A relatively new scam is on the rise where imposters posing as bank representatives are trying to swindle you out of your savings.

As with most convincing hoaxes, this one seems legitimate.

At first.

A scammer contacted

Pieter Gunst, a lawyer, and alerted him to suspicious activity with his bank card and asked for some information.

Luckily, Gunst saw the red flags and managed to end the call before he was defrauded.

Gunst took to Twitter to spread awareness of the scam and began his tweet with an onomatopoeic exhalation.

"Oooof. Was just subjected to the most credible phishing attempt I've experienced to date."

He proceeded to outline how the phone conversation went down.

"1) 'Hi, this is your bank. There was an attempt to use your card in Miami, Florida. Was this you?'"

"Me: no."

The transaction was then "blocked" and the caller proceeded to ask for some information.

"2) 'Ok. We've blocked the transaction. To verify that I am speaking to Pieter, what is your member number?'"

"Me: <gives member number> (that number, by itself, is useless)."

That should have been a done deal, or so one would think.

But the imposter asked Gunst for further confirmation about recent transactions.

Then they asked for his PIN.

That was when the lawyer became wise to the phishing attempt and abruptly ended the conversation.

After hanging up, he immediately called the bank's fraud department.

Gunst explained how he thinks the attacker was able to access his account's transaction history.

Here is an important rule of thumb:

Never trust anyone asking for your PIN number, regardless of who you think is on the other end.

Changing passwords is a necessary evil.

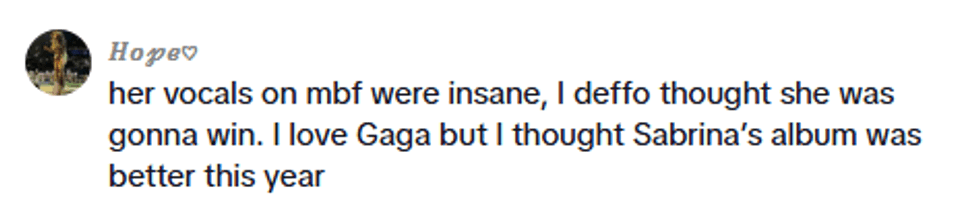

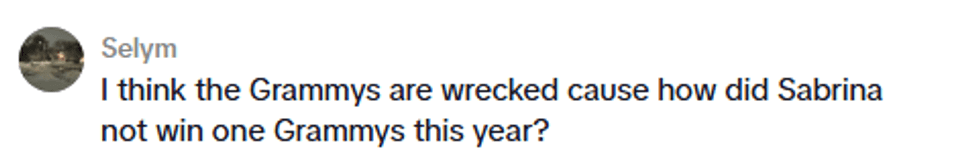

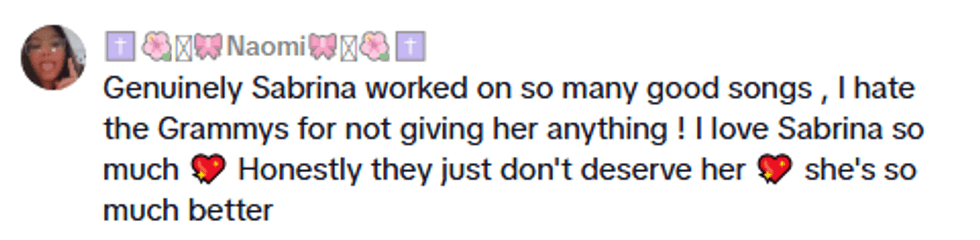

Those familiar with the stunt shared their insight.

Keep in mind that if a caller posing as someone from your bank initiates contact, they should already know your card number and PIN.

Making things more complicated, different countries have different levels of requiring information.

Nevertheless, you might want to think twice before answering the phone.

However, that MO does not work for everyone.

The Federal Trade Commission reported 535,000 complaints about imposter scams in 2018, 69% of which were handled over the phone.

The FTC urges people never to give out their account information over the phone.

A bank or payment card company that is contacting you first will never ask you for your account number, let alone your PIN.

When you reveal private information, your money is not the only thing at risk of being stolen. Your identity could also be compromised.

If you think you have been a victim of a scam, immediately call the number from a bank statement or an official bank document and then proceed to file a complaint with the FTC.

And while resetting all your passwords is annoying, it will be worth the effort for your peace of mind.

******

Have you listened to the first season of George Takei's podcast, 'Oh Myyy Pod!'?

In season one we explored the racially charged videos that have taken the internet by storm.

We're hard at work on season two so be sure to subscribe here so you don't miss it when it goes live.

Here's one of our favorite episodes from season one. Enjoy!

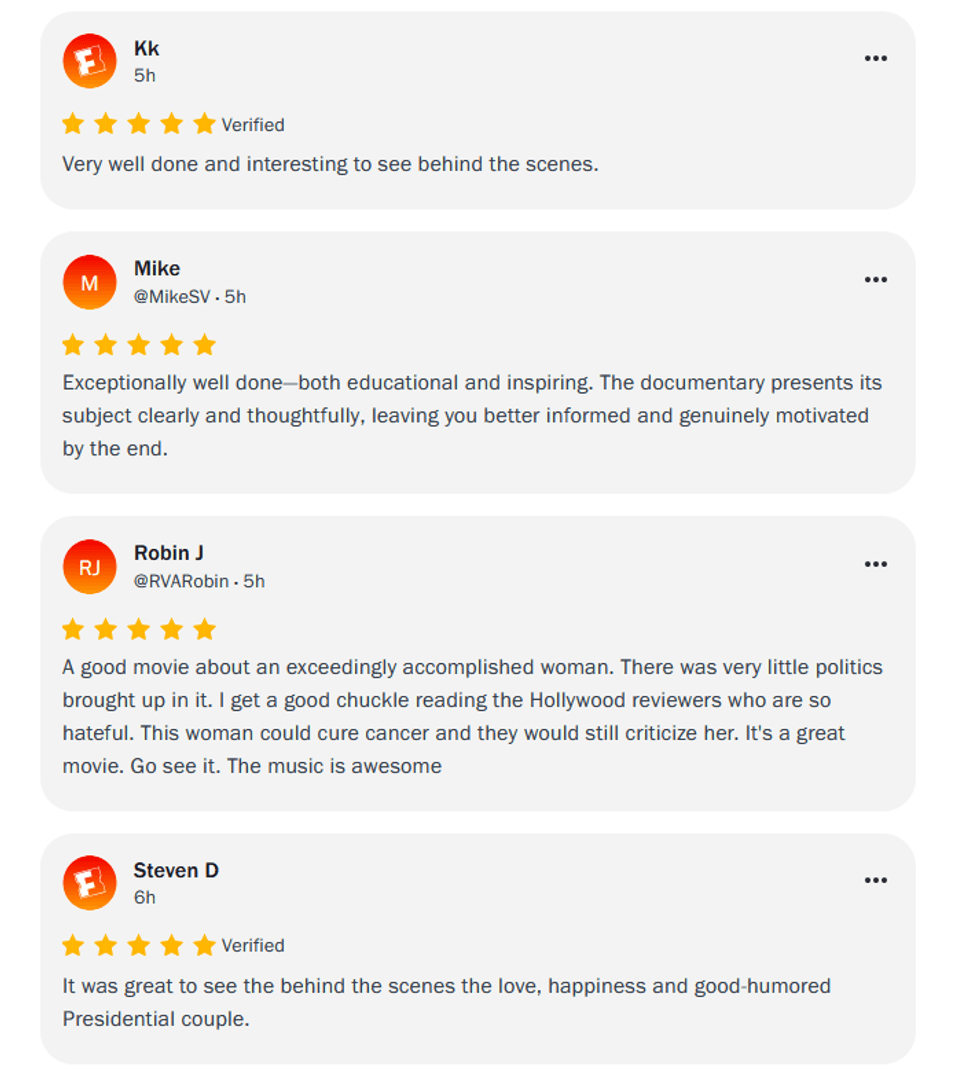

@obamaatredrobin/X

@obamaatredrobin/X

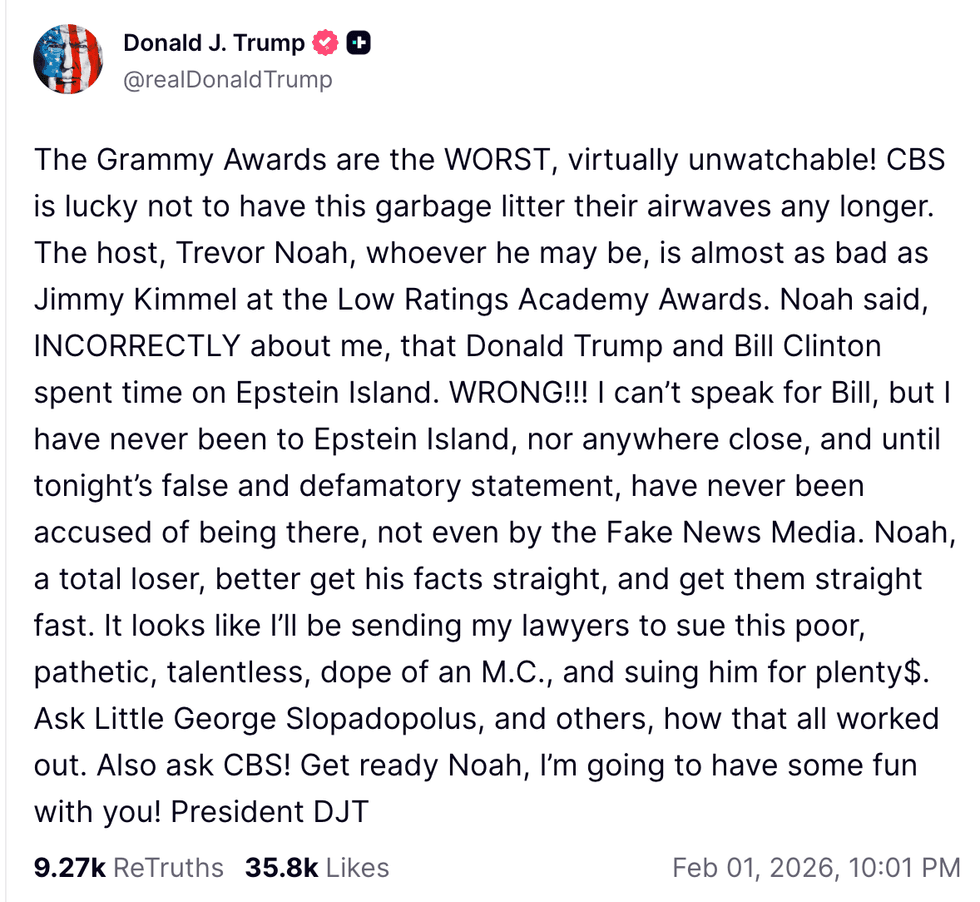

@realDonaldTrump/Truth Social

@realDonaldTrump/Truth Social

@.a.zan/TikTok

@.a.zan/TikTok @.a.zan/TikTok

@.a.zan/TikTok @.a.zan/TikTok

@.a.zan/TikTok @.a.zan/TikTok

@.a.zan/TikTok @.a.zan/TikTok

@.a.zan/TikTok @.a.zan/TikTok

@.a.zan/TikTok @.a.zan/TikTok

@.a.zan/TikTok @.a.zan/TikTok

@.a.zan/TikTok @.a.zan/TikTok

@.a.zan/TikTok @.a.zan/TikTok

@.a.zan/TikTok @.a.zan/TikTok

@.a.zan/TikTok @.a.zan/TikTok

@.a.zan/TikTok @.a.zan/TikTok

@.a.zan/TikTok @.a.zan/TikTok

@.a.zan/TikTok @.a.zan/TikTok

@.a.zan/TikTok