when someone has no retirement plan, and they are older. Like, past 50, and their plan is just 'I can always work more to get more money.' When people don't acknowledge the reality of sickness, emergencies outside their control (COVID-19, for instance), and infirm due to old age."

“Also, hidden addictions are usually lurking if someone seems to be making buckets of money, and has little to no savings, rents long term, etc."

“Alsoooooo there are .... Parasitic..... Types who have a pattern of seeking out more financially secure people. If they have a dating history of that, it's a big red flag."

"When people embellish their past to seem like they are ultra-successful ultra-ambitious renaissance people. Like, at age ____ started this business where I was a pilot, within ___ years it was so successful me and my partner sold it and now it's the biggest business in <city>."

"Then, after that, I got into upscale finish carpentry and made all this money working for this wealthy person and this wealthy person and I made so much... Then, I pivoted to real estate, and made all this money......."

"That's a big red flag. They'll usually have a few sob stories sprinkled in, like a spouse that took them to the cleaners.... Then a death or weather catastrophe or embezzling business partner... To explain why they're still just working-class despite all this success and ambition. Big. Red. Flags." WoodyAllenDershodick

“That friend of mine is me. Don't be me."

“A friend of mine did this with credit cards. Didn't understand the meaning of "Don't spend more than you have." and thought that meant "Don't spend more than the limit." He figured it out after he under a $20,000 mountain of credit card debt. That friend of mine is me. Don't be me.” Bangersandmash13

If you're finding some of these red flags apply to you there are free apps and budgeting info online. It's hard to save if you're struggling however, sometimes-like the instances above-some education really is all that's needed.

Want to "know" more? Never miss another big, odd, funny, or heartbreaking moment again. Sign up for the Knowable newsletter here.

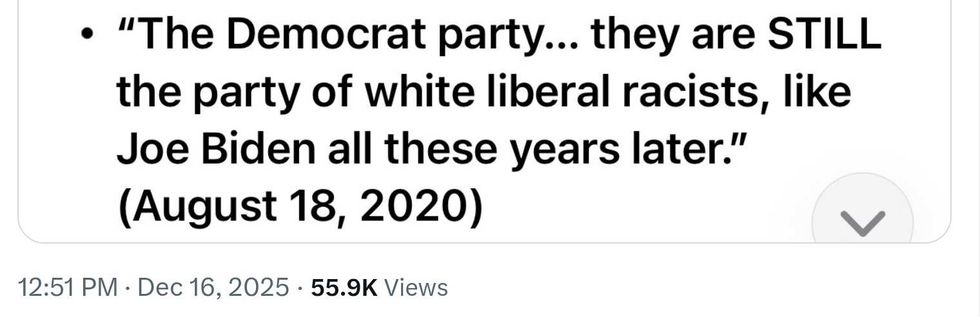

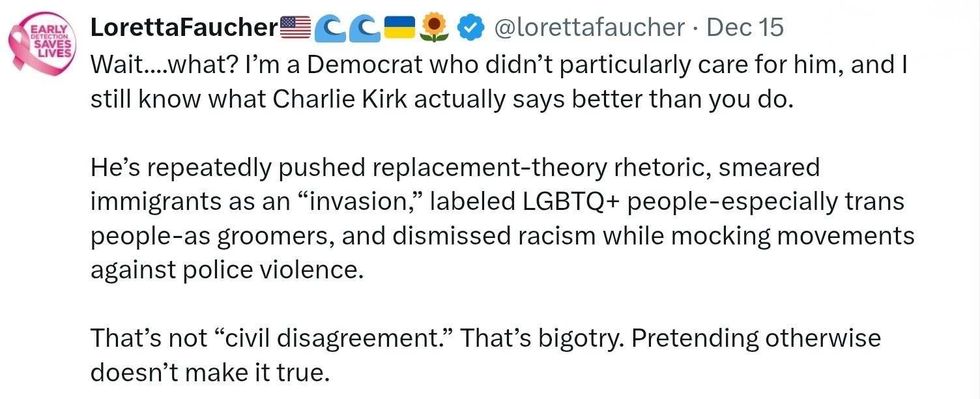

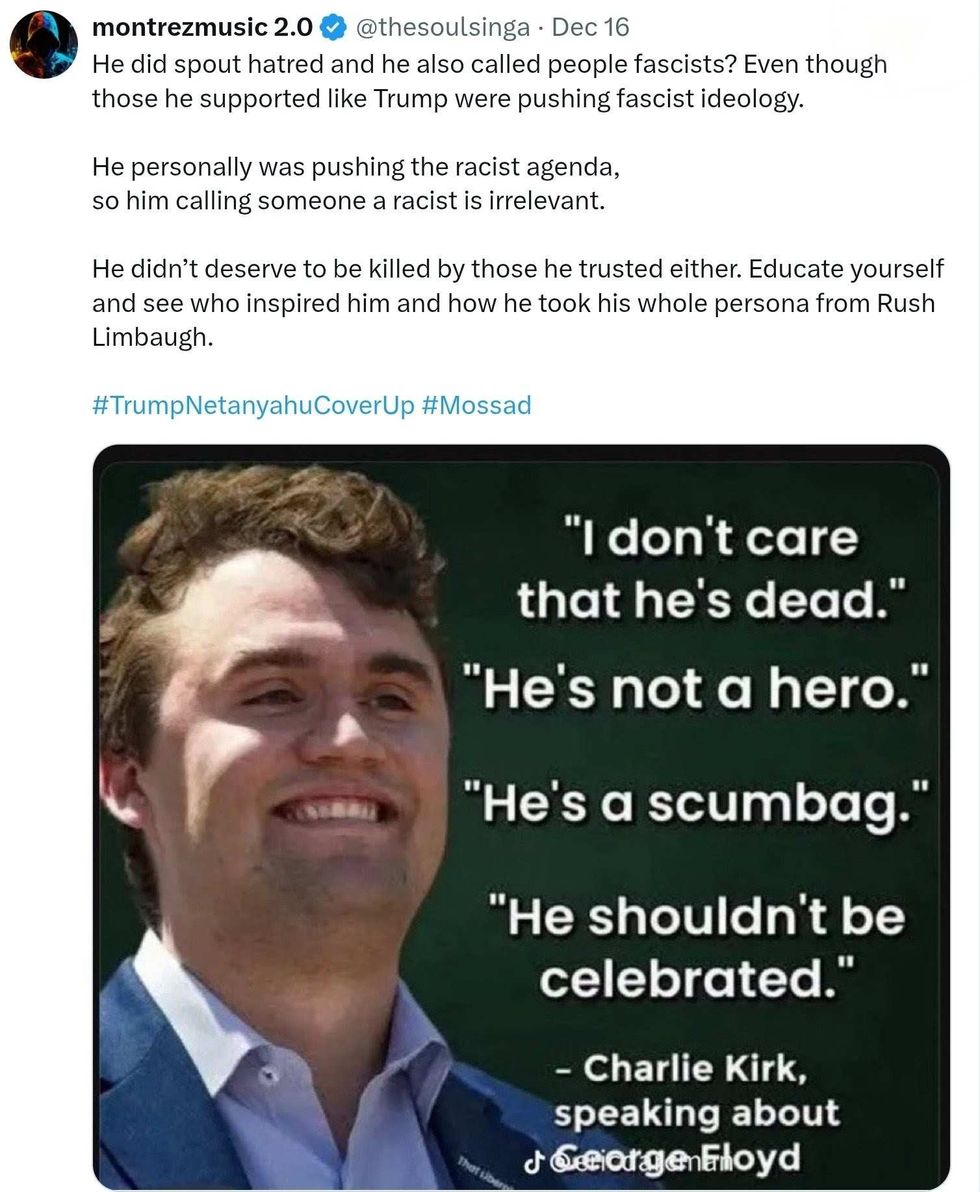

Replying to @StefanMolyneux/X

Replying to @StefanMolyneux/X Replying to @StefanMolyneux/X

Replying to @StefanMolyneux/X Replying to @StefanMolyneux/X

Replying to @StefanMolyneux/X Replying to @StefanMolyneux/X

Replying to @StefanMolyneux/X

Playing Happy Children GIF by MOODMAN

Playing Happy Children GIF by MOODMAN  May The Fourth Be With You

May The Fourth Be With You

Nhh GIF by New Harmony High School

Nhh GIF by New Harmony High School