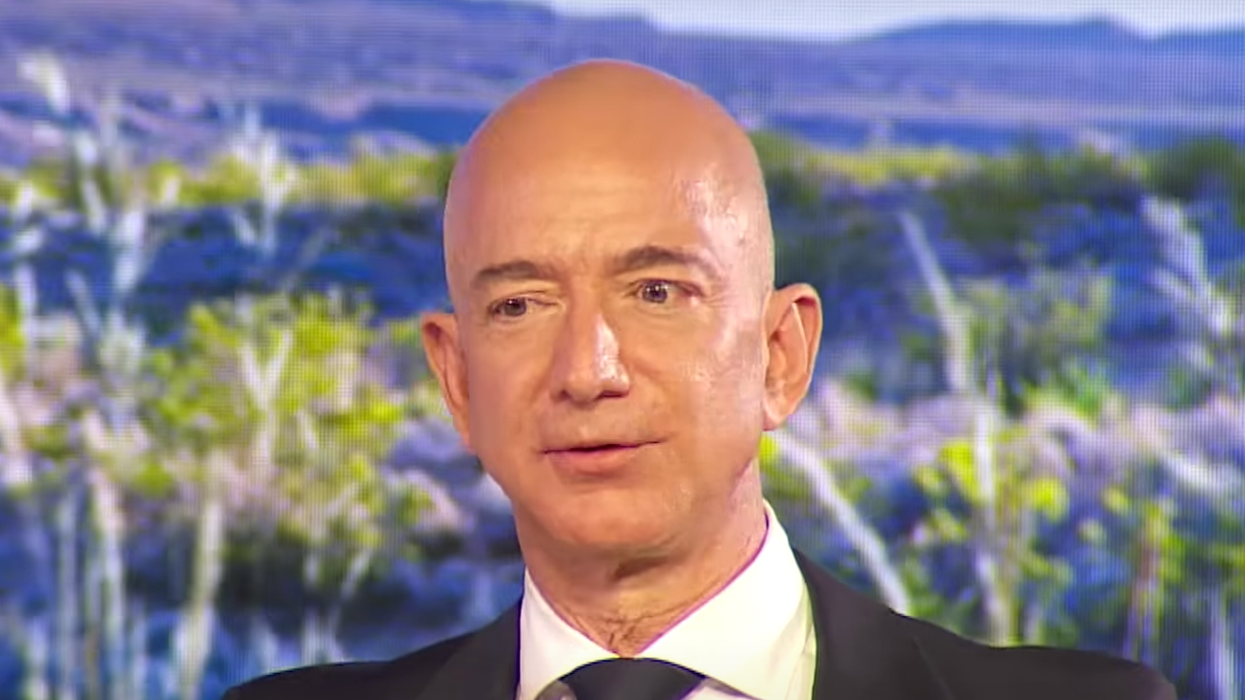

From 2014 to 2018, the 25 wealthiest Americans paid an average of 15.8 percent, or $13.6 billion, in personal federal income taxes. This despite the fact that their actual net worth grew by $401 billion in the same period. That's according to a bombshell leak and analysis by ProPublica of what are normally confidential personal income tax filings.

The problem, as with many things in America, is a structural one. The U.S. taxation system is built upon the idea of taxing labor income, meaning how much you actually earned in exchange for your work in a year, as well as any realized capital gains you saw. That means that if someone's stocks they already own appreciated by hundreds of billions of dollars, they still don't pay any tax on that appreciation because it's neither income nor realized capital gains.

People with that much money also have armies of accountants able to take advantage of tax loopholes that reduce even the income that the very wealthy normally would have to pay. Here's one example: When you have billions of dollars in stocks, you can borrow large amounts from a bank using those stocks as collateral for the loan. This would allow you to use the money while paying the bank back and to deduct the interest on the loan as an expense against your income.

Corporations do this all the time by creating holding companies in tax havens, to which the profits from their multinational operations flow. They loan the actual operating companies money from that holding company so that the loans appear as liabilities on their books. That results in low to no income tax on the operating company, and low to no income tax on the holding company in the tax haven.

The revelations, which the IRS warns may have come from illegal disclosures that they will prosecute if true, will add significant weight to calls from progressives like Sen. Elizabeth Warren, who wants a wealth tax set at 2 percent of any individual net worth over $50 million.

While the Biden Administration has not ruled out a wealth tax, Treasury Secretary Janet Yellen noted that a wealth tax is "something that has very difficult implementation problems."

Much of that wealth isn't necessarily held within the United States and could be obscured by things like blind trusts and anonymous bank accounts. Much of it could be moved to tax havens if it is not already there, requiring a multinational level of cooperation to halt. Already, the administration will face a challenge enforcing a proposed 15 percent minimum corporate tax, as it would require small nations to stop luring capital over to their cash-strapped economies by offering low tax havens. Finally, some very wealthy individuals could simply renounce their U.S. citizenship and repatriate to more tax-favorable countries.

The Biden White House is instead pressing for more realizable goals, such as a hike to the capital gains tax for gains over $1 million. This move won't stop the very wealthy, however, from accumulating great sums of wealth without paying income tax. So long as they can leverage their wealth in exchange for liquidity, that gives them enormous maneuvering power with no tax liability. In fact, the interest on that very liquidity gives them a write-off against what income they do report.

Until these kinds of arrangements can be foreclosed or taxed, the ultra-rich will continue to pay a smaller percent of their income than the average working American.

breast cancer GIF by Baptist Health South Florida

breast cancer GIF by Baptist Health South Florida  Teddy Bear Doctor GIF

Teddy Bear Doctor GIF  feeling neck skin GIF

feeling neck skin GIF  praying GIF

praying GIF

Snail Ugh GIF by Sticker Book iOS GIFs

Snail Ugh GIF by Sticker Book iOS GIFs  Serious

Serious  Home Alone Reaction GIF by 20th Century Fox Home Entertainment

Home Alone Reaction GIF by 20th Century Fox Home Entertainment  Cat Working GIF

Cat Working GIF