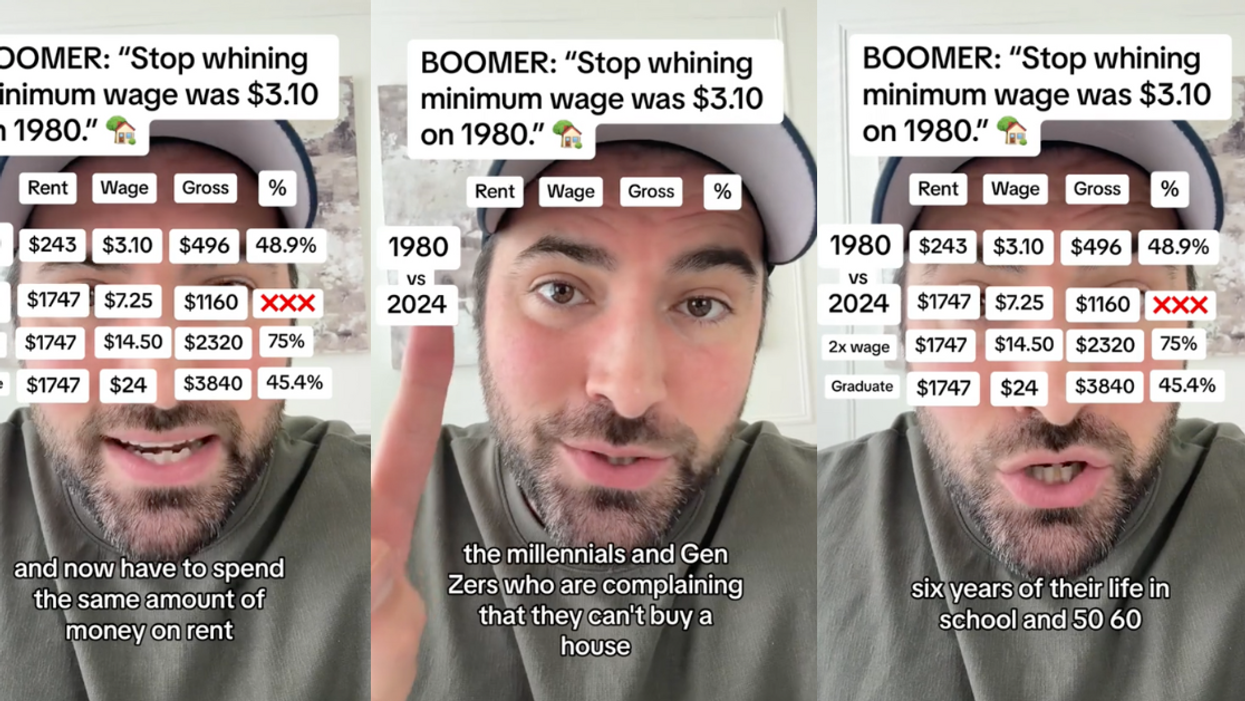

A realtor on TikTok went viral after comparing the income-to-rent ratio of recent college graduates versus minimum wage workers in 1980.

The breakdown is seriously astounding.

Realtor and TikToker Freddie Smith (@fmsmith319) recently shared his eye-opening analysis on the platform, and it has already been viewed more than 6 million times.

Smith captioned his video with a familiar Boomer position:

"Boomer: 'Millennials and Gen Z need to stop complaining about housing prices.'"

He then explained in his video exactly why it's so much more difficult for people to afford housing now than in 1980, even with minimum wage increases over time.

Smith began:

"Millennials and Gen Zers who are complaining that they can’t buy a house are not working for minimum wage."

"These are people making 60, 70, 80, $90,000 a year who can no longer afford a house. But minimum wage workers are also complaining because they can’t afford rent."

He then dove into the comparisons of the "back in my day" rent and income against today's.

"If you look back to 1980, the rent was $243, and minimum wage was $3.10, meaning your monthly gross was $496. So, to rent this apartment, it would be 48.9% of your gross income back in 1980."

"But let’s fast forward to 2024. The average rent is $1,747. The federal minimum wage is $7.25, giving you $1,160. You can’t even get an apartment with a federal minimum wage."

Basically, in 1980, a worker earning minimum wage would spend about half of their earnings on rent whereas workers earning minimum wage today wouldn't even get close to covering it with their paychecks.

So the TikToker did the math again, this time doubling the current minimum wage, and the results were still staggering.

"But let’s be generous and double the federal minimum wage because people at Walmart and fast food joints are making $14.50 to $15."

"So, $14.50 would bring you to $2,320. So technically, you’re making more, but this is your gross, and [rent would] be 75% of your gross income [if you were] making double the federal minimum wage in 2024. But let’s take it even a step further."

Yes, making double the minimum wage still puts a renter in the position of spending 75% of their income on rent.

Smith then shared his research in which he found the average college graduate makes $24 per hour, and he put that into the equation, as well.

"Someone with a bachelor’s degree could afford this one-bedroom apartment, but it would be 45.4% of their gross income. A college graduate is spending the same amount of their income on rent as the minimum wage worker in 1980."

And let's not forget that these people just spent tens of thousands of dollars and four-plus years to get to that point versus the minimum wage earners of 1980 who "put on a hat, learned skills for two weeks, and started their job."

You can watch below.

@fmsmith319 Boomer: “Millennials and Gen Z need to stop complaining about housing prices.”

While the numbers were astounding, people in the comments weren't surprised at Smith's findings as they expressed they are currently experiencing that exact struggle.

Many also noted that it's not enough just to be able to afford rent, as most places require a person's income to be at least three times that of the monthly rent.

It's definitely a struggle out there.

And while we certainly appreciate this TikToker's breakdown, we really hope some progress in this area is on the horizon.

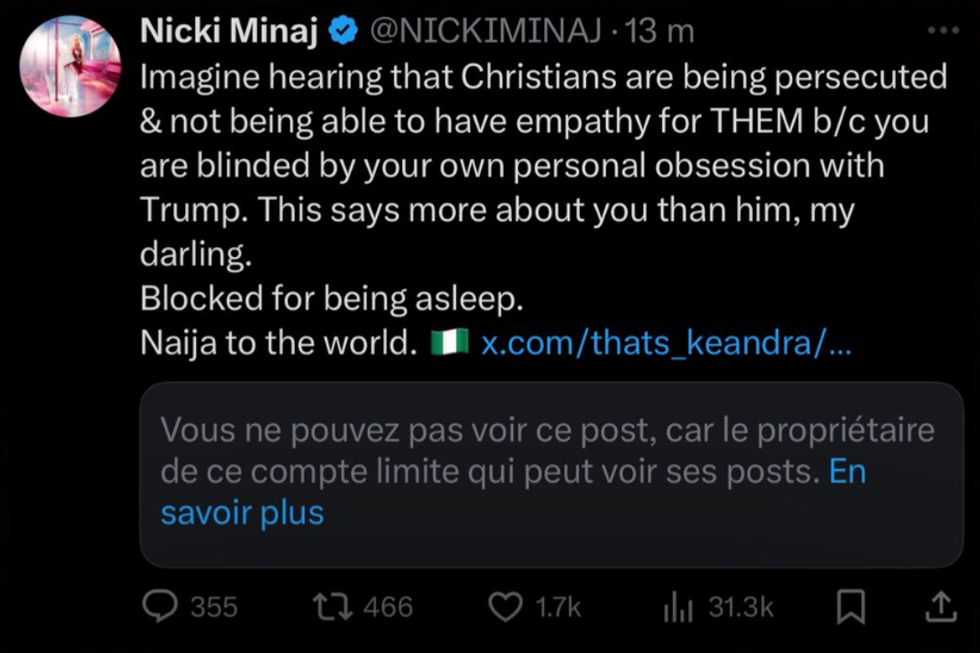

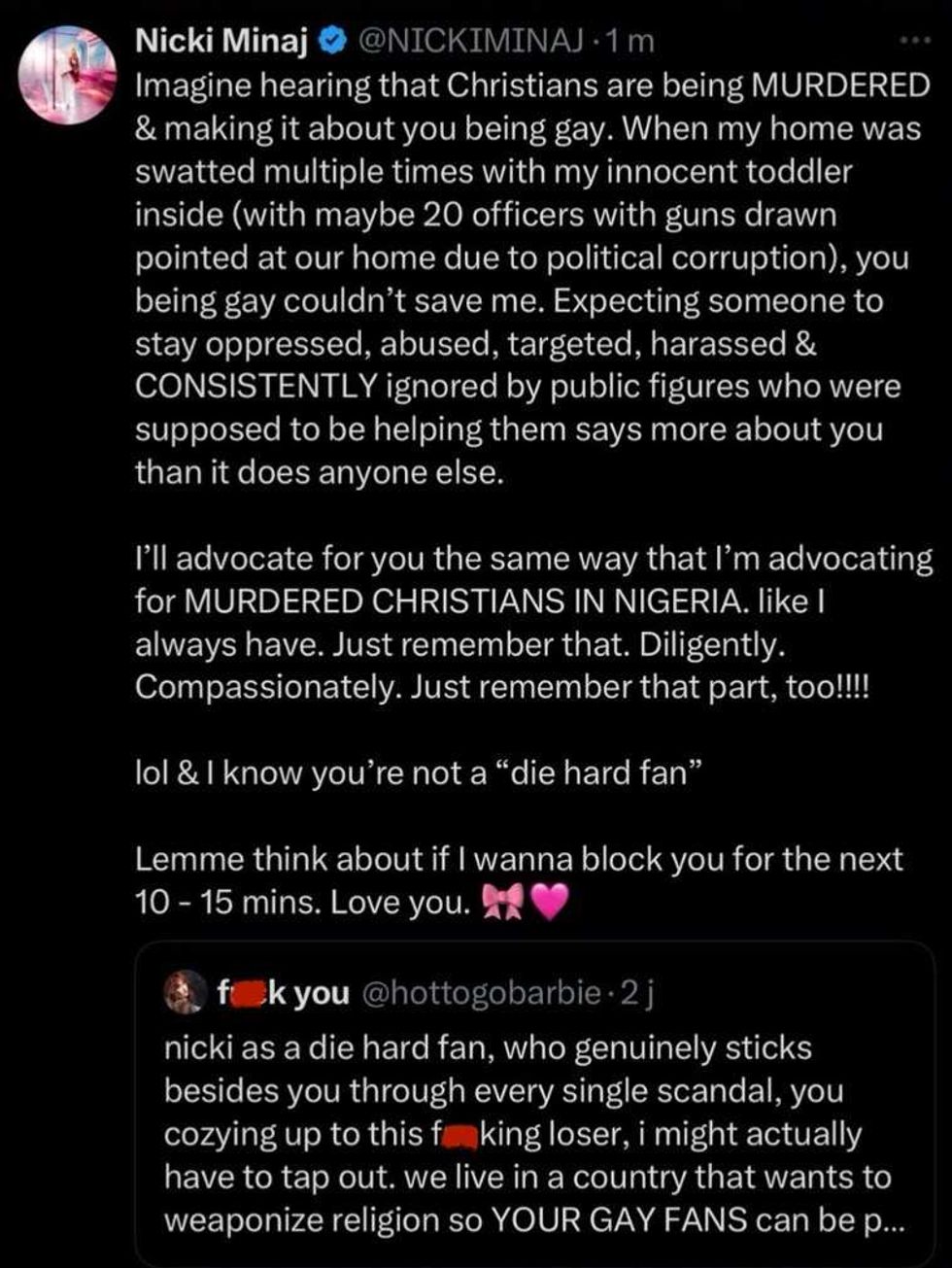

@NICKIMINAJ/X

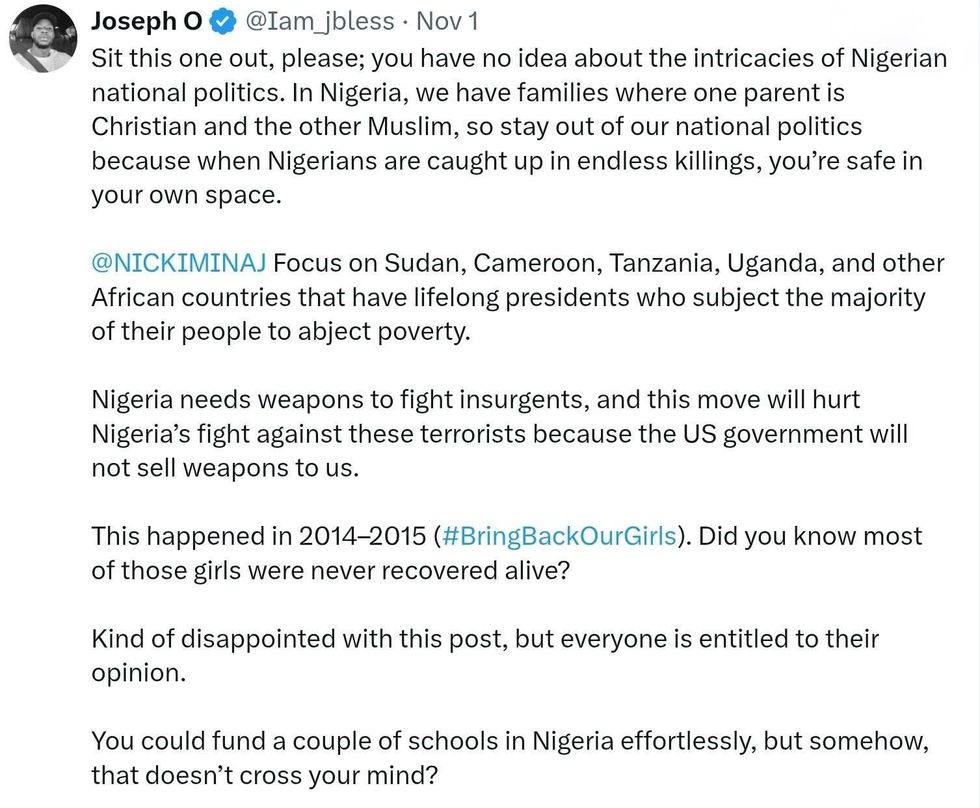

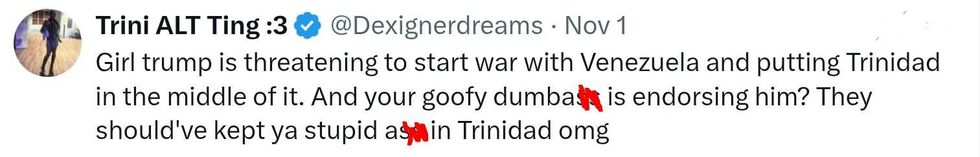

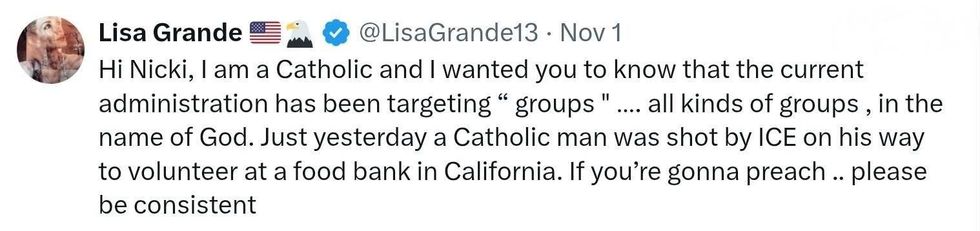

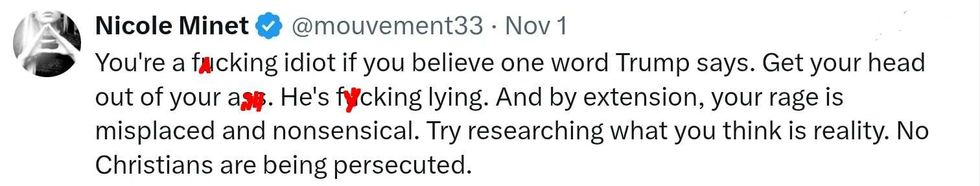

@NICKIMINAJ/X @NICKIMINAJ/X

@NICKIMINAJ/X @NICKIMINAJ/X

@NICKIMINAJ/X @NICKIMINAJ/X

@NICKIMINAJ/X @NICKIMINAJ/X

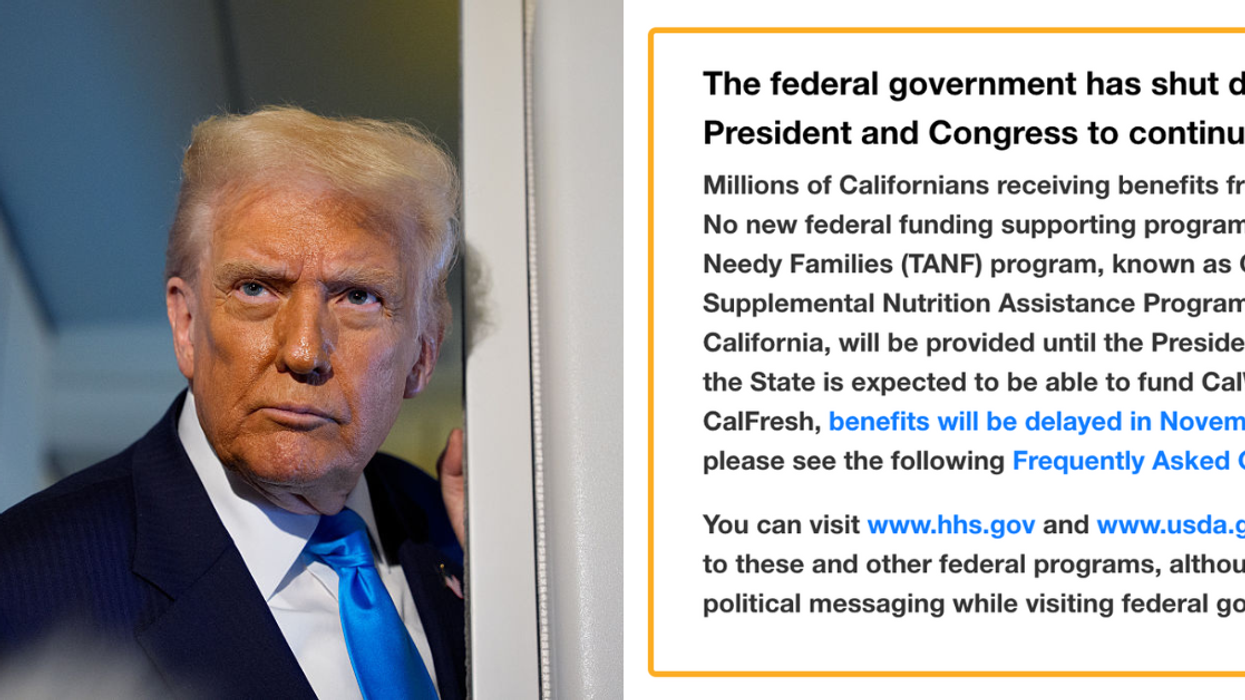

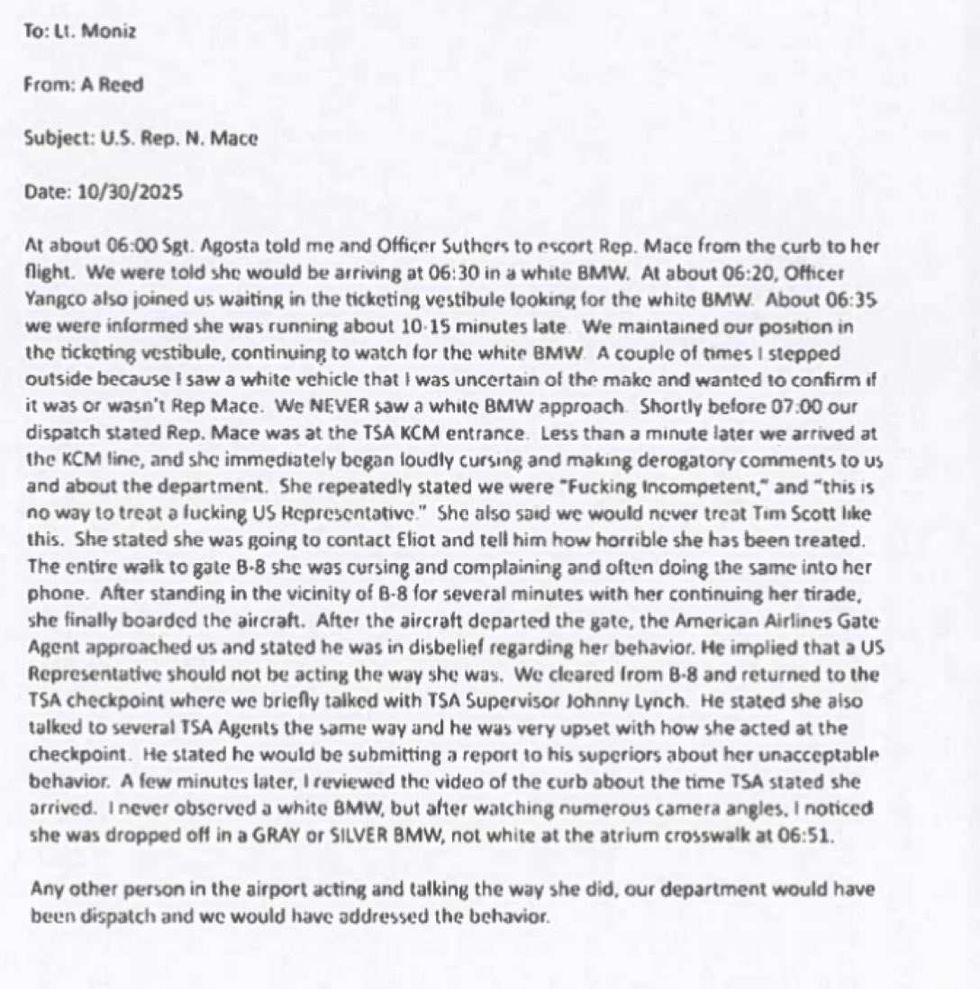

@NICKIMINAJ/X TMZ/Facebook

TMZ/Facebook TMZ/Facebook

TMZ/Facebook TMZ/Facebook

TMZ/Facebook TMZ/Facebook

TMZ/Facebook TMZ/Facebook

TMZ/Facebook TMZ/Facebook

TMZ/Facebook TMZ/Facebook

TMZ/Facebook TMZ/Facebook

TMZ/Facebook @NICKIMINAJ/X

@NICKIMINAJ/X @NICKIMINAJ/X

@NICKIMINAJ/X

@lily.billsy/TikTok

@lily.billsy/TikTok @jojami/TikTok

@jojami/TikTok @strawbvny/TikTok

@strawbvny/TikTok @missingstrapon/TikTok

@missingstrapon/TikTok @damanmills/TikTok

@damanmills/TikTok @finnster2080/TikTok

@finnster2080/TikTok @jayjhis/TikTok

@jayjhis/TikTok @wyrdcreechur/TikTok

@wyrdcreechur/TikTok @itsmetheemochick/TikTok

@itsmetheemochick/TikTok @cassandra_psydragon/TikTok

@cassandra_psydragon/TikTok @transybooo/TikTok

@transybooo/TikTok @karikunz2/TikTok

@karikunz2/TikTok

@people/Instagram

@people/Instagram @people/Instagram

@people/Instagram @people/Instagram

@people/Instagram @people/Instagram

@people/Instagram @people/Instagram

@people/Instagram @people/Instagram

@people/Instagram @people/Instagram

@people/Instagram @people/Instagram

@people/Instagram

@AuntSassyX

@AuntSassyX

@dontburndinner/Instagram

@dontburndinner/Instagram @dontburndinner/Instagram

@dontburndinner/Instagram @dontburndinner/Instagram

@dontburndinner/Instagram @dontburndinner/Instagram

@dontburndinner/Instagram @dontburndinner/Instagram

@dontburndinner/Instagram @dontburndinner/Instagram

@dontburndinner/Instagram @dontburndinner/Instagram

@dontburndinner/Instagram @dontburndinner/Instagram

@dontburndinner/Instagram @dontburndinner/Instagram

@dontburndinner/Instagram @dontburndinner/Instagram

@dontburndinner/Instagram @dontburndinner/Instagram

@dontburndinner/Instagram @dontburndinner/Instagram

@dontburndinner/Instagram