Since the passage of the Republican backed and White House endorsed tax cuts, members of the GOP and Trump administration touted the eventual inevitable benefits to the middle class of the large tax cuts for corporations and the wealthy. They claimed the cuts would create new jobs and bonuses for working class Americans.

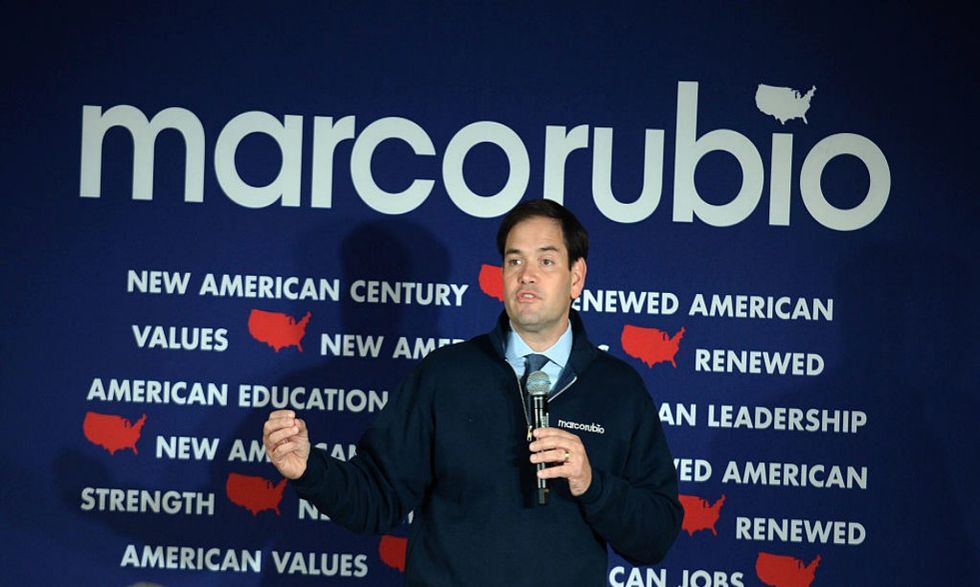

Now, Republican U.S. Senator from Florida Marco Rubio admits that has not happened. In an interview with The Economist, Rubio states "there's no evidence whatsoever that the money's been massively poured back into the American worker."

Instead of the major windfall trickling down as predicted by the GOP to employees through raises and bonuses, Rubio says:

"There is still a lot of thinking on the right that if big corporations are happy, they're going to take the money they're saving and reinvest it in American workers. In fact they bought back shares, a few gave out bonuses; there's no evidence whatsoever that the money's been massively poured back into the American worker."

Rather than benefit the working class and the overall economy, the nonpartisan Congressional Budget Office released an economic forecast stating the decline in federal tax revenue will raise the United State's annual deficit to more than $1 trillion by 2020.

With 33 seats in the Senate, 435 seats in the balance in the House, and 14 state governorships up for grabs in the upcoming midterm elections, the Republican Party needs to convince Americans that the tax cuts benefit them. But from the beginning, the tax cuts were not popular among voters.

Rubio's break from the party line casts doubt over his party's plans to win with voters in November. But Rubio, unlike many of his fellow Republicans is not up for reelection this year. The senator's current term of office ends in 2022.

According to a spokesperson from Rubio's office, "Rubio pushed for a better balance in the tax law between tax cuts for big businesses and families, as he's done for years. As he said when the tax law passed, cutting the corporate tax rate will make America a more competitive place to do business, but he tried to balance that with an even larger child tax credit for working Americans."

The reason for Rubio's break from his party on the official message regarding the tax cuts is unclear.

But the White House and the majority of the GOP still tout the tax cuts as an eventual benefit to American workers. According to the Trump administration, 275 companies increased wages, announced bonuses or promised new hires. House Speaker Paul Ryan described the economic impact from the cuts as "even exceeding our expectations."

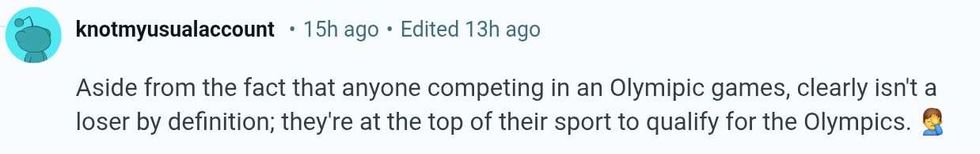

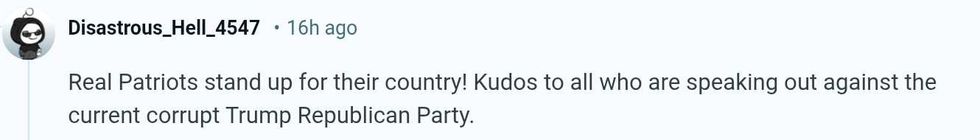

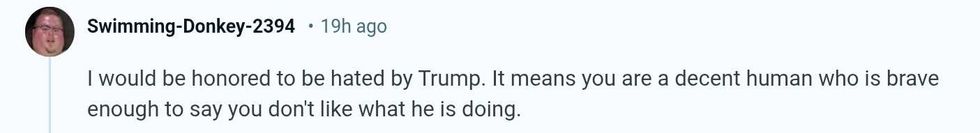

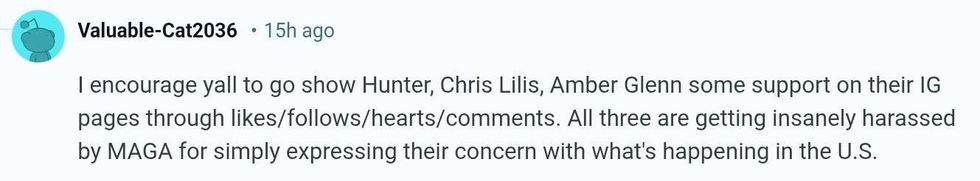

The impact of Republican Party members like Rubio admitting the tax cuts largely benefited just the wealthy and corporations they were designed to help remains to be seen. But the public has been sounding off on the GOP tax plan since it was passed and signed in December and are now commenting on Rubio's admission of who really benefited.

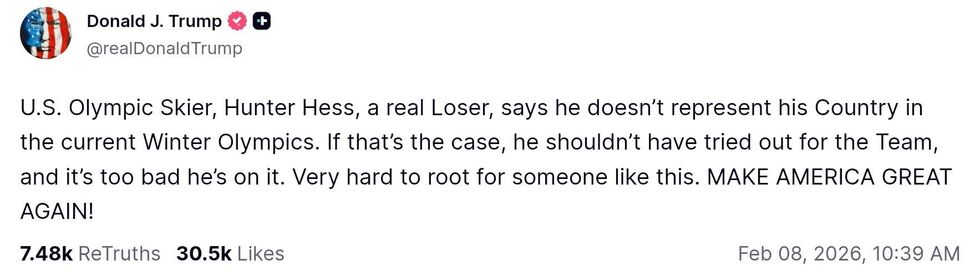

@realDonaldTrump/Truth Social

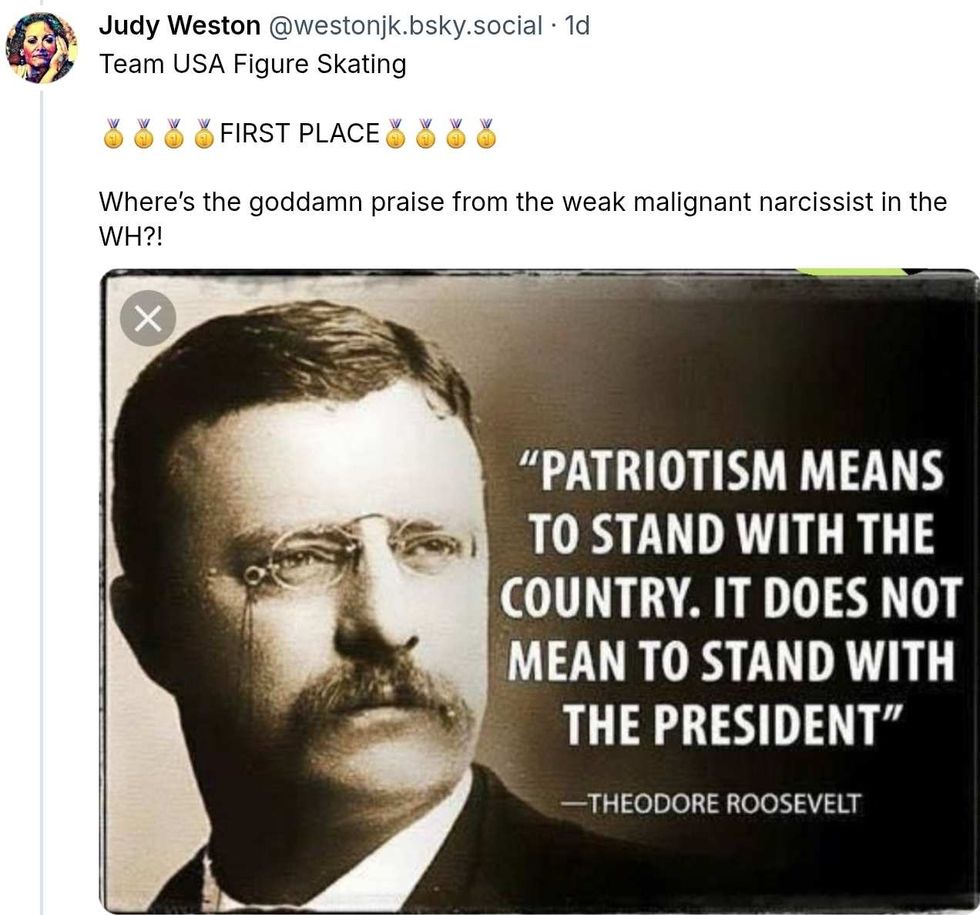

@realDonaldTrump/Truth Social @westonjk/Bluesky

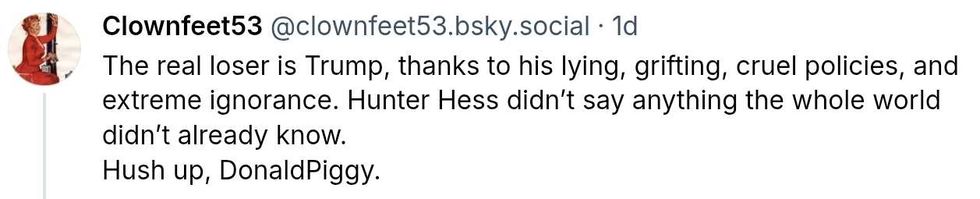

@westonjk/Bluesky @clownfeet53/Bluesky

@clownfeet53/Bluesky @shankhead/Bluesky

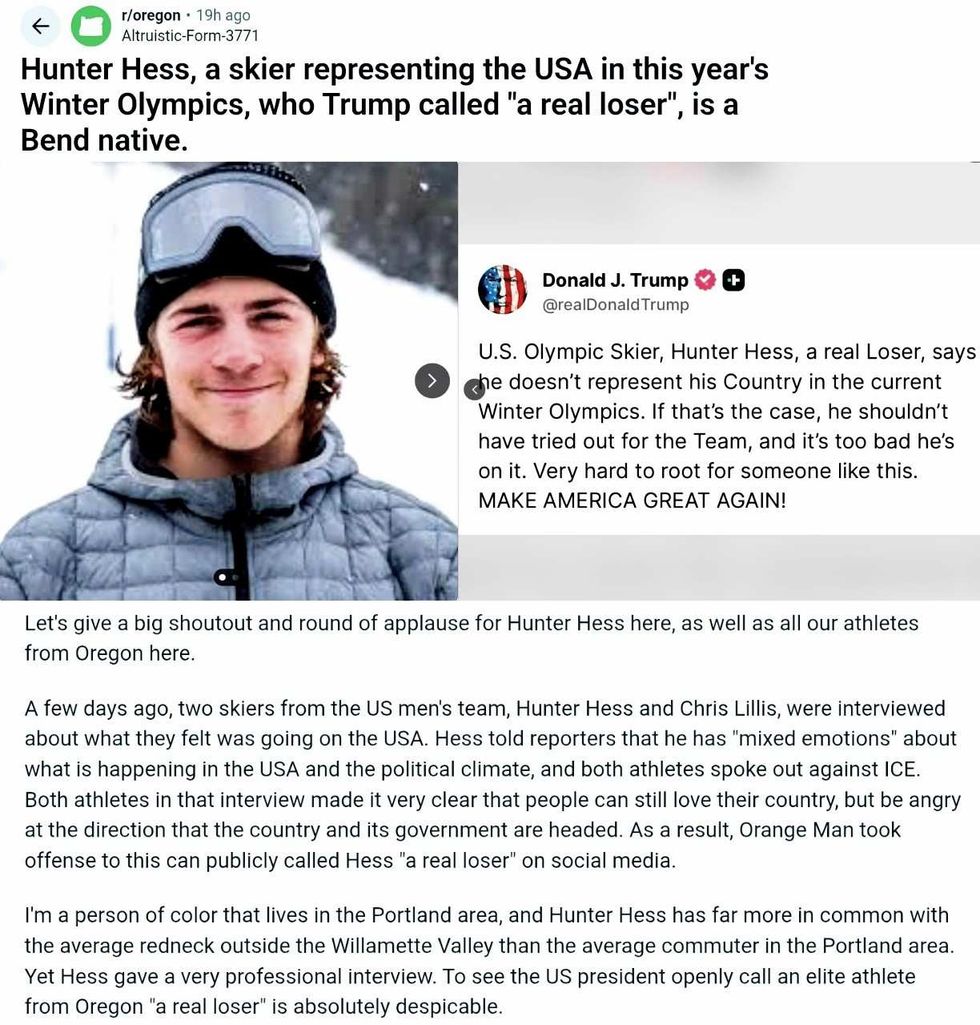

@shankhead/Bluesky r/Oregon/Reddit

r/Oregon/Reddit r/Oregon/Reddit

r/Oregon/Reddit r/Oregon/Reddit

r/Oregon/Reddit r/Oregon/Reddit

r/Oregon/Reddit r/Oregon/Reddit

r/Oregon/Reddit r/Oregon/Reddit

r/Oregon/Reddit r/Oregon/Reddit

r/Oregon/Reddit r/Oregon/Reddit

r/Oregon/Reddit r/Oregon/Reddit

r/Oregon/Reddit r/Oregon/Reddit

r/Oregon/Reddit r/Oregon/Reddit

r/Oregon/Reddit

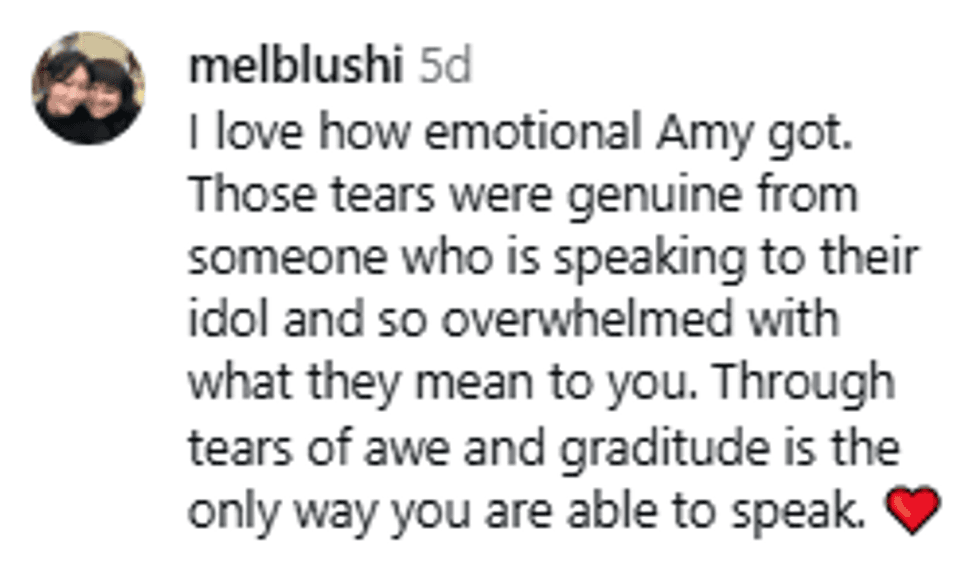

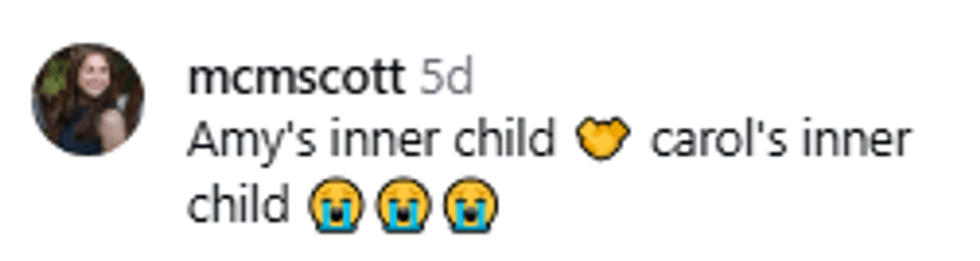

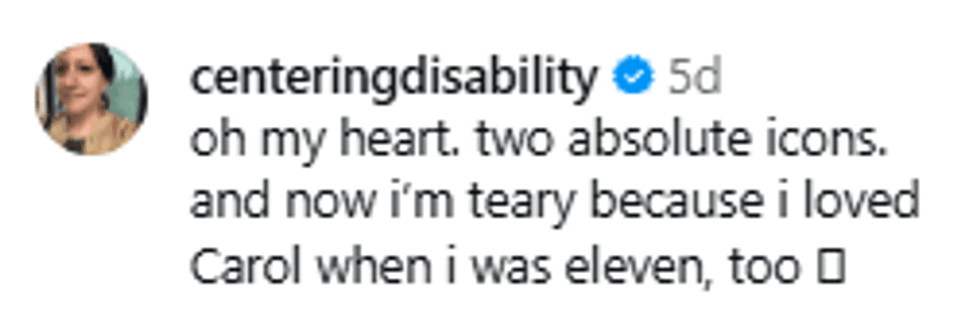

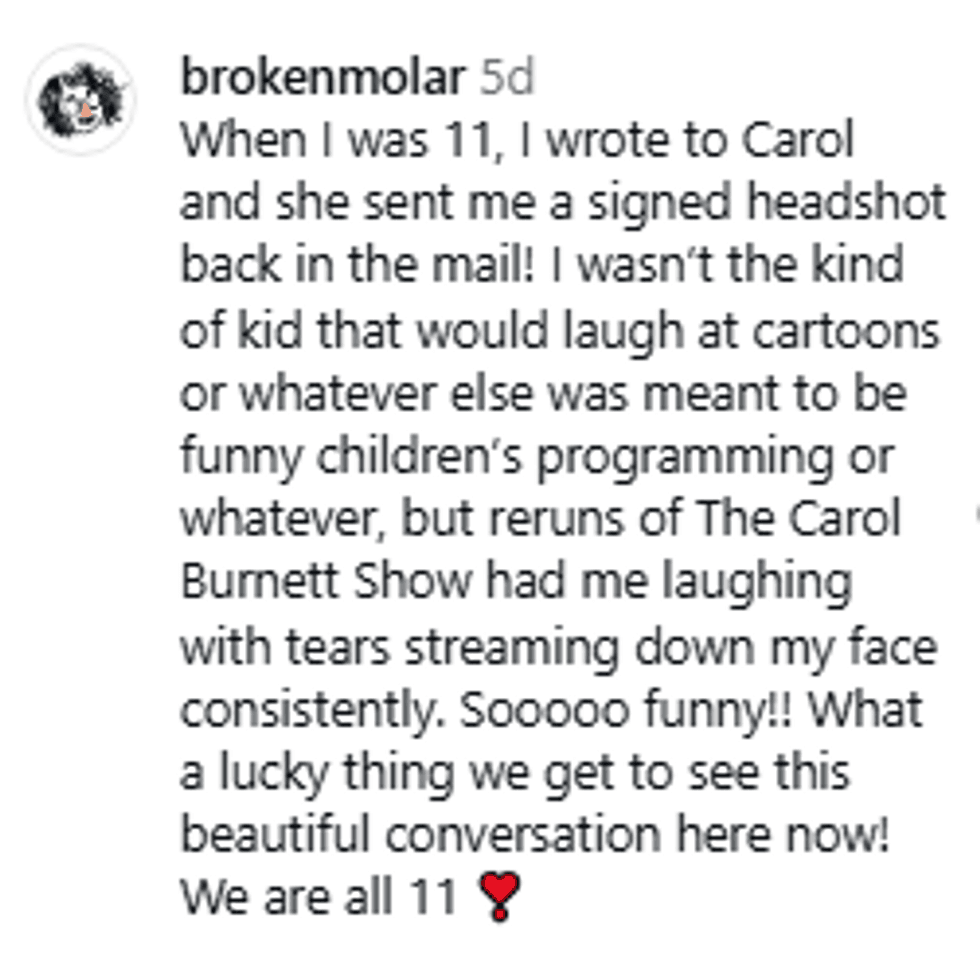

@goodhangwithamy/Instagram

@goodhangwithamy/Instagram @goodhangwithamy/Instagram

@goodhangwithamy/Instagram @goodhangwithamy/Instagram

@goodhangwithamy/Instagram @goodhangwithamy/Instagram

@goodhangwithamy/Instagram @goodhangwithamy/Instagram

@goodhangwithamy/Instagram @goodhangwithamy/Instagram

@goodhangwithamy/Instagram @goodhangwithamy/Instagram

@goodhangwithamy/Instagram @goodhangwithamy/Instagram

@goodhangwithamy/Instagram @goodhangwithamy/Instagram

@goodhangwithamy/Instagram @goodhangwithamy/Instagram

@goodhangwithamy/Instagram

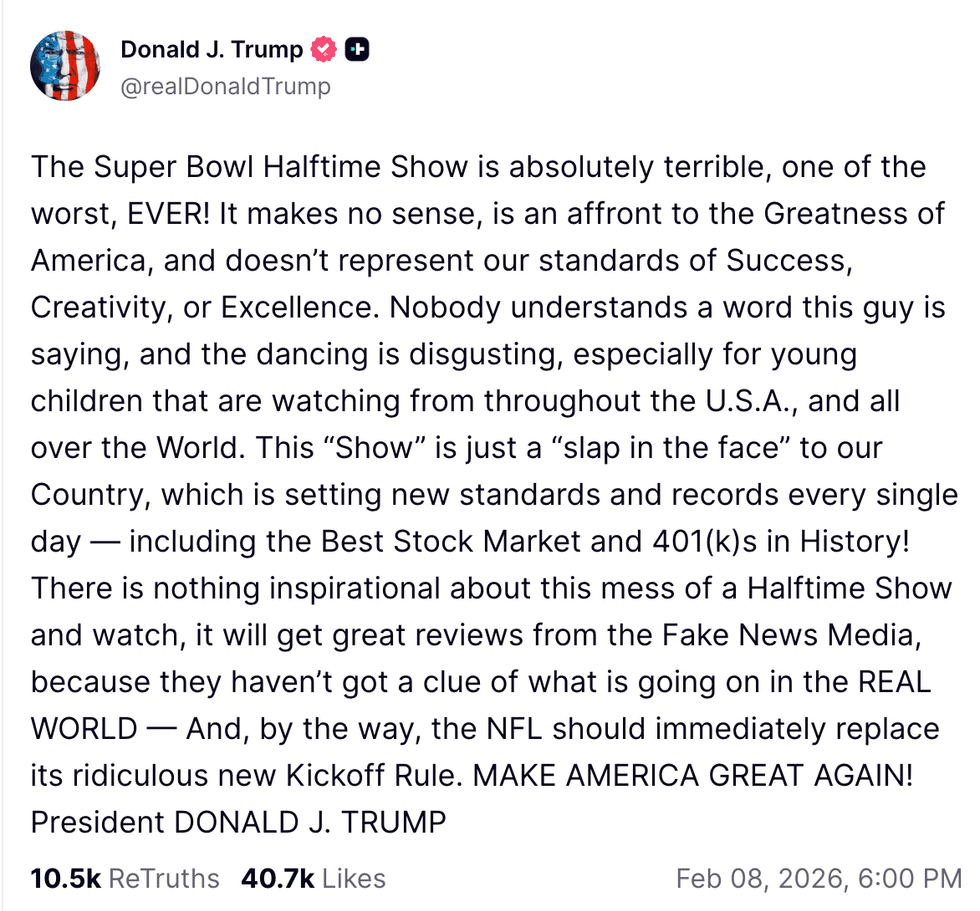

@realDonaldTrump/Truth Social

@realDonaldTrump/Truth Social