A federal judge in California slapped a $97 million fine on Wells Fargo for not paying its employees enough money during their breaks.

In January, U.S. District Judge Percy Anderson ruled in favor of mortgage bankers and consultants that filed a class action suit in California, alleging that San Francisco-based Wells Fargo violated state labor laws by underpaying them during scheduled breaks. The $97 million payment is less than the original amount sought by the plaintiffs, however, which was $400 million.

Under California law, employees are entitled to a paid 10-minute break per every four hours of work. The complaint alleged that between March 17, 2013 and August 1, 2017, Wells Fargo failed to provide adequate compensation to their employees during their breaks. The court agreed with this, and imposed the $97 million fine.

Wells Fargo spokesman Tom Goyda said in a statement to Bloomberg that the ruling will be appealed.

"Wells Fargo's compensation structure for its home mortgage consultants complies with California's wage and hour laws, including pay for all break periods, and allows our [home mortgage consultants] to earn competitive, performance-based compensation. We plan to appeal on the basis that the court's decision reflects both a misunderstanding of our HMC compensation plan and a misapplication of the relevant state law."

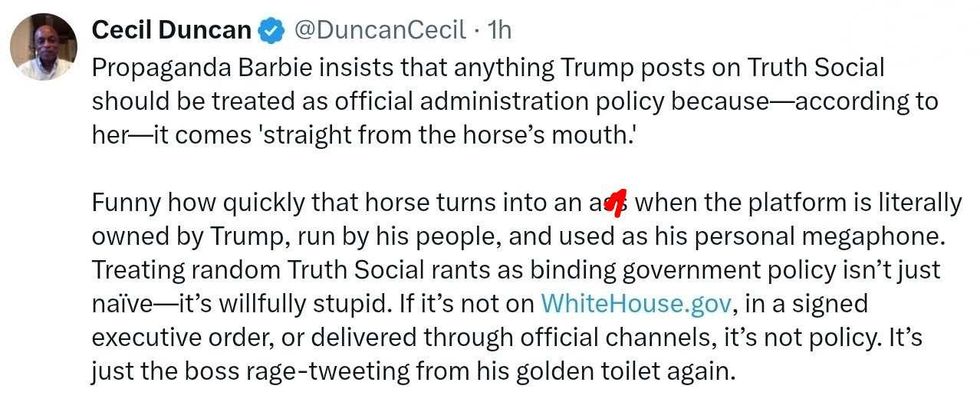

Consumers on Twitter expressed their frustration with predatory banking and business practices, in which Wells Fargo has been a participant in recent years.

@DuncanCecil/X

@DuncanCecil/X @@realDonaldTrump/Truth Social

@@realDonaldTrump/Truth Social @89toothdoc/X

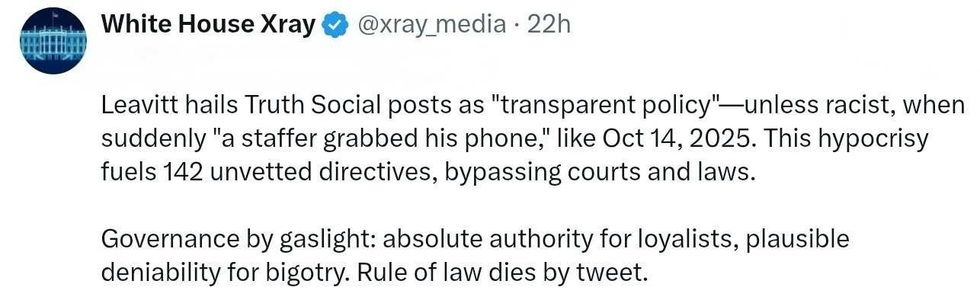

@89toothdoc/X @xray_media/X

@xray_media/X @CHRISTI12512382/X

@CHRISTI12512382/X

@sza/Instagram

@sza/Instagram @laylanelli/Instagram

@laylanelli/Instagram @itssharisma/Instagram

@itssharisma/Instagram @k8ydid99/Instagram

@k8ydid99/Instagram @8thhousepath/Instagram

@8thhousepath/Instagram @solflwers/Instagram

@solflwers/Instagram @msrosemarienyc/Instagram

@msrosemarienyc/Instagram @afropuff1/Instagram

@afropuff1/Instagram @jamelahjaye/Instagram

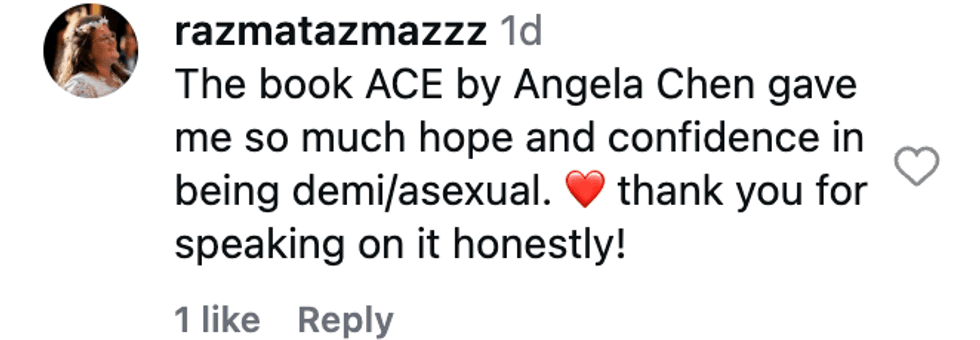

@jamelahjaye/Instagram @razmatazmazzz/Instagram

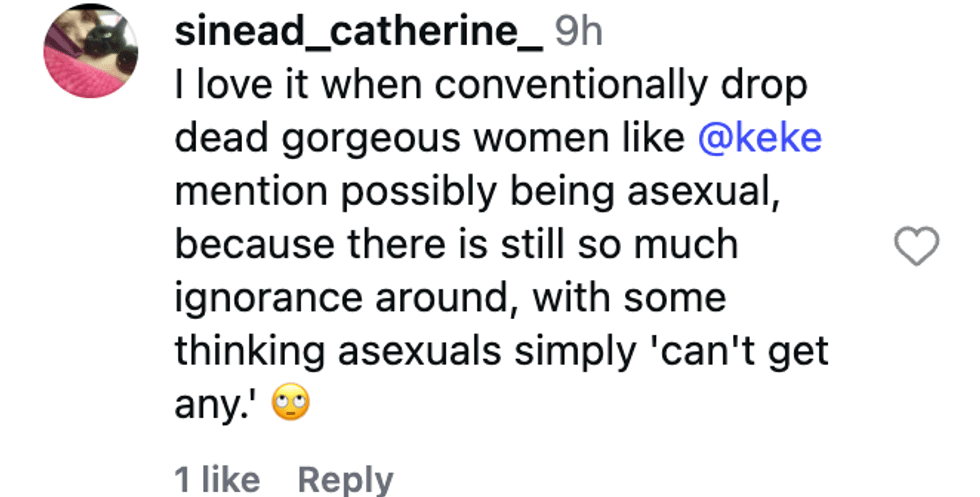

@razmatazmazzz/Instagram @sinead_catherine_/Instagram

@sinead_catherine_/Instagram @popscxii/Instagram

@popscxii/Instagram