Liberals and moderates criticized President Donald Trump and the GOP driven tax breaks of 2017 even before they were enacted.

But now, after two years and ample proof the claims Trump and the Republican controlled Congress made when they pushed the plan through were false, more voices are joining in.

Conservative commentator Johnny Burtka, executive director for The American Conservative magazine called President Trump's 2017 tax law a mistake and "the Paul Ryan agenda."

In a Monday interview on Hill.TV, Burtka said:

"It was a big mistake for Trump."

Burtka added:

"[Trump] had the infrastructure opportunity — so many other issues to lean into what really got him elected in the first place and he capitulated to the Paul Ryan agenda."

The President of course proclaimed the law a boon to business, corporations and the lower and middle classes.

Trump stated:

"[C]orporations are literally going wild over this."

The GOP and Trump claimed the major tax breaks for corporations and the wealthiest would lead to higher wages and more jobs.

Such claims proved untrue.

Watch the full segment here.

These are the 100 fortune 500 companies that paid nothing in taxesyoutu.be

Instead of increased wages or new jobs, corporations preferred stock buy backs and executive bonuses.

A recent report by Institute on Taxation and Economic Policy found 91 Fortune 500 companies paid no federal taxes in 2018. Almost 400 companies paid an average federal tax rate of about 11 percent, half the official rate established under Trump's tax law.

Burtka stated the tax overhaul only made sense in theory since it was pure speculation that corporations would raise wages or create new jobs with their federal economic handouts. Burtka noted what many others had.

Instead of using their tax cuts to raise worker wages, create jobs or even invest in new research and infrastructure, most companies used it to buy back stocks.

Burtka said:

"There needs to be a fundamental reevaluation of priorities and the economy needs to serve the American nation and the American people."

Based on the lower and middle class public's view of Trump's tax break for corporations and the wealthy, Burtka's assessment may be accurate.

But Trump & Republicans ALREADY gave us the "Middle Class Miracle", Trump claimed.

The miracle was that he said it with straight face.

Turned out to be HUGE TAX breaks to BILLIONAIRES.

Make no mistake, if Trump gets re-elected, the WEALTHY get ANOTHER Tax break!

— American Voter (@AmericanVoter6) November 13, 2019

You're welcome at my place for a brew anytime, Malcolm. Trump's greatest accomplishment, besides giving the rich an unnecessary tax break, is convincing America he's not the intellectually and morally bankrupt businessman New York has endured for decades.

— DearDougie (@NotTheRealDoug1) December 23, 2019

Last tax scam, you Moscow Mitch, and the Republicans gave a tax break to 1% of the wealthiest Americans. It was the biggest transfer of wealth,from the poor to the rich, in USA history. Impeached, illegitimate, Incompetent, Pathological Lying Trump, nobody believes you.

— Jeannie A Beanie (@BeannieJeannie_) December 23, 2019

Even other fiscal conservatives are highly critical of how it has increased the deficit.

It's call the Trump tax break voted in by a GOP lead congress (both houses) in 2017. But the 2018 Midterm election was a reaction to that mistake. Have faith in We the People.

— Bull Moose Society🇺🇸 (@BullMooseSoci) November 15, 2019

Leading up to the 2020 election, Trump and his supporters keep touting the economy. But a new strategy may be needed.

Aside from those who already support Trump, it does not appear anyone else is buying the tax break narrative Trump and the GOP are selling.

The book Poison Tea: How Big Oil and Big Tobacco Invented the Tea Party and Captured the GOP is available here.

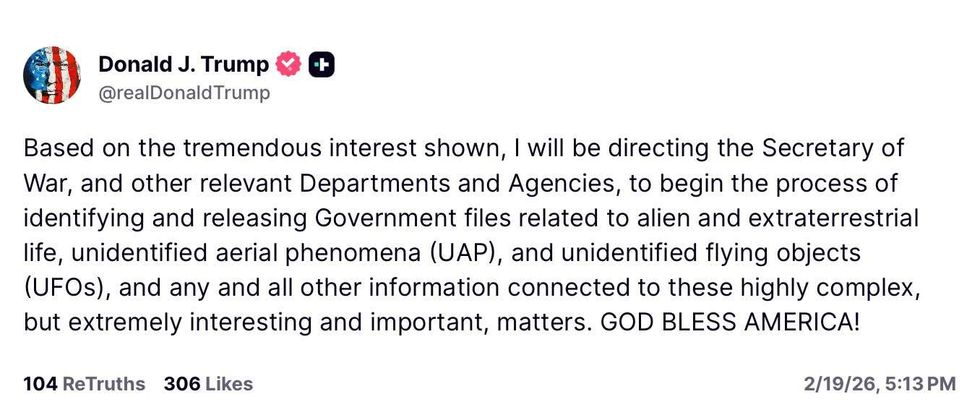

@realDonaldTrump/Truth Social

@realDonaldTrump/Truth Social

@gutterutterart/Instagram

@gutterutterart/Instagram @gutterutterart/Instagram

@gutterutterart/Instagram @gutterutterart/Instagram

@gutterutterart/Instagram @gutterutterart/Instagram

@gutterutterart/Instagram @gutterutterart/Instagram

@gutterutterart/Instagram @gutterutterart/Instagram

@gutterutterart/Instagram @gutterutterart/Instagram

@gutterutterart/Instagram @gutterutterart/Instagram

@gutterutterart/Instagram @gutterutterart/Instagram

@gutterutterart/Instagram @gutterutterart/Instagram

@gutterutterart/Instagram @gutterutterart/Instagram

@gutterutterart/Instagram