Colorado Republican Representative Lauren Boebert was instantly called out for "projecting" after she accused Democratic President Joe Biden and the left-wing of having "no concept" of "personal responsibility."

Boebert's remark came after Biden vowed to more strictly regulate banks after Silicon Valley Bank (SVB) collapsed following a run on its deposits, impacting startups in the United States and abroad.

Biden blamed former Republican President Donald Trump's administration for the collapse, noting they'd loosened banking regulations that would have forestalled the bank's failure.

Boebert soon lashed out with the following message via her official Twitter account:

“Biden is more than halfway done with his term and he’s STILL blaming Trump, and some people STILL believe him. Personal responsibility is something the Left really has no concept of."

You can see Boebert's tweet below.

Boebert has a long history of making excuses for Trump's policy decisions and his personal behavior that contributed to the January 6 insurrection.

Many have criticized her in turn.

The reasons for SVB's collapse are more complicated than either Biden or Boebert could get into but there is no question the Trump administration's decision to loosen banking regulations played a role in the ongoing crisis.

In 2018, the Economic Growth, Regulatory Relief, and Consumer Protection Act freed some banks from policies that were implemented following the financial crisis of 2007 and 2008 to protect banks and the overall financial system from collapsing.

The rollback kept in place the central structure of the 2010 Dodd–Frank Wall Street Reform and Consumer Protection Act, which on one level prohibited banks from trading customer's deposits for their profit and using or owning hedge funds, protected against "too big to fail" policies, and offered protections against risky transactions.

However, the rollback got rid of regulations for small and midsize banks by raising the threshold from $50 billion in assets to $250 billion, a move which was fiercely opposed by Massachusetts Democratic Senator Elizabeth Warren.

Warren wrote this week that the rollback meant SVB and the full-service commercial bank Signature Bank lacked oversight that would have made them "subject to stronger liquidity and capital requirements to withstand financial shocks."

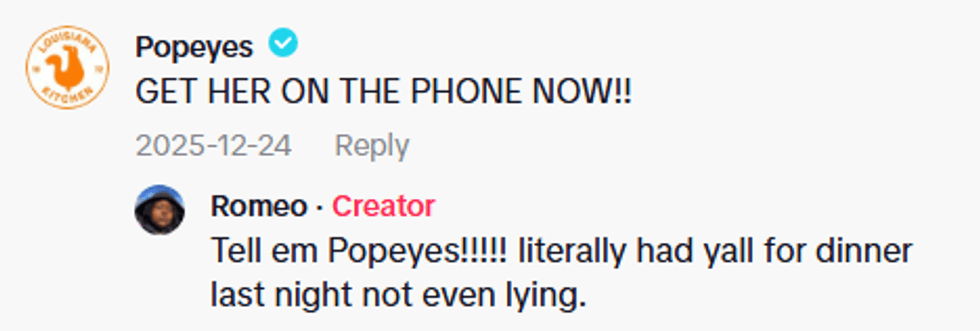

@romeosshow/TikTok

@romeosshow/TikTok @romeosshow/TikTok

@romeosshow/TikTok @romeosshow/TikTok

@romeosshow/TikTok @romeosshow/TikTok

@romeosshow/TikTok @romeosshow/TikTok

@romeosshow/TikTok @romeosshow/TikTok

@romeosshow/TikTok @romeosshow/TikTok

@romeosshow/TikTok @romeosshow/TikTok

@romeosshow/TikTok @romeosshow/TikTok

@romeosshow/TikTok @romeosshow/TikTok

@romeosshow/TikTok

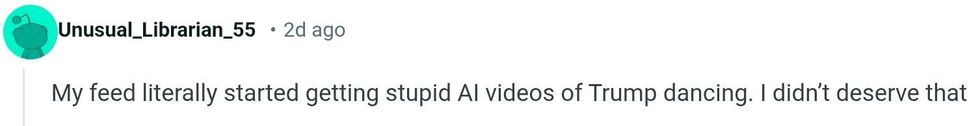

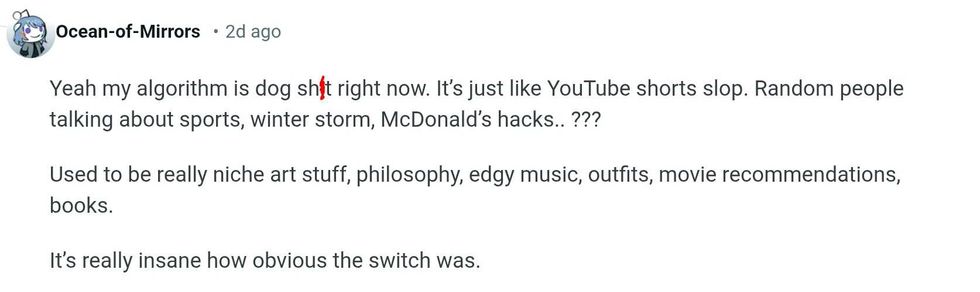

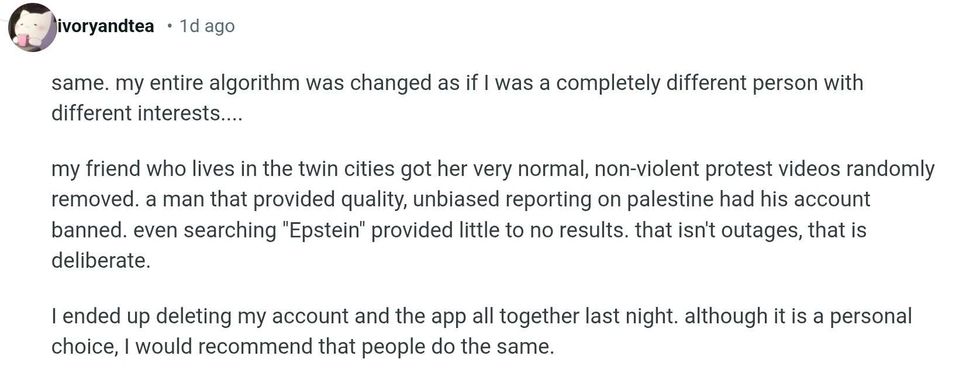

r/technology/Reddit

r/technology/Reddit r/technology/Reddit

r/technology/Reddit r/technology/Reddit

r/technology/Reddit r/technology/Reddit

r/technology/Reddit r/technology/Reddit

r/technology/Reddit r/technology/Reddit

r/technology/Reddit r/technology/Reddit

r/technology/Reddit r/technology/Reddit

r/technology/Reddit r/technology/Reddit

r/technology/Reddit r/technology/Reddit

r/technology/Reddit r/technology/Reddit

r/technology/Reddit r/technology/Reddit

r/technology/Reddit r/technology/Reddit

r/technology/Reddit r/technology/Reddit

r/technology/Reddit r/technology/Reddit

r/technology/Reddit