For years, hedge fund managers have used a tactic called "shorting" to profit from the stock market. Shorting occurs when an investor borrows a stock and sells it immediately at market rate, expecting the price to drop in the future.

When the price drops substantially, these shares are returned to the company at the lowered price, with the investor pocketing the difference.

But if the price of that borrowed stock increases, the investor is still responsible for returning the stock at its heightened value.

That's why Wall Street continues to reel from the GameStop saga, which saw retail investors from the Reddit community r/wallstreetbets invest in GameStop en masse to increase its value and foil the plans of hedge funds to short its stock.

The initiative succeeded beyond what anyone imagined, with GameStop stock rising from its initial $18 value at the beginning of the month to over $400 a share, forcing Melvin Capital—one of the firms attempting to short the company—to close its shares at a crushing loss.

Billionaire hedge fund manager Leon Cooperman railed against the development on CNBC's Squawk on the Street, claiming the effort was an attack on wealthy people.

Cooperman said:

"The reason the market's doing what it's doing is people are sitting at home, getting their checks from the government and this fair share is a bull s**t concept. It's just a way of attacking wealthy people and I think it's inappropriate. We've all got to work together and pull together."

While Cooperman doesn't seem to have monetary stake in the GameStop saga, he's long been known for his advocacy on behalf of the absurdly wealthy, often directing his ire to progressive politicians calling for greater restrictions on Wall Street, like financial transaction taxes.

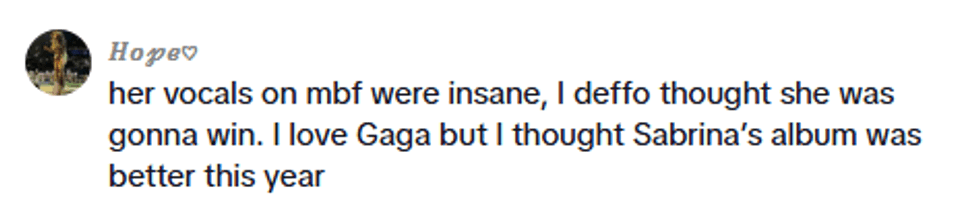

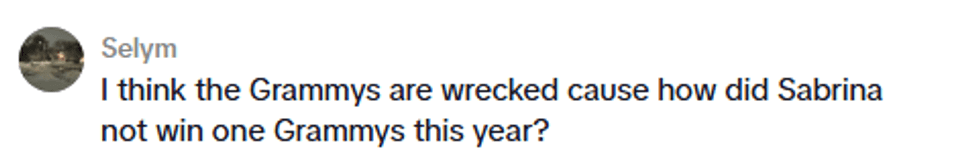

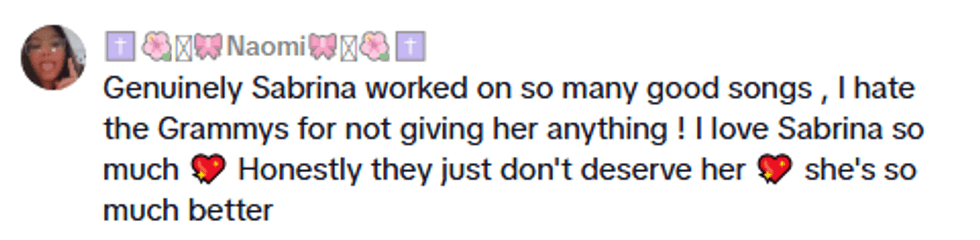

Twitter users were appalled to see a billionaire investor rail against everyday people investing.

Many were giddy to see Cooperman so irate.

Stock trading apps like Robinhood are currently facing backlash for restricting transactions on GameStop stock.

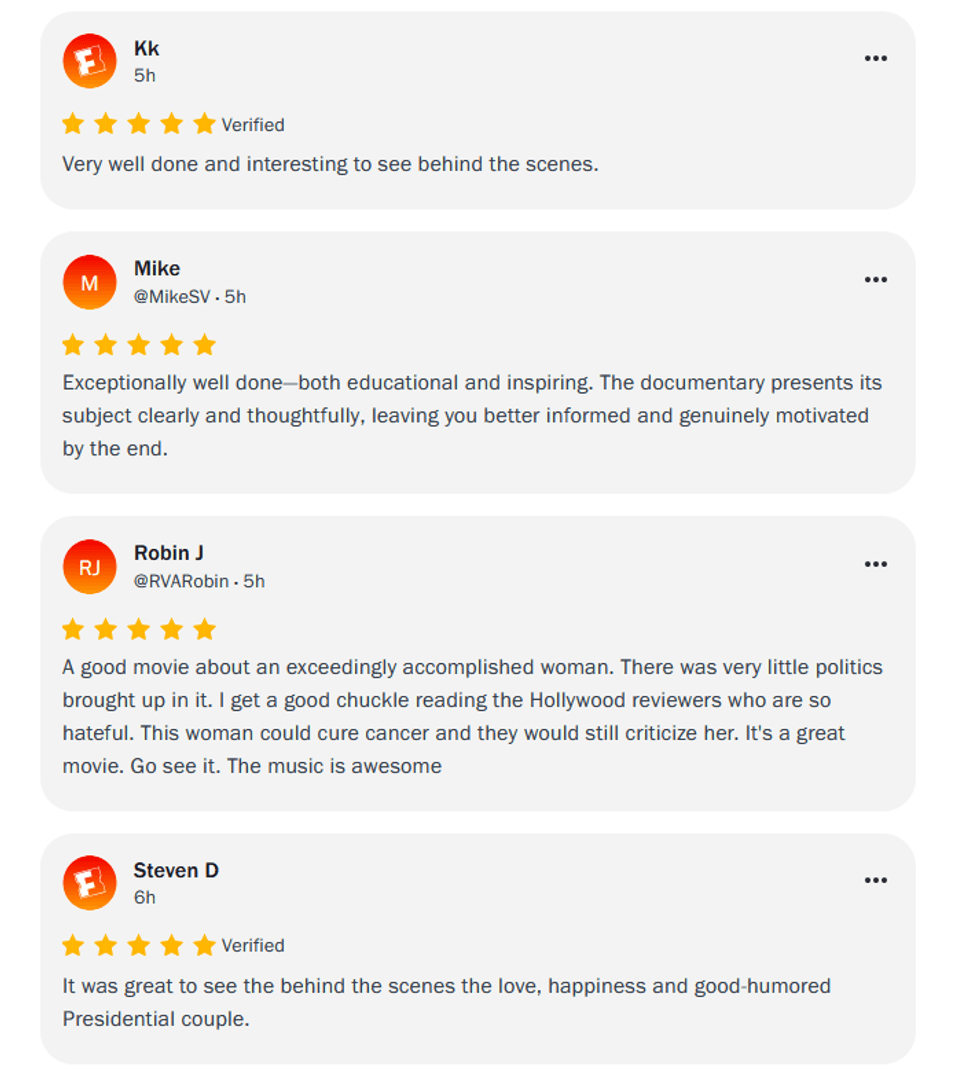

@obamaatredrobin/X

@obamaatredrobin/X

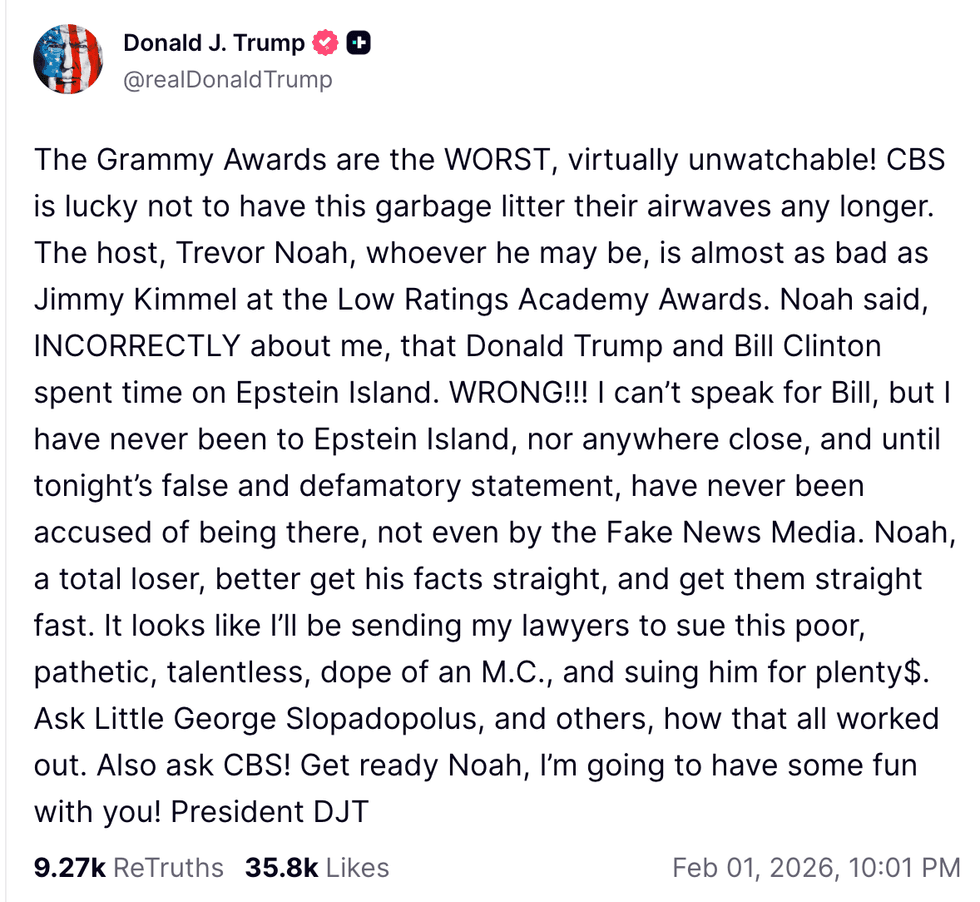

@realDonaldTrump/Truth Social

@realDonaldTrump/Truth Social

@.a.zan/TikTok

@.a.zan/TikTok @.a.zan/TikTok

@.a.zan/TikTok @.a.zan/TikTok

@.a.zan/TikTok @.a.zan/TikTok

@.a.zan/TikTok @.a.zan/TikTok

@.a.zan/TikTok @.a.zan/TikTok

@.a.zan/TikTok @.a.zan/TikTok

@.a.zan/TikTok @.a.zan/TikTok

@.a.zan/TikTok @.a.zan/TikTok

@.a.zan/TikTok @.a.zan/TikTok

@.a.zan/TikTok @.a.zan/TikTok

@.a.zan/TikTok @.a.zan/TikTok

@.a.zan/TikTok @.a.zan/TikTok

@.a.zan/TikTok @.a.zan/TikTok

@.a.zan/TikTok @.a.zan/TikTok

@.a.zan/TikTok