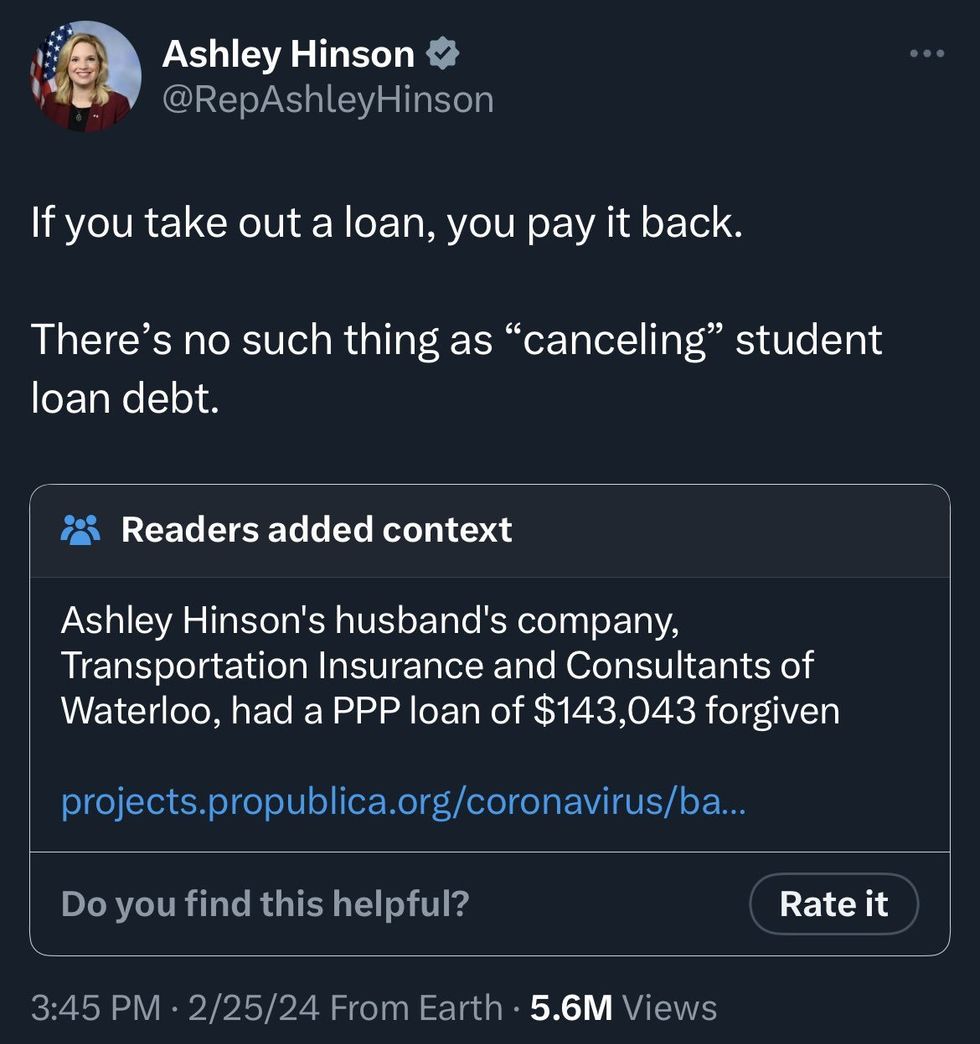

Iowa Republican Representative Ashley Hinson was hit with an epic Community Note on X, formerly Twitter, after she criticized President Joe Biden's student loan forgiveness plan, arguing that "if you take out a loan, you pay it back."

Hinson claimed that "'canceling' student loan debt" does not exist.

However, she later received a brutal reminder via a Community Note that the Transportation Insurance and Consultants of Waterloo, a company run by her husband, Matthew Arenholz, received $143,043.18 in Paycheck Protection Program (PPP) loans that were forgiven by the government.

PPP loans are backed by the Small Business Administration (SBA) and were designed to help businesses keep their workforce employed during the COVID-19 pandemic; Arenholz's debt forgiveness was first reported by the investigative outlet ProPublica.

Liberal activist Ron Filipkowski, the chief editor of MeidasTouch, highlighted the Community Note in a post and criticized Hinson with the following remark:

"My favorite part is when they all go through their tortured explanations of why their government subsidies are different."

You can see his post and the Community Note below.

Many have called out Hinson's hypocrisy.

The Department of Education's brand-new student loan forgiveness plan is designed to be more targeted and legally robust than the initial debt relief program proposed by the Biden administration that the Supreme Court struck down in a ruling last summer.

Officials hope that this new plan, which focuses on specific groups of borrowers, will effectively address longstanding repayment challenges, ballooning balances, attendance at low-value or predatory schools, and eligibility for existing forgiveness programs that haven't been utilized.

The proposed rules for the new plan highlight a focus on borrowers experiencing financial hardship. The Education Department aims to consider a range of indicators, including the borrower's financial circumstances, loan history, institutional considerations, and demographics. This approach seeks to tailor relief to those most in need, addressing the challenges faced by individuals grappling with the economic impact of student loan debt.

r/psychologyofsex/Reddit

r/psychologyofsex/Reddit r/psychologyofsex/Reddit

r/psychologyofsex/Reddit r/psychologyofsex/Reddit

r/psychologyofsex/Reddit r/psychologyofsex/Reddit

r/psychologyofsex/Reddit r/psychologyofsex/Reddit

r/psychologyofsex/Reddit r/psychologyofsex/Reddit

r/psychologyofsex/Reddit r/psychologyofsex/Reddit

r/psychologyofsex/Reddit r/psychologyofsex/Reddit

r/psychologyofsex/Reddit r/psychologyofsex/Reddit

r/psychologyofsex/Reddit r/psychologyofsex/Reddit

r/psychologyofsex/Reddit r/psychologyofsex/Reddit

r/psychologyofsex/Reddit r/psychologyofsex/Reddit

r/psychologyofsex/Reddit r/psychologyofsex/Reddit

r/psychologyofsex/Reddit r/psychologyofsex/Reddit

r/psychologyofsex/Reddit r/psychologyofsex/Reddit

r/psychologyofsex/Reddit r/psychologyofsex/Reddit

r/psychologyofsex/Reddit r/psychologyofsex/Reddit

r/psychologyofsex/Reddit r/psychologyofsex/Reddit

r/psychologyofsex/Reddit r/psychologyofsex/Reddit

r/psychologyofsex/Reddit r/psychologyofsex/Reddit

r/psychologyofsex/Reddit r/psychologyofsex/Reddit

r/psychologyofsex/Reddit r/psychologyofsex/Reddit

r/psychologyofsex/Reddit r/psychologyofsex/Reddit

r/psychologyofsex/Reddit