A recent bombshell New York Times report uncovered last month that President Donald Trump, the first major presidential candidate in decades not to release their tax returns and financial disclosures, only paid $750 in taxes in 2016 and 2017. For 10 of the last 15 years, he paid nothing.

Trump also spearheaded The Tax Cuts and Jobs Act of 2017, which his allies praise as the "Trump Tax Cuts," but according to Policy Genius:

On the whole, low-income families appear to have received the least savings, while high-income families saved the most. Middle-class families saw mixed results. The biggest winners from Trump's tax cuts were probably businesses. Between 2017 and 2018, corporations paid 22.4% less income tax. The total value of refunds issued by the IRS to businesses also increased by 33.8% nationally.

It's the tax plan of Democratic presidential nominee Joe Biden that the Trump campaign is focusing on.

Trump has repeatedly targeted Biden's tax plan on Twitter this week, without offering many specifics, claiming it would "destroy all that you have built!" Trump tweeted about Biden's tax plan three times on Wednesday alone.

That same day, one of the President's sons and executives at the Trump Organization, Eric Trump, shared a picture of a news broadcast showing the combined state and federal tax rates for California, New Jersey, and New York.

Biden's Tax Plan https://t.co/M4iZs64Zly pic.twitter.com/Fr1bP6odea

— Eric Trump (@EricTrump) October 21, 2020

There are nuances not evident in the picture of a television.

The increased rates in Biden's tax plan apply to Americans making over $400 thousand per year. Trump's allies have falsely claimed that the Biden tax plan would raise taxes for 82 percent of Americans. These rates also don't account for potential deductions, especially state and local deductions which Trump's tax cuts capped at $10 thousand.

Eric Trump's attempt to smear it largely backfired, especially given the Trumps' own taxation woes.

Bitch your dad paid less in taxes in a year than I pay for rent in a month maybe sit this one out https://t.co/yrDNl2IEKE

— The Volatile Mermaid (@OhNoSheTwitnt) October 21, 2020

I wouldn't bring up taxes, Eric. Your family has some issues with that.

— Hazel (@HazeyDaisey17) October 21, 2020

All this does is make me hungry for wings, even though Wingstop is not my favorite. Haven't tried it in a while though.

Oh, and I've paid more taxes than your dad every year since I entered the workforce, and I am decidedly not part of his alleged income bracket.

— DanaERTurton (@danada0109) October 21, 2020

Tax evaders say what? The definition of Criminal, Trumps. https://t.co/rhBT2rDdU0 pic.twitter.com/9ZlP8AAAXb

— Rhett's Granny (@ldimarco2) October 21, 2020

I'm hoping @JoeBiden is going to tax @realDonaldTrump more than 750 dollars

— Brad Traynor (@BradTraynor) October 21, 2020

Well Eric, while that is an impressive semi screen shot, I don't think it captures the entire plan, but don't worry your daddy won't pay more because he doesn't make any money.

— Chris Claus (@OpenmindedREP) October 21, 2020

Others pointed out how few people make over $400 thousand per year.

It's really going to hurt me because I make -- checks notes -- wait a minute, I don't make $400,000 a year. Thoughts and prayers for all those making $400K and more a year and now have to contribute their fair share to finally help Make America Great Again.

— Jim Donald (@jdonald3rd) October 21, 2020

In 2021, Biden's proposals would increase taxes, on average, for the top 5% of households and reduce taxes on households in the bottom 95%.

— pegitha (@pegitha) October 21, 2020

Awesome. So this is what the 1% will be paying so we all can have health care?

Badass.

— Micah Faulkner (@MicahFaulkner11) October 21, 2020

Trump has yet to release his tax returns.

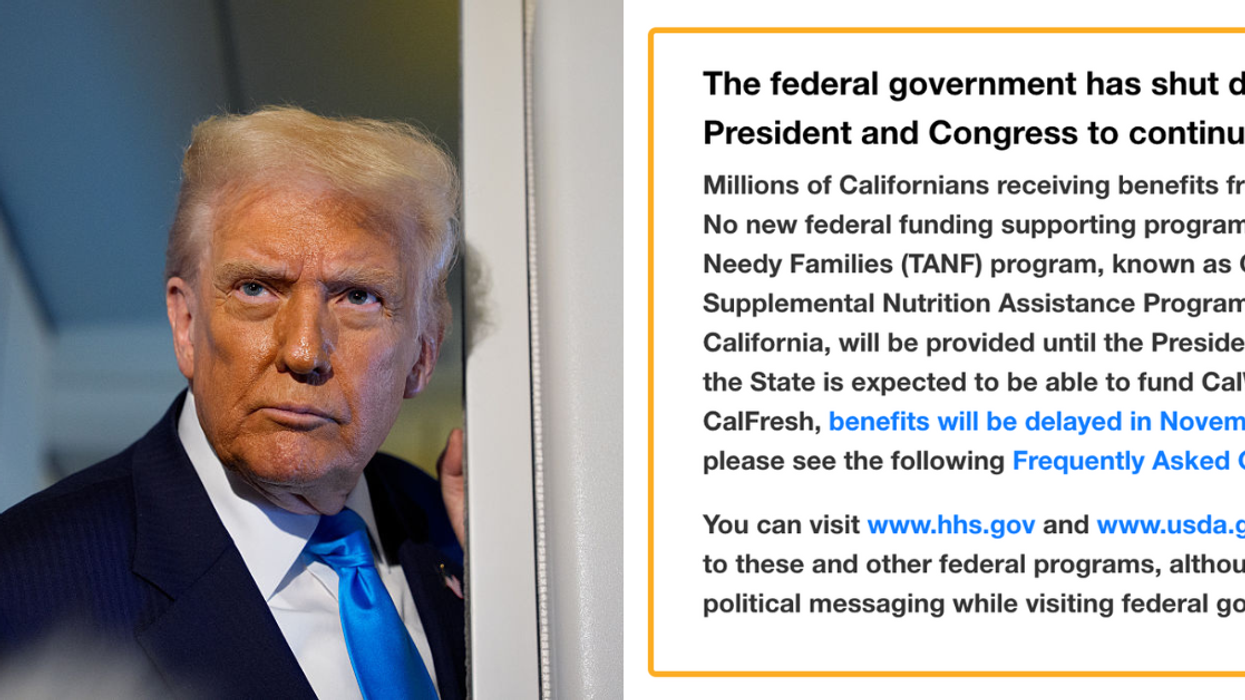

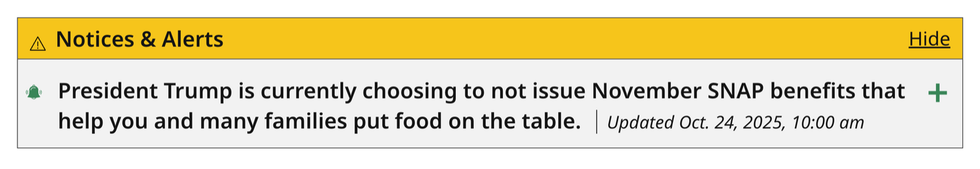

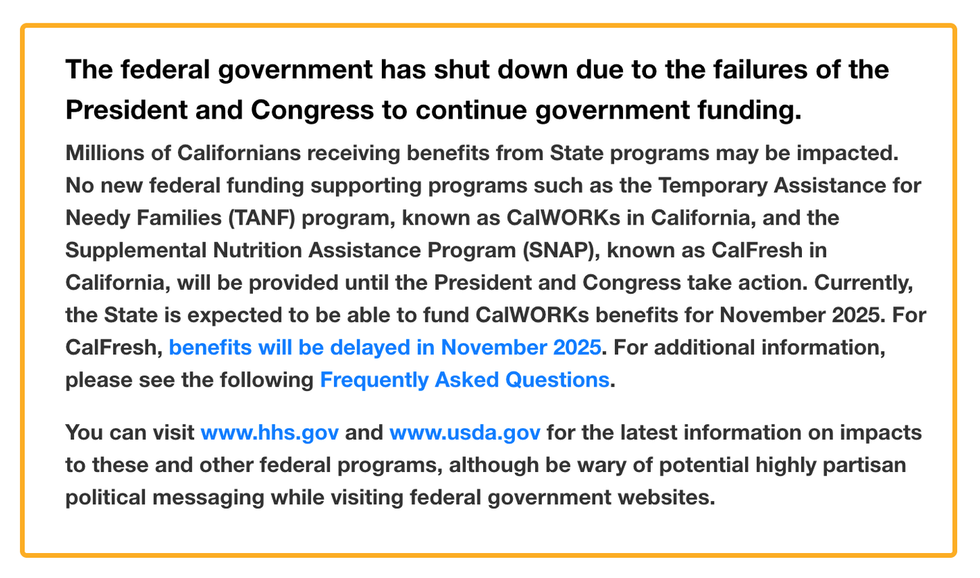

mass.gov

mass.gov cdss.ca.gov

cdss.ca.gov

Sad Break Up GIF by Ordinary Frends

Sad Break Up GIF by Ordinary Frends  so what who cares tv show GIF

so what who cares tv show GIF  Iron Man Eye Roll GIF

Iron Man Eye Roll GIF  Angry Fight GIF by Bombay Softwares

Angry Fight GIF by Bombay Softwares

@jimmykimmellive/Instagram

@jimmykimmellive/Instagram @jimmykimmellive/Instagram

@jimmykimmellive/Instagram @jimmykimmellive/Instagram

@jimmykimmellive/Instagram @jimmykimmellive/Instagram

@jimmykimmellive/Instagram @jimmykimmellive/Instagram

@jimmykimmellive/Instagram @jimmykimmellive/Instagram

@jimmykimmellive/Instagram @jimmykimmellive/Instagram

@jimmykimmellive/Instagram @jimmykimmellive/Instagram

@jimmykimmellive/Instagram @jimmykimmellive/Instagram

@jimmykimmellive/Instagram @jimmykimmellive/Instagram

@jimmykimmellive/Instagram @jimmykimmellive/Instagram

@jimmykimmellive/Instagram @jimmykimmellive/Instagram

@jimmykimmellive/Instagram @jimmykimmellive/Instagram

@jimmykimmellive/Instagram @jimmykimmellive/Instagram

@jimmykimmellive/Instagram