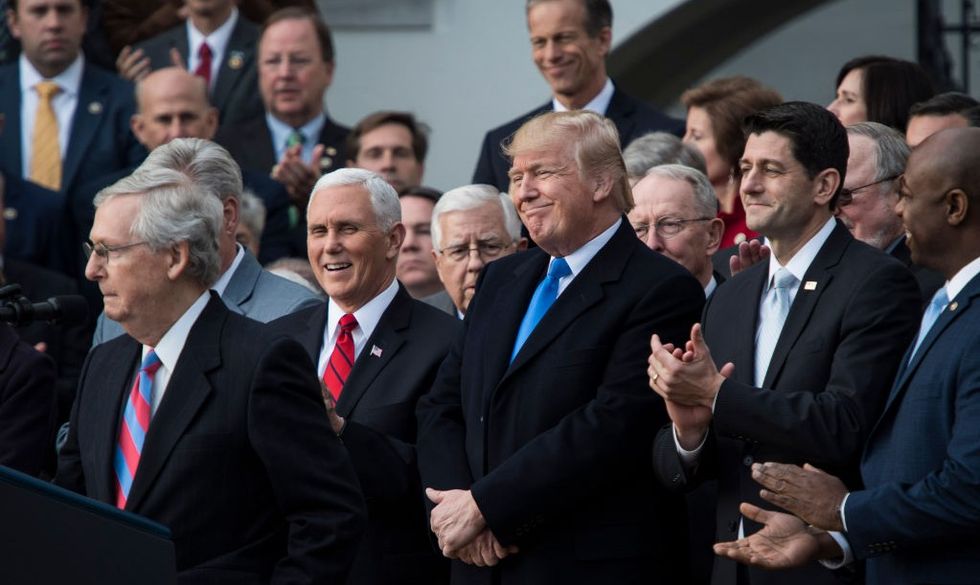

Back in December, Republican Senate Majority Leader Mitch McConnell stated:

"If we can’t sell this to the American people, we ought to go into another line of work."

The Kentucky Senator made the statement after the Republican controlled Senate passed the tax plan endorsed by President Donald Trump and the GOP. Now it looks like some of McConnell's colleagues—and maybe even McConnell—may need to find new jobs.

In a poll conducted by the Republican National Committee (RNC), public opinion of the GOP tax plan passed in December 2017 is less than favorable. The one piece of legislation held up as the major achievement of the Trump administration failed to impress voters.

This news does not bode well for the GOP heading into November's midterm elections.

The key to the success of selling the Trump tax reform lay in convincing middle and working class voters that they somehow benefit from the GOP designed tax cuts. But it appears most are not buying what Trump and the GOP are selling.

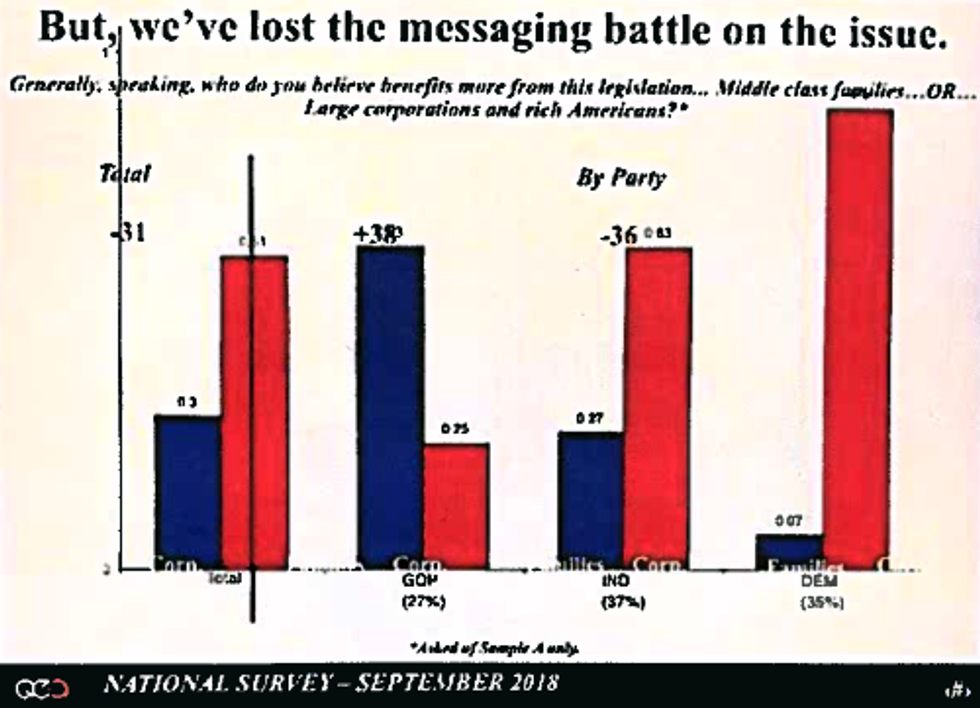

Voters responding to the poll overwhelmingly viewed the GOP tax plan as a benefit to corporations and the rich, not the middle class or workers. Dubbed the "Tax and Jobs Act" by Trump and his party, 61 percent of respondents said the new tax law benefits "large corporations and rich Americans" over "middle class families." Only 30 percent felt families benefited.

In the words of the RNC poll report:

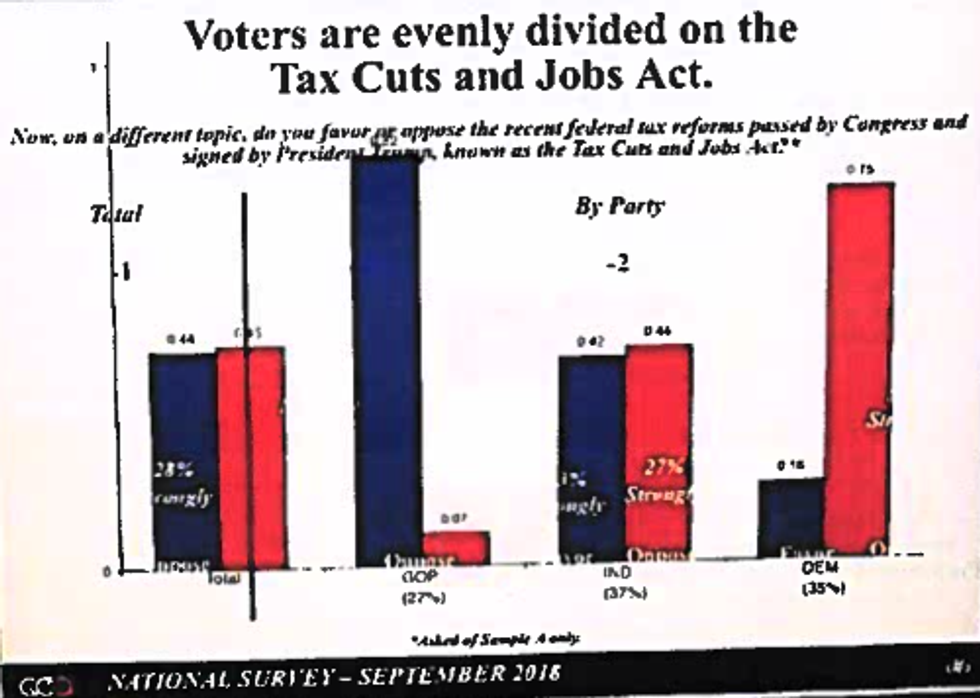

"Voters are evenly divided on the Tax Cuts and Jobs Act. But, we’ve lost the messaging battle on the issue."

While the data concerning their tax plan shows that perception is true, the GOP hoped to convince their supporters and other voters otherwise. The poll, completed September 2 by RNC firm Public Opinion Strategies however found voters evenly divided as far as approval of tax reform with 44 percent for and 45 percent against.

The even split benefited from strong support from GOP voters and an evenly split independent vote.

The GOP tax plan dropped the corporate tax rate permanently to 21 percent from 35 percent. It also temporarily reduced individual tax rates, doubled standard deduction, eliminated or capped some itemized deductions and created a special tax break for "pass-through businesses" until the end of 2025.

According to an analysis from the Urban-Brookings Tax Policy Center, by 2025, "25 percent of the gains will go to the top 1 percent while 66 percent of the benefits will go to the top one-fifth of earners." Meanwhile, with reductions in itemized deductions, some middle and working class taxpayers may pay more in taxes.

By 2027, 83 percent of the GOP tax plan benefits go to the top 1 percent.

Trump signed his new tax law on December 22. The legislation went ahead without a single Democrat voting in favor of the changes.

And some voters will remember who voted for the bill dubbed the #GOPTaxScam while at the polls in November.

But the perception of the benefits of the GOP tax cuts was not the only bad news from the RNC poll.

Voters worry the Trump tax law heralds cuts to Social Security and Medicare. According to the RNC poll, "most voters believe that the GOP wants to cut back on these programs in order to provide tax breaks for corporations and the wealthy."

Despite the unfavorable message from their first round of tax reform, Republicans still plan to push more cuts to benefit the same groups before the 2018 midterms in November. The GOP plans to hold a floor vote in the Paul Ryan controlled House of Representatives next week.

But Speaker of the House Ryan's planned floor vote is largely symbolic. With a tighter margin in the Senate—and several key Senators fighting to keep their seats in the midterms—their latest tax cuts stand little hope of passage in the Senate.

However House Republicans can try to campaign on a narrative of voting for tax cuts for working and middle class people while the try to retain their own seats in the November elections. Speaker Ryan is retiring and will face no potential backlash.

In an email sent by his office to GOP members, Ryan stated:

"We promised more jobs, fairer taxes, and bigger paychecks. And we delivered on that promise."

He also added the RNC branded slogan "Better Off Now." If only he could get voters to believe it.

Midterm elections are set for Tuesday, November 6, 2018.

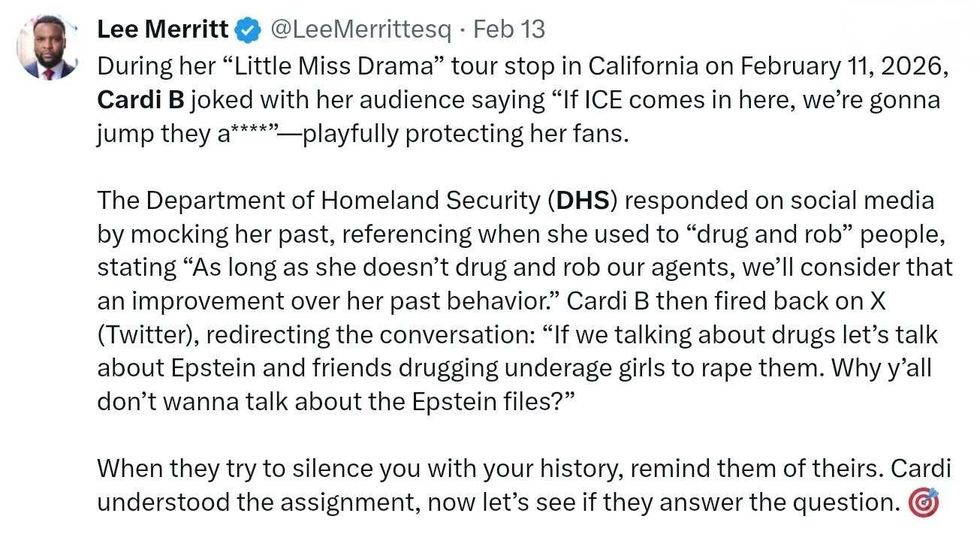

@LeeMerrittesq/X

@LeeMerrittesq/X @bob_moss/X

@bob_moss/X @jelanijones/Bluesky

@jelanijones/Bluesky @Aurkayne/X

@Aurkayne/X @sadcommunistdog; @froglok/Bluesky

@sadcommunistdog; @froglok/Bluesky