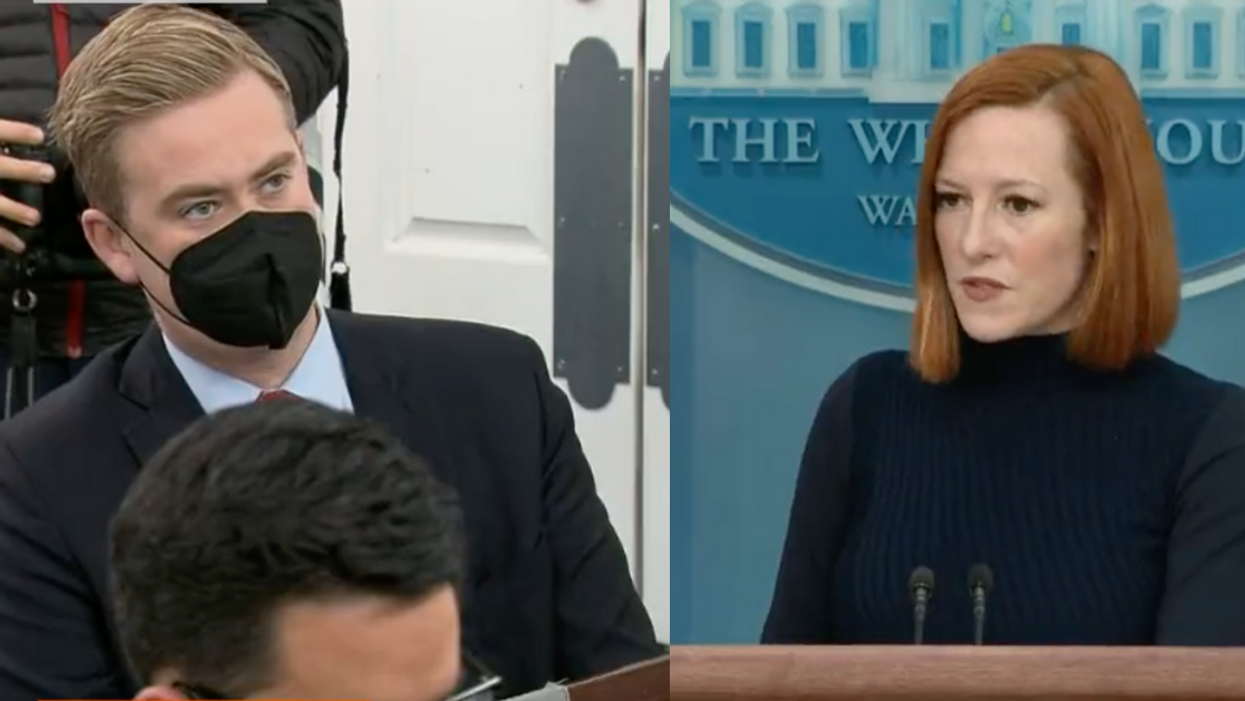

White House Press Secretary Jen Psaki issued a firm rebuke of former President Donald Trump's economic policies after Fox News reporter Peter Doocy suggested that President Joe Biden doesn't care about the nation's economic recovery.

Stock market indexes not a reliable indicator of a nation's economic health but that didn't stop Doocy, with whom Psaki has regularly sparred, from asking for comments from Biden after the Dow Jones Industrial Average fell 1,115 points amid fears the Federal Reserve would soon aggressively tighten policy, a reversal from policies it had earlier put in place to fight the COVID-19 pandemic.

You can watch what happened in the video below.

Doocy, speaking shortly after the Dow plunged earlier that morning, asked:

“Does the president think it’s a big deal that today the Dow Jones is down, at one point, more than 1100 points?”

Psaki was quick to note that the Biden administration is more apt to focus "on the trends in the economy, not any one day and any single indicator" before taking a jab at former President Donald Trump, who was often criticized for his noted preoccupation, even obsession, with the stock market:

"Unlike his predecessor, the President does not look at the stock market as a means by which to judge the economy."

"I would note that the market is up around 15% compared to when President Biden took office but our measure of success is how real working families are doing.”

The exchange soon went viral, with many lauding Psaki for her measured response.

Stocks later rebounded after investors bought tech shares that had been subject to a sharp sell-off as concerns about the Federal Reverse changing its policies gripped Wall Street.

The Dow ultimately closed up 99.13 points, or 0.3%, at 34,364.50, marking one of the market's best comebacks in a long time. Marko Kolanovic, JPMorgan’s top stock strategist, called the sell-off "overdone" and reiterated that the firm expects "the earnings season to reassure, and in a worst case scenario could see a return of the ‘Fed put.’”

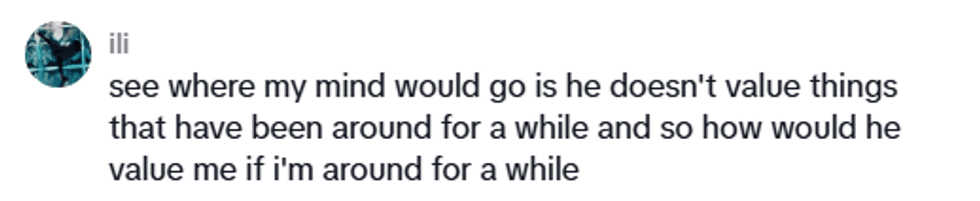

@maddy.aubry/TikTok

@maddy.aubry/TikTok @maddy.aubry/TikTok

@maddy.aubry/TikTok @maddy.aubry/TikTok

@maddy.aubry/TikTok @maddy.aubry/TikTok

@maddy.aubry/TikTok @maddy.aubry/TikTok

@maddy.aubry/TikTok @maddy.aubry/TikTok

@maddy.aubry/TikTok @maddy.aubry/TikTok

@maddy.aubry/TikTok @maddy.aubry/TikTok

@maddy.aubry/TikTok @maddy.aubry/TikTok

@maddy.aubry/TikTok @maddy.aubry/TikTok

@maddy.aubry/TikTok @maddy.aubry/TikTok

@maddy.aubry/TikTok @maddy.aubry/TikTok

@maddy.aubry/TikTok @maddy.aubry/TikTok

@maddy.aubry/TikTok @maddy.aubry/TikTok

@maddy.aubry/TikTok @maddy.aubry/TikTok

@maddy.aubry/TikTok @maddy.aubry/TikTok

@maddy.aubry/TikTok @maddy.aubry/TikTok

@maddy.aubry/TikTok @maddy.aubry/TikTok

@maddy.aubry/TikTok @maddy.aubry/TikTok

@maddy.aubry/TikTok

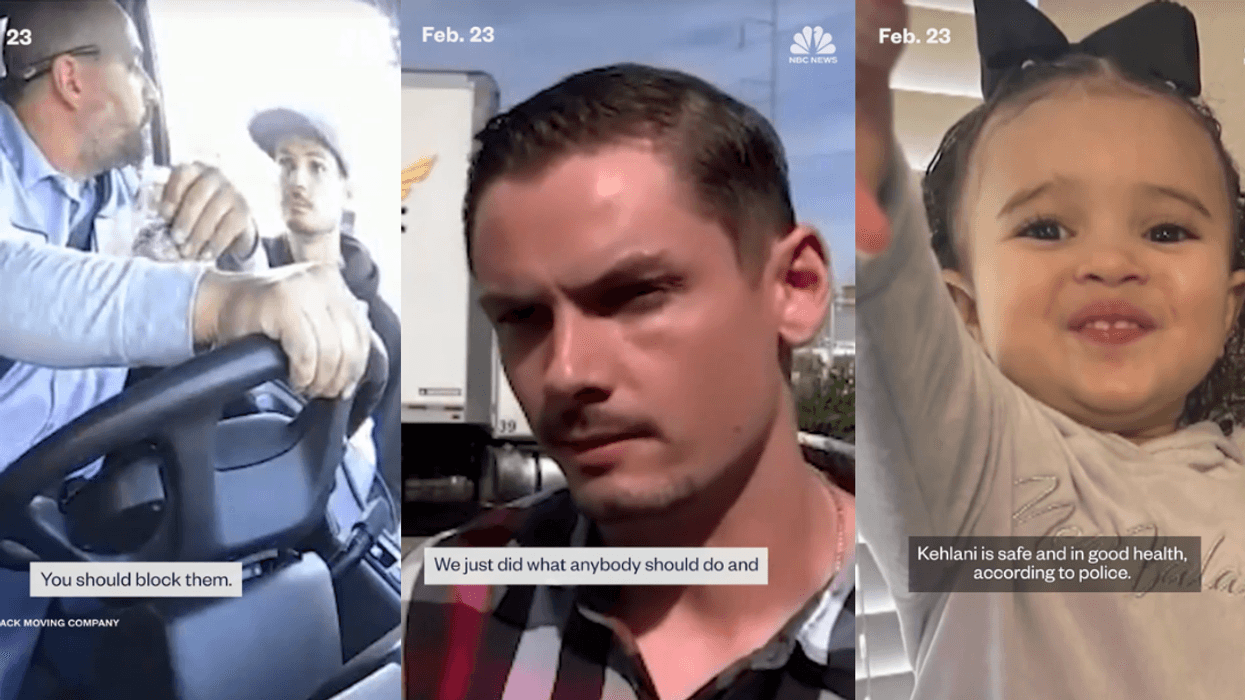

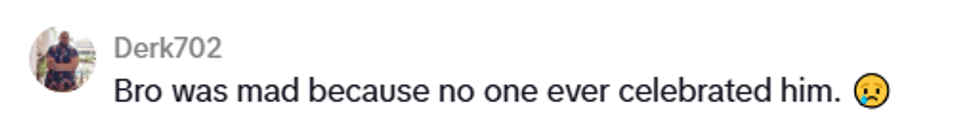

@nbcnews/TikTok

@nbcnews/TikTok @nbcnews/TikTok

@nbcnews/TikTok @nbcnews/TikTok

@nbcnews/TikTok @nbcnews/TikTok

@nbcnews/TikTok @nbcnews/TikTok

@nbcnews/TikTok @nbcnews/TikTok

@nbcnews/TikTok @nbcnews/TikTok

@nbcnews/TikTok @nbcnews/TikTok

@nbcnews/TikTok @nbcnews/TikTok

@nbcnews/TikTok @nbcnews/TikTok

@nbcnews/TikTok

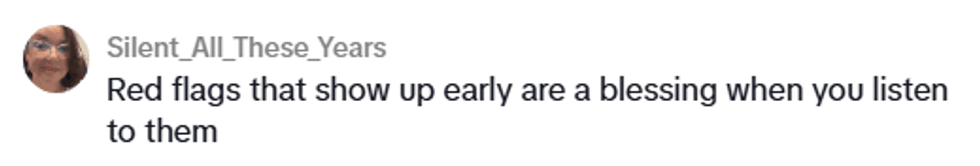

@hi_its_chey/TikTok

@hi_its_chey/TikTok @hi_its_chey/TikTok

@hi_its_chey/TikTok @hi_its_chey/TikTok

@hi_its_chey/TikTok @hi_its_chey/TikTok

@hi_its_chey/TikTok @hi_its_chey/TikTok

@hi_its_chey/TikTok @hi_its_chey/TikTok

@hi_its_chey/TikTok @hi_its_chey/TikTok

@hi_its_chey/TikTok @hi_its_chey/TikTok

@hi_its_chey/TikTok @hi_its_chey/TikTok

@hi_its_chey/TikTok @hi_its_chey/TikTok

@hi_its_chey/TikTok @hi_its_chey/TikTok

@hi_its_chey/TikTok @hi_its_chey/TikTok

@hi_its_chey/TikTok @hi_its_chey/TikTok

@hi_its_chey/TikTok

@ritawilson/Instagram

@ritawilson/Instagram @bettyjo46/Instagram

@bettyjo46/Instagram @dottdott65/Instagram

@dottdott65/Instagram @betseyboop/Instagram

@betseyboop/Instagram @ondinefortune/Instagram

@ondinefortune/Instagram @heathermessina/Instagram

@heathermessina/Instagram @mlejordan/Instagram

@mlejordan/Instagram @icu2qtpie/Instagram

@icu2qtpie/Instagram @ryan.mannino013/Instagram

@ryan.mannino013/Instagram @helen_nk0730/Instagram

@helen_nk0730/Instagram @steph.lynn_26/Instagram

@steph.lynn_26/Instagram @themovieposterguy/Instagram

@themovieposterguy/Instagram