One of the hardest things about "adulting" is having to figure out what the best financial decisions are. What's a good investment? Do we get that 401k or pension when it seems like they're all being taken away from people all the time? Is stuffed crust pizza really worth the extra cost?

One Reddit user asked:

What's the worst financial decision you've ever made?

We'll admit, there's like $7 in the bank right now, so nobody crown us financial wizards or whatever - but even at our worst we've never screwed up quite as bad as some of these people.

1. Wedded Bliss

Paid $80,000 for my wedding and honeymoon last summer. Getting divorced this summer.

Honestly, our relationship kind of changed after the honeymoon. We used to have a very active lifestyle, lots of hiking, traveling locally, just going out and doing fun stuff around the city, cooking together, walking the dogs, etc.

She got her first job (social worker - nursing home) after we got married and started going to work (9 to 5). She was always tired after work, I'd come home at like 6 or 7 and she's already in bed. Weekends were worse, slept in until almost noon. Feeling tired and headaches were a nearly daily occurrence.

She preferred to stay in and watch TV, or go spend time at her parents' and would get very upset if I didn't want to go to her parents.

We stopped doing all the fun things we used to do. She would rather facetime her parents or her kid brother or girlfriends then get out of the house and go somewhere with me. I asked her numerous times to see a doctor, or a neurologist, or a psychologist, someone who could help with the situation. She went to see a GP and a shrink, nothing ever came of it.

I went on a few hikes by myself as she did not want to go. All I got was complaints from her and her parents about why would I leave her at home and go somewhere. Her parents getting involved only made it worse as they refused to do anything constructive to help and would rather blame someone else, me in this case.

Eventually, she just left to her parents. Took as much of her stuff as she wanted and all of the wedding gift money. That was about $14,000. She left any old stuff she didn't want and the two dogs that I got her.

2. Scratch-Offs

On my 18th birthday, I stopped by a store and bought my first lottery ticket for $1 and scratched it off. I won $5!

That feeling of "winning" and being "ahead" was quite lovely. But I knew that the only way I could stay ahead was never to play the lottery again for the rest of my life, and be happy with that extra $4 or play the lottery more until someday I won a bigger prize. I've spent hundreds of dollars since then on lottery tickets chasing plan "B".

3. The Money Pit

Buying a "money pit" house.

It was architecturally interesting and loaded with character, but in constant need of expensive repairs (as is often the case with older homes).

It seems as though the house "owned us," instead of the other way around.

4. No Degree Needed

Going to a university to gain a job that didn't require a university degree. I make decent money. I'm barely able to keep my head above water because of my college debt. Once I left school I was making minimum wage while trying to pay off 60k in debt which isn't exactly easy. As a result my loans went into default. Today I don't use my degree even though I have a job I love.

Never look down on skilled trades. I made that mistake that trades were for those who can't understand or get into higher learning. Don't fall into that trap. The people that I work with are rough around the edges but incredibly brilliant. I should have ascribed to the philosophy I do now, "if you're the smartest one in the room, you're in the wrong room." I got lucky and am able to hold on and pay them off because I have a decent job and became a specialist in a niche field. If that didn't happen I would be broke and bitter with only my own arrogance to blame. There are many types of intelligence and I was wrong to dismiss those I didn't understand. It was a hard lesson but one I won't forget.

5. For A Sword

Sold my car for a sword. It was a replica worth maybe $40. It ran perfectly, and only had some small superficial damage. Blue book, it was worth $2,300.

6. A Year's Subscription

Once in a moment of weakness I bought a year's subscription to an "adult dating site." That was a regrettable and embarrassing choice.

7. Trust Fund Money

When I turned 17 due to some unfortunate circumstances I inherited part of a trust fund that gave me an outrageous income for someone that age. I started building a ridiculous Jeep CJ-8. As I was doing most of the work myself I needed something to drive in the interim that could double as a daily driver as well. A brand new Porsche 928 S4 fit the bill. By the time I started college that fall I realized what a douchebag I was because the Porsche wasn't suitable for New England winters and the Jeep would have to be shipped because it had a useful range of around 120 miles per tank. Learned an expensive lesson about depreciation when I sold the Porsche to buy a reasonable car and an even more expensive lesson about what money pits custom cars are.

8. Credit Cards

When I was 18 I got my first credit card because every other day I was getting the s*** in the mail. Without reading anything I chose one on the highest amount, 250. Not even two weeks later I paid for concert tickets for myself and three friends after them agree they'd pay me back. I never got the money back and because I couldn't pay back I started earning interest, an amount I don't remember but my mother called it "extremely f-ing high" and she wasn't one to cuss.

Screwed my credit for years and once I got things going good Bank of America f-ed me over when they started their "we're going to drop the more expensive payments and make you pay for the half dozen over drawn items instead of going by the date of the item" that ended in a civil suit which got me nothing except a worse credit rating.

9. Financed A Dell

In 2007 I financed a Dell laptop. It was something like a $2200 laptop and of course my 17 year old brain didn't understand what the implications of a minimum payment were, plus I didn't listen to my parents. Every monthly payment was like 95% interest. Paid it off in 2012 paying something like 50% more than the cost of it.

It was a life lesson and now I only finance things if there's 0% interest if paid within so-and-so months. I've dipped my toes into financing for a mattress, couch, television, and other things since then and always paid off before the grace period ends. I'll never make the same mistake again.

10. Custom Boomerangs Are A Thing?

$200 on a custom boomerang. Went to the field next to my high school, first throw, curved more than I anticipated (having never thrown a boomerang before in my life) and went right through the bay window facing the backyard of some poor sap's house. Never got it back, never got another one.

Giphy

H/T: Reddit

Roberto Schmidt/AFP via Getty Images

Roberto Schmidt/AFP via Getty Images

u/pizzaratsfriend/Reddit

u/pizzaratsfriend/Reddit u/Flat_Valuable650/Reddit

u/Flat_Valuable650/Reddit u/ReadyCauliflower8/Reddit

u/ReadyCauliflower8/Reddit u/RealBettyWhite69/Reddit

u/RealBettyWhite69/Reddit u/invisibleshadowalker/Reddit

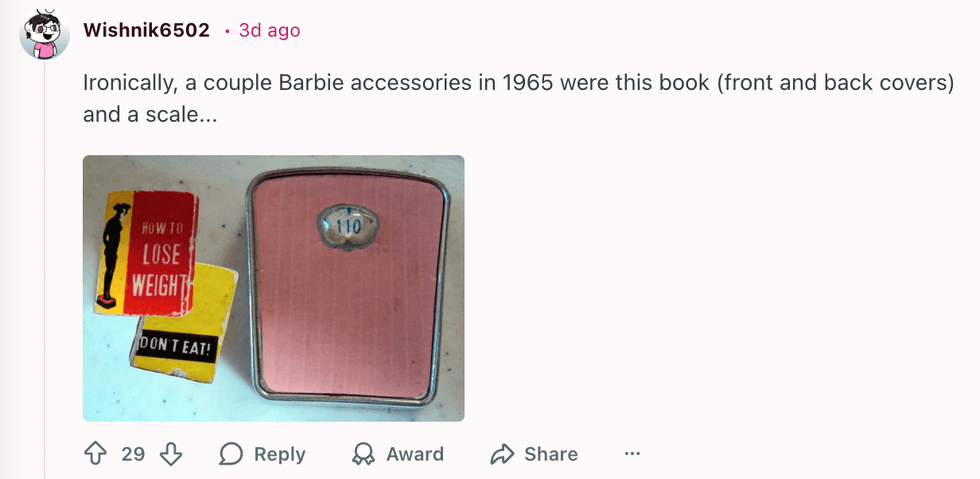

u/invisibleshadowalker/Reddit u/Wishnik6502/Reddit

u/Wishnik6502/Reddit u/kateastrophic/Reddit

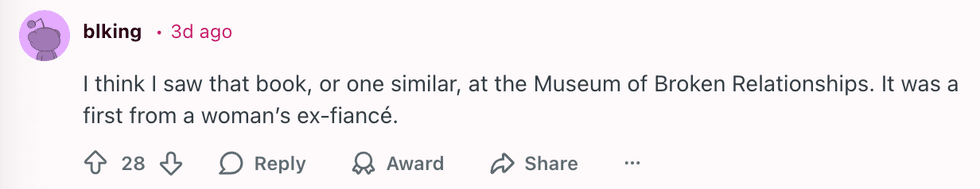

u/kateastrophic/Reddit u/blking/Reddit

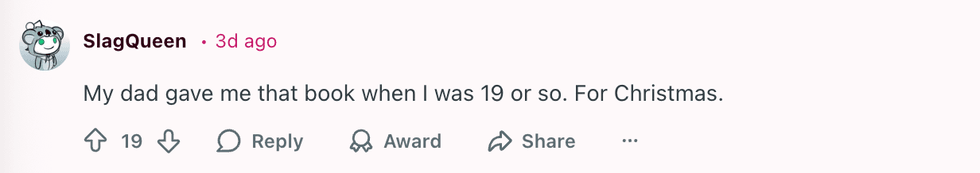

u/blking/Reddit u/SlagQueen/Reddit

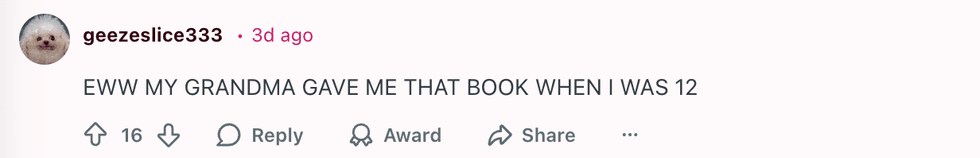

u/SlagQueen/Reddit u/geezeslice333/Reddit

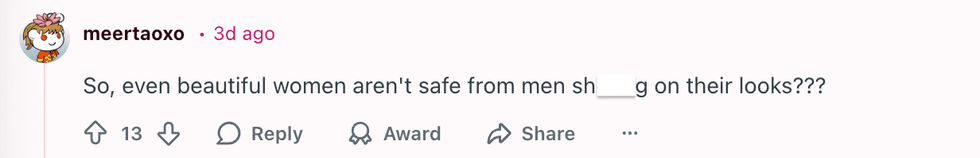

u/geezeslice333/Reddit u/meertaoxo/Reddit

u/meertaoxo/Reddit u/crystal_clear24/Reddit

u/crystal_clear24/Reddit u/stinkpot_jamjar/Reddit

u/stinkpot_jamjar/Reddit

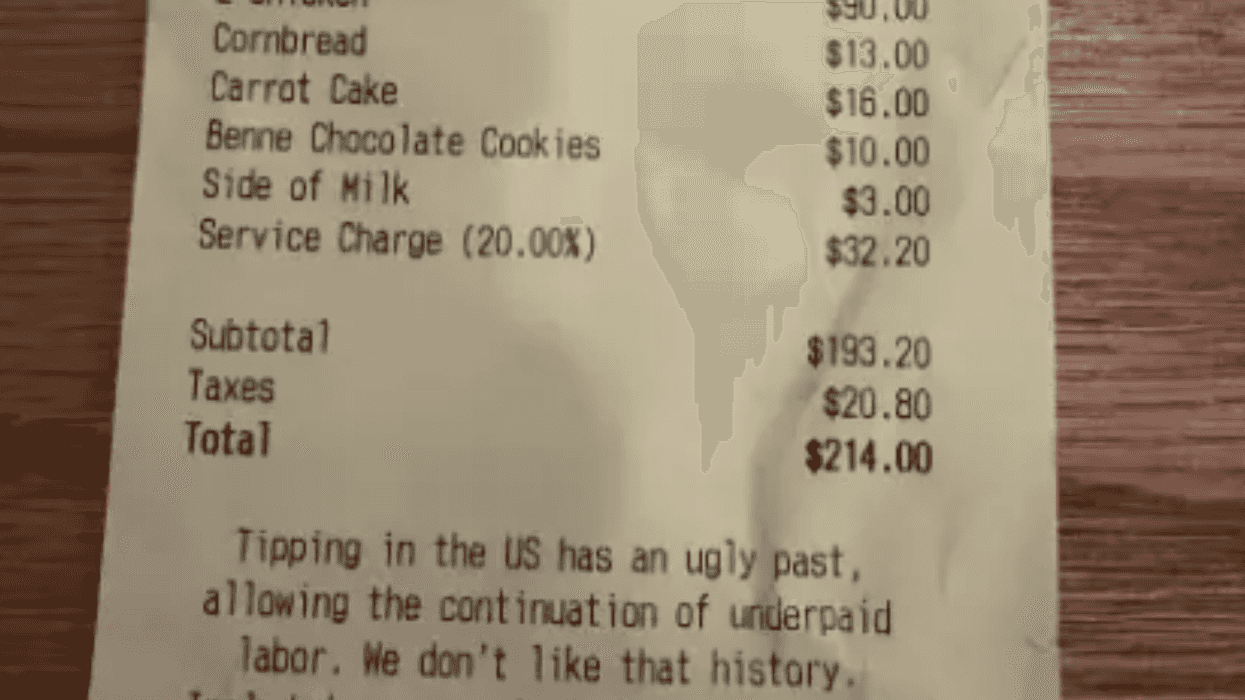

u/Bulgingpants/Reddit

u/Bulgingpants/Reddit

@hackedliving/TikTok

@hackedliving/TikTok @hackedliving/TikTok

@hackedliving/TikTok @hackedliving/TikTok

@hackedliving/TikTok @hackedliving/TikTok

@hackedliving/TikTok @hackedliving/TikTok

@hackedliving/TikTok @hackedliving/TikTok

@hackedliving/TikTok @hackedliving/TikTok

@hackedliving/TikTok @hackedliving/TikTok

@hackedliving/TikTok @hackedliving/TikTok

@hackedliving/TikTok @hackedliving/TikTok

@hackedliving/TikTok

@vanderjames/Instagram

@vanderjames/Instagram @vanderjames/Instagram

@vanderjames/Instagram @vanderjames/Instagram

@vanderjames/Instagram @vanderjames/Instagram

@vanderjames/Instagram @vanderjames/Instagram

@vanderjames/Instagram @vanderjames/Instagram

@vanderjames/Instagram @vanderjames/Instagram

@vanderjames/Instagram @vanderjames/Instagram

@vanderjames/Instagram @vanderjames/Instagram

@vanderjames/Instagram @vanderjames/Instagram

@vanderjames/Instagram