Los Angeles comedian Avalon Penrose decided to shed some light on the confusing status of the stock market by explaining it in layman's terms in a hilarious Twitter video.

Reddit's push in helping the stock of retailer GameStop's prices soar caused quite the commotion online.

Reddit users drove up the value of GameStop Corp.'s price, which nearly doubled in Tuesday trading with its market value rising to over "$10 billion as its shares soared 685% this year," according to the Los Angeles Times.

The phenomenon is known as "a short squeeze," which we'll get to later.

So when Penrose saw social media users being more confused than ever after seeing several tweets and videos explaining Reddit's involvement in Wall Street, she stepped up to explain the stock market in "normal person" terms.

a normal person explains what's happening on the stock market: pic.twitter.com/zKKvULCirX

— Avalon Penrose (@avalonpenrose) January 27, 2021

Her conviction quickly devolved into a series of stops and starts but wound up getting nowhere.

"There are these people who have lots of money, and they have hedges around their house. And they go to the market, like, it's not a real market. It's metaphorical, but it's real."

Her uncertainty on the subject became very clear.

"And they go, 'uh-oh, that company's not doing well so I'm gonna make it do worse.' And they pull out some papers, and they say, 'Who wants to make a deal?'"

"'If this company's good... if it stays... if it goes down, and I get money from you and if it goes up then I give you money, but they don't tell you it's not gonna go up.'

The rest of the discourse took a nosedive with unintelligible blabber and she concluded with:

"So yeah, if you have any questions, let me know."

Twitter got a kick out of her "normal person's" take on the stock market.

I have an MBA.

I HATED finance, and this is why.

It's like if astrology and witchcraft had a baby, and that baby was raised by a fantasy football league.

— Q is for Quentin, who sank in a mire (@amyisquitebusy) January 28, 2021

I just have one question, forgive me if this seems naive, I'm new to lawn care. So, if I trim my hedges with manual clippers instead of electric ones, will the rich people at the market give me more money or less?

— ⚡️CMM⚡️ (@moorloc) January 27, 2021

Ok so. I have only one stock because I'm a vegetarian and chicken and beef stock is big no-no for me. Is that bad for my money? :/ thanks for help

— Benedikt Maier 🚴♂️🎒 🇪🇺🇭🇰🏳️🌈 (@BenediktMaier) January 27, 2021

Why are so many of you overlooking how freaking wonderful her performance in the video is? The way she loses steam after the opening! The way her voice gets quieter! The panic in her eyes as the explanations get more convoluted! Subtle, comedic, beautifully timed. Brava!

— Hey Joe R (@rydley) January 28, 2021

It's all about hedges pic.twitter.com/pQFbX40AzE

— Katie_Silver (@Katie_Silver) January 28, 2021

Her convincing characterization of a clueless person wanting to give advice made some people miss the joke completely.

Why are so many of you overlooking how freaking wonderful her performance in the video is? The way she loses steam after the opening! The way her voice gets quieter! The panic in her eyes as the explanations get more convoluted! Subtle, comedic, beautifully timed. Brava!

— Hey Joe R (@rydley) January 28, 2021

Any questions lmao that was painful to watch how come she looked like she was about to cry the whole time. She may own some stocks but she doesn't seem to understand how the market really works with that explanation lmao.

— kevin biesty (@biesty26) January 28, 2021

Proof that you don't NEED to have an opinion on everything especially things that you really have no experience or comprehension of. The right answer if you don't know is, "I don't know."

— Nick Zivanovich (@NickZivs) January 28, 2021

Write down what you want to say, memorize it and then do the video so you're not nervous or having any hiccups.

You know what they say ma'am, "if you want to make it to Carnegie Hall, practice, practice, practice!"

— Grinch's Dog Max (@DeafGhostbuster) January 28, 2021

Was she recording this while her vibrating panties were turned on? Because that's what it looked like.

Also, "I have stocks so I understand stocks" is like that guy that votes Trump and says: "I have Fox News so I understand news"...

— JMA (@JMA986) January 28, 2021

Jesus Christ!! It's not complicated. This broad sounds like she about to have a mental breakdown. The Hedge shorted GameStop stocks, some wallstreetsBets Chad (me included) noticed said hedge shorting GameStop n decided to buy which made us a lot of money but the hedge lost 😂

— Evil-Patriarchal-BlackMan (@TheLadieKiller) January 28, 2021

The 24-year-old comedian filmed the ad-libbing from inside her car in one take and uploaded the clip on Twitter with low expectations.

Within 24 hours, the video gained 13.4 million views and more than 400,000 likes. Soon, Penrose was inundated with calls from agents, managers and a studio exec.

She said of her newfound popularity:

"I cannot tell you how much I did not expect this to happen...I was coming from a place of authenticity of not having any idea what the f— was going on."

"And I think that everyone else was experiencing the same thing."

"They genuinely thought ... that I was actually going to give a legitimate breakdown of what was happening in the stock market ... when they realized it was someone who they could relate to that also had no idea what the hell's going on."

Her video even caught the attention of SpaceX CEO Elon Musk, who tweeted:

"A hedge fund that shorts is a shrubbery."

Penrose replied:

"This tweet was for business only & not jokes so if u need a financial advisor let me know otherwise keep scrolling."

this tweet was for business only & not jokes so if u need a financial advisor let me know otherwise keep scrolling

— Avalon Penrose (@avalonpenrose) January 28, 2021

For anyone wanting an actual explanation of the current stock market crisis, Michael Hilzik of the Los Angeles Times weighed in.

"If you've shorted a stock at $20, your potential gain is $20, again if it goes to zero. (You sold at $20, and you're buying it back, or 'covering,' at zero.) But if the shares keep rising, your potential loss is unlimited."

"This is the phenomenon behind the GameStop action. It's known as a short squeeze. The stock bulls higher, eventually surpassing the capacity of the shorts to remain short."

"They bail out by covering—that is, buying—at a higher price, swallowing their losses. Their buying action pushes the stock even higher, forcing more shorts to cover, until finally all the short sellers are swept out."

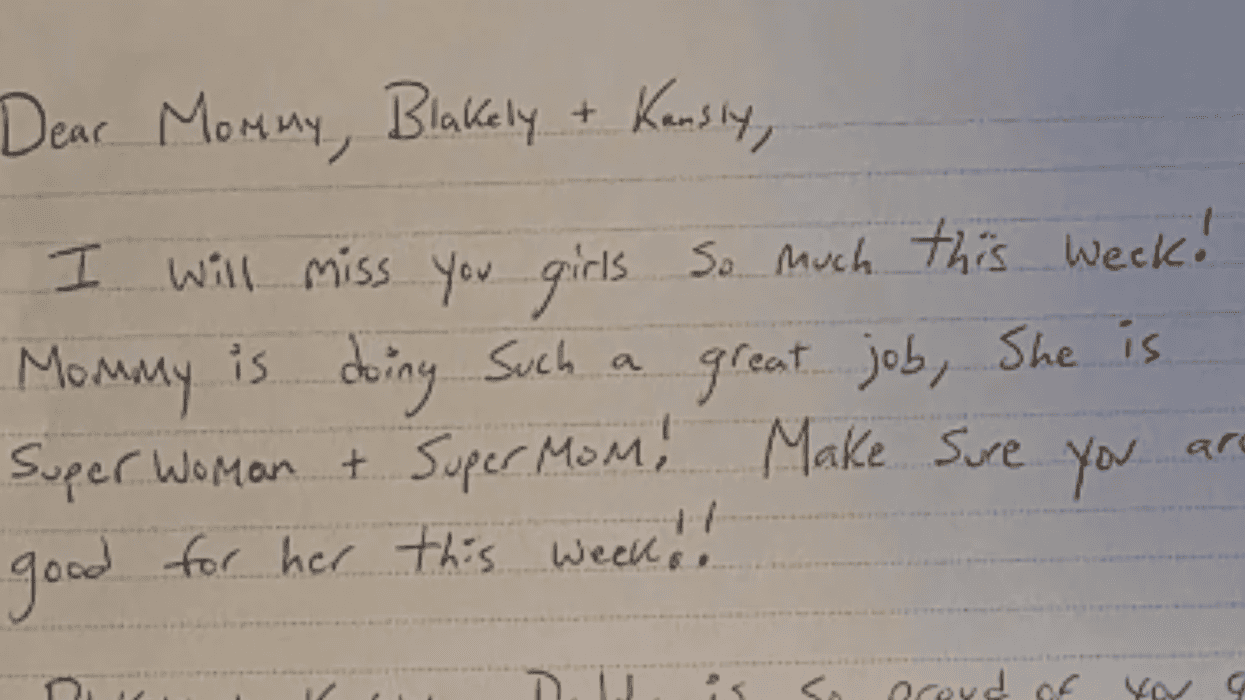

@jennifer.garner/Instagram

@jennifer.garner/Instagram @jennifer.garner/Instagram

@jennifer.garner/Instagram @jennifer.garner/Instagram

@jennifer.garner/Instagram @jennifer.garner/Instagram

@jennifer.garner/Instagram @jennifer.garner/Instagram

@jennifer.garner/Instagram @jennifer.garner/Instagram

@jennifer.garner/Instagram @jennifer.garner/Instagram

@jennifer.garner/Instagram @jennifer.garner/Instagram

@jennifer.garner/Instagram @jennifer.garner/Instagram

@jennifer.garner/Instagram @jennifer.garner/Instagram

@jennifer.garner/Instagram @jennifer.garner/Instagram

@jennifer.garner/Instagram @jennifer.garner/Instagram

@jennifer.garner/Instagram @jennifer.garner/Instagram

@jennifer.garner/Instagram @jennifer.garner/Instagram

@jennifer.garner/Instagram @jennifer.garner/Instagram

@jennifer.garner/Instagram @jennifer.garner/Instagram

@jennifer.garner/Instagram @jennifer.garner/Instagram

@jennifer.garner/Instagram @jennifer.garner/Instagram

@jennifer.garner/Instagram @jennifer.garner/Instagram

@jennifer.garner/Instagram @jennifer.garner/Instagram

@jennifer.garner/Instagram

@ameliaknisely/X

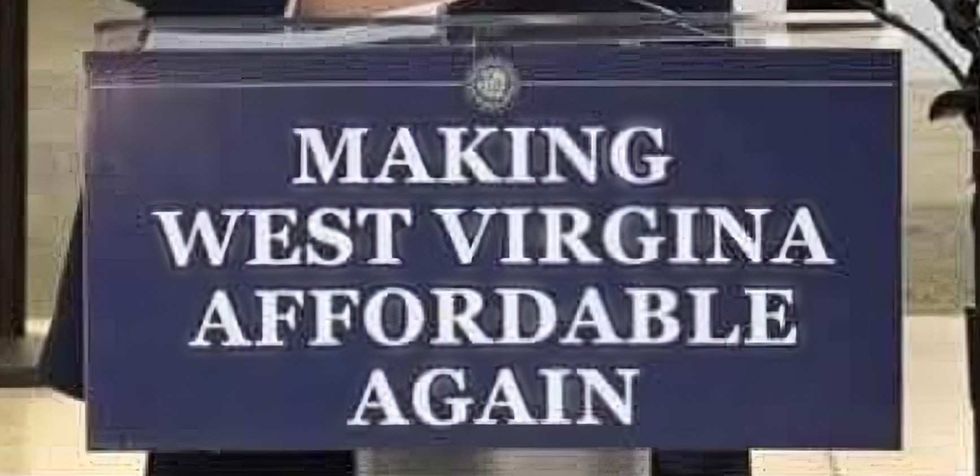

@ameliaknisely/X WDTV 5 News/Facebook

WDTV 5 News/Facebook r/WestVirginia/Reddit

r/WestVirginia/Reddit WDTV 5 News/Facebook

WDTV 5 News/Facebook r/WestVirginia/Reddit

r/WestVirginia/Reddit r/WestVirginia/Reddit

r/WestVirginia/Reddit WDTV 5 News/Facebook

WDTV 5 News/Facebook r/WestVirginia/Reddit

r/WestVirginia/Reddit r/WestVirginia/Reddit

r/WestVirginia/Reddit WDTV 5 News/Facebook

WDTV 5 News/Facebook WDTV 5 News/Facebook

WDTV 5 News/Facebook