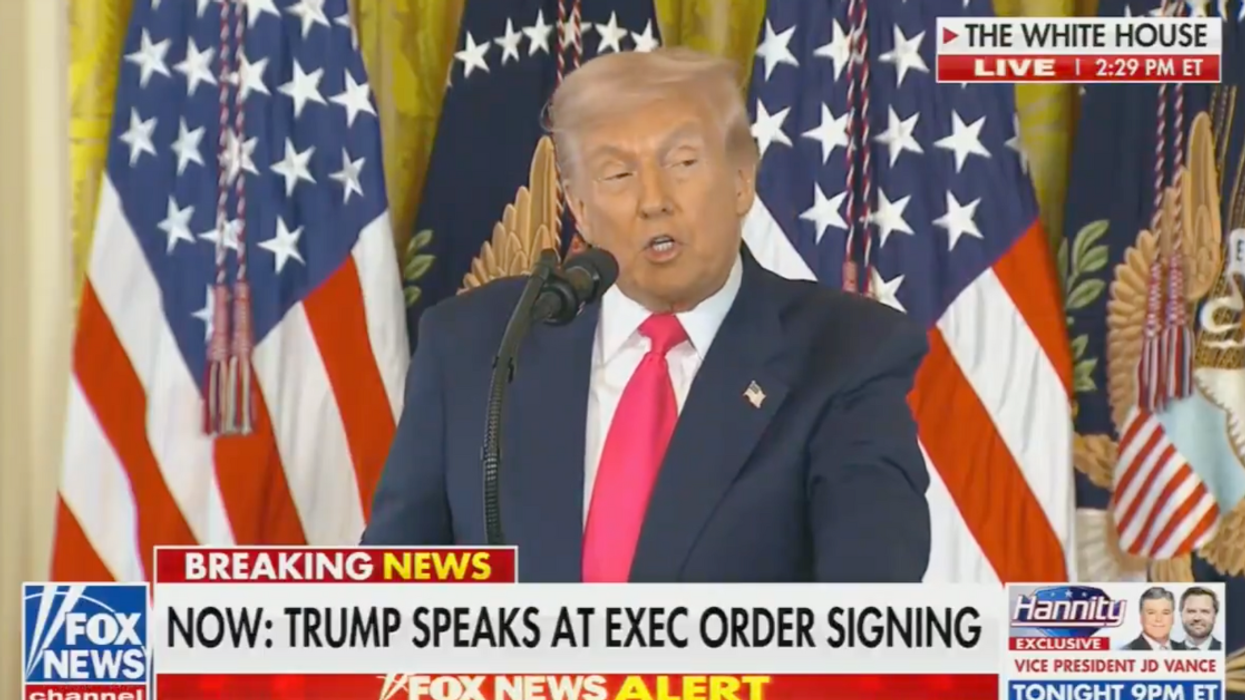

On Tuesday's edition of "American Newsroom," Fox News anchor Sandra Smith seemed downright shocked at Fox News's own polling showing major support for taxing the wealthy.

As Smith acknowledged, their polling shows that 70% are in favor of increasing taxes on those making more than $10 million and 65% favor those making over $1 million.

Smith then brought in Charles Payne, host of Fox Business' "Making Money" to explain such a "movement against capitalism," as she put it, and his response was...revealing:

"The idea of fairness has been promoted in our schools for a long time and we're starting to see kids that grew up on this notion that fairness above all...and now they're becoming voting age, and they're bringing this ideology with them."

Watch it below:

People had plenty to say about that––and the jokes piled on.

Even Ocasio-Cortez weighed in with a short and sweet note about respect:

Ironically, the Fox News Channel originally used the slogan "Fair and Balanced" when the network was first established. In 2017, the slogan was changed to "Most Watched, Most Trusted."

The Fox News poll in question, conducted in late January, found voters "prefer increasing spending on domestic programs over cutting taxes and reducing spending, and their preferred way to finance that spending — is tax the wealthy. Among the poll's other findings:

Fifty-one percent of voters want to spend more on programs such as infrastructure, national defense, education, and health care. That includes 63 percent of Democrats, 50 percent of independents, and 39 percent of Republicans.Forty percent prefer the federal government cut taxes, spending, and regulations.

At the same time, there is broad support for increasing taxes on the wealthiest families. Voters support tax increases on families making over $10 million annually by a 46-point margin (70 percent favor-24 percent oppose), and support a hike on those making over $1 million by 36 points (65-29 percent).

Additionally, a new poll from Morning Consult also shows that the majority of Americans support a wealth tax like the one Warren has suggested by a 60-21 margin, a number that includes majority support from Republican voters. Americans also support raising the marginal tax rate back up to 70 percent, as Ocasio-Cortez has suggested.

Yesterday, Warren took a shot at former Starbucks CEO Howard Schultz, who criticized her wealth tax proposal.

“Free Medicare for all, government-paid, free college for all — first of all, there’s no free. I mean nothing is free,” Schultz said a few days ago, adding that while he sees the need for “comprehensive tax reform,” Warren’s “ridiculous plan of taxing wealthy people a surtax of 2 percent because it makes a good headline or sends out a tweet when she knows for a fact that’s not something that’s ever gonna be passed, this is what’s wrong.”

“You can’t just attack these things in a punitive way by punishing people,” he concluded.

In response, Warren posted the results of the Morning Consult poll.

"Dear Howard Schultz: if you’re looking for bold ideas with broad bipartisan appeal for your ‘centrist’ presidential campaign, may I suggest my #UltramillionaireTax?” she tweeted, noting how the tax would provide avenues for such initiatives as student debt relief and health care.

Americans “don’t want to replace a self-absorbed billionaire President with another one,” she said. “Americans want real change. We should listen.”

Ocasio-Cortez has suggested going back to a marginal tax rate of 70 percent on income over $10 million, which she says her critics have mischaracterized as a tax on all income.

“You look at our tax rates back in the sixties and when you have a progressive tax rate system, your tax rate, let’s say from zero to $75,000, maybe 10 percent or 15 percent, etc,” she said during an interview last month. “But once you get to the tippy-tops — on your 10 millionth dollar — sometimes you see tax rates as high as 60 or 70 percent. That doesn’t mean all $10 million are taxed at an extremely high rate, but it means that as you climb up this ladder, you should be contributing more.”

@GovPressOffice/X

@GovPressOffice/X

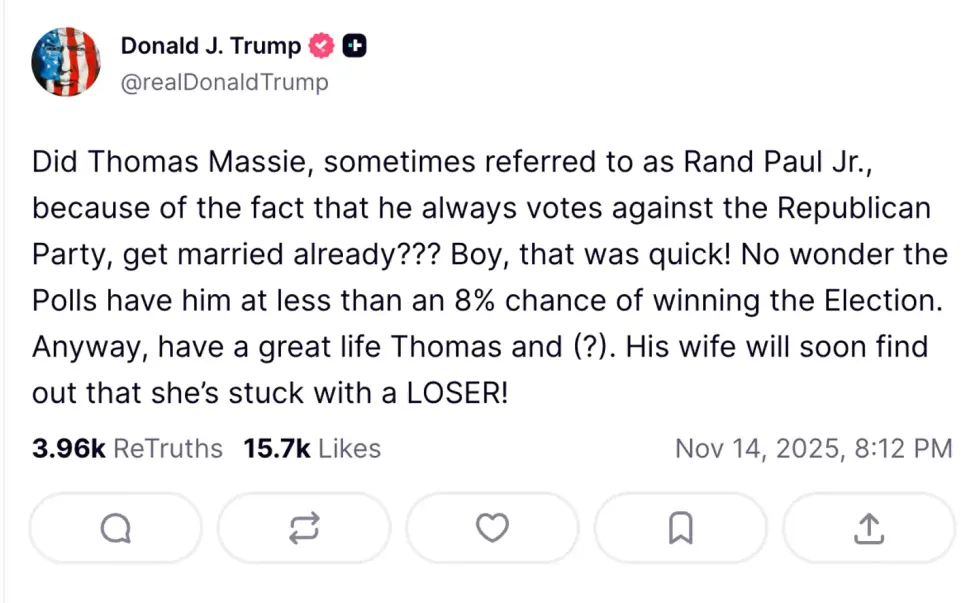

@realDonaldTrump/Truth Social

@realDonaldTrump/Truth Social