TIME magazine announced Tesla CEO Elon Musk as 2021's "Person of the Year," and a lot of people are not having it—especially Democratic Massachusetts Senator Elizabeth Warren.

Warren blasted TIME for its decision to honor the businessman who, as she put it, amassed a $297 billion fortune by "freeloading" off of the rest of the country.

See her tweet on the matter below.

Along with an article about Musk's honor by TIME, Warren tweeted:

"Let’s change the rigged tax code so The Person of the Year will actually pay taxes and stop freeloading off everyone else."

But Warren didn't just stop there.

She posted another tweet which included a parody of Musk's TIME cover created by non-profit activist group Americans for Tax Fairness that throws into stark relief just how strikingly he has benefitted from the tax code.

Along with the parody TIME cover, which points out Musk paid no federal income tax in 2018 and has paid an effective tax rate of 3.27% since—a rate less than one-fourth of the average 13.3% most non-wealthy Americans pay—Warren wrote:

"When someone makes it big in America—millionaire big, billionaire big, Person of the Year big—part of it has to include paying it forward so the next kid can get a chance, too."

Musk has frequently—and usually snidely—decried any government proposal or journalistic analysis that suggests he should pay taxes on his wealth.

Most recently, Democratic Senator Ron Wyden proposed an overhaul of the American tax code that would take Musk's tax liability to $10 billion per year.

That number sounds big, but it is a fraction of Musk's wealth. After all, he'd still have $287 billion left after the first year, which would still make him the world's richest man by a more than $100 billion margin.

Nevertheless, Musk whined about the proposal on Twitter, implying it amounts to theft because the government has "run out of other people's money"—a preposterous and mendacious charge given Tesla's dependence on tax dollars for its operations.

Exactly. Eventually, they run out of other people’s money and then they come for you.

— Elon Musk (@elonmusk) October 26, 2021

Musk's company is both a government contractor and a recipient of federal subsidies—as in handouts of Americans' tax dollars—for its operations.

And Tesla owes its very existence to government handouts. It would have shuttered altogether in 2009 if the federal government had not bailed the company out, again with Americans' tax dollars.

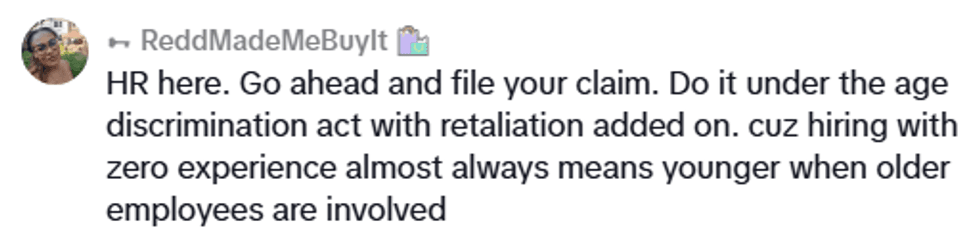

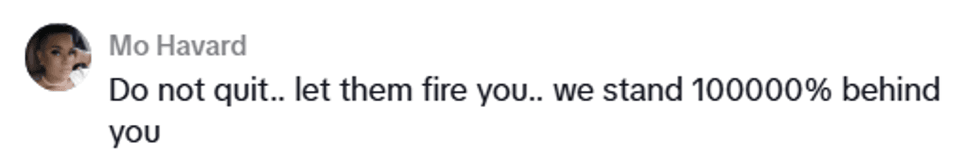

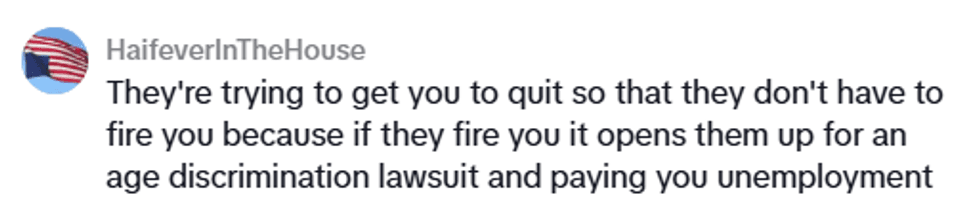

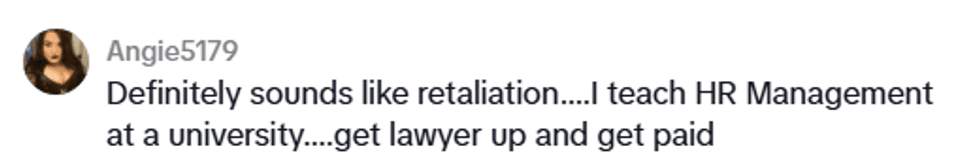

On Twitter, many people cheered Warren on for calling Musk out as America's most entitled and ungrateful billionaire.

Despite his history with handouts of government tax dollars, Musk told TIME he opposes subsidies like those that have been the linchpin of his success because the government is "not a good steward of capital."

The Benny Show

The Benny Show

@neilforreal/Bluesky

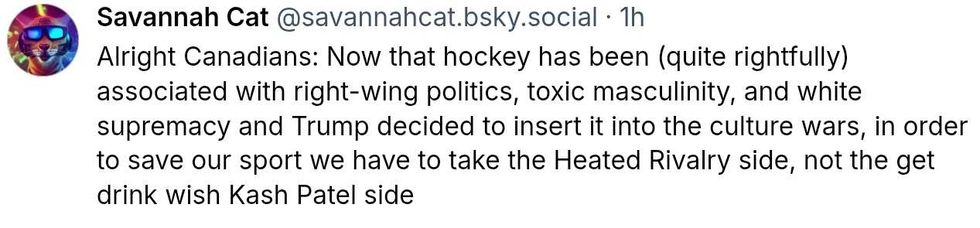

@neilforreal/Bluesky @savannahcat/Bluesky

@savannahcat/Bluesky @qadishtujessica.inanna.app

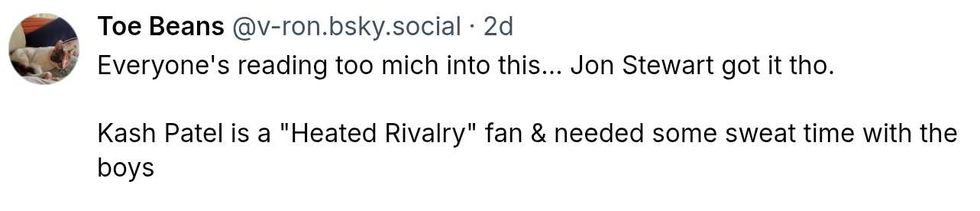

@qadishtujessica.inanna.app @v-ron/Bluesky

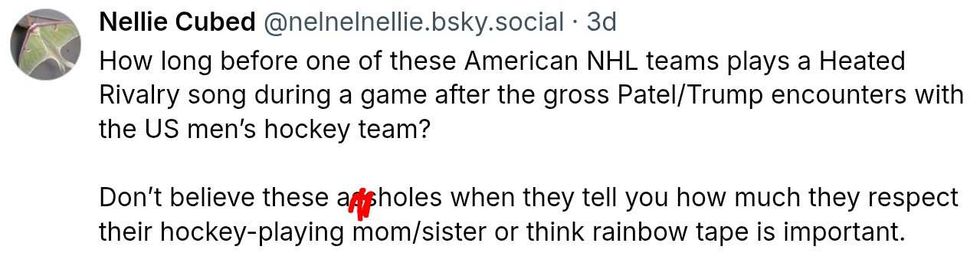

@v-ron/Bluesky @nelnelnellie/Bluesky

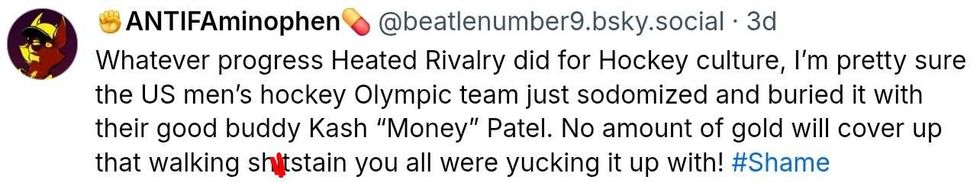

@nelnelnellie/Bluesky @beatlenumber9/Bluesky

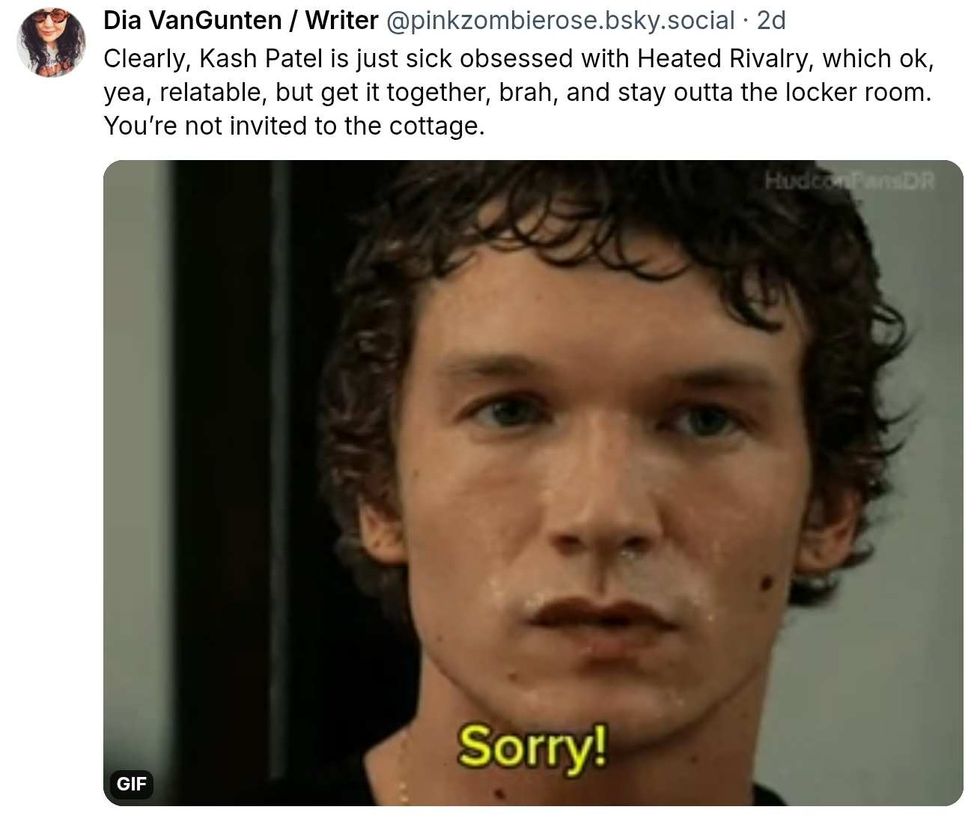

@beatlenumber9/Bluesky @pinkzombierose/Bluesky

@pinkzombierose/Bluesky

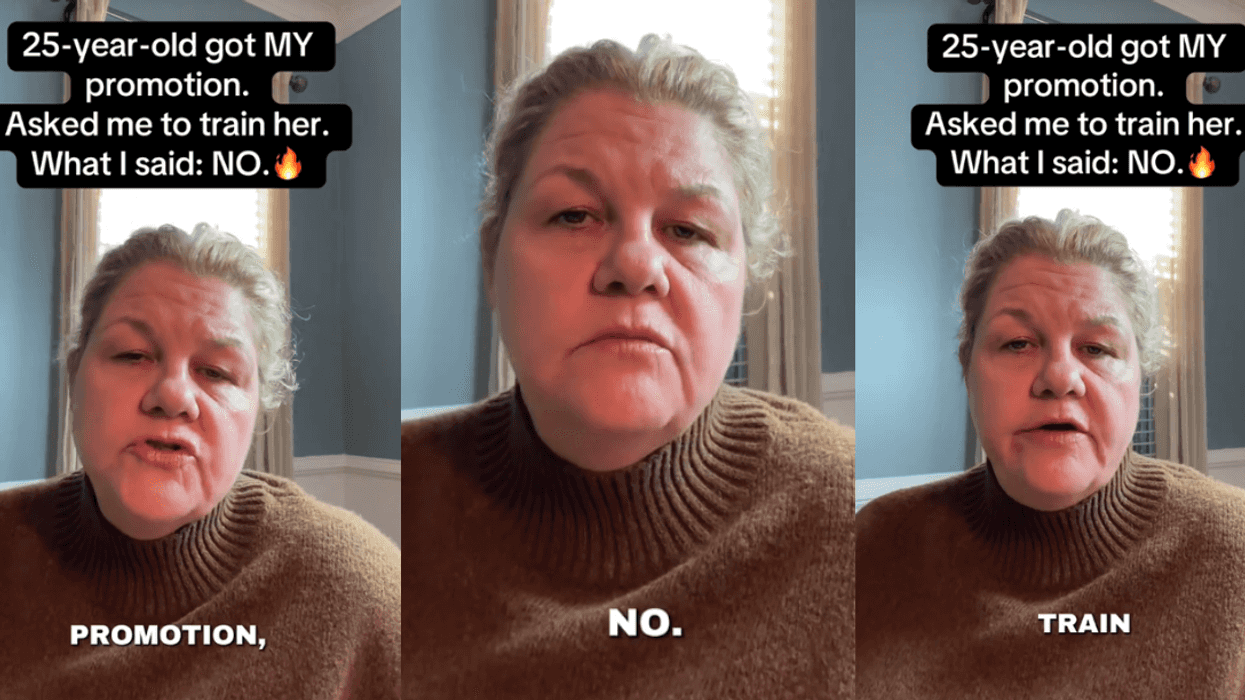

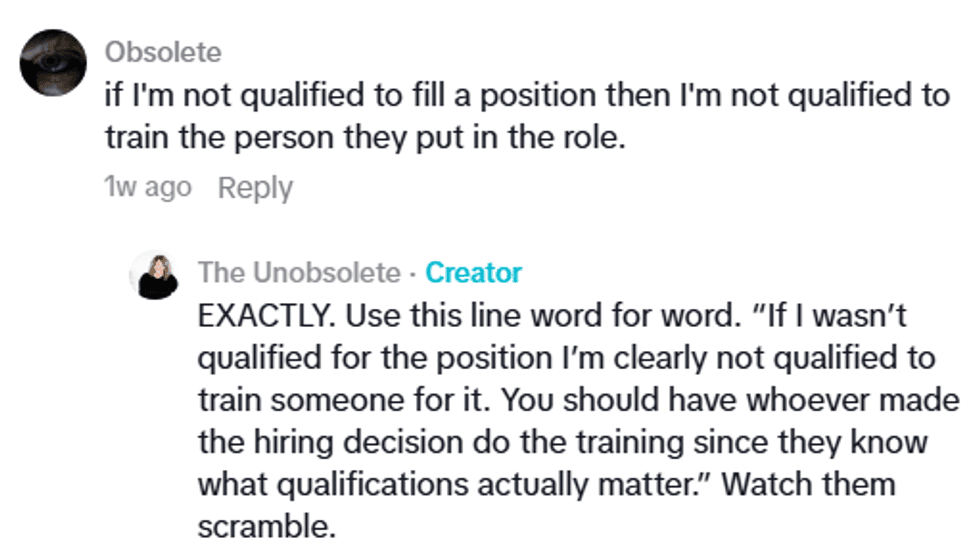

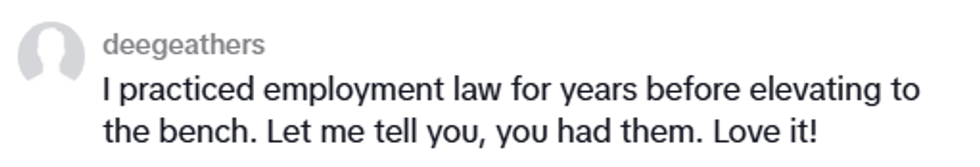

@theunobsolete/TikTok

@theunobsolete/TikTok @theunobsolete/TikTok

@theunobsolete/TikTok @theunobsolete/TikTok

@theunobsolete/TikTok @theunobsolete/TikTok

@theunobsolete/TikTok @theunobsolete/TikTok

@theunobsolete/TikTok @theunobsolete/TikTok

@theunobsolete/TikTok @theunobsolete/TikTok

@theunobsolete/TikTok @theunobsolete/TikTok

@theunobsolete/TikTok @theunobsolete/TikTok

@theunobsolete/TikTok @theunobsolete/TikTok

@theunobsolete/TikTok @theunobsolete/TikTok

@theunobsolete/TikTok @theunobsolete/TikTok

@theunobsolete/TikTok @theunobsolete/TikTok

@theunobsolete/TikTok @theunobsolete/TikTok

@theunobsolete/TikTok @theunobsolete/TikTok

@theunobsolete/TikTok @theunobsolete/TikTok

@theunobsolete/TikTok @theunobsolete/TikTok

@theunobsolete/TikTok

@laysuperstar/TikTok

@laysuperstar/TikTok @laysuperstar/TikTok

@laysuperstar/TikTok @laysuperstar/TikTok

@laysuperstar/TikTok @laysuperstar/TikTok

@laysuperstar/TikTok @laysuperstar/TikTok

@laysuperstar/TikTok @laysuperstar/TikTok

@laysuperstar/TikTok @laysuperstar/TikTok

@laysuperstar/TikTok @laysuperstar/TikTok

@laysuperstar/TikTok @laysuperstar/TikTok

@laysuperstar/TikTok @laysuperstar/TikTok

@laysuperstar/TikTok @laysuperstar/TikTok

@laysuperstar/TikTok @laysuperstar/TikTok

@laysuperstar/TikTok @laysuperstar/TikTok

@laysuperstar/TikTok @laysuperstar/TikTok

@laysuperstar/TikTok @laysuperstar/TikTok

@laysuperstar/TikTok