"How Millennials Should Spend Their Money" articles are something everyone is familiar with at this point. They make a concerted effort to make it seem like any money problems are simply a result of unwise spending, and not of an utter lack of sufficient income. Avocado toast, anyone?

Along this same vein, CNBC posted the following infographic to twitter, from their Millennial Money:

The very idea that $100k per year is an average salary is laughable (or cry-able, if you're one of the many earning significantly less than that). Reading the linked article, which features 25-year-old Trevor Klee, just makes things worse.

You are greeted with the following video caption upon opening the article:

If you look back at the infographic, you'll see that he is paying only $825 in rent. In Boston.

Reading further reveals that he has 4 roommates, so some expenses are split 5-ways. His ability to have surplus income is beginning to make sense.

When discussing starting out working for himself as a test-prep tutor in Cambridge, he says, "I had no money. I had savings, but I had no income, so I desperately needed to find people."

Given many people's inability to earn enough to pay bills, let alone have savings, the idea that having savings means having "no money" is ludicrous to many.

CNBC even goes so far as to quote Trevor calling himself a "terrible employee", adding further insult to injury.

Twitter had a field day with CNBC's post.

Many also expressed varying levels of anger and disbelief.

Given that Klee is a Princeton grad, the lack of student loan payments are especially surprising. Ivy League schools are not known for being affordable.

Even members of older generations showed up to call CNBC out.

All-in-all, this share from CNBC only serves to show how out of touch they are with the financial reality facing many young Americans.

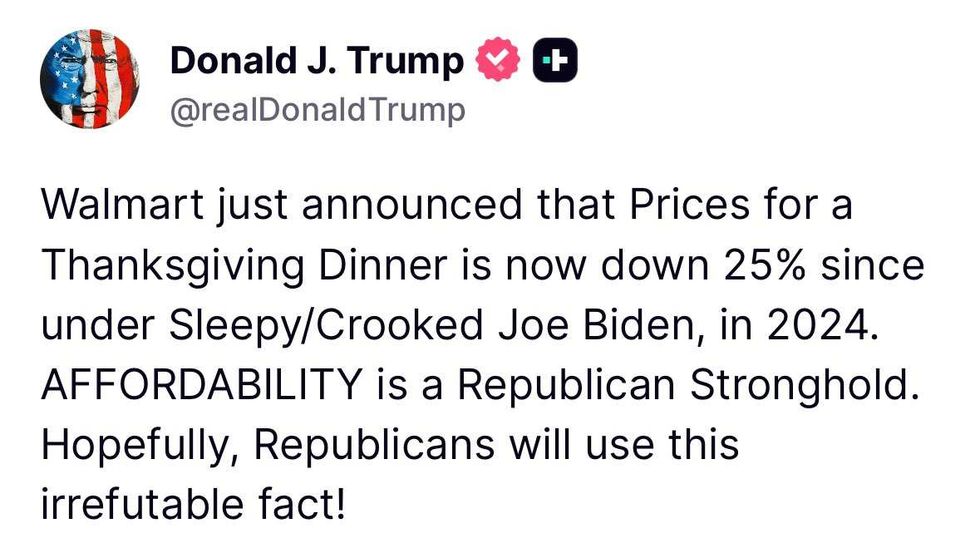

@realDonaldTrump/Truth Social

@realDonaldTrump/Truth Social

breast cancer GIF by Baptist Health South Florida

breast cancer GIF by Baptist Health South Florida  Teddy Bear Doctor GIF

Teddy Bear Doctor GIF  feeling neck skin GIF

feeling neck skin GIF  praying GIF

praying GIF