Over one in three (37%) young Americans are putting off getting married because of debt, according to new research.

A poll of 1,000 millennials and 1,000 Gen Zers found — of the younger generations with debt — 84% have considered delaying or holding off on taking their relationship to the next level because they want to pay off their debts first.

Due to debt, 37% are delaying engagements, while a further 37% are holding off on getting married. Another 25% have put on hold moving in with their partner, while 29% have delayed purchasing a home.

SWNS

At the same time, debt is no longer taboo among younger generations.

Conducted by OnePoll in conjunction with Laurel Road, a digital lending platform, the survey explored the relationship dynamics and financial habits of 1,000 millennials and 1,000 Gen Zers.

Results uncovered that 81% of respondents understand debt is common amongst their peers — and don't want to let it negatively affect their romantic relationships.

The results also revealed that a third (33%) of respondents currently have debts they are working to pay off, but younger generations are trying to be proactive and seek advice about how best to handle their finances.

Nearly three in five (58%) respondents reveal they found out about their partner's debt within a year of being together.

However, when it comes to the most appropriate time to reveal debt to a partner, results reveal that a third (34%) consider it appropriate to inform their significant other about their debt within six months of being in a committed relationship.

Interestingly enough, a whopping 84% of respondents are open about discussing their debt with a partner.

However, the survey suggests that this openness is not always immediate. Of those with debt, nearly half (49%) have avoided discussing their debt with a partner when it comes up in conversation and 65% are currently hiding that debt from their partners.

As a result, millennials and Gen Zers are going to their partners for money advice and support. Seventy-six percent of those studied say they often seek advice from their partner about how best to manage their financial situation.

Beyond giving general advice, millennials and Gen Zers are supporting and encouraging their partners to be proactive about their finances and debts.

Fifty-five percent of respondents worked on a budget or payment plan together with their partner while a further 36% researched refinancing options in an effort to help each other manage the other's debt.

“Debt and personal finance can be a tricky topic for even the most stable couples, but it's essential to be open about your debt if you are going to grow a relationship," said Alyssa Schaefer, Chief Marketing Officer for Laurel Road.

“Our survey also found that student debt especially, has become a widespread financial concern among millennials and will likely be the same for Gen Z. It's encouraging to see the empathy that younger generations have developed for one another."

Almost half (38%) of those whose partners have spoken to them about their debt have offered to take it on themselves.

Over half (56%) would be willing to help their partner with paying off student loans, while 38% would be willing to assist their partner with their credit card debt.

Unfortunately, having debt can also be a deal-breaker for many. Forty-six percent have considered breaking things off with a partner over student loans while a further 28% have considered ending a relationship because of credit card debt.

That said, millennials and Gen Zers reveal being so open about their finances allows their relationships to thrive. Seventy-four percent say talking about their financial situation with their partners and getting their advice makes their relationship stronger.

Schaefer said:

“Not only are younger generations more empathetic about the common financial pressures of their significant others, but they are providing actionable advice and support."

"Millennials and Gen Zers have an incomprehensible amount of information at their fingertips, which is why advice from a partner or peer is so highly-regarded – it's the trust factor."

"We were delighted to see this trust factor come through. At Laurel Road, we see this every day through our Refer-A-Friend Program."

TOP 5 WAYS MILLENNIALS AND GEN ZERS HANDLE SPEAKING ABOUT DEBT WITH THEIR PARTNER

- Avoid discussing debt if it comes up in conversation 49%

- Decide to withhold information about debt 45%

- Share how much debt they currently have 41%

- Discuss a plan to pay off their debt 37%

- Seek out advice on how to pay off debt 18%

u/mlg1981/Reddit

u/mlg1981/Reddit u/Miserable-Cap-5223/Reddit

u/Miserable-Cap-5223/Reddit u/riegspsych325/Reddit

u/riegspsych325/Reddit u/raysofdavies/Reddit

u/raysofdavies/Reddit u/NotAsBrightlyLit/Reddit

u/NotAsBrightlyLit/Reddit u/LvLtrstoVa/Reddit

u/LvLtrstoVa/Reddit u/mysocalledmayhem/Reddit

u/mysocalledmayhem/Reddit

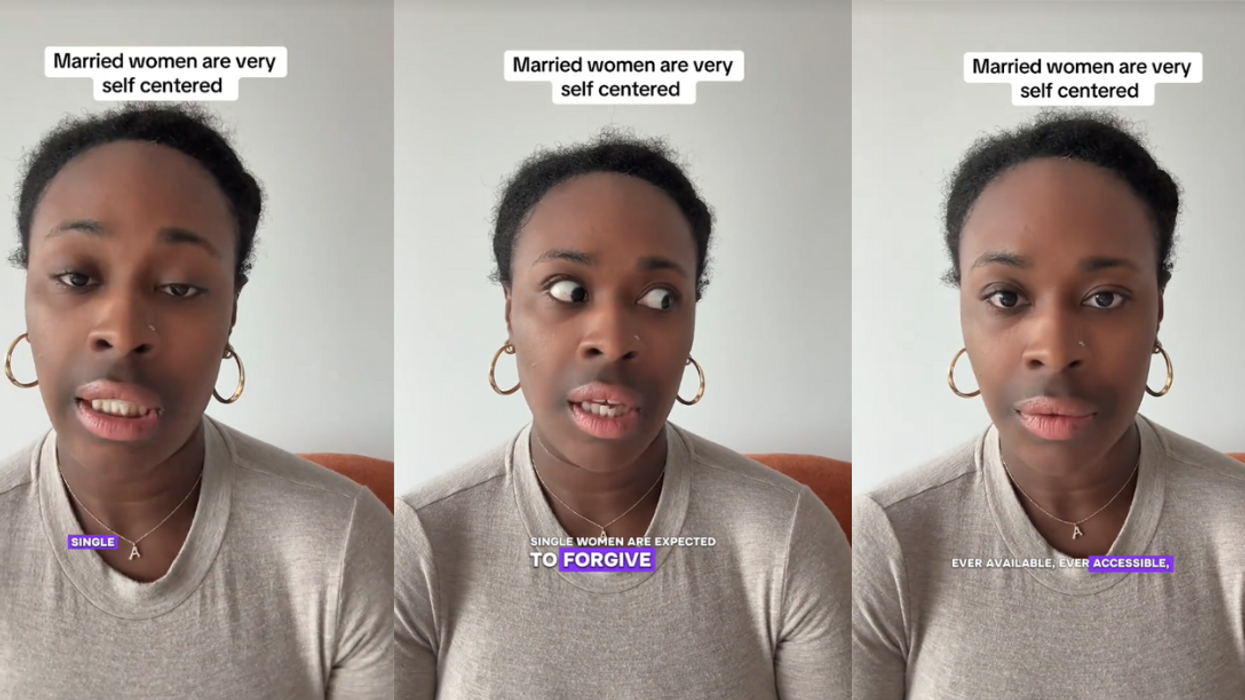

@unpunishablewoman/TikTok

@unpunishablewoman/TikTok @unpunishablewoman/TikTok

@unpunishablewoman/TikTok @unpunishablewoman/TikTok

@unpunishablewoman/TikTok @unpunishablewoman/TikTok

@unpunishablewoman/TikTok @unpunishablewoman/TikTok

@unpunishablewoman/TikTok @unpunishablewoman/TikTok

@unpunishablewoman/TikTok @unpunishablewoman/TikTok

@unpunishablewoman/TikTok @unpunishablewoman/TikTok

@unpunishablewoman/TikTok @unpunishablewoman/TikTok

@unpunishablewoman/TikTok @unpunishablewoman/TikTok

@unpunishablewoman/TikTok

@helsmcp/TikTok

@helsmcp/TikTok @helsmcp/TikTok

@helsmcp/TikTok @helsmcp/TikTok

@helsmcp/TikTok @helsmcp/TikTok

@helsmcp/TikTok @helsmcp/TikTok

@helsmcp/TikTok @helsmcp/TikTok

@helsmcp/TikTok @helsmcp/TikTok

@helsmcp/TikTok @helsmcp/TikTok

@helsmcp/TikTok @helsmcp/TikTok

@helsmcp/TikTok @helsmcp/TikTok

@helsmcp/TikTok