President Donald Trump's tariffs––25 percent on steel and aluminum imports––has reduced the workforce of Mid Continent Nail Corp., a Missouri plant, by 20 percent and "could be out of business by Labor Day — or that remaining production could move to Mexico or another country," The Washington Post reports.

That's the opposite outcome from what the president and his supporters claimed would happen once his tariffs went into effect and, The Post notes, which "have instead hampered a Mexican company’s multimillion-dollar effort to create jobs in the United States."

Indeed, when Deacro, the Mexican company, purchased Mid Continent Nail Corp., the plant's workers had expressed fears that their jobs would be outsourced to Mexico. That's not what happened at all. Mid Continent's factory doubled in size, bolstered, in part, by fewer restrictions on steel exports after the North American Free Trade Agreement. The plant's workers enjoyed a time of relative prosperity and Mid Continent "shipped steel into Missouri, willing to pay skilled workers more to take advantage of cheaper energy costs in the United States and a location that allowed swift delivery to U.S. customers."

Layoffs have already begun; the company now employs fewer than 400 workers, down from about 500 before President Trump's tariffs took effect last month.

“We’re in a situation where we’re fighting against our own country,” said Chris Pratt––no, not that Chris Pratt––an operations general manager at Mid Continent. “It seems like a battle we shouldn’t be having to fight.”

Pratt says the company is "in a situation where we’re fighting against our own country." He added: “It seems like a battle we shouldn’t be having to fight.”

According to Jim Glassman, a Mid Continent spokesman, "moving nail production to Mexico or another country is a possibility, but it is a bad alternative. Mid Continent does not want to move and is not planning to do so." He said that the plant's workers remain hopeful that "President Trump will save their jobs."

One of these workers is Philip Bennett, a machine repairman. Bennett has health insurance through the company that covers his five-year-old daughter, who has a congenital heart condition for which she's undergone multiple surgeries.

“There’s a lot of good things that he is doing. But he’s affecting me now, and I don’t appreciate it,” said Bennett, who voted for President Trump. “I mean, I don’t expect him to come down here. It’d be nice — and see what he’s affecting, and see the people he’s hurting.”

And hurt them the tariffs have: While the workers fear additional layoffs and an eventual closure of the plant, The Post notes that "not a single Mexican employee has been fired."

When interviewed by reporters from Deacro's headquarters in Monterrey, Mexico, Luis Leal, the company's vice president of trade, said: “The strength of the domestic market [in Mexico] has helped us."

The hits the president's tariffs have dealt the economy continue to be felt, but if you ask the president, the economy is "stronger than ever before."

In recent days, the president has taken to boasting of economic and job records, though the data––now and then––shows that he inherited a healthy economy from President Barack Obama. His comments appear to be a distraction from the scathing criticisms he's facing since his performance during a press conference in Helsinki, during which he sided with Russian President Vladimir Putin over his own intelligence agencies and their assessment that Russian operatives interfered in the 2016 presidential election and undermined American democracy.

The president has not responded to any observations about the effects his tariffs have had on factories like Mid Continent Nail Corp., whose workforces are comprised of many people who voted for him with the expectation that he would remedy a decline in American manufacturing.

The plight of Mid Continent Nail Corp. brings to mind the president's thorny history with Harley-Davidson.

After the president announced his tariffs earlier this year, the European Union levied additional import taxes on American products in response. Among the products subject to additional import taxes: motorcycles. The new tariffs would hit Harley-Davidson especially hard.

In a filing last month, Harley-Davidson noted that:

Harley-Davidson believes the tremendous cost increase if passed onto its dealers and retail customers, would have an immediate and lasting detrimental impact to its business in the region, reducing customer access to Harley-Davidson products and negatively impacting the sustainability of its dealers’ businesses.

All of this news comes as Harley-Davidson’s domestic sales have declined in recent years, and the company’s plight is at odd’s with the president’s claim that winning trade wars is “easy.”

The president had previously lauded Harley-Davidson as an example of business success, but the company’s recent actions indicate American workers have not benefited from President Trump’s corporate tax cuts as much as he might hope.

In January, Harley-Davidson told Kansas City workers it would close a plant there, a net loss of 350 jobs. Mere days later, the company announced a dividend increase––and a stock buyback plan to repurchase 15 million of its shares. Those shares are worth about $696 million.

The announcement of the closure blindsided union representatives, saidGreg Tate, a staff representative for the United Steelworkers District 11, which represents about 30 percent of the Harley-Davidson plant’s workers.

“We really never had any belief that they were going to shut the Kansas City facility down,” Tate said. The announcement was “the first anyone found out about it.”

Tate notes that Harley-Davidson’s decision to hire a casual workforce (temp workers who would boost production during peak season) will be easier and cheaper for the company:

This is a decision we did not take lightly. The Kansas City plant has been assembling Harley-Davidson motorcycles since 1997, and our employees will leave a great legacy of quality, price, and manufacturing leadership. We are grateful to them and the Kansas City community for their many years of support and their service to our dealers and our riders.

The GOP tax plan slashed the corporate tax rate to 21 percent from 35 percent. Proponents of the plan insisted companies would use the windfall to increase their investments in labor or business expansions. The opposite is true: Companies are outsourcing jobs and paying shareholders.

In fact, a recent analysis found that corporate stock buybacks hit a record $178 billion in the first three months of 2018. By contrast, average hourly earnings for American workers are up 67 cents over the past year. Harley Davidson makes about $800 million to $1 billion in pre-tax profit, according to Seth Woolf, an analyst at North Coast Research.

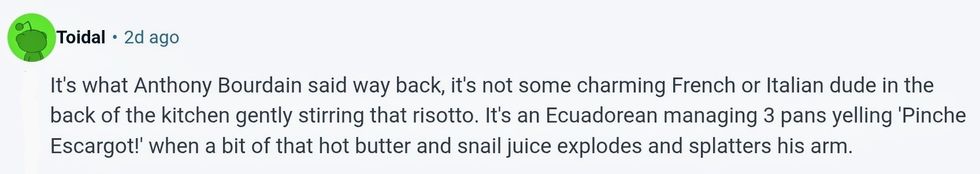

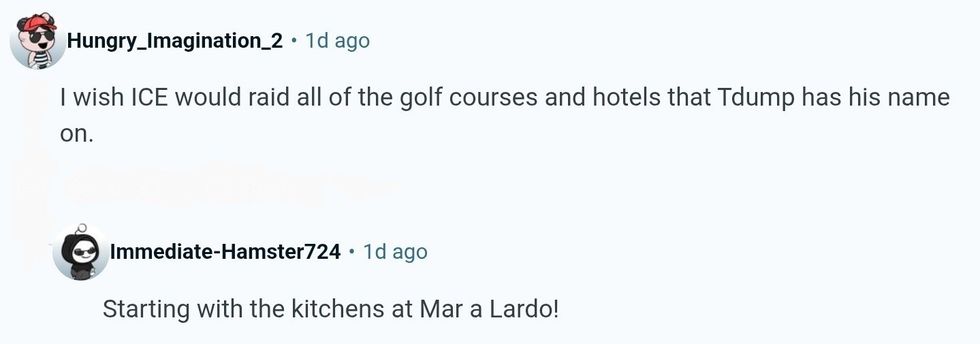

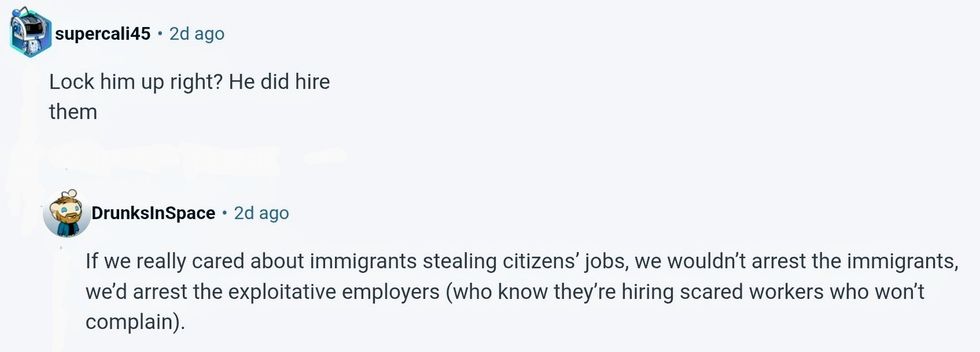

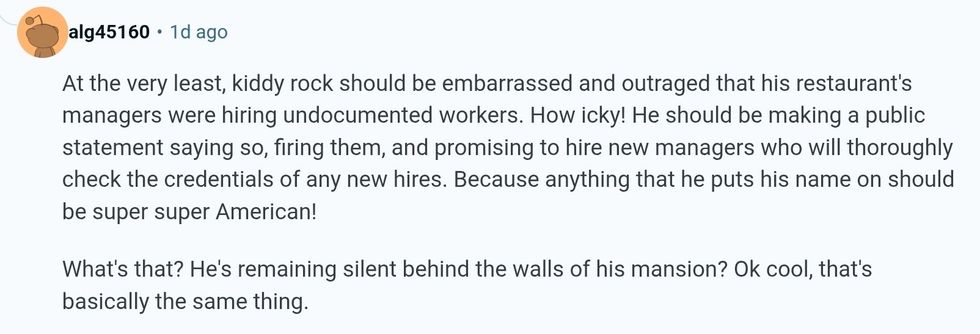

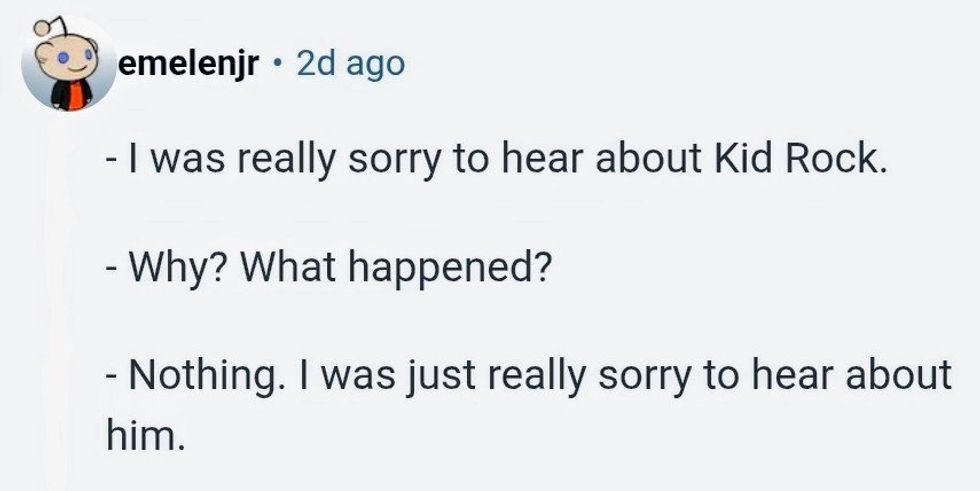

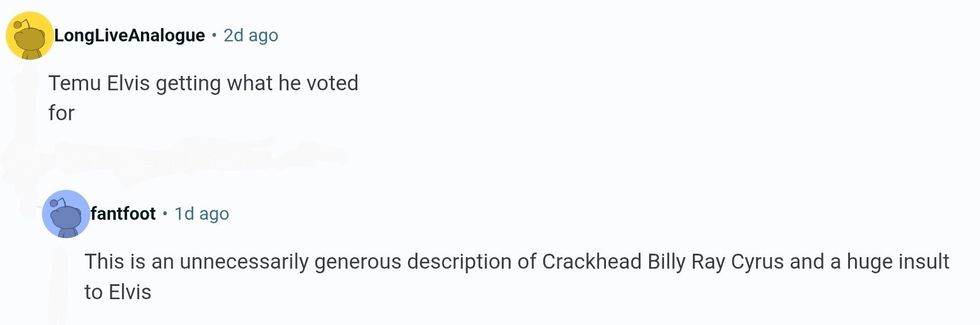

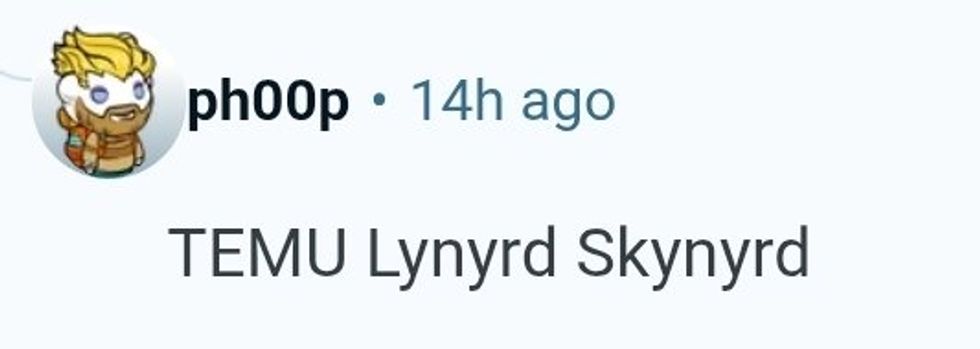

r/Music/Reddit

r/Music/Reddit r/Music/Reddit

r/Music/Reddit r/Music/Reddit

r/Music/Reddit r/Music/Reddit

r/Music/Reddit r/Music/Reddit

r/Music/Reddit r/Music/Reddit

r/Music/Reddit r/Music/Reddit

r/Music/Reddit r/Music/Reddit

r/Music/Reddit r/Music/Reddit

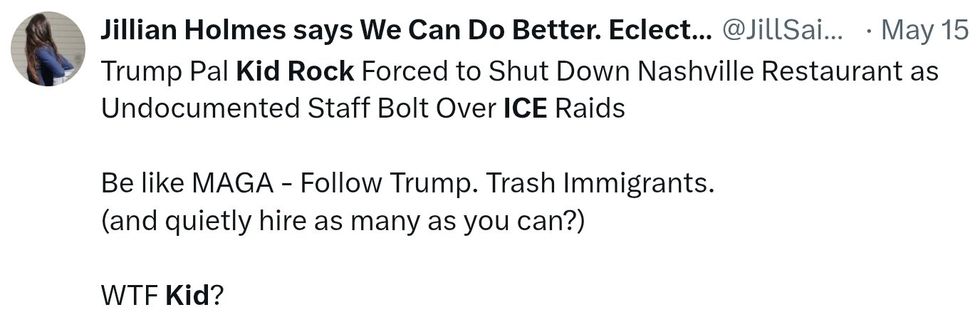

r/Music/Reddit @JillSaidIt/X

@JillSaidIt/X r/Music/Reddit

r/Music/Reddit r/Music/Reddit

r/Music/Reddit r/Music/Reddit

r/Music/Reddit r/Music/Reddit

r/Music/Reddit r/Music/Reddit

r/Music/Reddit r/Music/Reddit

r/Music/Reddit r/Music/Reddit

r/Music/Reddit r/Music/Reddit

r/Music/Reddit r/Music/Reddit

r/Music/Reddit r/Music/Reddit

r/Music/Reddit r/Music/Reddit

r/Music/Reddit r/Music/Reddit

r/Music/Reddit

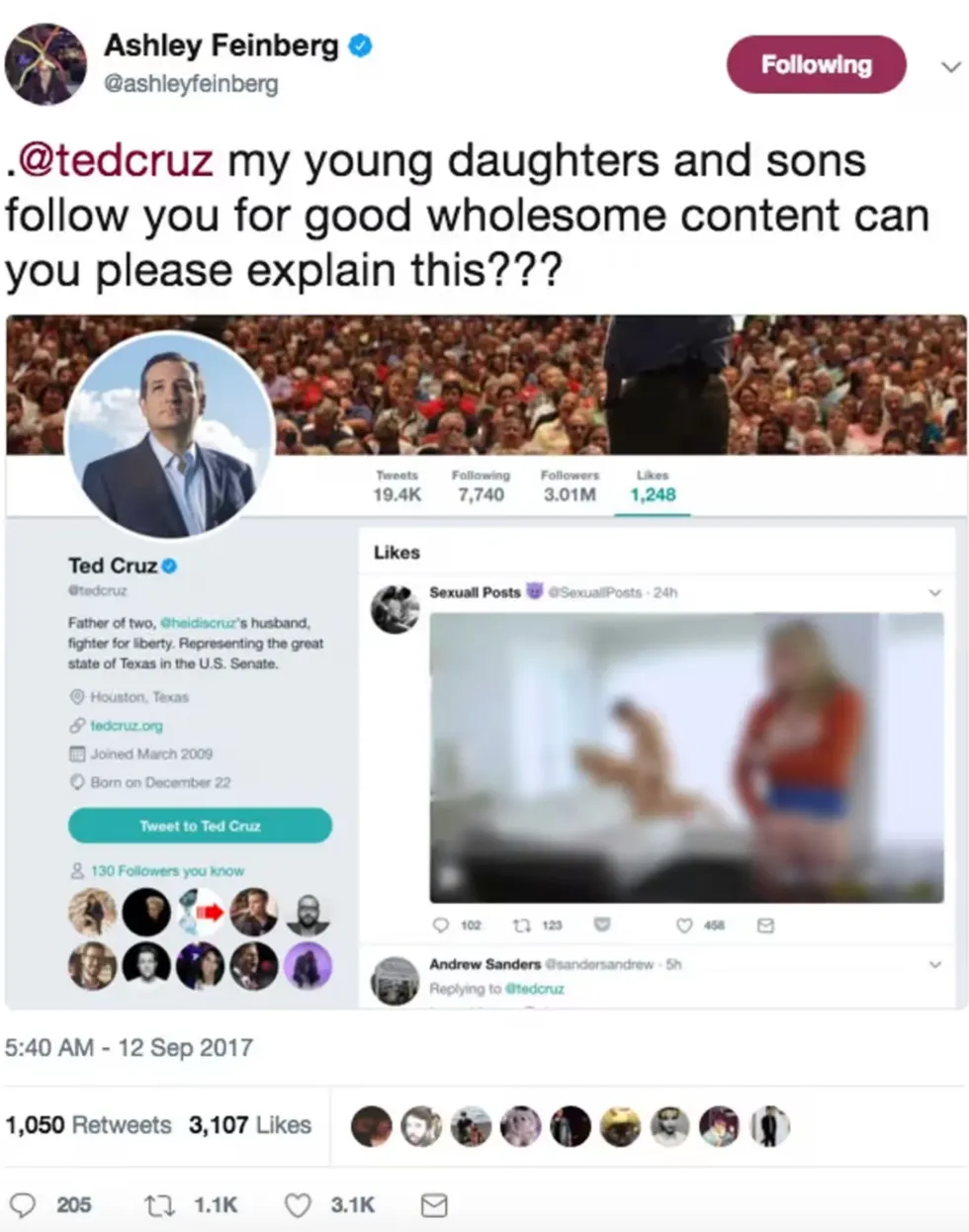

@ashleyfeinberg/X; @tedcruz/X

@ashleyfeinberg/X; @tedcruz/X @tedcruz/X

@tedcruz/X

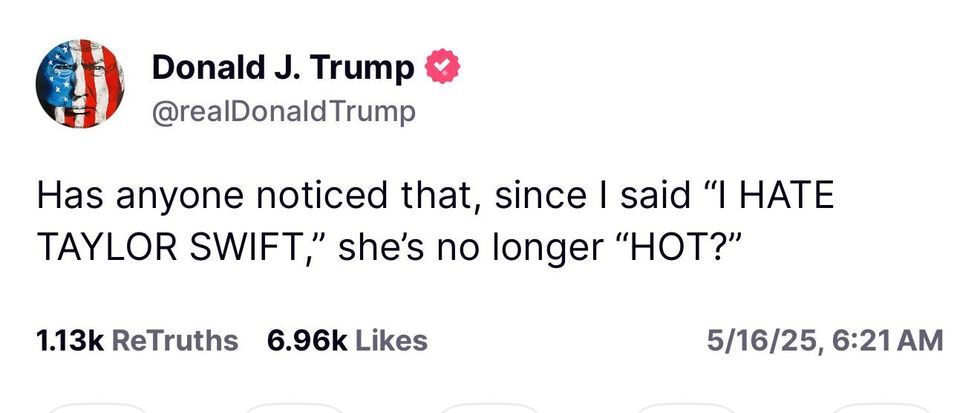

@realDonaldTrump/Truth Social

@realDonaldTrump/Truth Social